Tax season is stressful for small business owners. Paying Uncle Sam your hard-earned money is not pleasant. However, many ways exist to reduce how much you pay the government. In this article, discover 7 tax hacks for self-employed business owners to save money and pay fewer taxes. First, let’s break down the tax liability you'll owe.

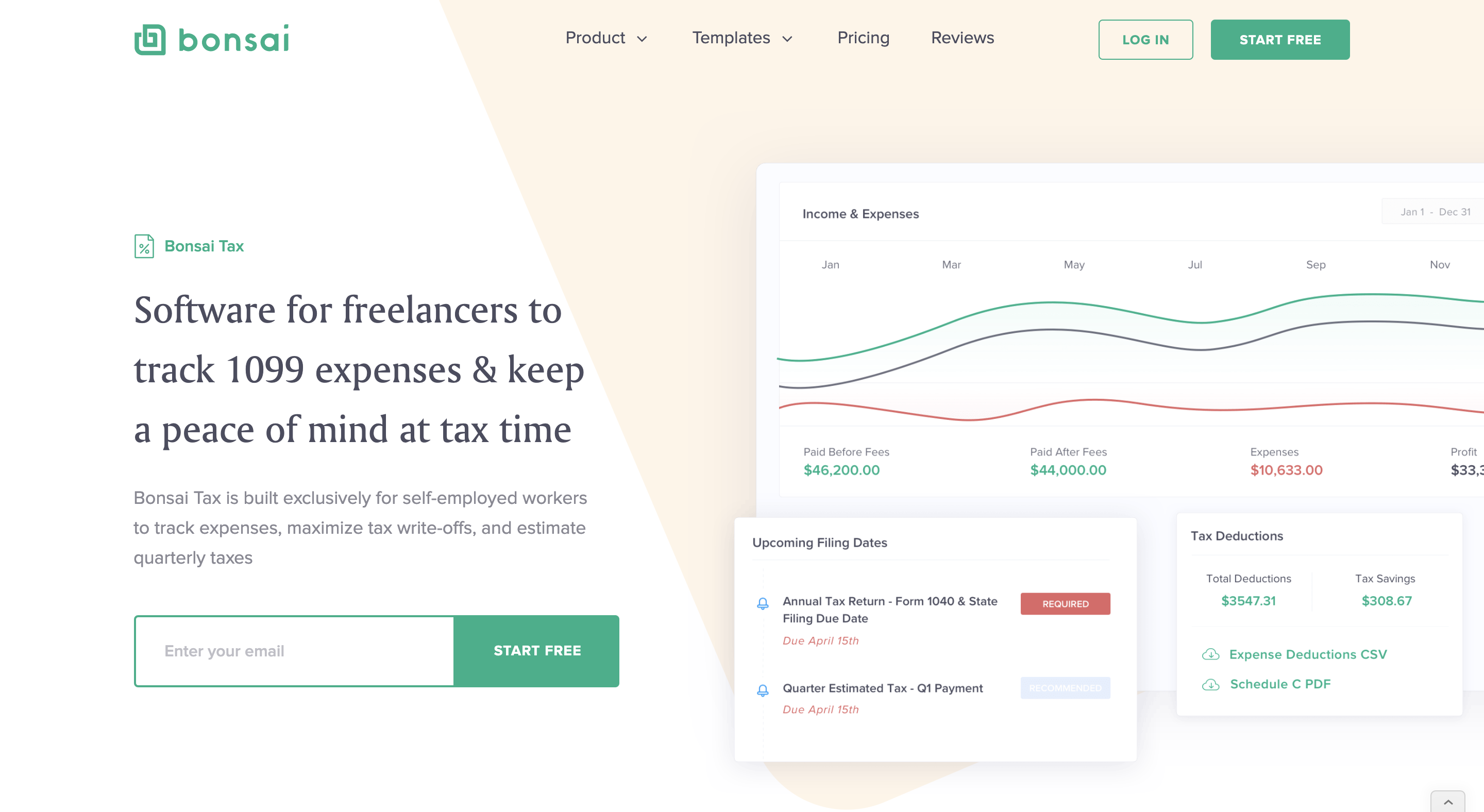

Note: If you want tax software to help you manage your write-offs and send you important due date filing reminders, try Bonsai Tax. Our app will scan your bank/credit card receipts to discover potential tax write-offs and help you maximize your savings. Typically, users save $5,600 from their tax bill. Claim your 7-day free trial today.

