Filing a 1099 for attorney fees involves reporting nonemployee compensation received for legal services. Attorneys must accurately report these fees on Form 1099-NEC or 1099-MISC, depending on the nature of the payment. Key steps include understanding IRS guidelines, distinguishing between 1099-MISC and 1099-NEC, and ensuring timely filing to avoid penalties. Recent changes in reporting requirements, effective from 2024, emphasize the importance of compliance. Attorneys should also consider tax deductions and estimated payments to manage their tax liabilities effectively. Utilizing tools like Bonsai Tax can simplify tracking and recording tax deductions. Proper filing of 1099 forms not only ensures compliance but also helps avoid IRS audits and potential fines.

As a lawyer, you'll receive your legal fees in nonemployee compensation.

If you are an attorney or lawyer, you are responsible for paying taxes on your legal services. 1099 legal fees do not have tax withheld, so you'll need to report non-employee compensation taxes on your own.

The Internal Revenue Service and tax laws are particularly stringent with law firms and attorneys because they typically handle their client's money and are normally high-income earners.

If you fail to report a Form 1099 to the IRS, you'll receive a tax audit notice to pay the missing taxes. Form 1099-NEC and 1099-MISC are major sources of information for the IRS.

This guide covers everything from reporting requirements, estimated payments, self-employment taxes owed, business expense deductions, and more.

Recent reporting requirement changes were made in 2024, so we'll break those down first.

Note: If you want an easy way to manage and record all of your tax deductions, try Bonsai Tax. Our software will scour through your bank/credit card receipts to discover potential tax write-offs. On average, users save $5,600 from their tax bill. Try a 7-day free trial today.

When should you report gross proceeds paid on form 1099?

There are two tax forms you'll typically deal with as a lawyer: 1099-MISC and 1099-NEC. 1099 forms report miscellaneous income to the IRS, including:

- Nonemployee compensation

- Rents

- Royalties

- Prizes

- Awards

You only have to report legal fees made from generating taxable income or running your business. You should especially report the income if you plan to claim a tax deduction for the attorney fees.

Typically, IRS 1099 Forms are not required to be sent out to limited liability companies (LLCs) taxed as C or S corporations. This does not apply to legal services. Payments to lawyers must be reported on a Form 1099-NEC or Form 1099-MISC even if they are an LLC taxed as a corporation. Legal services are the exception to the general rule of not reporting payments made to a corporation. Let's break down each of these forms.

