Los contratistas independientes, los autónomos y otros trabajadores por cuenta propia tienen necesidades empresariales, retos y «dolores de cabeza» únicos en comparación con las personas que trabajan para otros. Por ello, necesitan una herramienta digital fácil de usar y asequible, diseñada específicamente para ellos.

La aplicación integral para autónomos Bonsai ha ayudado a cientos de miles de emprendedores autónomos a simplificar y optimizar las tareas administrativas, financieras y de relación con los clientes necesarias para desarrollar su actividad empresarial. Si eres autónomo y buscas ahorrar tiempo y optimizar tu flujo de trabajo, sigue leyendo para descubrir cómo el kit de herramientas digitales de Bonsai, con plantillas integradas, un gestor de deducciones fiscales y funciones de contabilidad, puede ser la solución que impulse tu negocio al siguiente nivel.

Nota: Si necesitas ayuda para gestionar facturas, impuestos o pagos como autónomo, podemos ayudarte. De hecho, pruebe una versión de prueba gratuita de 14 días de nuestro paquete de productos todo en uno y comprueba por ti mismo por qué 1099 contratistas nos adoran.

Los autónomos lo hacen todo

A diferencia de los empleados tradicionales que trabajan para la empresa de otra persona, con sus propias normas y expectativas, los contratistas independientes son responsables de crear su propia infraestructura empresarial —en términos de finanzas, relaciones con los clientes, producción de productos, cumplimiento normativo, etc.—, a menudo por su cuenta.

Además, a diferencia de los empleados W-2, a quienes se les retienen automáticamente los impuestos de cada nómina, los trabajadores autónomos (1099) son responsables de calcular y reservar sus pagos de impuestos al IRS, y de asegurarse de que se presenten y paguen a tiempo y en su totalidad.

Los trabajadores autónomos podrían necesitar ayuda

Trabajar por cuenta propia es liberador, pero también difícil, especialmente cuando todas las tareas organizativas, además del trabajo profesional, recaen sobre los hombros del propio autónomo. Lo cual puede resultar desorientador, agotador y, en última instancia, contraproducente: ¿cómo puede uno centrarse en ofrecer un producto o servicio de la máxima calidad a sus clientes si su tiempo y su capacidad mental se ven mermados por todas esas responsabilidades?

En resumen: muchos trabajadores independientes modernos se sienten abrumados por las exigencias de ser a la vez su propio jefe y empleado, ya que esos roles pueden acumularse hasta convertirse en dos trabajos a tiempo completo independientes.

Los trabajadores independientes que no están tan abrumados suelen contar con ayuda.

Lo ideal sería que esa ayuda proviniera de un pequeño ejército de asistentes humanos especializados que gestionaran diversas facetas del negocio, pero ¿cuántos autónomos disponen de ese presupuesto?

Por suerte, vivimos en una época moderna en la que también contamos con la ayuda de programas y aplicaciones diseñados para facilitar ciertos aspectos del trabajo, entre los que destaca la suite de productos todo en uno Bonsai (disponible como programa para ordenadores y como aplicación para dispositivos móviles).

Por qué los contratistas independientes necesitan software de gestión de relaciones con los clientes y contabilidad

Es tentador pensar que una sola persona puede «hacerlo todo», pero para que su negocio tenga éxito y sea sostenible en los próximos años, el emprendedor independiente debe trabajar de forma más inteligente, no más dura. Y eso significa automatizar los procesos que se prestan a la automatización, utilizar plantillas para la comunicación con los clientes y los formularios comerciales, y emplear herramientas digitales de contabilidad y declaración de impuestos para gestionar la mayor parte del trabajo administrativo necesario para dirigir un negocio.

Desafíos de los contratistas independientes

Dirigir un pequeño negocio propio, aunque sea una empresa unipersonal, no es una tarea fácil ni sencilla, y hay ciertos retos y dificultades que solo se dan en el mundo de los autónomos.

Captación de clientes

Los empleados regulares con formulario W-2 no tienen que preocuparse por atraer clientes a la empresa para la que trabajan (a menos que ese sea específicamente su trabajo). Por otro lado, los trabajadores autónomos son responsables de encontrar y «enganchar» a sus propios clientes, lo cual es una parte siempre desafiante y que requiere mucho tiempo en la gestión de un negocio.

