Ein Formular für das Selbstständigen-Kontobuch ist eine genaue, detaillierte Aufzeichnung oder ein Dokument Ihrer Einkünfte und Ausgaben aus selbstständiger Tätigkeit. Ein Selbstständigenbuch kann online über eine Tabellenkalkulation, ein Dokument aus einer Buchhaltungssoftware oder sogar in einem handschriftlichen Buch oder einer Tabelle geführt werden. So ziemlich alles, was Sie zur Erfassung aller Einnahmen und Ausgaben aus selbständiger Tätigkeit verwenden können.

Die wichtigste Funktion eines Selbstständigenbuchs besteht darin, genaue und aktuelle Aufzeichnungen über Ihre Einkünfte für Ihre Steuererklärung zu führen.

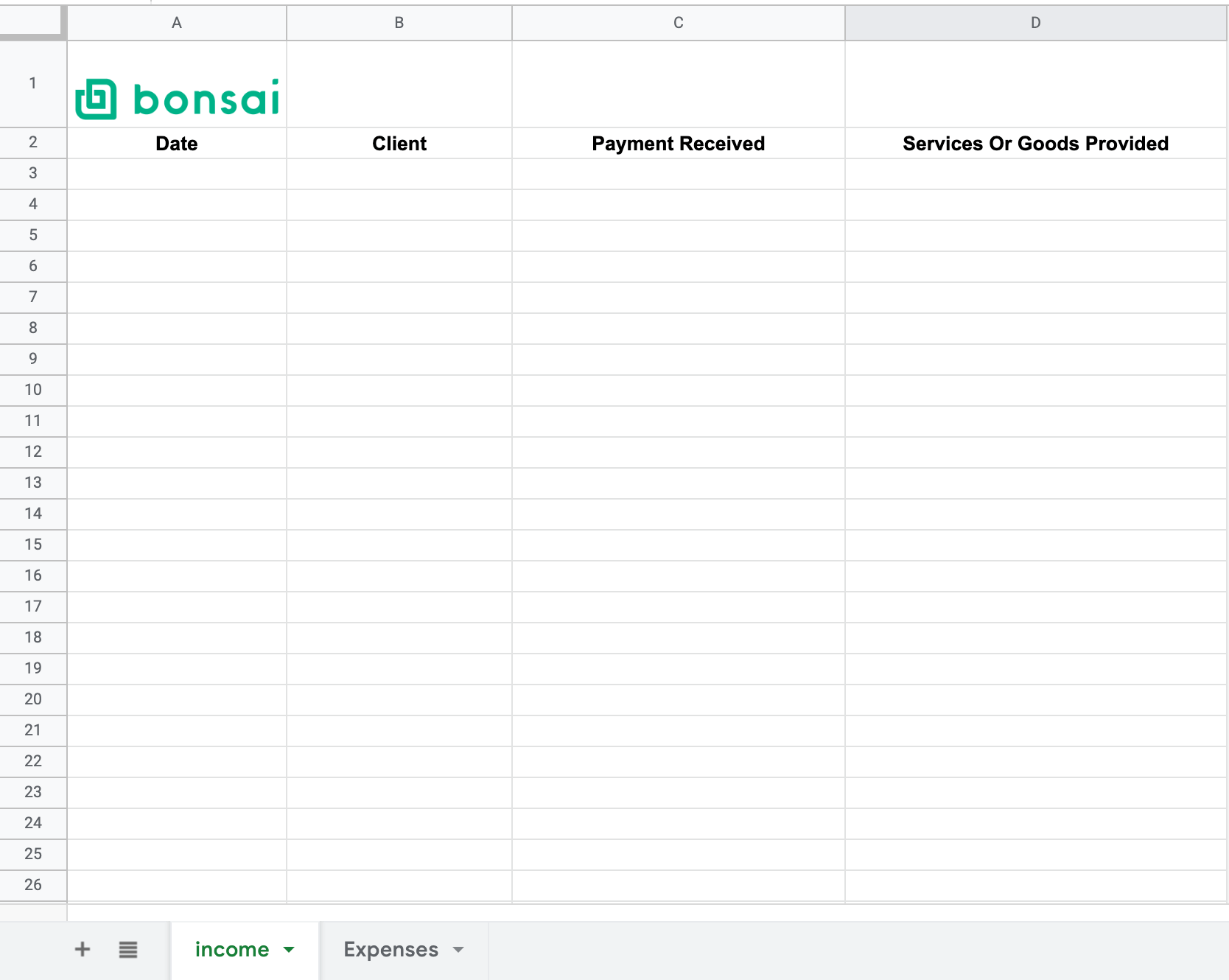

In diesem Artikel stellen wir Ihnen eine kostenlose Vorlage zur Verfügung und zeigen Ihnen, wie Sie Ihre Unterlagen für Selbstständige ordnungsgemäß dokumentieren. Laden Sie zunächst unsere kostenlose Vorlage für ein Selbstständigen-Kontobuch herunter.