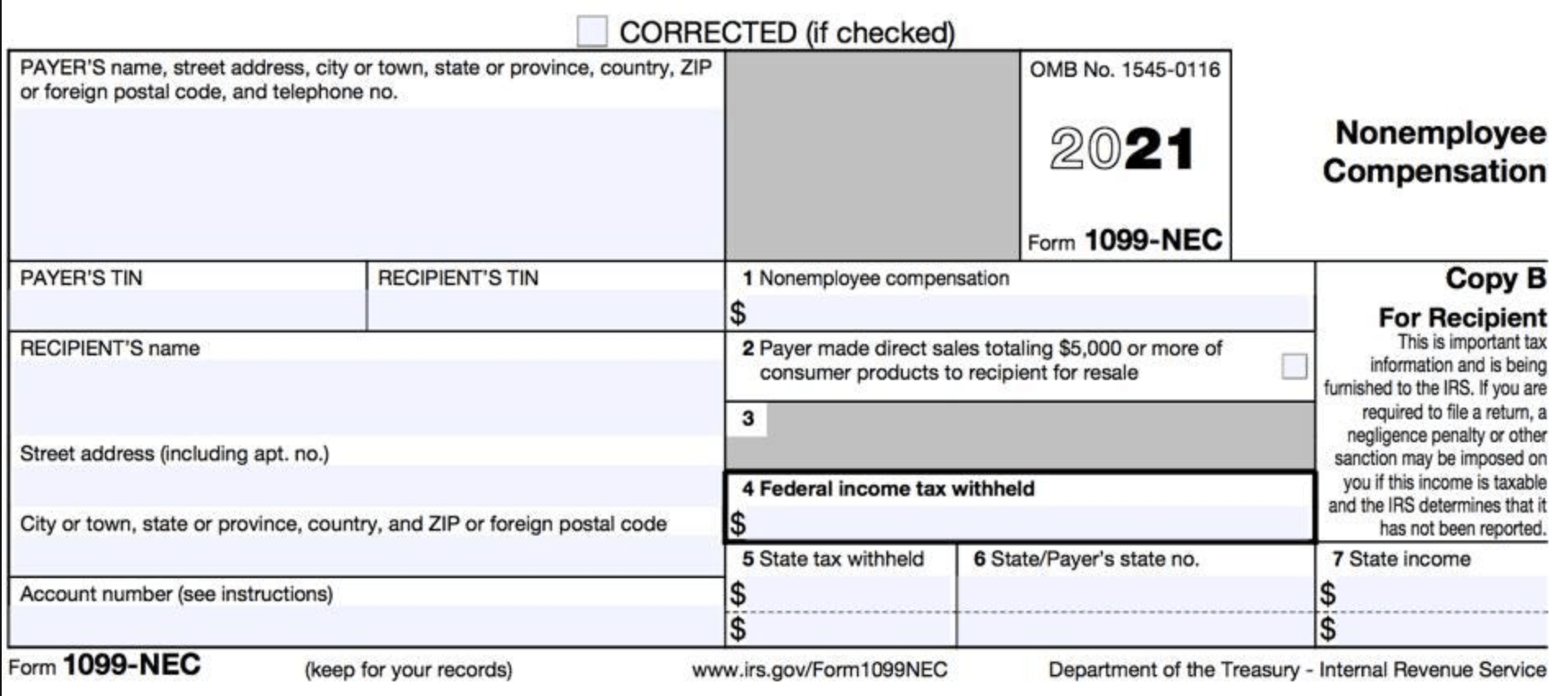

Form 1099-NEC

Prior to 2024, Form 1099-MISC was used to report nonemployee compensation. The reporting requirement was moved to the new Form 1099-NEC. Attorney legal fees, commissions, and other compensation over $600 paid to legal representatives must be reported in Box 1 of Form 1099-NEC. The size of your law firm or business does not matter. If you meet this requirement, you'll need to file a Form 1099-NEC.

For example, if a lawyer was paid $450 in legal fees for a session, the person or business hiring the attorneys or law firms does not need to send a Form 1099-NEC. If they are paid $450 in 2 separate years, the person or business will not need to provide a 1099 as well.

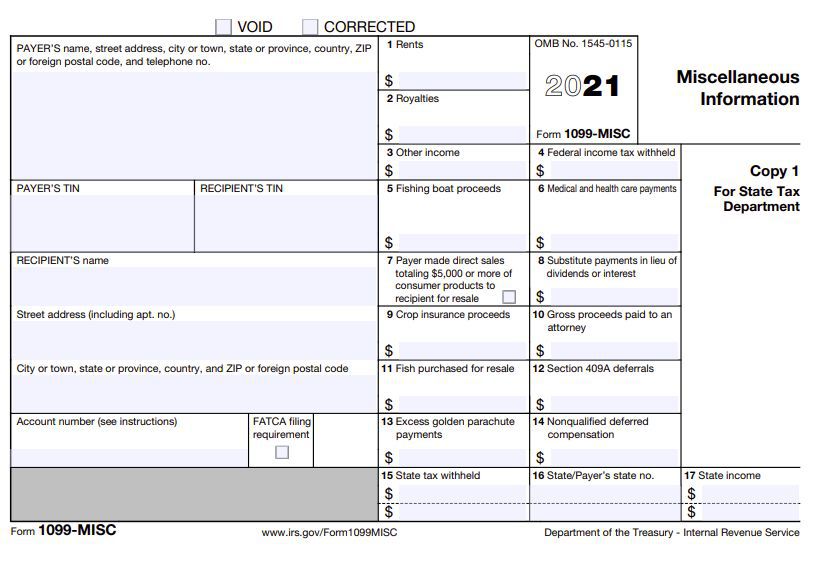

Form 1099-MISC

Some attorney and law firm payments are reported on IRS Form 1099-MISC instead of Form 1099-NEC. If payments above $600 are NOT reported in Box 1 of Form 1099-NEC and are made to an attorney or law firm in connection with legal services not directly provided by an attorney, they will likely be reported on 1099-MISC.

