Filing taxes as a photographer involves understanding self-employment tax obligations and maximizing available deductions. Start by organizing your income and expenses, using IRS forms like Schedule C for reporting. Key deductions include:

- Equipment depreciation

- Studio space

- Travel expenses

To estimate quarterly tax payments, calculate your expected annual income and apply the self-employment tax rate. Tools like Bonsai Tax can simplify tracking and filing. By staying informed and organized, photographers can minimize tax liabilities and avoid IRS complications, ensuring a smooth tax season each year.

I bet when you were imagining your journey as a freelance photographer, filing taxes never crossed your mind. At that time you were thinking of the beautiful moments you would capture. Stunning pictures that would make anybody looking at them linger for a while just to appreciate the artistry.

But, here you are wondering if you might find yourself on the wrong side of the Internal Revenue Service (IRS). Is it time you started paying your income taxes? What about your self-employment taxes?

Don’t worry. In this post, we will cover all the basics that a freelance photographer needs to learn to file their own taxes. Most importantly, we will discuss how you can take advantage of tax deductions to pay less tax.

It's not a walk in the park but with the right preparation and with the right tools, tax filing day will just be another normal day at work.

Note: The best way to stay on top of your freelance photographer taxes and maximize your tax savings, is with an app like Bonsai Tax. Our software will help you calculate your self-employment tax liability, send you filing reminders, and track all your business expenses for you (we'll scan your bank/credit card receipts to organize all your deductions automatically). Users typically save $5,600 from their tax bill with our services. Try a 7-day free trial today.

When to start paying self-employment taxes as a freelance photographer?

Does your tax bill start accumulating immediately when you earn your first dollar from photography?

Regulations state that if you are the sole proprietor of your business and you are below the age of 65, you become obligated to pay taxes if you earn a minimum of $13,850 per year in 2024.

Additionally, If your annual income, after deducting tax credits and business-related costs, is $400 or more, the government expects you to pay self-employment tax to the tune of 15.3%. This exclusively to caters to your Medicare and Social Security taxes.

Note, if you haven’t legitimized your photography business, you will still be liable to pay tax for its income but you can’t claim deductions from its expenses. This is because the IRS no longer allows deduction of business expenses against hobby income.

How to become a legitimate business as a freelance photographer

If you have been doing photography as a hobby, consider legitimizing it either by getting a sole proprietorship license or registering it as a limited liability company (LLC).

Understanding legal business structures for freelance photographers

Choosing the right business structure for your freelance photography

Freelance photographers typically choose between operating as a sole proprietorship, an LLC, or an S corporation. Each structure impacts your taxes, liability, and paperwork differently. A sole proprietorship is the simplest and most common choice, where your business income is reported on your personal tax return using Schedule C. However, it offers no liability protection.

Forming an LLC (Limited Liability Company) provides personal liability protection, separating your business debts from your personal assets. In 2024, many photographers prefer LLCs because they can choose to be taxed as a sole proprietorship or an S corporation, which may reduce self-employment taxes. For example, an LLC taxed as an S corp allows you to pay yourself a reasonable salary and take additional profits as distributions, lowering Social Security and Medicare taxes.

Understanding these options helps you balance tax savings with legal protection. Using tools like LegalZoom or consulting a CPA can simplify the setup process. Start by assessing your income level and risk tolerance, then select the structure that fits your freelance photography business goals best.

How your business structure affects freelance photographer taxes

Your chosen business structure directly influences how you file taxes and what tax forms you use. Sole proprietors report all income and expenses on IRS Form 1040 Schedule C, paying self-employment tax of 15.3% on net earnings. This tax covers Social Security and Medicare contributions.

LLCs have flexible tax treatment. By default, a single-member LLC is treated like a sole proprietorship, but you can elect S corporation status by filing IRS Form 2553. This election can reduce self-employment taxes by splitting income into salary and distributions. For example, if your freelance photography business earns $80,000, paying yourself a $50,000 salary and taking $30,000 as distributions could save you thousands in taxes.

State taxes vary by location. California imposes an $800 annual LLC tax plus a gross receipts fee, while Texas has no state income tax but charges a franchise tax. Always check your state’s rules and consider consulting a tax professional to optimize your tax strategy for 2024.