Self-employment tax basics

If you are a small business owner, you won't have your taxes withheld by an employer from every paycheck. Full-time employees have their taxes withheld from each paycheck in order to pay for Federal taxes. Self-employed individuals are responsible for paying the employer's portion of their taxes.

Self-employment taxes are composed of Social Security and Medicare taxes. This amounts to

Now, let's dive into 7 tax tips to help you save money on your tax return.

Tax hacks for small business owners

Here are 7 tax hacks a small business owner can leverage to save money during tax season:

- Maximize deductible business expenses

- Utilize tax software to find write-offs

- Claim the qualified business income deduction

- Take advantage of equipment losses

- Choose between itemized and standard deductions

- Keep detailed expense records

- File on time to avoid penalties

Claim business expenses

This is the most common and easy hack to use. The Internal Revenue Service allows business owners to write off the expenses they incur from running their business throughout the year. Any "ordinary" and "necessary" expense for your business can be used to lower your taxable income.

Some common tax deductions for small business owners to deduct during tax time include:

- Office supplies

- Business travel

- Home office expenses

- Advertising costs

- Professional services

- Internet services

- Office supplies

- Business equipment

- Mileage (use our mileage template to track miles)

- Vehicle expenses (a company car or one you use for your business can use the actual or standard mileage method to deduct car expenses)

- Business meals

- Home space

- Medical expenses

- Continued education or training costs

- Self-employment taxes

- Travel expenses (commuting to work does not typically count as a deductible expense)

- Related newspaper or magazine subscription

- Rent

- Health insurance

- Legal costs

- Start-up fees

- Advertising fees

See our 1099 deductions guide for more information for a full description of write-offs you can claim.

If you have old equipment, don't sell it yet. By abandoning the tools, a business owner will incur an ordinary loss which might be a better option because it's fully deductible.

If you don't want to keep detailed records of your business expenses, take the standard deduction. The standard deduction is a fixed dollar amount non-itemizers subtract from their income before income tax is applied.

If you want to skip using a worksheet for self-employed deductions to record all your expenses and use a tax software to handle it all for you, then try Bonsai Tax. Our app will scan your bank/credit card receipts to discover potential tax deductions you can claim at the end of the year. Users of our app typically save $5,600 from their tax bill. Try a 7-day free trial here.

Automatic Business Deduction

This tax write-off was introduced by the Tax Cuts and Jobs Act at the end of 2017.

The amounts you can deduct for the 2024 tax year are:

- $12,550 for single taxpayers

- $12,550 for married taxpayers filing separately

- $18,800 for heads of households

- $25,100 for married taxpayers filing jointly

- $25,100 for qualifying surviving spouses

The amount you can deduct was increased for the 2024 tax year. They are:

- $12,950 for single taxpayers

- $12,950 for married taxpayers filing separately

- $19,400 for heads of households

- $25,900 for married taxpayers filing jointly

- $25,900 for qualifying surviving spouses

Track your income and expenses with our free tax ledger template.

Standard versus itemized deduction

Here's a quick breakdown of the itemized deduction versus the standard. The standard way lowers your income by one fixed amount. On the other hand, itemizing deductions requires tracking your receipts to deduct eligible business expenses and lower your tax bill. Choose the method that reduces your tax bill the most.

When it comes to deducting tax write-offs and lowering your taxable income, claiming itemized deductions typically results in higher deductions. That is why it is vital to keep proper records of your business receipts.

Use tax filing software

In the modern age, tax filing software can take away the pain of filing your own taxes. All you need to do is answer questions about your business, and tax software will help you seamlessly file your taxes.

The beauty of tax filing software is that self-employed people with little to no tax knowledge can accurately file their tax returns, avoid IRS audits, and maximize their owed refund.

For example, Bonsai Tax is one of the best tax software for small business owners. The app scans your bank/credit card receipts to discover tax deductions from your spending throughout the year. Try a 7-day free trial of our small business software today.

The average cost of most tax software is ~$20.

Alternatively, you could even use the government's FreeFile program. Depending on your income, you may be able to prepare and file your taxes at no cost.