Gross proceeds paid to a lawyer related to legal services will be reported on Box 10 of the Form 1099-MISC. Box 10 is only for reporting payments or specific fees to attorneys. Those payments related to a settlement agreement with another person or business fall into this category.

For example, if an insurance company pays a claimant's attorney $150,000 to settle a claim, the insurance company reports the gross proceeds of $150,000 on box 10 of Form 1099-MISC.

Also, payments of at least $10 in broker payments or royalties in lieu of tax-exempt interest or dividends need to be reported on Form 1099-MISC for the 2024 tax year.

Self-Employment Taxes

As an independent contractor or law firm, you'll need to pay self-employment tax on your earnings. The tax rate is composed of two parts, Social Security (12.4%) and Medicare (2.9%). So, when you calculate your self-employment taxes, you'll owe 15.4%.

Social Security tax only applies to the first $160,200 of payments or compensation in 2024. There is no limit for taxes paid for Medicare tax. Let's review how a lawyer would pay for these taxes over the course of a year.

Quarterly Tax Payments

Independent contractors in the United States operate on a "pay-as-you-go" system in order to pay their self-employment and income taxes. This means lawyers will need to send payments to the IRS four times a year.

Lawyers who expect to owe at least $1,000 when they file their tax return may need to make estimated tax payments. In order to calculate quarterly tax payments, simply take your total tax liability from the previous year (Social Security, Medicare, income, and any other taxes) and divide that number by four.

These four payments are due by:

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2026

- April 15

- June 15

- September 15

- January 15 of the following year

You can calculate and send in payments via IRS form 1040-ES. Filing electronically is an option as you can send in payments to the IRS via Direct Pay.

You'll want to send in the right amount on time, otherwise, you can pay an underpayment penalty. If you miss payment deadlines, you'll pay a penalty rate of generally around .5% of the amount owed for each month or part of a month the tax is not paid (with a maximum of 25%).

Read our full guide to send estimated tax payments.

When do attorneys need to issue 1099 for attorney fees?

Whether or not legal firms and lawyers need to issue a Form 1099-NEC is a confusing topic. Although most law firms and legal representatives send checks to clients for legal settlements, most lawyers getting paid a joint settlement check are not considered "payers" and do NOT have to send out 1099 forms. The settling defendant would be considered the payor, and not the law firm or lawyer.

Payments for physical injury is an important exception to the 1099 form rules. The requirements to send out a 1099 do not apply to payments for personal physical injuries or physical sickness i.e. legal settlements for slip-and-fall injuries, car accidents, or medical malpractice cases. Such payments are typically tax-free for the injured person so no 1099 is needed.

However, there are instances where the attorney or law firm would have to issue a Form 1099-NEC or Form 1099-MISC.

An attorney or law firm paying fees for referral or co-counsel above $600, must issue a Form 1099 to the recipient. The same goes for a client paying a law firm or lawyer more than $600 in a year as a part of the client's business, must send out an IRS Form 1099.

Also, if attorney management and oversight functions oversee client monies, they become "payers". Thus they are required to issue Forms 1099 whenever they disburse funds.

When not to issue Form 1099 for attorney fees

Payments to corporations generally don’t require Form 1099

You do not need to issue Form 1099 for attorney fees paid to a corporation, including law firms structured as C or S corporations. The IRS exempts payments to corporations from 1099 reporting, which helps reduce unnecessary paperwork for businesses.

For example, if you pay $5,000 in legal fees to a law firm incorporated as an S corporation, you can skip issuing Form 1099-NEC or 1099-MISC. However, sole proprietors and partnerships providing legal services must receive a 1099 if payments exceed $600 during the tax year.

To avoid mistakes, verify the attorney’s business structure using Form W-9 before making payments. This step ensures you comply with IRS rules and prevents over-reporting that could trigger audits or penalties.