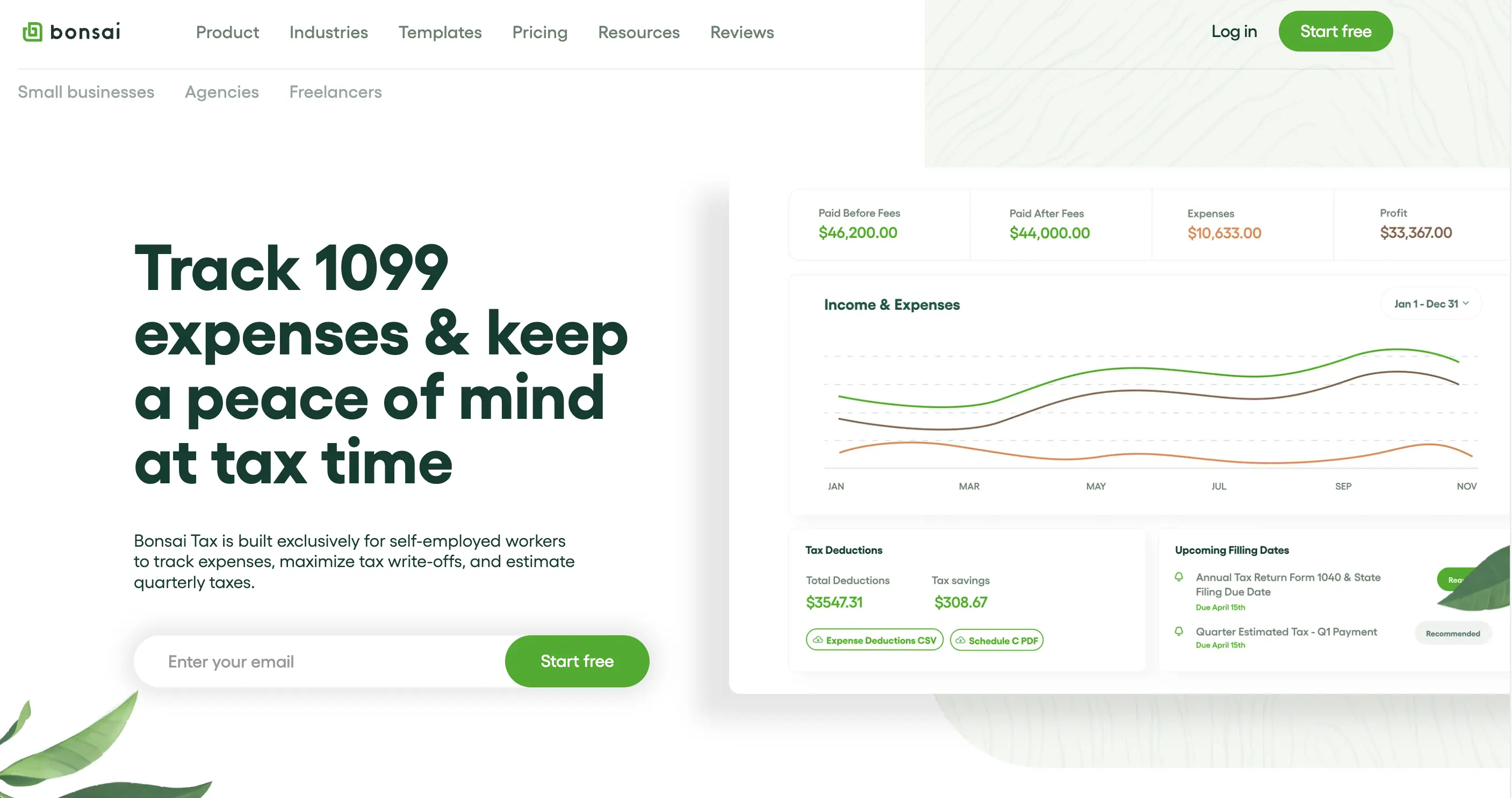

Hinweis: Wenn Sie Rechnungen, Verträge und Geschäftsausgaben verwalten, Ihre Steuern berechnen und sofort ein Geschäftskonto einrichten möchten, probieren Sie Bonsai aus. Mit anderen Worten: Bonsai ist der Traum eines jeden Einzelunternehmers. Wir nehmen Ihnen die mühsame Nachverfolgung Ihrer Einkünfte und Ausgaben als Selbstständiger ab und erleichtern Ihnen die Führung Ihres Unternehmens erheblich. Probieren Sie noch heute eine 7-tägige kostenlose Testversion.

Was Sie mit einem Selbstständigen-Kontobuch verfolgen sollten

Sie füllen das Formular für die Selbstständigenbuchhaltung mit allen erforderlichen Finanzunterlagen und Buchhaltungsinformationen für Ihre Steuern aus. Sie erfassen Einnahmen und Ausgaben mit:

- Datum: Datum, an dem die Ausgabe oder Zahlung eingegangen ist.

- Betrag: Wie viel Sie für die Ausgabe oder Rechnung erhalten oder bezahlt haben.

- Grund: Der Grund, warum Sie den Kauf getätigt haben.

- Kategorieausgaben: Die Art der geschäftlichen Absetzbarkeit für die Ausgaben.