Gestión de las relaciones con los clientes (CRM)

El concepto de «gestión de las relaciones con los clientes» hace referencia a los principios, prácticas, directrices, estrategias, herramientas y tecnologías que una empresa adopta con respecto a sus clientes. Cualquier negocio exitoso necesita un conjunto de herramientas o un sistema de gestión de relaciones con los clientes bien optimizado que permita al profesional independiente comunicarse fácilmente con los clientes para presentarles propuestas de proyectos, presupuestos, contratos, facturas y otras comunicaciones.

Gestión de tareas/tiempo

Cuando se trabaja por cuenta propia y se compaginan diferentes proyectos de múltiples clientes, llevar un control del tiempo que se dedica a cada trabajo es sin duda un reto, uno que no se puede dejar de lado, sino que requiere un sistema de gestión para evitar que todo se convierta en un caos.

Los contratistas independientes tienden a subestimar la cantidad de tiempo que dedican a un proyecto cuando facturan a los clientes, ya que calculan (en lugar de registrar) el número de horas facturables.

Seamos sinceros: es bien sabido que los trabajadores autónomos y los creativos suelen infravalorar su tiempo y restar importancia a su trabajo. Por eso es fundamental que los autónomos lleven un control del tiempo que dedican al trabajo con herramientas objetivas: tecnología inteligente que registra y reporta las horas facturables en tiempo real, con cifras reales (¡y sin subestimarse!).

Contabilidad/Contabilidad/Declaración de impuestos

Los contratistas independientes son conocidos por no ser muy buenos en el seguimiento de ingresos y gastos, establecer (y cumplir) presupuestos, llevar un control de los plazos burocráticos, presentar los impuestos 1099 correctamente y a tiempo, y otras prácticas de contabilidad y gestión financiera. Ahí es donde entra en juego nuestro software fiscal para autónomos.

A los contratistas independientes les resulta especialmente difícil conservar y organizar todos los recibos de los gastos empresariales; al fin y al cabo, su objetivo es ofrecer un servicio excelente a todos y cada uno de sus clientes. Desafortunadamente, no llevar un registro de los recibos o de los gastos relacionados con el trabajo da lugar a tener que pagar más impuestos sobre unos ingresos netos más elevados . ¡Es dinero que sale del bolsillo del contratista independiente! La aplicación sabrá automáticamente qué recibos guardar para los impuestos y los organizará por ti.

Nota: Si quieres un software que organice tus recibos automáticamente y te ahorre mucho dinero a la hora de pagar impuestos, prueba Bonsai Tax. Nuestra aplicación ayuda a los usuarios a ahorrar una media de 5600 dólares en sus impuestos. Prueba y comprueba por ti mismo cuánto ahorrarás utilizando nuestro gestor de gastos. Solicite tu prueba gratuita de 7 días aquí.

¿Quién puede beneficiarse del software/aplicación móvil Bonsai?

La mayoría de los contratistas independientes desearían poder centrarse simplemente en ofrecer los mejores productos o servicios a sus clientes, pero, en el mundo moderno, si quieres trabajar de forma independiente, ahora eres una pequeña empresa (y estás sujeto a las normas y reglamentos que se aplican a las pequeñas empresas, por no hablar de los inevitables gastos empresariales).

Como resultado, la mayoría de los trabajadores independientes de una amplia gama de profesiones se beneficiarían de la ayuda del conjunto de herramientas digitales Bonsai, por nombrar solo algunas:

- diseñadores gráficos

- desarrolladores de software

- redactores publicitarios

- fotógrafos

- entrenadores personales

- conductores de camiones

- paseadores de perros

- agentes inmobiliarios

- influencers de las redes sociales

- consultores de todo tipo

El software de CRM/contabilidad Bonsai está diseñado para trabajadores 1099 (es decir, entidades comerciales/profesionales/empresariales independientes que prestan servicios al público en general), por lo que la mayoría de los trabajadores autónomos se sentirán como en casa con Bonsai.

Nota: Escucha, si eres autónomo, Bonsai puede hacerte la vida MUCHO más fácil. Podemos ayudarte a almacenar recibos digitales para impuestos, gestionar facturas, enviar propuestas... lo que necesites. Prueba una prueba gratuita gratuita y compruébelo usted mismo.