Registering your freelance photography business and staying compliant

Registering your freelance photography business depends on your chosen structure and location. Sole proprietors often operate under their own name, but you can file a Doing Business As (DBA) name with your local government to create a professional brand. LLCs and corporations require filing formation documents with your state’s Secretary of State office.

After registration, obtain an Employer Identification Number (EIN) from the IRS, which is free and can be done online in minutes. An EIN is necessary if you plan to hire employees, open a business bank account, or elect S corporation status. Additionally, check if your city or county requires a business license or permits for photography services.

Maintain compliance by keeping accurate records, paying estimated quarterly taxes, and renewing any licenses annually. Use accounting software like QuickBooks Self-Employed or Bonsai’s tax tools to track expenses and income efficiently. Staying organized helps you avoid penalties and focus on growing your freelance photography business.

What is the difference between quarterly and annual tax returns for freelance photographers?

Business tax is calculated annually. Making quarterly payments helps avoid a situation where you cannot afford to pay the full annual debt at once.

If you estimate your tax bill for the year to be $1,600, it makes more economic sense to pay four installments of $400 throughout the year rather than one large payment at tax season.

Still, as per the IRS, any self-employed person with a tax liability of $1000 or more after subtracting federal tax withholdings, is required to complete or file estimated tax payments each quarter.

Federal tax withholding is the amount withheld from your paycheck by your employer to cater to federal taxes. You are self-employed but one of your clients may be automatically withholding a percentage of your pay as withheld tax.

In this case, make sure to deduct the amount from your estimated tax to avoid overpaying.

If the taxes withheld cover more than 90% of your estimated tax debt for the current year or 100% of your tax debt for the previous year, you don't need to make quarterly payments.

How to estimate quarterly tax payments as a freelance photographer

To estimate your quarterly tax payment, use Form 1040-ES. It’s one of the six IRS forms that every freelance photographer needs to be familiar with. I will be telling you what each of these forms does in a short while.

Form 1040-ES contains everything you need to know to determine the estimated taxes for each quarter. It prompts you to enter your financials such as your expected gross income, list of tax-deductible expenses, and your federal tax withholding.

It will then guide you through the math process of coming up with the quarterly estimate by telling you when to subtract, multiply, or divide.

The form also contains additional information such as the date when each payment is due and situations that may lead to penalties.

Don’t worry about overestimating or underestimating your due tax in one quarter. You can always correct it when you do your estimates in the next quarter. And if at the end of the last quarter it turns out you have overpaid, you can request a refund or have the overpayment apply to future tax payments.

Sales tax and VAT considerations for photographers

Understanding when to charge sales tax or VAT

Freelance photographers must charge sales tax or VAT when selling taxable goods or services, depending on their location and client base. In the U.S., sales tax applies to tangible products like printed photos or physical albums, but not always to digital downloads or services. Photographers working with clients in the European Union must charge VAT on most services and digital products regardless of format.

For example, a photographer in California selling printed photo books to local clients must collect California sales tax, which ranges from 7.25% to 10.25% depending on the city. However, if the same photographer sells a digital photo package to a client in New York, sales tax may not apply because digital goods are exempt in many states. In contrast, a UK-based photographer selling digital images to EU clients must charge VAT at the standard 20% rate.

To comply, freelancers should register for sales tax or VAT collection in states or countries where they have a tax nexus or meet revenue thresholds. Use tools like TaxJar or Avalara to automate tax rate calculations and filings. Understanding these rules early helps avoid penalties and ensures accurate pricing.

How to collect and remit sales tax or VAT

Collecting and remitting sales tax or VAT requires setting up proper invoicing and record-keeping systems. Photographers should include the tax amount as a separate line item on invoices and receipts to maintain transparency with clients. Many invoicing platforms like QuickBooks, FreshBooks, or HelloBonsai offer built-in tax calculation features that automatically add the correct sales tax or VAT based on client location.

Remittance frequency depends on local regulations but typically occurs monthly or quarterly. For instance, California requires monthly sales tax returns if the tax liability exceeds $500; smaller sellers can file quarterly. VAT returns in the EU usually happen quarterly but can vary by country. Photographers should track all taxable sales and keep digital or physical copies of invoices for at least three years in case of audits.

