Tax deductions for lawyers are crucial for reducing taxable income and maximizing savings. Key deductions include home office expenses, advertising costs, travel expenses, legal education costs, and office supplies. Lawyers should also consider deductions for retirement contributions and professional memberships. Keeping detailed records of all business-related expenses is essential for claiming these deductions accurately. By understanding and utilizing these tax write-offs, self-employed attorneys can significantly lower their tax burden. It's advisable to use tools like Bonsai Tax to automate expense tracking and ensure no deduction is overlooked. This proactive approach not only saves money but also streamlines the tax filing process.

Filing your independent contractor taxes is one of those life administration tasks that you want to get done as quickly and smoothly as possible. But in the tax season rush, you might be missing out on some important deductions that could be saving you a lot of money.

Tax deductions are the expenses that you subtract from your yearly 1099 legal fees revenue when calculating your taxable income. As a self-employed attorney, there are many ways to reduce your taxable income, by keeping track of all expenses for running your business.

This article brings you the top 10 tax deductions for attorneys to make sure you don't leave anything out. Take advantage of all possible deductions and use your law practice expenses to lower your tax burden.

Note: If you want an automatic way to discover tax write-offs and maximize your lawyer deductions, try Bonsai Tax. Our app will scan your bank/credit card receipts and neatly categorize and track your tax deductions. The majority of users save at least $5,600 from their tax bill. Claim your 7-day free trial here.

What Business Expenses Can You Deduct as a Lawyer or Law Firm?

Remember to keep clean records or receipts as proof for your tax deductions. You don't want the IRS to catch you without receipts if you get audited. Now, let's go over some of the most common tax deductions for lawyers that you may or may not be aware of.

Home Office

If you are running your law firm or starting a solo law practice from home and you have a designated space where you do most of your work, you may be able to claim a home office tax deduction. In addition, you can deduct a part of your home expenses because you also use it for business. These include rent, insurance, repairs, and utilities.

You can also deduct expenses that are only related to your business (use our actual expenses worksheet), such as the cost of a special phone line for your home office space or repainting it. Again, take the time to learn how to do it properly, as the IRS has strict requirements that you must follow (including that the space is used exclusively for business purposes) otherwise you can risk an IRS audit.

Office Supplies

In addition to your home office expenses, you can claim a tax deduction on 100% of the cost of office supplies that you keep on hand and use throughout the year. These include record-keeping supplies such as invoices, receipts, printers, cabinets, storage lockers, and even beverages for the employee break room.

To deduct tax on your office supplies, you must prove that they are “ordinary and necessary” to run your business. This means that you cannot use the same supplies for personal purposes. For example, if you buy a printer for your office, but you also use it to print your kid’s homework every now and then, that would be considered personal use. Therefore, the costs of the printer would not be deductible in this case.

Keep in mind; you can only deduct costs of material USED during the current year. If you buy copy paper in bulk but have a considerably large amount of it left at the end of the year, you cannot deduct the full cost of it.

Marketing

Almost all of your marketing campaign expenses are tax-deductible. You must retain all invoices and receipts to include these expenses in your annual budget. Deductions for marketing expenses include the costs of:

- Flyers

- Printable Ads

- Online and social advertisement (Google, Facebook, etc.)

- Website creation

- SEO services

- Hiring an agency to conduct your marketing campaigns

A common misunderstanding on this topic is regarding the costs of ads on vehicles. While the cost of putting the ad itself on the vehicle IS deductible, you can't claim tax deductions for the expenses of driving the car around to advertise your business.

Note: Check out our tax hacks for self-employed entrepreneurs to discover more ways to save money. The article will talk about different credits and deductions you can claim to save money during tax time.

Traveling

Another tax deduction available for you as an attorney are business travel expenses. If you have a client to meet in a different city or need to travel for any reason exclusively related to your business, you may deduct your expenses during the trip. These include.

- Transportation (airfares, Rideshare apps like Uber or Lyft, train, or bus fares)

Meals

- Lodging

- Taxis and shuttles

- Laundry services

The IRS will consider your trip as business travel only if you go somewhere far away from your “tax home”. This means, the general area where your main place of business is, regardless of where you have your family home.

For example, let’s say you live with your family in Los Angeles, but you work in San Diego during the week, where you stay in hotels and eat in restaurants. Even though you are traveling for business purposes, you are not traveling away from your main place of business, which makes all of these travel expenses non-deductible.

