If you receive a 1099-NEC as a sole proprietor (independent contract), you must fill out a Schedule C when filing your annual tax returns. This is true regardless of whether you are a full-time solopreneur or are generating income from a side hustle. The Schedule C is used to report the profits or losses related to your business. It can also be used to report wages/expenses you had a statutory employee and income/expenses of qualified joint ventures.

You may also need to file a Schedule C if you are a Single-Member limited liability company (SMLLC) as this type of entity is not treated as a separate entity for federal income tax purposes. It is treated the same a sole proprietorship unless you choose to have it treated as a corporation - which comes with additional rules that need to be followed.

The below also does not include a state tax-related item specific to your state. For state tax items you should always talk to a professional if you are not familiar with your state tax laws.

Note: If you want to skip out on the hassle of using a template, try our 1099 expense tracker to automatically categorize your receipts. Our software scans your bank/credit card statements to discover potential deductions. On average, our users save $5,600 from their tax bill. Claim your 7-day free trial here.

Tracking Income for the Schedule C

Compared to expenses, tracking the income that is reported on your Schedule C is fairly straightforward. If you make non-W2 income as a sole proprietor it needs to be tracked and included on your tax forms.

A common mistake is to assume you will receive a 1099-NEC for all of the income you generate. While you should be receiving a 1099-NEC from every customer/client you earn more than $600 from there is no guarantee they will fulfill their obligation. Not receiving your 1099 does not absolve you from accurately claiming your income.

Additionally, while the 1099-NEC minimum amount is $600, you are required to claim all of your income - even if it is $1. Fortunately, this also means you get to claim all of your expenses which could result in a net deduction if you spent more than made. This is very common in the first few years of a sole proprietorship.

Tracking Expenses for the Schedule C

On one hand, tracking your expenses is easy. If you spent money on your business, it is likely a business expense. On the other hand, depending on the type of expenses there are specific rules that need to be followed (such as prorating expenses based on personal/business use).

To make tracking Schedule C expenses easier, the best option is to use a 1099 template (Schedule C template). Most of the time, this will be an excel template because it is the simplest to use and easiest to customize based on your specific business. You can make a copy of our Google docs template here.

Is a Free or Paid 1099 Excel Template Better?

This is a bit of an unfair question but one that is often asked. The answer entirely depends on what needs to be tracked and how much effort you want to put into it.

For example, if you have a very small side-hustle and you are not preparing your own taxes then a free excel template should do the trick. On the other hand, if you are doing your own taxes or have a larger sole proprietorship then a premium solution is the safer choice but that doesn't mean you should limit yourself to a basic excel spreadsheet.

An automated expense tracker typically offers a more comprehensive solution. While it may require upfront or monthly costs, it also saves you time and provides peace of mind. Automated solutions should be consistently updated to align with current tax laws.

If you download a spreadsheet from 2016 it will not match up to the current Schedule C layout or current deduction rules.

This doesn't mean there are not excellent free 1099 excel spreadsheets available, it just means you need to be conscientious of the pros and cons of each option. Download Bonsai's free template here

How to Use This Free Excel Template to Prepare Your Schedule C

This free excel template is perfect for a small sole proprietor or side hustle. It doesn't have all of the bells and whistles of a comprehensive tax solution but the template does provide all of the essential information need to prepare a Schedule C and could be provided to your tax professional.

Note: The IRS allows you to track receipts digitally. If you would like to save yourself a lot of time and maximize your deductions from your tax bill, try Bonsai Tax. Our tax software automatically tracks, organizes and records your deductions for you. Try a 7 day free trial here now.