Use accounting software that integrates with payment processors to simplify tax remittance by generating reports showing total taxable sales and collected taxes. Staying organized and timely with filings reduces the risk of fines and helps maintain a professional business reputation.

Special considerations for international sales

International sales introduce additional complexity for freelance photographers regarding sales tax and VAT. For U.S. photographers selling to clients abroad, sales tax generally does not apply, but VAT or GST may be charged depending on the buyer's country. For example, Canadian clients may require GST/HST collection if the photographer's sales exceed CAD 30,000 annually.

Photographers selling digital downloads worldwide should be aware of the EU’s VAT rules for digital services, which require VAT to be charged based on the buyer's country, not the seller's. This means photographers must register for VAT in the EU or use the VAT Mini One Stop Shop (MOSS) system to simplify filings across multiple countries.

To manage international tax obligations, freelancers can use platforms like Stripe Tax or PayPal Commerce, which automatically calculate and collect the correct VAT or GST during checkout. Consulting a tax professional familiar with cross-border sales can also help avoid costly mistakes and ensure compliance.

Navigating deductions and write-offs relevant to photographers

Identifying common deductible expenses for freelance photographers

Freelance photographers can deduct many business-related expenses to lower their taxable income. Common deductions include camera equipment, lenses, lighting gear, and computer software used for editing photos. For example, if you purchase a $2,000 camera in 2024, you can deduct the full cost under Section 179 or depreciate it over several years depending on your tax strategy.

Other deductible costs include studio rent, props, travel expenses for shoots, and marketing efforts like website hosting or social media ads. If you use your car to travel between client locations, you can deduct mileage at the IRS standard rate of 65.5 cents per mile for 2024. Keeping detailed records and receipts is essential to substantiate these deductions during tax filing.

To maximize deductions, track every business expense separately using tools like QuickBooks Self-Employed or Bonsai’s expense tracker. These platforms help organize receipts and categorize expenses, making it easier to claim all eligible write-offs. Regularly updating your records ensures you don’t miss out on valuable tax savings when tax season arrives.

How to handle home office and studio deductions correctly

Many freelance photographers work from home or rent a dedicated studio space, both of which can qualify for tax deductions. The home office deduction applies if you use a specific area exclusively and regularly for photography-related work. You can deduct a portion of your rent or mortgage, utilities, and internet based on the percentage of your home used for business.

For example, if your home office occupies 200 square feet in a 2,000-square-foot home, you can deduct 10% of eligible household expenses. Alternatively, the simplified home office deduction allows a flat $5 per square foot up to 300 square feet, which can be easier to calculate. If you rent a separate studio, all rent and associated costs like utilities and insurance are fully deductible as business expenses.

To claim these deductions accurately, maintain a floor plan or photos showing your workspace and keep utility bills and lease agreements. Using tax software like TurboTax or consulting a tax professional can help ensure you apply these deductions correctly and avoid IRS scrutiny.

Leveraging depreciation and equipment write-offs for big purchases

Expensive photography equipment can be written off through depreciation or Section 179 expensing, which allows you to deduct the full cost in the year of purchase. For 2024, Section 179 limits permit up to $1,160,000 in qualifying equipment deductions, making it a powerful tool for freelancers investing in high-cost gear.

If you buy a $5,000 lighting kit, you can choose to deduct the entire amount immediately or spread the deduction over several years using the Modified Accelerated Cost Recovery System (MACRS). Immediate expensing improves cash flow by reducing taxable income in the purchase year, but spreading depreciation might benefit you if you expect higher income in future years.

To decide which method suits your situation, use accounting software like FreshBooks or consult a CPA familiar with freelance photographer taxes. Properly leveraging depreciation rules can significantly reduce your tax burden and free up capital for further business growth.

Organizing and preparing for tax season

Set up a dedicated system for tracking income and expenses

Freelance photographers should establish a dedicated system to track all income and expenses throughout the year. Using accounting software like QuickBooks Self-Employed or Wave can simplify this process by automatically categorizing transactions and generating reports. This helps ensure no income or deductible expense goes unrecorded, which is crucial for accurate tax filing in 2024.