- Dienstleistung/Produkt: Wie haben Sie das Einkommen erzielt und wer ist der Kunde, wenn es sich um eine Rechnung handelt? Sie notieren den Anbieter (wenn es sich um eine Ausgabe handelt).

Laden Sie unsere Vorlage für das Selbstständigen-Kontobuch kostenlos herunter

Sie müssen Ihre Ausgaben und Einnahmen aus selbständiger Tätigkeit ordnungsgemäß aufzeichnen, um am Jahresende Steuern auf Ihre Einkünfte zu zahlen. Sie geben Ihre Einkünfte (oder Verluste) aus selbständiger Tätigkeit in Schedule C oder Formular 1040 alle Einkünfte aus Geschäften an, die Sie als Einzelunternehmer mit Gewinnerzielungsabsicht betrieben haben.

Erstellen Sie eine Kopie dieser Tabellenkalkulationsdatei und laden Sie Ihre kostenlose Vorlage für ein Selbstständigen-Kontobuch herunter.

So verwenden Sie unser Formular für Selbstständige

Nachdem Sie nun eine Kopie erstellt und unsere Vorlage für das Selbstständigen-Kontobuch heruntergeladen haben, führen wir Sie durch die einzelnen Schritte zur Verwendung. Weiter unten in diesem Artikel zeigen wir Ihnen eine elegante Möglichkeit, wie Sie mit einer Software automatisch ein Selbstständigen-Kontobuch erstellen können.