Use a travel expense tracker to get an accurate picture of how much you are spending during business trips and keep track of all your receipts.

Mileage

If you own a law firm or are a self-employed attorney, you most likely use your car for business purposes all the time. If you have to meet with a client, go somewhere to view evidence, take a deposition or just drive to court, you can take the standard mileage deduction on those business-related drives.

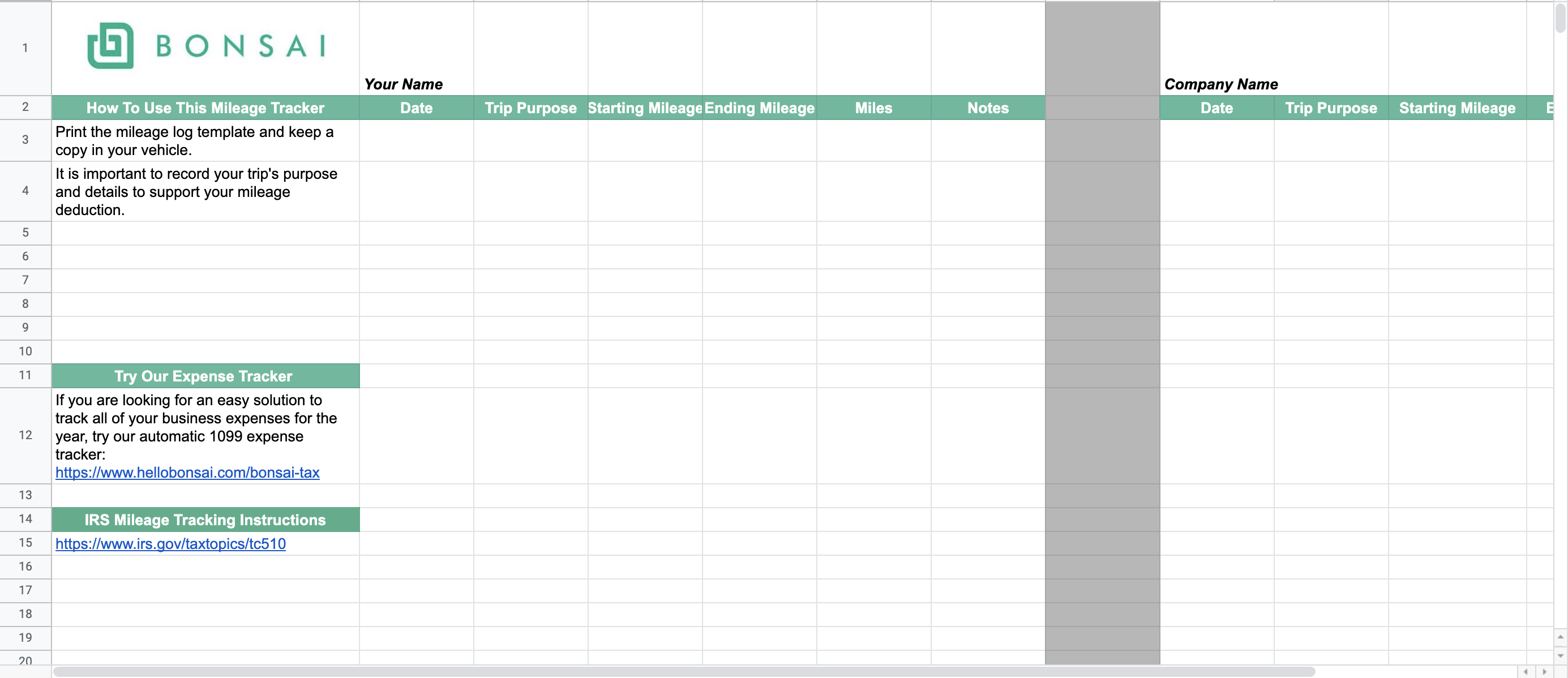

For 2021 the IRS’s standard mileage rate is 57 cents per mile driven for business. You must keep track of every drive and make sure you record exact mileage amounts. If it’s done with pen and paper, this may be a tedious process, but you can find a mileage tracking app to automatically log every trip.

Instead of deducting tax based on miles driven, you can choose the actual expenses method and deduct all of your car expenses such as gas, oil, tires, maintenance, and insurance.