El paquete de productos Bonsai All-In-One: todo lo que necesita para gestionar su negocio como contratista independiente.

Además de ofrecer productos de la más alta calidad, un servicio de atención al cliente dedicado y una garantía de precisión, el valor clave de Bonsai reside en proporcionarte un conjunto de herramientas diseñado para ti, que combina y entrelaza funciones que abordan cada uno de los aspectos que suelen ser un «dolor de cabeza» para los autónomos:

- Plantillas para formularios/documentos de uso frecuente: propuestas , contratos y facturas redactados para transacciones/condiciones aplicables a contratistas independientes.

- Características/funciones organizativas, como la gestión de tareas y el seguimiento del tiempo.

- Ayuda contable y fiscal con la declaración de ingresos, el seguimiento de los gastos empresariales (incluido el seguimiento del kilometraje), la clasificación y el cálculo de las deducciones fiscales, las estimaciones trimestrales del pago de impuestos, la generación de informes de gastos, las declaraciones de impuestos de fin de año, etc. No es necesario utilizar una plantilla de Excel para los gastos 1099.

La aplicación todo en uno Bonsai para contratistas independientes elimina la necesidad de alternar entre múltiples soluciones de software, ya que proporciona una cuenta unificada en la nube a través de la cual se puede acceder a estas funciones y utilizarlas con facilidad, además de integrarlas entre sí.

¿Por qué reinventar la rueda cuando puedes usar plantillas Bonsai?

A los contratistas independientes les gusta hacer las cosas a su manera (¡por eso se hicieron independientes!), por lo que suelen redactar propuestas, contratos y facturas desde cero.

Pero, aunque se trata de una ética de trabajo admirable, cuando se trata de documentos formales o trámites burocráticos, las plantillas realmente ayudan a ahorrar tiempo y esfuerzo.

Las plantillas de documentos son directrices: pueden utilizarse «tal cual» o, como prefieren la mayoría de los profesionales, personalizarse según las características o parámetros únicos de cada negocio. Su objetivo principal es sugerir contenidos útiles y crear una estructura/formato para diversos documentos formales de acuerdo con las últimas normas y prácticas.

Por lo tanto, si eres de esos trabajadores independientes obstinados a los que les gusta que las cosas sean «tal cual», el uso de las plantillas de Bonsai para propuestas, contratos y facturas no limitará tu estilo, sino que lo mejorará: puedes ajustarlas como necesites y, al mismo tiempo, beneficiarte de sugerencias útiles y una estructura básica.

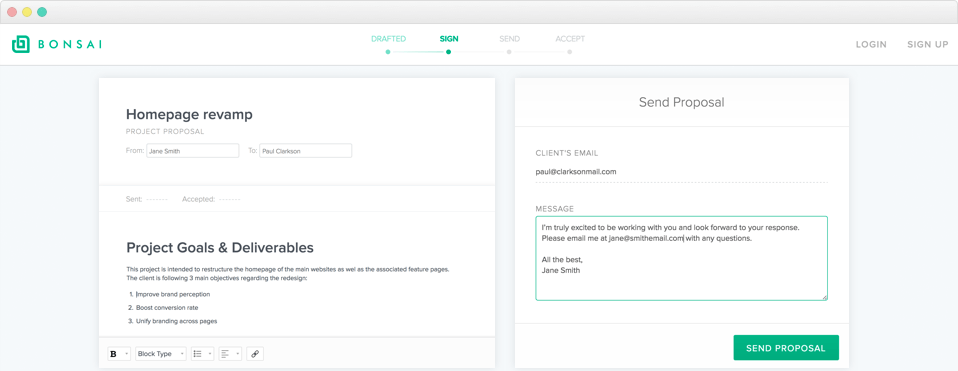

Propuestas

¡No hay nada como una propuesta comercial o de proyecto clara y concisa para describir de forma informativa lo más destacado de lo que puedes hacer por el cliente!

Plantillas flexibles para propuestas de Bonsai:

- Se puede personalizar para añadir su propia marca/oferta.

- Permite mostrar múltiples opciones de paquetes de servicios para que cada cliente elija (ideal para aumentar las ventas).