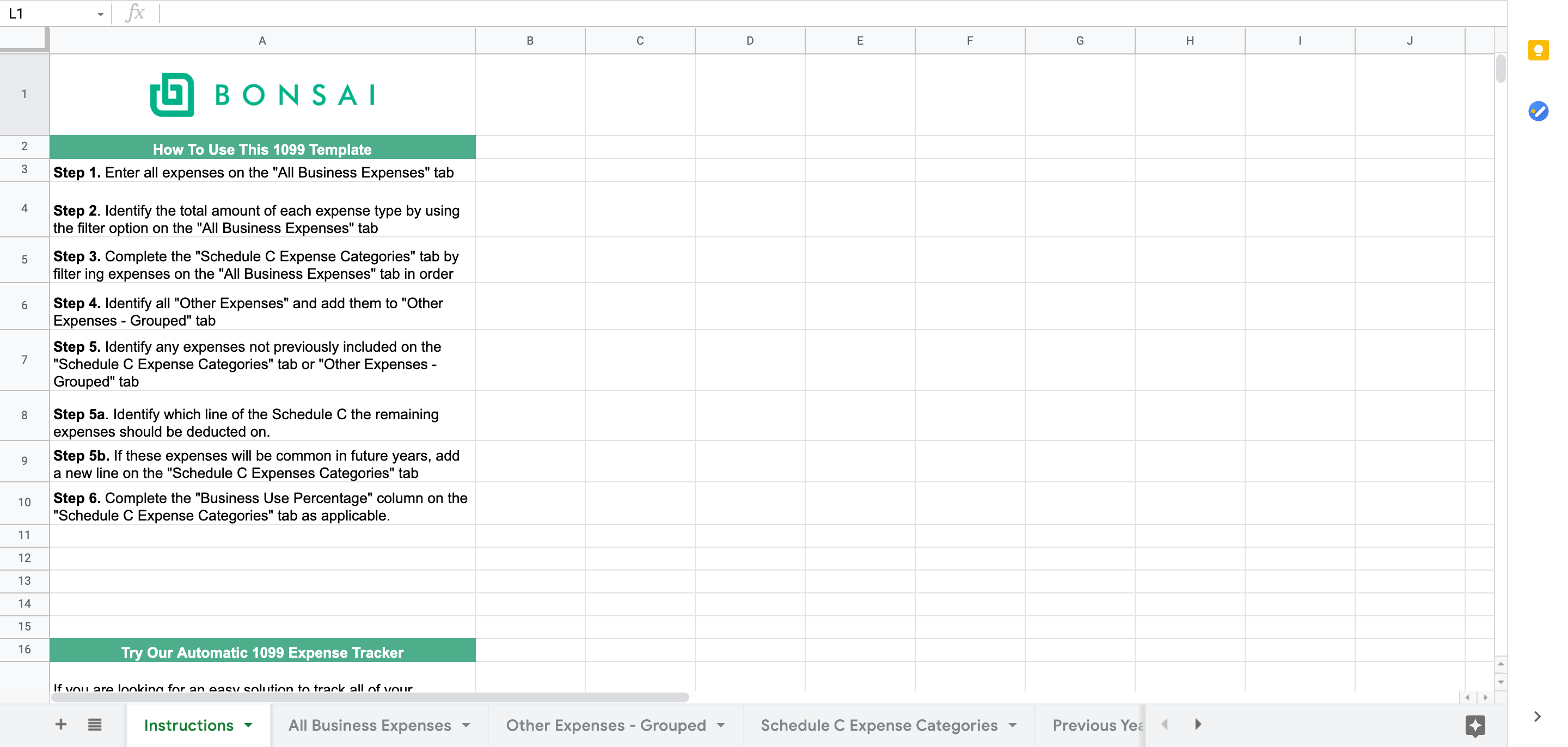

Instructions Tab

The Instructions Tab has all of the basic instructions needed to use this spreadsheet and categorize expenses based on their Schedule C line.

How to Use this 1099 Template

There are 6 basic steps to using this 1099 Template

Step 1. Enter all expenses on the "All Business Expenses" tab of the free template

Step 2. Identify the total amount of each expense type by using the filter option on the "All Business Expenses" tab

Step 3. Complete the "Schedule C Expense Categories" tab by filter ing expenses on the "All Business Expenses" tab in order

Step 4. Identify all "Other Expenses" and add them to "Other Expenses - Grouped" tab

Step 5. Identify any expenses not previously included on the "Schedule C Expense Categories" tab or "Other Expenses - Grouped" tab

Step 5a. Identify which line of the Schedule C the remaining expenses should be deducted on.

Step 5b. If these expenses will be common in future years, add a new line on the "Schedule C Expenses Categories" tab

Step 6. Complete the "Business Use Percentage" column on the "Schedule C Expense Categories" tab as applicable.

Is a Premium Version of the Template Available?

We also offer an automatic 1099 expense tracker. This is an easy to use solution for tracking all of your business expenses for the year. It is ideal for freelancers, sole proprietors, and solopreneurs which need a more robust solution than the free template. It is also the perfect choice if you just want to save time with a more automated option than the free excel 1099 spreadsheet. Claim your 7-day free trial here. Users typically save $5,600 on their tax bill.