Open a retirement savings account

Freelancers can reduce taxable income by investing in a traditional retirement account. A financial advisor can help you open a retirement savings account to help you avoid paying taxes. Contributions to an individual retirement account (IRA) are tax-deductible. The IRS provides special tax benefits for those who invest in an IRA. Self-employed individuals can invest in tax-deferred retirement savings.

Freelancers or self-employed individuals can contribute up to $6,000 for 2024, and deduct that amount from their tax liability. Contributions are deductible in the year they are paid. You only pay tax on the withdrawals after you retire.

Qualified business income (QBI)

The QBI deduction was introduced by the IRS on December 31, 2017. Eligible self-employed and small-business owners with total taxable income in 2024 at or below $182,100 for single filers and $364,200 for joint filers may qualify for a 20% write-off on your taxable business income.

Who Qualifies?

The qualified business income deduction was designed for folks with "pass-through income" or business income reported on a personal tax return. Here's a list of entities that qualify to claim the QBI deduction.

- Sole proprietorships.

- Partnerships.

- S corporations.

- Limited liability companies.

Read more here for how to claim the QBI Deduction.

Claim home office deductions to lower your taxable income

If you have a space in your home used as your principal place of business, you may qualify for the home office deduction. Whether you own or rent, you can claim the deduction for any residence including a single-family home, apartment, condo, or houseboat. It does not apply to hotels or other temporary accommodations.

There are two IRS-approved methods to claim this deduction, the simplified and actual expense methods.

Simplified Method

The IRS introduced this method to calculate a home office deduction with ease. To calculate this write-off, simply measure your home office space you designate for business use and multiply it by the IRS's per square foot rate. The rate for 2024 is $5 per square foot with a maximum of 300 square feet ($1,500 per year).

Actual Expense Method

Using this method requires you to keep receipts for your home office expenses. Track the actual expenses you incur to make your earnings when working from home.

Receipts such as:

- repairs for home

- office supplies

- home utilities

- insurance

- cleaning costs

- phone and wifi

- computer/laptop expenses

- utilities

- furniture (chair/desk)

- mortgage interest

- real estate taxes

Qualified home-related itemized deductions can be claimed in full on a Schedule A.

Work with a certified public accountant

Tax accountants have vast industry knowledge to save you a lot of time when filing taxes. A professional accountant can help you create a tax strategy to lower your tax bill.

Small businesses that work with a CPA can discover a customized game plan to avoid paying taxes. A tax preparer not only helps you file your taxes but also gives you advice on ways to spend, save, and invest money in the future. This helps you prepare for the next tax year.

An accountant can help you set up quarterly tax payments to be withdrawn from your bank account or earnings. This way, you avoid paying the government one lump sum during tax time.

Hire subcontractors instead of employees

Small business owners have the advantage of subcontracting work to freelancers. Businesses that hire freelancers do not pay payroll taxes. Employers must cover half of Social Security and Medicare taxes in addition to employee salaries.

You can typically save more money hiring a freelancer instead of a full-time employee. For example, hiring a full-time professional writer for marketing requires paying benefits such as health care, disability insurance, unemployment insurance, and income protection. For a contractor, you don't pay for those benefits.

Tax hacks to save money at the end of the year

Here are tax hacks to save you money during tax time. For an easy way to get through tax season and save a ton of money, try Bonsai Tax. Our app sends filing reminders so you don't miss a tax payment and tracks your deductions. On average, users save $5,600 on their small business tax bills. Try a 7-day free trial today.

Set aside money to pay your tax liability. Since income and self-employment tax are based on your earnings, save a percentage from your monthly income. Most accountants recommend setting aside at least 30% of your payments to be safe.

Consider charitable giving strategies

Use charitable donations to reduce taxable income

Charitable donations can directly reduce your taxable income by allowing you to claim deductions on your tax return. For freelancers and small business owners in 2024, itemizing deductions on Schedule A lets you subtract qualified donations from your adjusted gross income, lowering your overall tax bill. This strategy works best if your total itemized deductions exceed the standard deduction, which is $13,850 for single filers and $27,700 for married couples filing jointly in 2024.

To maximize this benefit, keep detailed records of all donations, including receipts and acknowledgment letters from charities. Donations of cash, goods, or even appreciated assets like stock can qualify, but each type has specific documentation requirements. For example, donating appreciated stock held for more than one year can help you avoid capital gains taxes while still claiming a deduction equal to the fair market value.