- Notificarle cuando se vea su propuesta y permitir al cliente aceptar la propuesta desde cualquier dispositivo y cualquier lugar.

- Añade a tu imagen de excelencia y profesionalidad con su diseño elegante y minimalista.

Se ha demostrado que las propuestas ayudan a conseguir trabajos y a mejorar la tasa de aceptación: ¡deja que las plantillas de propuestas de Bonsai te ayuden con esta parte tan esencial de tu negocio!

Contratos

Cualquier asesor jurídico, así como cualquier contratista independiente con experiencia, estará de acuerdo en que los acuerdos por escrito son la forma más segura desde el punto de vista legal a la hora de realizar un intercambio de bienes o servicios por dinero con un cliente (los acuerdos verbales pueden servir para algunas transacciones de poca importancia, pero son muy difíciles de demostrar ante un tribunal).

Es decir: necesitas un contrato. Puedes redactar fácilmente todos los contratos que necesites utilizando las plantillas de contratos para autónomos de Bonsai, que han sido cuidadosamente revisadas y que:

- Disponible en varias versiones, incluyendo acuerdos de confidencialidad.

- Permite firmar, almacenar y enviar los contratos de forma electrónica.

- Recuerde automáticamente a su cliente que se requiere su firma y le informaremos cuando se firme el contrato.

Cuando se trata de crear documentos legalmente vinculantes, como contratos de trabajo, es difícil prever todas las cláusulas legales y el lenguaje que suelen incluir este tipo de materiales. Las plantillas de contratos Bonsai están redactadas por profesionales del ámbito jurídico y contienen las advertencias y los obstáculos legales más habituales y frecuentes, previstos en nombre del contratista independiente.