Payments for personal legal services are excluded

Form 1099 for attorney fees is not required when payments are made for personal legal services unrelated to your business. The IRS requires 1099 reporting only for payments made in the course of your trade or business.

For instance, if you hire an attorney to handle your personal estate planning or family law matters, you do not need to report those payments on Form 1099. This rule applies even if the payments exceed $600 in a calendar year.

Keep clear records to distinguish personal legal expenses from business-related ones. Doing so helps you avoid unnecessary filings and simplifies your tax reporting process for 2024 and beyond.

Payments made through third-party networks may not require 1099

Payments to attorneys processed through third-party payment networks like PayPal or credit card companies typically do not require you to issue Form 1099. These platforms report transactions directly to the IRS using Form 1099-K.

For example, if you pay an attorney $1,000 via a credit card, the payment processor will handle reporting. This rule applies regardless of whether the attorney is a sole proprietor or a corporation, reducing your administrative burden.

To stay compliant, confirm how payments are processed and retain documentation. If you pay attorneys directly by check or cash, you must issue Form 1099 when applicable. Understanding these distinctions helps prevent duplicate reporting and penalties in 2024.

Exceptions for payments under $600 and other special cases

You are not required to issue Form 1099 for attorney fees if total payments to the attorney are less than $600 in a calendar year. The IRS sets this threshold to reduce reporting for small transactions.

Payments made to employees of your company for legal services as part of their employment compensation do not require 1099 reporting. Similarly, reimbursements for legal expenses paid on your behalf are excluded.

Track all payments carefully and consult IRS Publication 15 (Circular E) or a tax professional to identify any unique exceptions that may apply to your situation in 2024. This diligence ensures you avoid unnecessary filings and stay aligned with current tax laws.

Consequences and penalties for incorrect 1099 filings

Financial penalties for late or incorrect 1099 filings

The IRS imposes specific financial penalties for filing 1099 forms late or with errors. For 2024, the penalty ranges from $60 to $610 per form, depending on how late the correction is submitted.

If you file within 30 days after the due date, the penalty is $60 per form. It increases to $130 per form if filed after 30 days but before August 1. Missing the August 1 deadline results in a $610 penalty per form.

For example, if a small business files 10 incorrect 1099 forms for attorney fees and submits corrections after August 1, the total penalty could reach $6,100. These penalties apply separately to both the IRS and the recipient copies, doubling potential costs.

Using software like QuickBooks or Tax1099 can help catch errors early and avoid these fees.

Review all 1099 forms carefully before submission and file corrections promptly if mistakes are found. Set calendar reminders for the January 31 deadline and use e-filing services to reduce risks of late or inaccurate filings.

Impact on tax audits and increased scrutiny

Incorrect 1099 filings, especially for attorney fees, can trigger IRS audits or increased scrutiny of your tax returns. The IRS cross-checks reported payments with recipient filings, and discrepancies may raise red flags. Consistent errors could lead to a more extensive audit, which is time-consuming and costly for freelancers and small businesses.

For example, if you report $15,000 in attorney fees on your 1099 but the attorney reports a different amount or does not receive a form, the IRS may question your deductions. This mismatch can delay your tax refund or result in additional taxes owed. Maintaining accurate records and confirming recipient information before filing can prevent these issues.

To avoid audits, keep detailed payment records, including contracts and invoices, and reconcile amounts with the attorney before issuing 1099 forms. Using accounting tools like FreshBooks or Bonsai can help track payments and generate accurate reports for tax time.

Legal consequences of intentional misreporting

Deliberate misreporting or failure to file 1099 forms for attorney fees can lead to serious legal consequences beyond financial penalties. The IRS may impose fines for fraud, and in extreme cases, criminal charges can be filed. Intentional omission of payments to avoid taxes is considered tax evasion, which carries heavy penalties.

For instance, if a business intentionally excludes $20,000 paid to an attorney from 1099 reporting, the IRS can assess additional penalties equal to 75% of the underreported amount, plus interest and possible prosecution. This risk underscores the importance of honest and complete reporting.

Always prioritize compliance by accurately reporting all attorney fees paid. If unsure about complex situations, consult a tax professional or CPA to ensure your 1099 filings meet IRS requirements and avoid legal trouble.