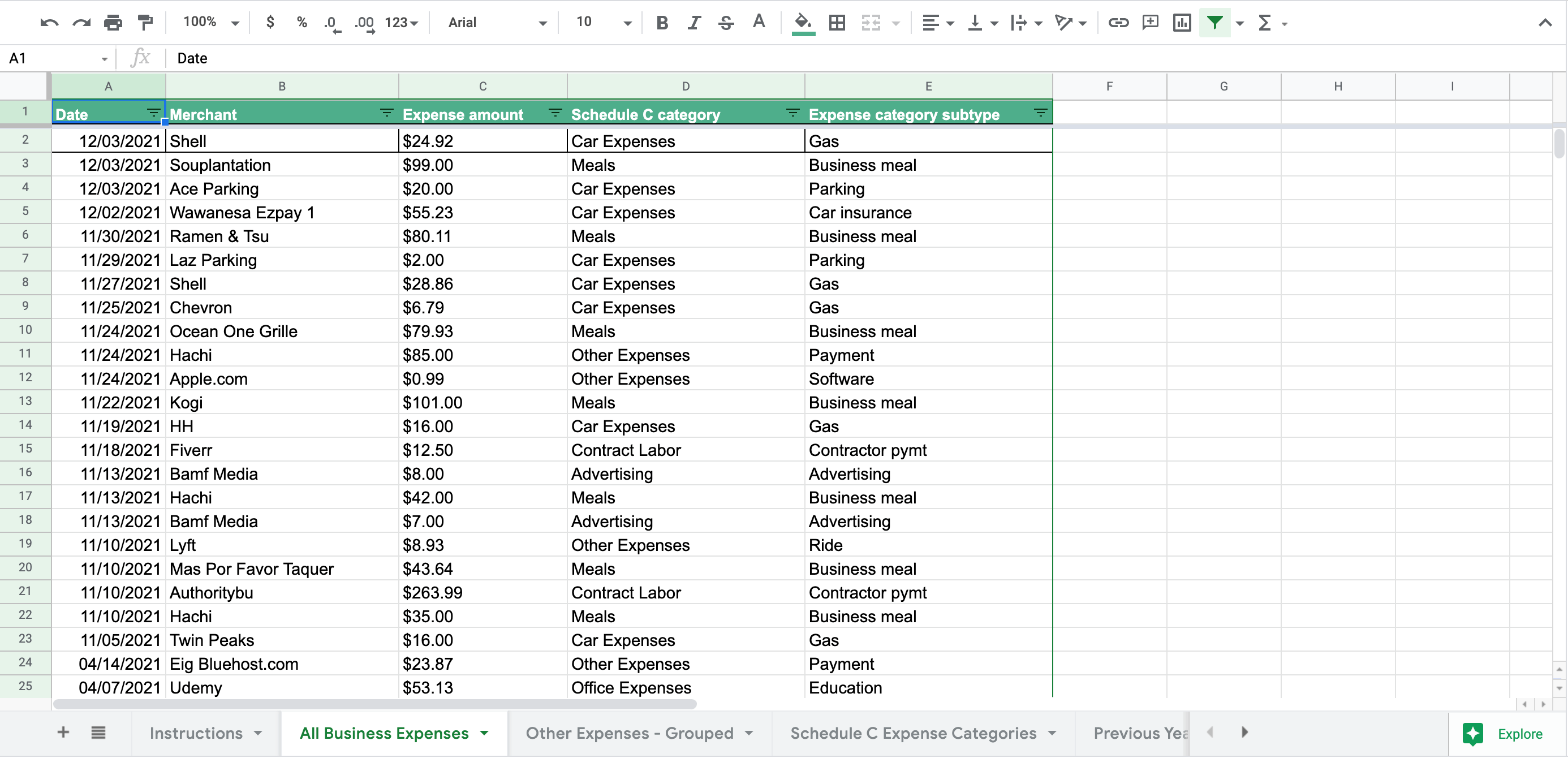

All Business Expenses Tab

The All Business Expenses tab on the excel template is exactly what is sounds like. This should be treated as your source of truth. Every expense you incur should be included on this tab even if it is not tax deductible. Doing this will make it easy to compare and reconcile your bank statements, Profit/Loss statement, and transaction records at the end of your fiscal year.

Column A - Date

The Date column may seem straightforward but how you report your taxes does make a difference. If you use a cash-basis method of accounting (which is the most common for side hustles and freelancers) then you enter the date you paid the expense. If you use an accrual method of accounting then you record the date the expense occurred. As a side note - if you are using the accrual method of accounting this spreadsheet will need to be used in tangent with your record keeping software to confirm accuracy and make any necessary adjusting entries following the close of your tax year.

Column B - Merchant

Technically the Merchant tab is not required from a Schedule C perspective but it is one of the easiest way to accomplish the following:

Compare your spreadsheet against your receipts you save for taxes to ensure everything has been included and that there are no duplicate entries.