Fügen Sie Ihr Einkommen aus selbständiger Tätigkeit hinzu

Einkommen ist der gesamte Umsatz, der in Ihr Unternehmen fließt, beispielsweise Gewinne aus verkauften Produkten oder Dienstleistungen. Sie sollten Ihr Bruttoeinkommen oder den Namen des Zahlenden und den Grund für die Überweisung notieren. Wenn Sie beispielsweise für einen Grafikdesign-Auftrag beauftragt wurden, würden Sie Details wie den Namen des Kunden oder den Namen des Zahlenden, den gezahlten Betrag, die Art des Auftrags (Logo oder Website-Design) und das Datum notieren und die Rechnung hochladen.

Wenn Sie als Freiberufler mit Kunden zusammengearbeitet haben, erhalten Sie höchstwahrscheinlich ein 1099-Formular. Das Formular 1099 belegt Ihr Einkommen und Ihre Steuern als Selbstständiger. Tragen Sie die Angaben aus Ihrem Formular 1099 in Ihr Dokumentationsformular für Selbstständige ein. Nutzen Sie unseren kostenlosen Rechner, um zu erfahren, wie viel Steuern Sie als Selbstständiger zahlen müssen.

Verfolgen Sie Ihre Ausgaben

In der Tabelle sollten Sie die Kosten für alle Ihre Geschäftsausgaben oder die Ausgaben für den Betrieb Ihres Unternehmens notieren. Geben Sie für steuerliche Zwecke an, warum Sie es für geschäftliche Zwecke gekauft haben. Die US-Steuerbehörde IRS verlangt, dass diese Ausgaben „gewöhnlich“ und „notwendig“ für Ihr Unternehmen sind, um als Steuerabzug geltend gemacht werden zu können. Entdecken Sie hier eine Liste mit 1099 Abzügen.

Viele Menschen nutzen Online-Apps und/oder Buchhaltungsdienste, um ihre Ausgaben und Einnahmen zu verfolgen.

Sie müssen Ihre Ausgaben nach der Einreichung mindestens 7 Jahre lang aufbewahren.

So verfolgen Sie Ihre Ausgaben mit Bonsai Tax

Bonsai Tax ist eine Ausgabenverwaltungssoftware, die Ihre Bank-/Kreditkartenabrechnungen scannt, um automatisch potenzielle Steuerabzüge zu ermitteln. Die App kategorisiert jede Ausgabe für Sie, aber Sie können die Kategorien auch manuell ändern.

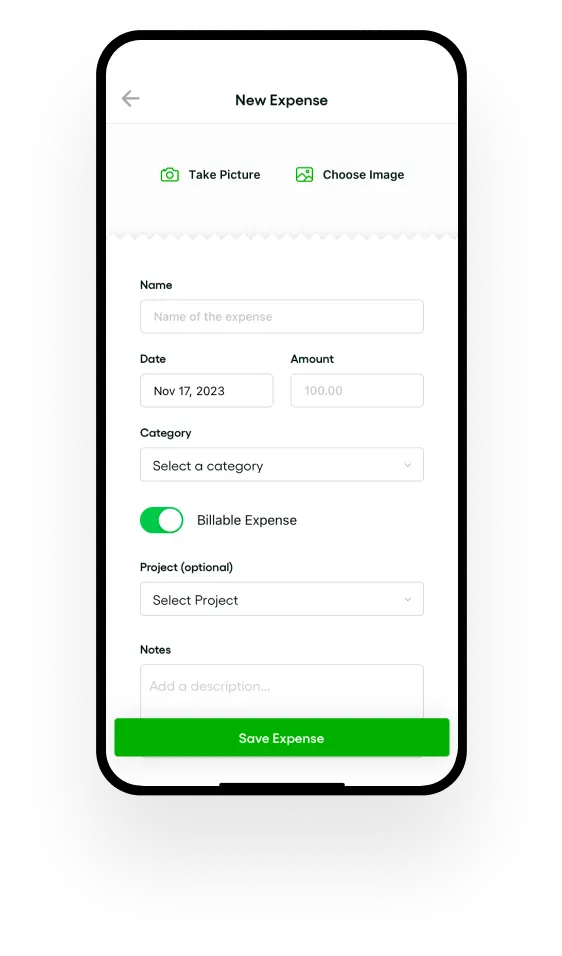

Schritt 1: Scannen Sie Ihre Belege ein.