For example, you can link your business bank account and credit cards to QuickBooks Self-Employed, which will track payments from clients and purchases of equipment or supplies. Keeping digital receipts organized with tools like Expensify or Shoeboxed also saves time when preparing for taxes. This proactive approach reduces the risk of missing deductions such as camera gear purchases or travel expenses.

To get started, set a monthly routine to review and reconcile your transactions. This habit prevents last-minute scrambles during tax season and helps you stay on top of your freelance photography finances. Consistent tracking is the foundation for stress-free tax preparation.

Understand and categorize deductible expenses specific to freelance photography

Knowing which expenses are deductible is essential for lowering your taxable income as a freelance photographer. Common deductible costs include camera equipment, editing software subscriptions like Adobe Creative Cloud, studio rental fees, travel expenses for shoots, and marketing costs such as website hosting or social media ads.

For instance, if you purchased a $2,000 camera in 2024, you can deduct the full cost or depreciate it over several years depending on your accounting method. Additionally, mileage driven for client meetings or photo shoots can be deducted at the IRS standard mileage rate of 65.5 cents per mile for 2024. Keeping detailed logs or using apps like MileIQ will support these deductions.

Accurately categorizing these expenses in your accounting system ensures you don’t overlook valuable deductions. Review your categories quarterly to confirm everything is correctly assigned and consult IRS Publication 535 for the latest rules on business expenses.

Organize important tax documents and prepare for quarterly estimated payments

Freelance photographers must organize all relevant tax documents such as 1099 forms from clients, receipts for expenses, and bank statements. Storing these digitally in cloud services like Google Drive or Dropbox makes retrieval easy during tax filing. This also helps if you are audited by the IRS.

In 2024, freelancers are required to make quarterly estimated tax payments to cover income and self-employment taxes. Missing these deadlines can result in penalties. Use the IRS Form 1040-ES to calculate and submit payments by April 15, June 15, September 15, and January 15 of the following year. Tools like TurboTax Self-Employed offer reminders and calculators to help manage these payments.

Set calendar alerts for quarterly deadlines and keep a folder with all payment confirmations. Staying organized throughout the year avoids surprises and ensures compliance with tax laws. This preparation ultimately saves you money and reduces stress during tax season.

What IRS forms do freelance photographers need to file their taxes?

- Form 1040 - This form is also known as the US Individual Income Tax Return and is used by the IRS to collect information about your income, deductions, and credits to calculate your taxable income and annual tax liability. Form 1040-ES that we discussed above is a variant of Form 1040 to estimate quarterly taxes.

- Schedule C form - This is the IRS form that helps self-employed individuals to determine their taxable income by prompting that they report income and business expenses in detail. You'll file a Schedule C on 1099 income.

- Schedule SE - This form accompanies Schedule C and is used to estimate your social security and medicare taxes for the year. The form will prompt you to enter all the relevant financials and guide you through the calculation process.

- Form 2106 - This form takes the place of Schedule C for people that have received or are planning to receive a W-2. This only applies to freelance photographers that also have regular jobs where taxes are withheld from their paychecks.

- Form 8829 - If you conduct your photography business from your home, Form 8829 is there to help you claim a portion of the expenses you incur. For instance, if you pay a rent of $700, and you have a home office. Form 8829 will help you write off a certain percentage of the rent as a business expense.

- Form 4562 - This form helps you write off the depreciation cost of your photography gear. Your camera and lenses will depreciate over time, right? Well, you can calculate how much they have depreciated each year and deduct that from your income. We will discuss the different methods to depreciate your property in the next section where we look at expenses you can write off as a photographer to reduce your taxes.

Freelance photographer business expenses to claim to reduce taxable income

As a photographer, you can deduct multiple expenses from your photography income. This reduces your taxable income and lowers the taxes you owe. Here are some common deductible expenses:

- Camera equipment

- Editing software subscriptions

- Studio rental fees

- Travel expenses for shoots

- Marketing costs such as website hosting and social media ads

Depreciation of photography equipment costs

All equipment that you'll use for more than a year is considered capital expenses. Your camera is a capital expense IRS allows you to annually deduct a fraction of the cost of these expenses from your gross income over several years. This process is called depreciation.

There are three methods used to depreciate your equipment.