To take this option, you must have sufficient proof of your expenses, so make sure to keep your receipts and maintenance records for at least 3 years after you file (in case of an audit). We recommend using a tax receipt organizer to keep all your documentation in place and ready for tax season.

Alternatively, you could track your miles with Bonsai's free mileage tracker spreadsheet.

Education

You can claim a tax deduction on ordinary and necessary expenses for the cost of education and training that you may provide to your employees. In addition, you may also deduct the costs of your own education that is related to your trade or business.

To be eligible for the deduction, you must prove that the education is to maintain or improve the skills required by law to keep your license or status. You won’t be able to claim an education expense deduction that are not strictly related to your business.

For example, you can deduct the costs of Continuing Learning Education (CLE), because these are classes required by law to keep your license. However, if you are taking a course to learn how to develop a website for your company, the costs of that course will not be tax deductible because you are not learning anything required to perform your job as an attorney.

Retirement Plans

In the 2020 tax year, the IRS increased the contribution limits for most retirement plans. By contributing to qualifying retirement accounts you may qualify for tax deductions by reducing your taxable income.

You can save for retirement using pre or after-tax dollars. If you use pre-tax dollars you can subtract that amount from your taxable income. For example, if you made $40,000 in the year, and were able to contribute $2,000 to your retirement plan, you would only pay taxes on $38,000.

These are the most popular retirement plans that you can choose as a solo attorney or owner of a law firm and take a tax deduction on your contributions.

SIMPLE IRA

The SIMPLE IRA plan, which stands for Savings Incentive Match Plan for Employees, is recommended for employers with 100 or fewer employees. It is quick to set up and the administrative responsibilities are minimum. The only downside is that you will be required to make employer contributions even if your employee doesn't contribute.

You can either choose to make a 2% contribution to all employees or a matching contribution of up to 3% of each employee's compensation. For 2021, the contribution limit for this plan is $13,500, and up to $16,500 for those age 50 and over.

Solo 401(k) Plan

A Solo 401(k) plan is a great option if you are planning for retirement on a freelance income. One of the main advantages of this plan is that it typically has the highest contribution limits among all retirement plans. The administrative and setup costs can be higher, but you are not required to make minimum contributions.

Additionally, it gives you the flexibility to choose between a traditional or a Roth plan which allows you to withdraw any money in the account tax-free at retirement age. The contribution limit for 2021 is $19,500 and up to $26,000 for those age 50 or more.

Credit Card Convenience Fees

Credit card companies will charge you a fee for accepting their card in your business. You may be charged a flat fee just for accepting that card, and an additional fee per transaction every time you take a payment. The average convenience fee is about 2.5% of the tax payment.

If you have a lot of transactions, the fees will add up quickly. The good news is, according to the IRS, you can deduct all credit card convenience fees as long as your law firm incurs/pays for them.

The fees charged by online payment platforms such as Stripe or PayPal are also tax-deductible.

Health Insurance

If you are paying for dental, medical, or long-term care insurance you may be eligible for a tax deduction. Suppose your healthcare expenses exceed 7.5% of your adjusted gross income (AGI), you can directly reduce your taxable income, by including the amounts paid for these expenses on your itemized deductions (including your family's insurance).

If your freelancer health insurance expenses don't exceed the 7.5% requirement, you can still deduct 100% of your health insurance premiums. The self-employed health insurance deduction, allows you to take an adjustment to your income, instead of an itemized deduction.

Student Loans

While you can’t claim a student loan deduction, the interest that you pay from the student loan IS tax-deductible. According to the IRS Publication 970, you can claim a deduction of up to $2,500 a year for interest on a qualified student loan.

The student loan must have been for you, your spouse, or a dependent, and you cannot claim the deduction if somebody else can claim you or your spouse as their dependent (even if you made the loan payments). The benefit applies to all loans, not just federal student loans.

You will also not be able to claim the deduction if you are married but are filing separately. The student loan must be from a qualified institution such as a college, university, or vocational school. It cannot be through an employer’s educational assistance program or from one of your relatives.

Keep Track of All Your Business Expenses and Get Ready for Tax Season

Now that you know the top expenses you can deduct taxes on, the next step is to keep track of them. This is the best way to have all of your paperwork ready for tax season. Need help with that?

Use Bonsai Tax to stay on top of your independent business. We help you track, organize and automate your expenses. You can also estimate quarterly tax bills and maximize your write-offs using our software specially designed for freelancers.

Start today with our 7-day free trial and see for yourself.