Mit unserer Software können Sie alle Ihre Ausgaben übersichtlich in einer herunterladbaren Tabelle organisieren. Machen Sie einfach ein Foto Ihrer berufsbezogenen Belege direkt in der Bonsai Tax App. Sie können das Formular ganz einfach herunterladen und an Ihren Steuerberater oder die Person senden, die Ihnen bei der Steuererklärung hilft.

Schritt 2: Laden Sie Bilder Ihrer Belege hoch

Die US-Steuerbehörde IRS akzeptiert digitale Belege als Nachweis für Ausgaben. Wenn Sie also dazu neigen, Papiere oder Quittungen zu verlieren, haben Sie Glück. Mit der Bonsai Tax App können Sie Fotos Ihrer einzelnen Belege mit Ihrem Smartphone aufnehmen und diese einfach in die Software hochladen.

Schritt 3: Rechnungen erstellen, versenden und verfolgen

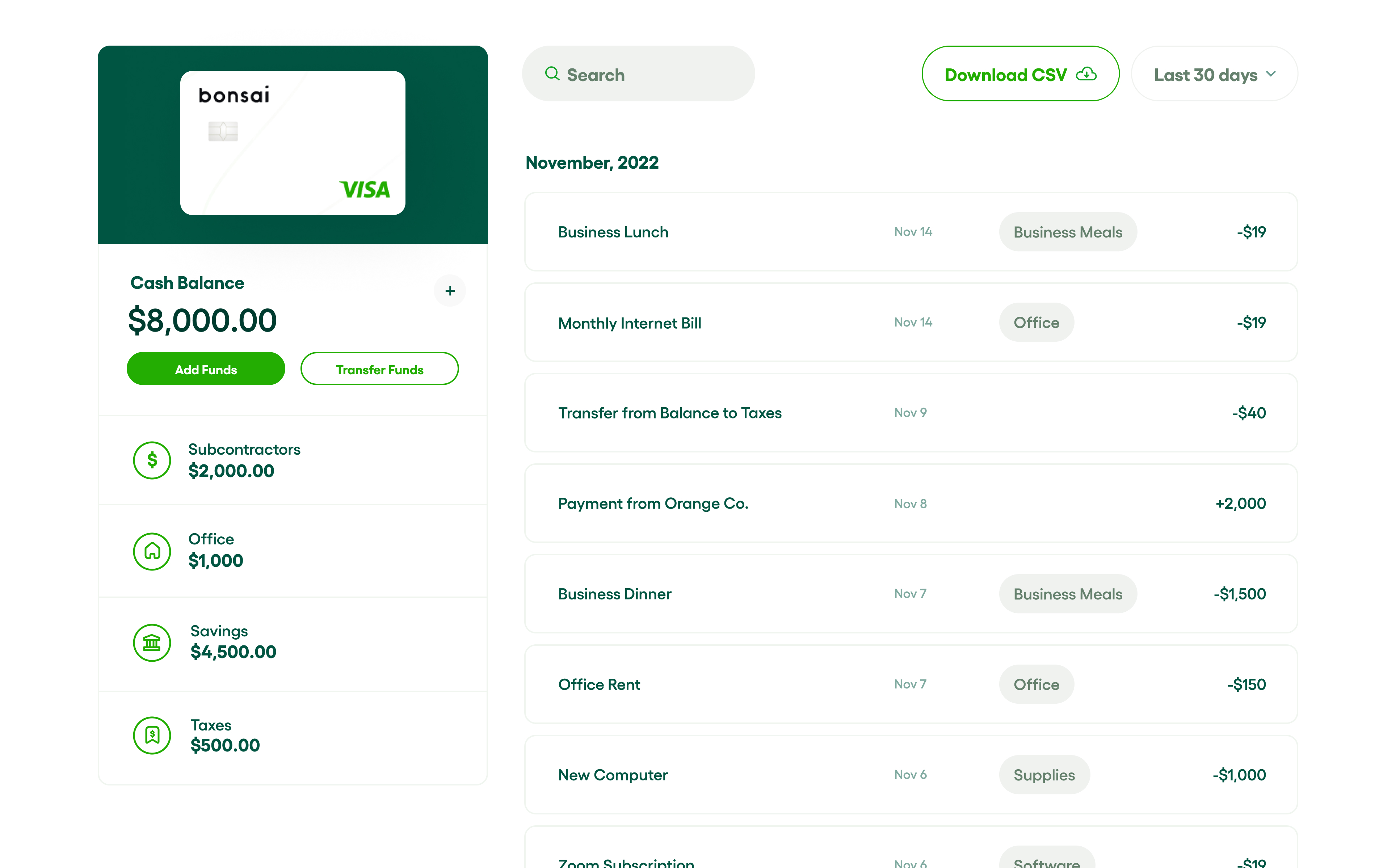

Mit der Bonsai-App können Sie Ihre Rechnungen erstellen und Zahlungen über Ihr Konto empfangen. Mit unseren Vorlagen können Sie nahtlos Rechnungen erstellen und diese zusammen mit Ihren Unterlagen zur Selbstständigkeit speichern. Mit Bonsai Payments können Sie Geld empfangen und schneller bezahlt werden. Ganz zu schweigen davon, dass Sie mit einem Konto Zugriff auf Vorlagen für Verträge und Angebote an einem Ort erhalten.

Fordern Sie hier Ihre kostenlose 7-Tage-Testversion an.

Erstellen Sie mit Bonsai automatisch ein Selbstständigen-Hauptbuch

