Invoicing is an indispensable aspect of running a business successfully. It ensures that businesses receive timely payments and helps maintain cash flow. However, invoicing can be a tedious and error-prone process, particularly if it is not optimized.

Inefficient invoicing can lead to payment delays, disputes with clients, and cash flow issues, which can impact a business's financial stability and growth. Therefore, it is essential for businesses to adopt best practices and optimize their invoicing process to maximize efficiency and reduce errors.

This article will provide tips for optimizing your invoicing process, including using automated invoicing systems, establishing clear payment terms, simplifying invoices, following up on overdue payments, offering multiple payment options, tracking invoices and payments, and providing detailed invoicing reports.

By following these 10 tips, businesses can streamline their invoicing process, improve cash flow, and maintain positive relationships with their clients:

1. Use an Automated Invoicing System

Automated invoicing systems can help businesses streamline their invoicing process and reduce the chances of errors. These systems eliminate the need for manual data entry, making the process faster and more accurate.

Automated invoicing systems also help businesses track their invoices, send reminders, generate invoices, and reports, which saves time and effort. Businesses can choose from a variety of invoicing software solutions available in the market, and they should select the one that best suits their needs and budget.

Using an automated invoicing system can help businesses increase efficiency and free up time for other critical business functions.

2. Establish Clear Payment Terms

To avoid payment delays and disputes, businesses should establish clear payment terms with their clients. This includes specifying the payment due date, the accepted modes of payment, and any late payment penalties. By communicating the payment terms upfront, businesses can ensure that their clients are aware of their expectations and avoid any misunderstandings.

Clear payment terms can also help businesses maintain positive relationships with their clients by setting expectations and avoiding any surprises.

3. Send Invoices Promptly

Sending invoices promptly is crucial for ensuring timely payment. Delayed invoicing can lead to delayed payments, which can impact cash flow. It is essential to send invoices as soon as possible after completing the work or delivering the product.

This sends a clear signal to clients that payment is expected promptly, and it also helps businesses stay on top of their invoicing and payment schedules. Prompt invoicing can also help businesses build trust with their clients by demonstrating their professionalism and reliability.