Straight-line depreciation

This is the simplest depreciation method and forms the foundation for all the others. First, you need to determine your equipment’s salvage value. That’s an estimate of how much the equipment will be worth after it has served its purpose.

Next, subtract the salvage value from the equipment’s original cost. Finally, divide that amount by the number of years you expect to use the equipment.

Let’s say you bought your camera for $3500 and you plan to use it for 5 years before upgrading. Assuming that after these 5 years the camera will be worth $1000, then that’s its salvage value. To calculate its depreciation, subtract $1000 from $3500 and divide the amount by 5. You get $500 meaning you can write off $500 per year for five years for the camera.

Double declining balance depreciation

This method of depreciation is most suited for properties that have a higher rate of depreciation in their earlier years than later years. It allows you to claim a larger deduction at the beginning and smaller deductions over time.

However, the total depreciation cost that is tax-deductible does not change. Using the above example, the total amount to be deducted will still be $2500.

The only difference is that instead of writing off $500 for 5 years, you can write off $1000 in the first year and then spread the remaining $1500 across the remaining 4 years.

Sum-of-the-Years' Digits Depreciation

This last method involves more calculations but if you feel that it suits you better than the other two then go for it. There is no easy way to explain it so I’ll just use an example.

The first step is to create fractions based on how much useful life your equipment has remaining. Using our camera example, in the first year, you have five years of life remaining, in the second year, you have 4 years of life remaining. Year 3 has three years of life remaining and the process continues until you have no life remaining.

Add up all these years. 5+4+3+2+1 = 15. The fraction for year 1 will be 5/15 and year 2 will be 4/15. The last year will be 1/15. You get the drift, yes? To get how much you can write off for each year, multiply the year’s fraction with the product's salvage value.

Alternatively, you can deduct the whole depreciation cost of your equipment at once to get a huge tax break in the first year but small tax breaks in the next years.

Photography work equipment

Every piece of equipment that you bought to facilitate your photography business can be written off. This includes:

- Cameras

- Tripods

- Lenses

- Lights

- Computers

- Props

Studio and storage space for freelance photographers

How much do you pay for your studio? This amount can be tax-deductible too. The same is true for any payments you may make to cater to the storage of your photography equipment.

Travel expenses for freelance photographers

If you have to travel for a photography gig, that is considered business travel and you can deduct every expense you incur. This includes:

- Air tickets

- Meals

- Accommodation

- Car rentals

- Car insurance

As of 2024, the IRS accepts a deduction of 65.5 cents for every business mile you travel using your car.

Training costs for freelance photographers

To grow as a photographer, you may have to take a few classes. Every cost you incur to gain new knowledge about your business is tax-deductible. Training expenses also include magazines and books that you buy to learn about photography.

Other business expenses for freelance photographers

Now, the truth is we can’t exhaust all the expenses that are tax-deductible when filing freelance photography taxes. There are a lot of expenses, including:

- Business meals

- Telephone

- Insurance costs

- Legal expenses

- Marketing expenses

Other expenses will be unique to your business.

The important thing to know is that the IRS recognizes deductible expenses as any expense that you incur and is necessary to run your business.

Note, the IRS requires that you attach receipts for taxes as evidence that your write-offs were legitimate business expenses. The receipts also need to be categorized to determine what type of expense it was. This means you need to have a very accurate tracking system to account for all the expenses.

This brings us to the final part of this post.

How freelance photographers can get help with taxes

Every tax expert will tell you that practicing good bookkeeping is the best thing you can do to prepare yourself for tax time. You need to record every financial transaction that involves your business.

Admittedly, it’s not an easy task. The good news is that you no longer have to do it manually. There are multiple software solutions you can use to track your business income and expenses, and Bonsai Tax is one of them.

Our software integrates with your bank account and credit card and will automatically import your freelance income, expenses, then proceed to classify them for you.

Then to facilitate efficient tracking of cash transactions, the software comes with a receipt scanner. The scanner is equipped with optical character recognition technology that reads the content on the scanned receipt and inputs the data on your expense report.

But, here is the best part. The tool identifies expenses that are tax-deductible and automatically write them off. It will then use all the information provided to estimate your quarterly taxes so that you never get caught unprepared.