Wenn Sie nicht alle Ihre Einnahmen und Ausgaben aufzeichnen/berechnen möchten, dann nutzen Sie Bonsai, um dies automatisch für Sie zu erledigen. Unser Tool zur Erfassung von Geschäftsausgaben, Bonsai Tax, ist super einfach zu bedienen. Unsere App würde Ihre Kontoauszüge scannen, um mögliche Steuerabzüge zu ermitteln, die Sie von Ihrer Steuerrechnung geltend machen können. Die Nachverfolgung Ihrer Geschäftsabschreibungen muss nicht schwierig sein.

Unser neues Geschäftskonto für Freiberufler, das Bonsai-Geschäftskonto, kann Ihnen dabei helfen, Ihre geschäftlichen Ausgaben von Ihren privaten Ausgaben zu trennen. Wenn Sie kein Geschäftskonto haben, wäre es schwierig, bei einer Steuerprüfung private Ausgaben von geschäftlichen Ausgaben zu unterscheiden.

Mit Bonsai können Sie Rechnungen erstellen, Fotos Ihrer Belege hochladen und alle Ihre Ausgaben für Steuerzwecke verwalten. Nachdem Sie alle Ihre Daten in Ihr Konto eingegeben haben, können Sie bei der Steuererklärung einen Einnahmen- und Ausgabenbericht erstellen. Einfach gesagt: Es ist die einfache Art, Ihr selbstständiges Unternehmen zu führen.

Beispiel für ein Selbstständigen-Hauptbuch

Hier ist ein Beispiel für ein ausgefülltes Formular zur Dokumentation des Selbstständigenbuchs. Auch diesen gesamten Prozess können Sie mit Bonsai vereinfachen.

Warum Sie ein Selbstständigen-Kontobuch verwenden sollten

Ein Selbstständigen-Kontobuch bietet eine Vielzahl von Vorteilen für die Finanz- oder Geldverwaltung. Lassen Sie uns einige Gründe betrachten, warum Sie ein Hauptbuch führen sollten.

