At the end of the tax year, most self-employed individuals try to minimize their self-employment tax liability by saving their receipts for business-related activities. After all, a self-employed taxpayer will owe 15.3% on their earnings from self-employment or Social Security and Medicare taxes. After you calculate your net earnings from self-employment, multiply it by the self-employed tax rate and you'll see how much you'll owe Uncle Sam.

If you are concerned with how much you'll owe, don't worry.

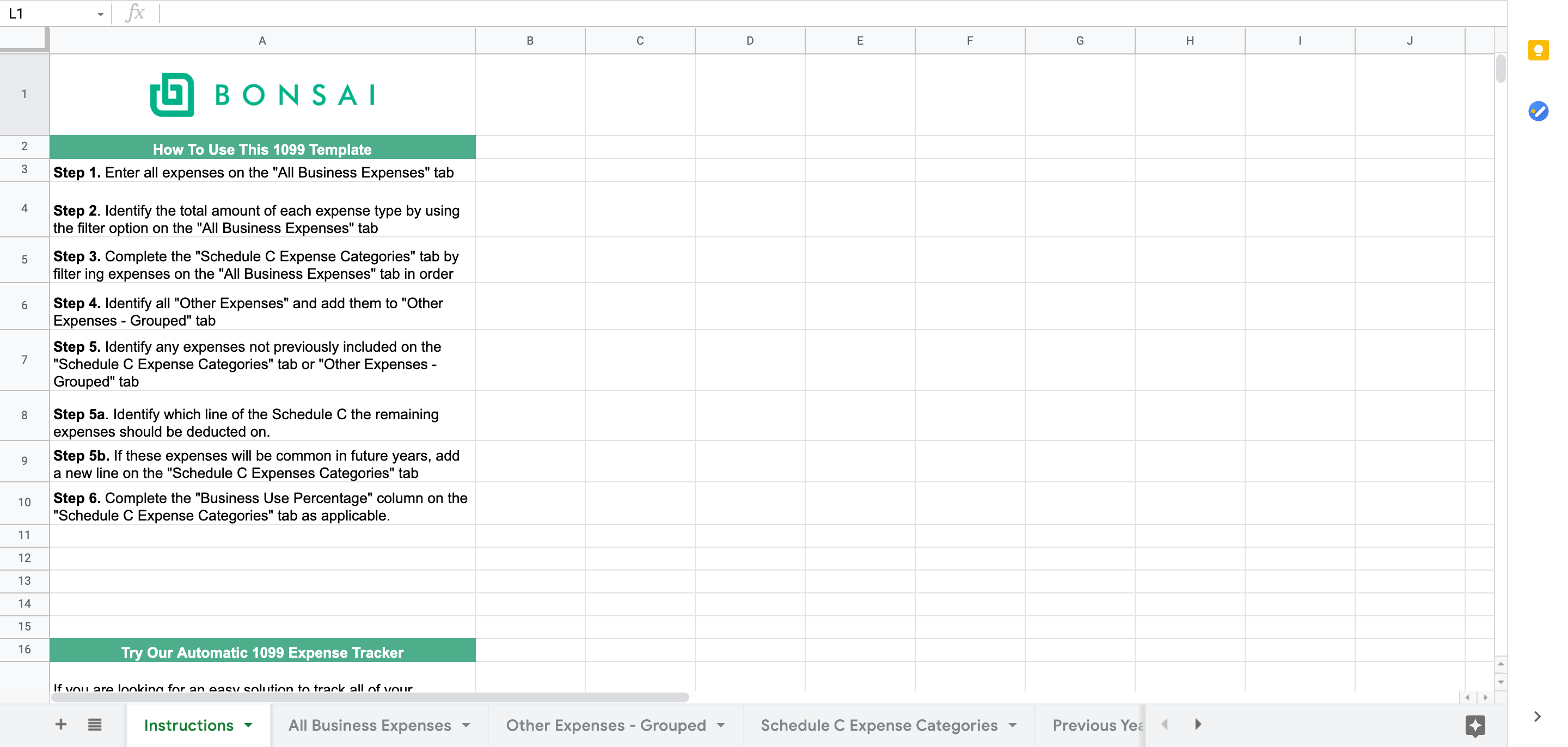

The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

Note: If you want to skip out on manually recording/organizing your business expenses, try Bonsai Tax. Our tax deduction finder would scan your credit card/ bank statements to find all the tax write-offs you qualify for and help you save thousands of dollars. In fact, users typically save $5,600 from their tax bill. Claim your 7-day free trial here.