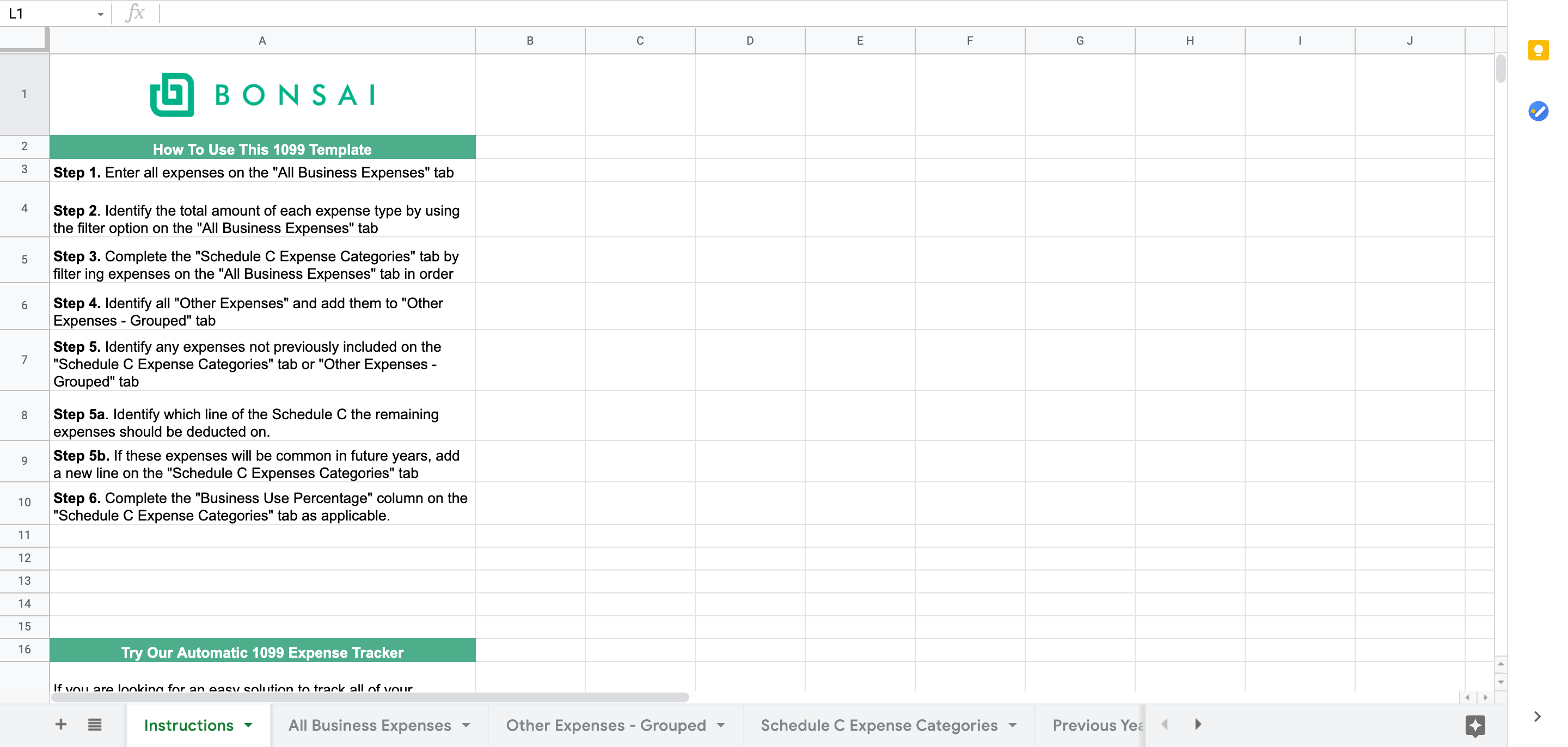

If you want to opt to manually track your expenses, try our free self-employed tax deductions worksheet.

Why Bonsai tax is better for freelance photographers than other expense tracking tools

Apart from efficient expense tracking, the software also comes with other modules that will be especially useful to you as a freelance photographer.

To start with, it comes with customizable invoice templates that are sent automatically to your client after the completion of a project.

It also features contract templates that will enable you to set the terms of your relationship with clients.

You can try our expense tracker for 14 days at no cost.