- Steuervorteile: Seien wir ehrlich. Steuern sind lästig. Wenn Sie jedoch Ihre Ausgaben mit einem Selbstständigen-Kontobuch systematisch dokumentieren, können Sie Ihr zu versteuerndes Einkommen reduzieren und Ihre Steuerlast senken. Wenn die manuelle Erfassung von Informationen zu zeitaufwendig wird, können Sie jederzeit eine App wie Bonsai Tax verwenden, um Ihre geschäftlichen Abschreibungen zu verfolgen. Tatsächlich sparen Nutzer mit unserer Software in der Regel durchschnittlich 5.600 Dollar. Fordern Sie noch heute Ihre kostenlose 7-Tage-Testversion an . Bonsai könnte Ihnen das Ausfüllen Ihrer Steuererklärung erheblich erleichtern.

- Bessere Finanzplanung: Durch eine übersichtliche Erfassung Ihrer Ausgaben und Einnahmen erhalten Sie einen klaren Überblick über die finanzielle Lage Ihres Unternehmens. Als Freiberufler ist es wichtig, genaue Aufzeichnungen zu führen, damit Sie genau wissen, wie viel Geld Sie pro Monat verdienen und wie viel Sie ausgeben. Ein Selbstständigen-Kontobuch kann Ihnen dabei helfen, Ihre zukünftigen Finanzen besser zu verwalten und zu prognostizieren.

- Zugang zu Krediten: Ein genau geführtes Selbstständigen-Kontobuch kann als Einkommensnachweis für Kredite dienen. Eine Zusammenfassung Ihrer Ausgaben und Einnahmen zeigt Ihr Nettoeinkommen und lässt Kreditgeber genau wissen, wie viel Sie nach Abzug Ihrer Ausgaben verdienen. Wenn Sie auch eine Krankenversicherung beantragen, kann Ihnen ein Selbstständigenbuch dabei helfen, Ihr Einkommen korrekt anzugeben.

Hinweis: Wenn Sie alle Ihre Rechnungen verwalten, Zahlungen empfangen, Ihre Steuerabzüge verfolgen und ein Online-Geschäftskonto an einem Ort eröffnen möchten, probieren Sie Bonsai aus. Bonsai bietet Ihnen alle Tools, die Sie für die Führung Ihres freiberuflichen oder selbstständigen Unternehmens benötigen. Selbstständige lieben unsere Buchhaltungssoftware, weil sie damit durchschnittlich 5.600 Dollar an Steuern sparen. Probieren Sie noch heute eine 7-tägige kostenlose Testversion.

Halten Sie Ihre Unterlagen für Ihr Selbstständigen-Konto genau!

Es ist äußerst wichtig, Ihre Vorlage für Selbstständige ständig zu aktualisieren und auf ihre Richtigkeit zu überprüfen. Eine ordnungsgemäße Buchführung ist sehr hilfreich, wenn Sie jemals Probleme mit dem Finanzamt bekommen sollten. Die Erstellung eines aktuellen und genauen Selbstständigenbuchs ist unerlässlich, damit es nützlich ist.

Selbstständige mit ungenauen Selbstständigen-Buchhaltungsunterlagen können bei der Steuererklärung mit Steuerstrafen und Zinsaufschlägen rechnen.

Denken Sie also daran, dass Selbstständigenbücher nur dann effektiv sind, wenn sie aktuell und korrekt geführt werden. Wenn ein Selbstständigen-Hauptbuch korrekt ist, würden die meisten Institutionen es als Einkommensnachweis akzeptieren.

Der beste Weg, um ein genaues Selbstständigen-Konto zu führen, ist die Verwendung einer Software wie Bonsai, mit der Sie alles für Ihre Steuern digital verfolgen können. Mit unserer App können Sie Ihre Rechnungen, Verträge, Geschäftsabschreibungen und Angebote an einem Ort verwalten. Probieren Sie Bonsai noch heute aus und überzeugen Sie sich selbst.

Wir hoffen, dass dieser Artikel Ihnen alle notwendigen Informationen zur Verwendung eines Dokumentationsformulars für Selbstständige sowie zu den Vorteilen, die Sie durch dessen Erstellung erhalten, geliefert hat.