How to correct mistakes on 1099 forms for attorney fees

Correcting errors on 1099 forms for attorney fees promptly is essential to reduce penalties and maintain compliance. The IRS allows you to file corrected 1099 forms if you discover mistakes after submission. Corrections should be made as soon as possible to avoid escalating fines.

To correct a 1099 form, fill out a new form with the correct information and check the "Corrected" box at the top. Submit the corrected form to both the IRS and the recipient. For electronic filings, platforms like Tax1099 or Track1099 simplify the correction process and automatically notify recipients.

Regularly review your payment records and cross-check with attorneys before year-end to catch errors early. Taking these steps can save you time, money, and stress during tax season.

Common mistakes to avoid when issuing 1099s for attorney fees

Misclassifying payments and missing reporting requirements

One common mistake is misclassifying attorney fees and failing to report them properly on Form 1099-NEC or 1099-MISC. For the 2024 tax year, the IRS requires businesses to report payments of $600 or more made to attorneys, including law firms, regardless of whether the attorney is incorporated. These payments typically go on Form 1099-NEC if they are for services, but payments for legal settlements often require Form 1099-MISC, Box 10.

For example, if you pay an attorney $1,200 for legal consultation, you must issue a 1099-NEC. However, if you pay a legal settlement to an attorney on behalf of a client, it generally requires a 1099-MISC. Confusing these categories can lead to IRS penalties or delayed tax processing. Always verify the nature of the payment and consult IRS instructions for the 2024 tax year to choose the correct form and box.

To avoid this mistake, keep detailed records of all payments to attorneys and clarify the purpose of each payment before issuing 1099s. Using accounting software like QuickBooks or specialized tax tools such as Tax1099 can help automate classification and reduce errors.

Failing to obtain correct taxpayer identification information

Another frequent error is not collecting or verifying the attorney's Taxpayer Identification Number (TIN) before issuing a 1099. The IRS requires a valid TIN, usually a Social Security Number (SSN) or Employer Identification Number (EIN), to process 1099 forms correctly. Missing or incorrect TINs can trigger backup withholding or IRS notices.

For instance, if you pay a freelance attorney $800 but do not have their W-9 form on file, you risk withholding 24% of the payment as backup withholding. To prevent this, request a completed Form W-9 from every attorney before issuing payments. Digital tools like HelloBonsai or DocuSign can streamline this process by securely collecting and storing W-9s.

Make it a standard practice to verify TINs early in your payment workflow. This reduces the chance of late corrections and ensures smooth 1099 filing for the 2024 tax year.

Submitting 1099s late or with incorrect information

Timely and accurate filing of 1099s for attorney fees is crucial to avoid IRS penalties. The deadline for providing 1099 forms to recipients is January 31, 2026, and the deadline to file with the IRS is also January 31, 2026, if filing electronically. Missing these deadlines or submitting forms with errors like wrong amounts or misspelled names can result in fines up to $290 per form.

For example, a small business that files 1099s late or with incorrect attorney fee amounts may face penalties that add up quickly, especially if multiple forms are involved. Using e-filing services like the IRS FIRE system or third-party providers such as Track1099 can help ensure deadlines are met and data is validated before submission.

To avoid late or incorrect filings, set calendar reminders early in the year and double-check all 1099 details against your payment records. Early preparation reduces stress and keeps your business compliant with IRS rules for 2024 reporting.

1099 rules for attorney fee settlements

Many legal representatives receive funds to disperse from a settlement via checks to their clients. This means law firms and many lawyers receive funds to pass to clients for a share of the settlement total.

For example, let's say that an attorney settles a real estate deal or case for $950,000 and it is sent to the lawyer's trust account. If it is divided up with the lawyer receiving 33 percent (or one third) of the settlement and the client will receive 67 percent. Although the lawyer will receive a 1099 form to report the gross proceeds, the legal representative will not report the entire $950,000 as gross proceeds.

According to the IRS, case settlement payments are reported under Box 10 on Form 1099-MISC.

All payees must provide a taxpayer identification number, such as a Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or Employer Identification Number (EIN), on payee statements.