By planning your charitable giving strategically, you can lower your taxable income and support causes you care about. Consider timing your donations to bunch multiple years’ worth into one tax year if it helps you surpass the standard deduction threshold. This approach makes your giving more tax-efficient and can increase your overall tax savings.

Leverage donor-advised funds for flexible giving

Donor-advised funds (DAFs) offer a smart way to manage charitable giving while optimizing tax benefits. These funds allow you to make a large donation in one year, receive an immediate tax deduction, and then distribute the money to charities over time. This is especially useful for freelancers and small business owners with fluctuating income who want to maximize deductions in high-earning years.

For example, if you expect a spike in income in 2024, contributing $10,000 to a DAF before year-end can reduce your taxable income for that year. You can then recommend grants to your favorite nonprofits gradually without worrying about timing your donations each tax season. Platforms like Fidelity Charitable and Schwab Charitable make setting up and managing DAFs straightforward.

Using a donor-advised fund also simplifies record-keeping since you receive one consolidated tax receipt for your contributions. This strategy provides flexibility and control over your charitable giving while ensuring you capture tax savings when it matters most.

Understand limits and exceptions to maximize deductions

There are limits on how much you can deduct for charitable donations each year, and understanding these rules helps you avoid surprises. In 2024, you can generally deduct cash contributions up to 60% of your adjusted gross income (AGI), but this limit can be lower for donations of property or to certain types of organizations.

If your donations exceed these limits, the excess can usually be carried forward and deducted over the next five tax years. For instance, if your AGI is $80,000 and you donate $60,000 in cash, you can deduct the full amount this year. However, if you donate $100,000, only $48,000 (60% of $80,000) is deductible now, and the remaining $40,000 can be carried forward.

Additionally, some states have their own rules and credits for charitable giving, which can further reduce your state tax liability. Check your state’s tax guidelines or consult a tax professional to ensure you’re maximizing deductions within both federal and state frameworks.

Factor in higher state, local, and standard deductions

Understand recent changes to state and local tax deductions

State and local tax (SALT) deductions have specific limits that impact your overall tax savings. For 2024, the federal SALT deduction cap remains at $10,000 for individuals and married couples filing jointly. This means you can only deduct up to $10,000 of combined property, income, and sales taxes paid to your state and local governments.

Some states, like California and New York, have higher local taxes, so it’s crucial to track these carefully. If you live in a high-tax state, consider strategies such as prepaying property taxes before year-end or timing income to reduce state tax liability. These moves can maximize your SALT deduction within the $10,000 limit.

Freelancers and small business owners should also note that SALT deductions apply only if you itemize your deductions. If your total itemized deductions do not exceed the standard deduction, you won’t benefit from SALT deductions directly. Evaluating your overall deduction strategy annually helps ensure you capture the most tax savings possible.

Maximize the standard deduction for 2024

The standard deduction for 2024 has increased to $13,850 for single filers and $27,700 for married couples filing jointly. This increase means more taxpayers can benefit without itemizing deductions, simplifying tax filing and potentially reducing taxable income significantly.

Freelancers with fewer deductible expenses may find the standard deduction more advantageous than itemizing. For example, if your total itemized deductions, including SALT, mortgage interest, and charitable contributions, are less than the standard deduction, claiming the standard deduction will lower your taxable income more effectively.

To take advantage of the higher standard deduction, review your expenses annually and compare your itemized deductions to the standard amount. Use tools like TurboTax, H&R Block’s tax calculators, or TaxAct to estimate which option yields the best tax outcome based on your 2024 income and expenses.

Combine deductions strategically for maximum tax benefit

Combining state, local, and standard deductions strategically can reduce your tax bill more than focusing on one alone. For instance, if your SALT deductions are close to the $10,000 cap, pairing them with other deductible expenses like business-related home office costs or retirement contributions can increase your total deductions.

Small business owners should also consider accelerating deductible expenses, such as purchasing equipment or prepaying certain business expenses before December 31, 2024. These tactics increase itemized deductions and may push your total deductions above the standard deduction threshold, maximizing your tax savings.

Regularly updating your bookkeeping and using accounting software like QuickBooks or Bonsai’s expense tracking can help you identify deductible expenses throughout the year. This proactive approach ensures you don’t miss opportunities to combine deductions effectively when filing your 2024 taxes.