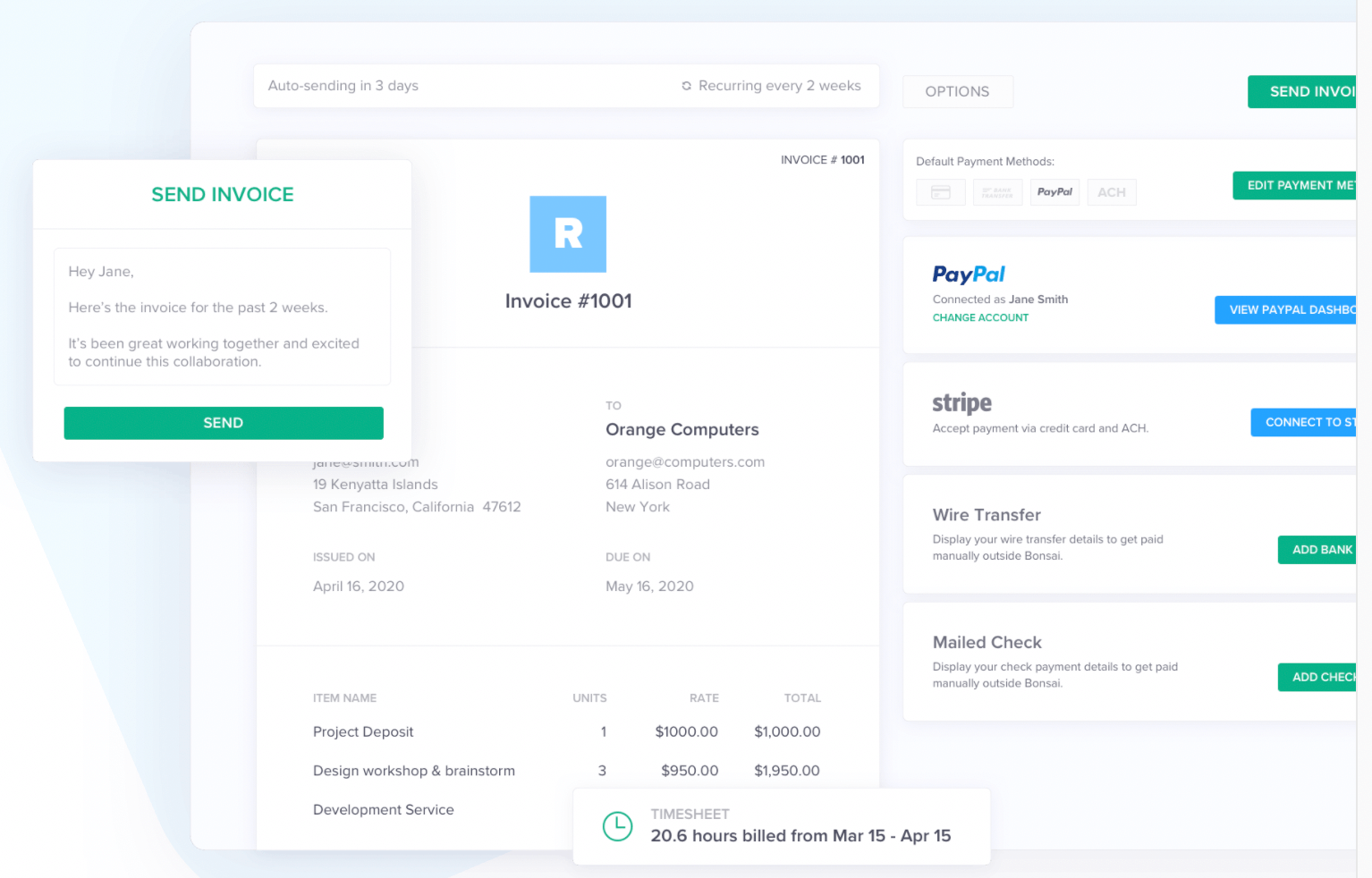

Facturas

Una facturación clara y puntual es un componente clave para ganar dinero como autónomo. Las facturas hacen que los clientes se sientan seguros con respecto a las transacciones; también sirven como recordatorios corteses pero insistentes para el cliente de que es hora de pagar la factura.

Plantillas de facturas para bonsáis:

- Automatice todos los procesos, desde la creación de la factura hasta su envío, pasando por el recordatorio a los clientes para que realicen el pago y la aplicación de recargos por demora en los pagos.

- Permita una variedad de opciones de pago globales (por ejemplo, tarjeta de crédito, pagos mediante «cámara de compensación automatizada», PayPal).

- Ofrece funciones avanzadas/profesionales, como pagos parciales, bloqueo de archivos adjuntos, etc.

Al igual que todas las demás plantillas de la suite, los materiales de facturación de Bonsai tienen un aspecto profesional, son personalizables y se pueden compartir fácilmente con colaboradores y clientes.

Bonsái: gestión del tiempo y de proyectos

Trabajar en varios proyectos a la vez requiere disciplina y planificación si se quiere llevar un control preciso de las horas facturables dedicadas a cada trabajo.

Las funciones de seguimiento de tareas y tiempo de Bonsai incluyen :

- Facturación sencilla: solo tienes que establecer tu tarifa por hora para el trabajo y Bonsai se encargará de la facturación.

- Opciones para compartir tareas con colaboradores, añadir comentarios entre ellos y realizar un seguimiento del tiempo para ver cuántas horas quedan por facturar.

- Disponibilidad en todas las plataformas online populares: se puede utilizar online como aplicación móvil, aplicación para macOS y extensión de Chrome.