Differences between 1099-MISC and 1099-NEC for attorney fees

When to use 1099-NEC for attorney fees

The 1099-NEC form is used to report nonemployee compensation, including payments made to attorneys for services. For 2024, the IRS requires businesses to file Form 1099-NEC if they paid an attorney $600 or more for legal services during the year. This applies regardless of whether the attorney is incorporated or not.

For example, if you hired a freelance attorney to handle contract work and paid them $1,200 in 2024, you must report this amount on Form 1099-NEC. This form must be submitted to the IRS and a copy provided to the attorney by January 31, 2026. Using 1099-NEC ensures you comply with IRS rules on reporting nonemployee compensation.

To file the 1099-NEC correctly, gather the attorney’s taxpayer identification number (TIN) using Form W-9 before making payments. Tools like QuickBooks and Tax1099 can help automate the filing process. Remember, failure to file or incorrect filing can lead to penalties, so double-check your records before submission.

When to use 1099-MISC for attorney fees

Form 1099-MISC is used to report miscellaneous income, including certain attorney fees that are not considered nonemployee compensation. Specifically, if you paid an attorney as part of a settlement or judgment, those payments typically go on Box 10 of the 1099-MISC, not the 1099-NEC.

For instance, if your business paid $10,000 to an attorney as part of a legal settlement in 2024, this amount should be reported on Form 1099-MISC, Box 10. This distinction is important because payments related to legal settlements are treated differently for tax purposes compared to fees for services rendered.

Make sure to review the nature of your payments to attorneys carefully. Using accounting software like FreshBooks or Xero can help categorize these payments correctly. Misreporting attorney fees can trigger IRS scrutiny, so it’s best to consult a tax professional if you’re unsure which form to use.

Key differences and filing tips for 2024

The main difference between 1099-NEC and 1099-MISC for attorney fees lies in the type of payment being reported. Use 1099-NEC for fees paid directly for legal services, and 1099-MISC for attorney fees related to settlements or judgments. Both forms require reporting payments over $600 in the 2024 tax year.

When filing, remember that the IRS deadline for submitting 1099-NEC forms is January 31, 2026, while 1099-MISC forms reporting non-NEC payments have a deadline of February 28, 2026, if filing by paper, or March 31, 2026, if filing electronically. This timing difference can affect your tax reporting schedule.

Keep detailed records of all attorney payments and their purposes to avoid errors. Use IRS instructions for Forms 1099-NEC and 1099-MISC as references. Leverage software like HelloBonsai or TurboTax to streamline the process and ensure you meet all 2024 filing requirements accurately.

Deductions attorneys could take for 1099 for attorney fees

A benefit of attorneys being independent contractors is, they can take advantage of tax deductions for expenses they incur in the course of their business.

Here's a short list of expenses you can claim:

- Office supplies

- Legal research materials

- Client-related travel costs

- Continuing legal education

- Professional licenses and dues

- Travel expenses for business

- Advertising costs

- Vehicle expenses

- Home office deductions

- Entertainment expenses

- Costs for improved education

- Related industry magazines or subscriptions

- Credit card fees

- Software

- Self-employment taxes

- Office supplies

- Casualty and theft losses

- Moving expenses

- Professional fees paid i.e. accountant and other contractors

Read our more comprehensive list of tax deductions for lawyers here.

When to file 1099 for attorney fees

This article went over the tax liability you'll owe, sending out a Form 1099-NEC or 1099-MISC, quarterly taxes, independent contractor deductions and more. Remember, you'll need to be careful with tax filing because the IRS will be more likely to audit you. After all, you'll handle client funds and you will most likely have a high income (read the IRS's lawyer audit guide).

If you have any questions about filing your taxes for your legal fees or law services, we always recommend you contact a professional accountant or CPA at the end of the tax year to answer your tax questions. Tax rules are always changing and the sure-fire way you can stay compliant is by working with a specialist for legal advice.

If you need help with managing/organizing your business deductions, then try Bonsai Tax. Our app will automatically scan your bank/credit card statements to uncover potential tax write-offs you can claim from your tax bill. In fact, the majority of our users save $5,600. Claim your 7-day free trial here.