Tax Write-Offs You May Qualify For

Here's a shortlist of business-related expenses self-employed individuals can claim to lower their tax bills.

- Business start-up expenses - legal costs, business structure fees, research expenses, borrowing costs, and expenses for technology

- Business use of your vehicle - we'll review how to track these costs more below.

- Continued education expenses - as long as it is an ordinary and necessary expense, education to maintain or improve your work

- Office supplies - internet bill, phone lines, utilities, cost of stationery, staples, binders

- Business insurance premiums - ordinary and necessary insurance premiums can be deducted from your taxes.

- Retirement savings - funds you place towards your retirement savings can be deducted from your taxes.

- Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense

- Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction.

- Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling

- Subscriptions and publications - newspaper subscriptions to relevant publications in your industry count as a tax write-off

- Rent - if you work from home, you may qualify for a rent deduction

- Advertising costs - Google adwords, billiards, sales promotions, public relations efforts, direct mail, product samples, websites csots are all deductible costs

- Contract services - hiring out contractors to help you fulfill your services can be deducted from your taxes

Read here for more deductions small business owners qualify for. You'll discover what exactly counts as a business expense.

Save All Your Receipts

In order to lower your gross income, you'll need to show the IRS proof that what you spent money on was actually for work or to complete your services/job. The IRS can still audit you a couple of years after your tax filing date if they recognize any red flags in the deductions you claim. This is why you want to be certain that what you deduct is reasonable for your profession or job.

The IRS has kept up with the changing time. Credit card statements will count as records for your tax write-offs.

You don't want to get struck by an IRS tax audit with no receipts. This can lead to unnecessary fines and penalties.

Note: If you want an automatic way to track your tax write-offs and avoid any IRS penalties for not having receipts, try Bonsai Tax. Our tracking services scan your bank/credit card statements to track and organize all of your potential tax write-offs. Users typically save $5,600 from their tax bill. Try a 7-day free trial of our services today.

.jpeg)

Recording Expenses For The Home Office Deduction On Your Income Tax Return

Self-employed individuals or independent contractors using their home for business purposes can claim a deduction for a home office on their personal income tax return.

The general rule or requirement for deducting home office expenses is if you use a section of your place of residence as the principal place of business, and a place where you use regularly/exclusively for work.

There are two methods for claiming the home office deduction. You can opt to take the simplified method (calculated by your home office's square footage) or the actual expense method. With the actual expense method, you'd have to record all your direct/indirect expenses instead of measuring the square foot of your home office.

Actual Expense Method

Before we get into all the business expenses that would qualify for, you can track your office costs with our worksheet for home office actual expenses. Here are some direct and indirect office expenses you can track to lower your income tax bill.

- home depreciation

- a portion of your electricity bill

- repairs

- insurance

- mortgage interest

- property taxes

Note: The team at Bonsai is here to help you maximize your small businesses deductions. Our expense tracker can help you automatically record and organize your tax deductions for you by scanning your bank/credit card statements. In fact, users typically save $5,600 from their tax bill. Try a 7-day free trial today.

Tracking Business Miles

Miles driven for business travel can lead to a giant tax write-off. Even if you use your personal car for business activity, you can claim the related expenses for the business use of your car.

Just like the home office deduction, there are two methods self-employed individuals can use to deduct vehicle expenses: the standard mileage rate and the actual expenses method.

The IRS has a mileage rate every year you can use to claim miles you drove for business. All you need to do is track your business miles, and multiply it by the IRS's mileage rate. The mileage rate in 2022 is 58.5 cents.

Try our template for business mileage tracking to record your miles.

If you opt to claim the actual expense method, here are some deductions you can record.

Actual Vehicle Expenses

- cost of gasoline

- oil

- car repairs (estimate receipts don't count)

- insurance

- depreciation on a vehicle

Here's To Lowering Your Self-Employment Tax Liability

If you are a small business owner, sole proprietor, or independent contractor, you have to understand one thing. The less business income you earn, the fewer taxes you'll pay. Period. Use this sheet to carefully record all your write-offs and lower your tax liability.

However, if you want to skip out on the headache of manually recording your receipts, try Bonsai Tax. Our app would scan your bank/credit card records to locate all the deductions you qualify for and help you maximize your tax savings. Our users save $5,600 from their self-employment taxes. Try a 7-day free trial today.

.webp)