4 Simplify Invoices

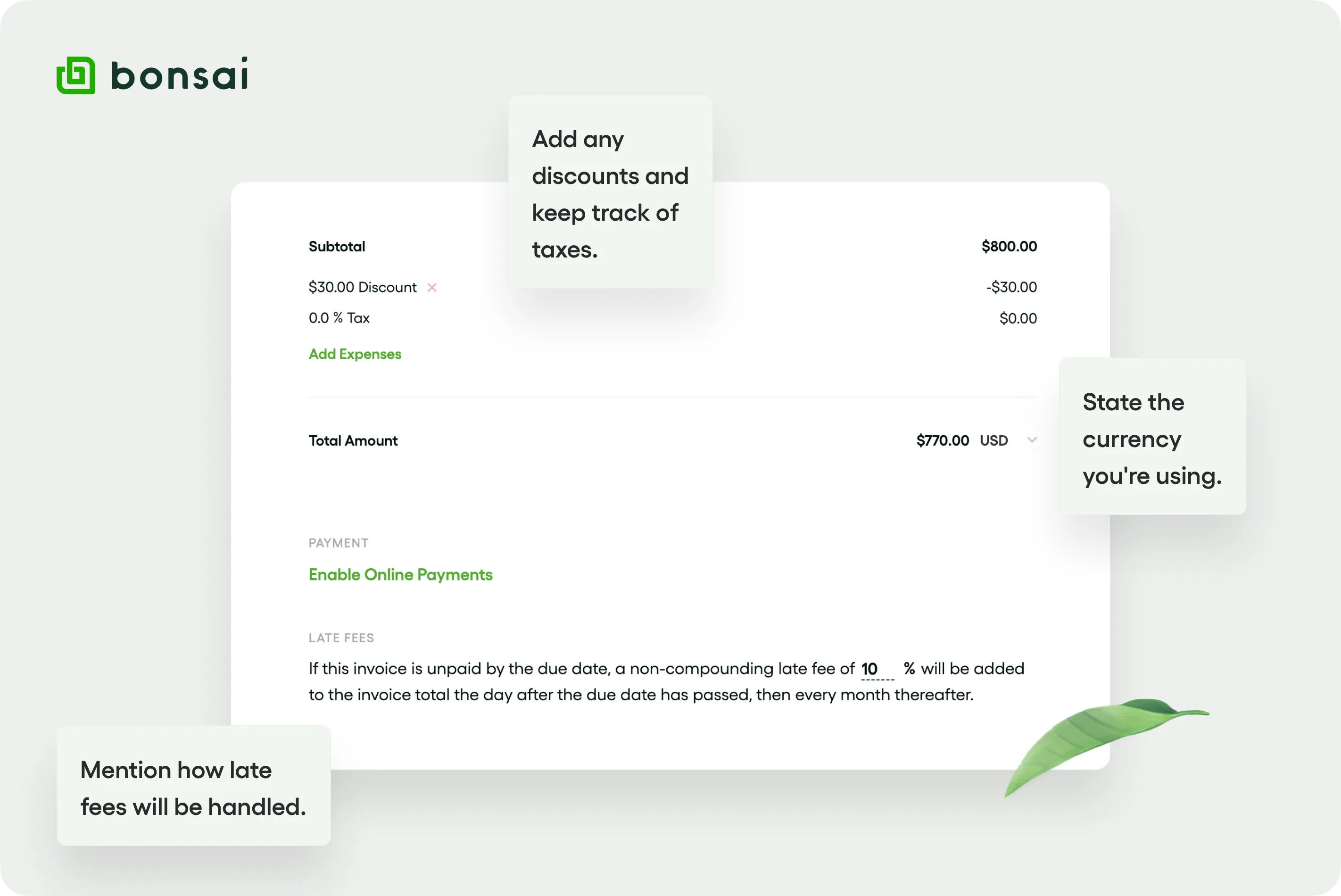

Invoices should be simple and easy to read, with all the necessary information clearly stated. This includes the client's name and address, the invoice date, a description of the products or services rendered, the amount due, and any applicable taxes or discounts. Consider using a free invoice generator to make sure you do not miss any of this critical client information.

By simplifying the invoice, businesses can avoid confusion and reduce the chances of errors. Simple invoices can also help clients process payments quickly and efficiently, improving the chances of timely payment.

5. Follow Up on Overdue Invoices

Despite establishing clear payment terms and sending invoices promptly, some clients may still need more time to receive payment. In such cases, it is essential to follow up on overdue invoices promptly. This can be done by sending reminders via email or phone, or by using an automated invoicing system that sends reminders automatically.

By following up on overdue invoices, businesses can improve their cash flow and maintain a positive relationship with their clients. Timely follow-up can also help businesses identify any issues that may be causing payment delays and address them promptly.

6. Offer Multiple Payment Options

Offering multiple payment options can make it easier for clients to pay their invoices quickly. This includes accepting payments via credit card, debit card, bank transfer, or online payment platforms such as PayPal or Stripe. By offering multiple payment options, businesses can cater to the diverse needs of their clients and reduce the chances of payment delays.

Multiple payment options can also help businesses build trust with their clients by demonstrating their commitment to making the payment process as convenient as possible.

7. Track Invoices and Payments

Tracking invoices and payments is essential for maintaining accurate records and ensuring timely payment. This can be done using an automated invoicing system, a spreadsheet, or an accounting software solution. Businesses should regularly reconcile their invoices and payments to avoid any discrepancies and identify any payment-related issues promptly.

Tracking invoices and payments can also help businesses generate reports that provide valuable insights into their invoicing performance, making it easier to identify areas for improvement.

8. Provide Detailed Invoicing Reports

Invoicing reports provide valuable insights into the invoicing process, including the number of invoices generated, the payment status of each invoice, and any outstanding balances. By providing detailed invoicing reports, businesses can track their invoicing performance, identify areas for improvement, and make informed decisions about their invoicing process.

Invoicing reports can also help businesses identify any payment-related issues and address them promptly, improving cash flow and maintaining positive relationships with their clients.

9. Implement a Late Payment Policy

Implementing a late payment policy is crucial for businesses that experience frequent delays in payment. A late payment policy should specify the penalties for late payment, such as interest charges or suspension of services. By implementing a late payment policy, businesses can encourage clients to make payments promptly and avoid payment disputes.

It is essential to communicate the late payment policy to clients upfront and ensure that it is included in the payment terms.

10. Provide Excellent Customer Service

Providing excellent customer service is critical for maintaining positive relationships with clients and ensuring timely payment. Businesses should communicate with their clients promptly and address any payment-related issues promptly and professionally.

Providing excellent customer service can also help businesses build trust with their clients, which can lead to repeat business and referrals. By prioritizing customer service, businesses can improve their invoicing process and maintain a positive reputation.

Conclusion

Invoicing is a vital aspect of any business operation, and optimizing the invoicing process can help businesses increase efficiency, reduce errors, and improve cash flow. By adopting the tips outlined in this article, businesses can streamline their invoicing process, reduce payment delays, and maintain positive relationships with their clients.

From using automated invoicing systems and establishing clear payment terms to providing excellent customer service and implementing a late payment policy, optimizing the invoicing process requires a commitment to continuous improvement and a willingness to adopt new technologies and best practices.

By implementing these tips and continuously refining their invoicing process, businesses can achieve financial stability and growth and focus on other critical business functions.

If you're looking to optimize your business invoicing process, look no further than Hello Bonsai. With our invoicing software solution, you can streamline your invoicing process, establish clear payment terms, and offer multiple payment options. Don't let inefficient invoicing hold your business back. Sign up for Hello Bonsai today and take your invoicing process to the next level!