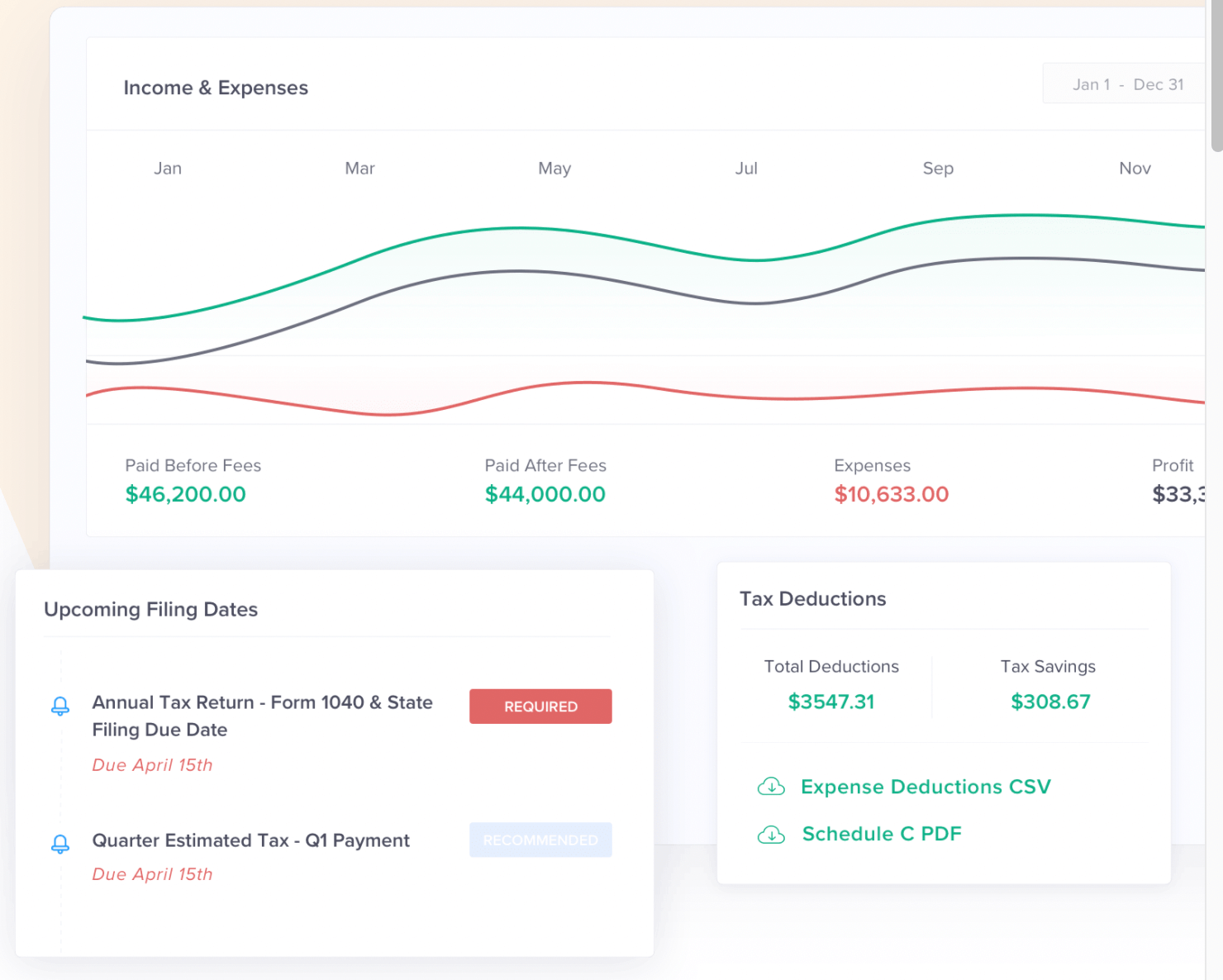

Software de contabilidad y fiscalidad Bonsai para autónomos

Muchos empresarios confesarán que la contabilidad empresarial y la declaración de impuestos son las tareas más abrumadoras y temidas de la gestión de una empresa.

Tener que registrar los ingresos, llevar un control de los gastos, clasificar y calcular las deducciones fiscales, declarar los impuestos estimados trimestrales y presentar la declaración de la renta al final del año resulta confuso, frustrante y, para algunas personas, francamente desconcertante.

¡El software de contabilidad Bonsai Tax al rescate! Después de responder algunas preguntas básicas para ayudar a determinar qué formularios son aplicables a su situación fiscal, la aplicación se encargará de la mayoría de las tareas relacionadas con los impuestos, tales como:

- Seguimiento de tus ingresos

- Realice un seguimiento de los gastos de su empresa mediante la importación automática de los datos de las tarjetas de crédito y las cuentas bancarias vinculadas, y escaneando (con su ayuda) los recibos originales que no existen en formato digital.

- Clasificar sus registros de gastos en las categorías deducibles correspondientes y calcular sus deducciones fiscales (con el seguimiento de los «gastos reales de combustible»/kilometraje para aquellos que reúnen los requisitos para deducciones por gastos de viaje).

- Generación de informes de gastos y pérdidas para mantenerte dentro del presupuesto.

- Cálculo de impuestos trimestrales y anuales / ayuda para presentarlos

El software de contabilidad Bonsai Tax es ideal para trabajadores 1099 de todo tipo de profesiones, tales como:

- conductores de camiones semirremolques (conductores de empresa y propietarios-operadores)

- conductores de vehículos compartidos (por ejemplo, Uber, Lyft)

- Servicios de entrega de comida y comestibles solicitados a través de aplicaciones en línea (por ejemplo, GrubHub, Instacart).

- 1099 anfitriones de Airbnb

- artistas que venden sus creaciones en línea (por ejemplo,«1099 Etsy-preneurs»)

- personas que revenden artículos en línea (por ejemplo, vendedores de eBay)

Consejo profesional: no te dejes intimidar por la legislación fiscal y la burocracia: puede que tenga mala reputación por ser un proceso abrumador y aburrido, pero fue creado por simples mortales y puedes entender perfectamente cómo funciona si no dejas que te intimide psicológicamente. En cambio, intenta entusiasmarte con ello: puede parecer una locura, pero incluso el mundo de los impuestos puede ser interesante si te lo propones.

Una vez que superas la «sequedad» del proceso, la contabilidad fiscal habitual, así como las declaraciones trimestrales y anuales, pueden llegar a ser no solo «menos terribles», sino incluso satisfactorias. Llevar las cuentas con rigor (presupuesto, recibos, deducciones, impuestos, etc.) no solo reporta beneficios económicos, sino también una recompensa espiritual inestimable: el orgullo y el control sobre la propia carrera profesional y el negocio.

Y no lo olvides: ¡con la aplicación Bonsai Tax, no estás solo! Nuestro software de contabilidad no solo le guiará en el mantenimiento de sus finanzas e impuestos a lo largo del año, realizando la mayor parte del seguimiento, clasificación y cálculo en su nombre, sino que también le permitirá adquirir más conocimientos y, por lo tanto, sentirse más cómodo con todo el proceso.

La solución del bonsái

Como cualquier contratista independiente con experiencia sabe (por haberlo aprendido por las malas), trabajar de forma más inteligente significa organizar, racionalizar, externalizar, optimizar y, cuando sea posible, integrar las diferentes «piezas del rompecabezas» del flujo de trabajo.

También se trata de llevar registros meticulosos, pero siendo minimalista al respecto (por ejemplo, deshacerse de los recibos en papel, las facturas y otros documentos impresos que ocupan espacio). Lea usted mismo algunas opiniones de clientes reales.

También se trata de elegir la mejor herramienta para el trabajo.

Las normas sobre el bonsái prevalecen sobre las aplicaciones para contratistas independientes

¡No hay que subestimar el valor de procesar todos los formularios, archivos y registros financieros y fiscales de su empresa en una única plataforma digital segura en línea de Bonsai (a la que puede acceder las 24 horas del día)!

Además, la versatilidad es importante, y la suite Bonsai y el software fiscal/las aplicaciones móviles para contratistas independientes son:

- Diseñado para satisfacer las necesidades de una amplia gama de trabajadores independientes, permitiendo que varios titulares de cuentas colaboren entre sí (el plan de precios incluye una versión básica y otra avanzada del paquete de productos, con un complemento gratuito de «Colaboraciones» y otros complementos opcionales de «Socios» y «Bonsai Tax»).

- Cubre Estados Unidos, Canadá, Reino Unido, Australia (y más) y admite 180 divisas.

- Totalmente basado en la nube. No es necesario descargar ningún software: siempre que tengas conexión a Internet en tu dispositivo Mac, PC, iOS o Android, podrás acceder a tu cuenta online desde cualquier lugar y en cualquier momento (¡y tus datos estarán almacenados de forma segura!).

- Famoso por su facilidad de uso (¡pregunte a nuestros más de 250 000 usuarios!).

En Bonsai, predicamos con el ejemplo.

Todo profesional independiente tiene la obligación de investigar sus opciones y elegir la herramienta más adecuada y con el mejor precio para las necesidades de su empresa.

Por eso invitamos a los autónomos a probar el paquete Bonsai + el software/las aplicaciones Bonsai Tax de forma gratuita: les da dos semanas para familiarizarse con la interfaz (disponible en ordenadores PC y Mac, así como en teléfonos inteligentes iOS y Android) y para hacerse una idea práctica de si este conjunto de aplicaciones y funciones se adapta a sus necesidades.

¡Prueba Bonsai y observa cómo fluye tu flujo de trabajo!