Most merchants will always fall into the same category expense so entering the merchant name will provide a reference point for future expenses (and double check the expense-type against prior expenses).

Column C - Expense Amount

The Expense Amount column includes the total amount you paid for the expense. If you received a discount (for example, 10% off if you pay within 30 days) then you will only include the amount paid - not the total amount due if you use cash accounting. If you use accrual accounting then you can enter the amount you paid on this spreadsheet but your full set of books will need to include the total amount billed, the discount received, and the amount paid.

Column D - Schedule C Category

The Schedule C Category column will be used to define the primary category of the expense. This will dictate which line of the Schedule C the expense will be reported on.

Column E - Expense Category SubType

This category may seem redundant at first glance but it is incredibly important for several reasons. First, it will allow you to easily determine if it is more beneficial to claim a standard mileage rate for vehicle usage or if it is worth effort (assuming you have all of your documentation) to itemize your vehicle expenses.

Second, it is easier to account for meals and business travel. Both meals and business travel have certain restrictions on how much is deductible (or if it is deductible) so adding a subtype explanation will make it easier to sort at the end of the year.

Third, the subtype is particularly important for justifying an expense as "Other Expenses". In order to fall into this category, there can be no doubt an expense can be placed in another category. If you are using a tax preparer the subtype could help clue them into whether an Other Expense could actually fall into another line item. Additionally, you will still need to list Other Expenses into general categories on the Schedule C so have the subtype will save you time if you are filing your taxes on your own.

Other Expenses - Grouped Tab

This excel template tab may be seem like a bit of duplicate compared to the "All Business Expenses" tab but it offers a unique benefit when completing tax forms because of how the data is characterized. As discussed earlier, your other expenses must still be line-itemed based on a grouping. The sole purpose of this tab is allow you to group your Other Expenses into the correct subcategory. Depending on the subcategory it also allows you to designate a specific Business Use Percentage which is important if you have a home office or utilize resources for both business and personal use. You could also use our free home office expenses spreadsheet to track your receipts.

Schedule C Expense Categories

This tab, by default, includes only the Schedule C lines most commonly used by freelancers/sole proprietors for 1099 deductions. As a result, your type of business may benefit from adding additional lines.

Advertising and Promotion

This spreadsheet begins with Line 8 of the Schedule C. Advertising and Promotion includes anything you can tie back to either generating new business/clients or boosting recurring sales from current and prior clients. Advertising is always 100% tax deductible as an expense

Car and Truck Expenses

Line 9 deals specifically with vehicle expenses. This type of expense can get tricky based on the size of your fleet and how you plan on claiming deductions. You can claim the actual expenses vs the standard mileage deduction.

The Standard Mileage Deduction

To use the standard mileage deduction, you take the number of miles driven for business purposes multiplied by the annual deduction rate. There are some restrictions on who can take this deduction.

To use the standard mileage rate deduction, you must own or lease the vehicle and:

- You must not operate five or more cars at the same time, as in a fleet operation,

- You must not have claimed a depreciation deduction for the car using any method other than straight-line,

- You must not have claimed a Section 179 deduction on the car,

- You must not have claimed the special depreciation allowance on the car, and

- You must not have claimed actual expenses after 1997 for a car you lease.

Keep in mind that to use this method of deduction, you must select it in the first year the vehicle is in service for your business. After the first year you do have the option to switch to the itemized option. The exception is if you lease your vehicle. If you lease your vehicle, you must use the standard mileage rate for the entire lease period, including renewals. Try our free mileage excel spreadsheet to track miles for taxes.

Actual Vehicle Expenses

To use the actual expense method you must track all of your vehicle related expenses like gasoline and can deduct a portion of those expenses based on business use. Business use is based on the miles driven for qualified business purposes vs. the miles driven for personal use during the tax year. There are also special depreciation rules which apply to this method of deduction.

Contract Labor

This line covers the total cost of contract labor for the tax year. This includes all payments to persons you do not treat as employees. Simply put, any amount you pay to individuals sole proprietors that do not receive a W-2 will be included. Keep in mind that if you pay someone more than $600 you must provide them with a 1099-NEC and file the 1099-NEC with the IRS. Prior to the use of the 1099-NEC, the 1099-MISC forms were used for this purpose.

Insurance

This expense line is used to deduct any insurance premiums paid for business insurance. This does not include amounts paid for employee health/accident insurance. You also cannot deduct amounts credited to any type of reserve for self-insurance. You also cannot deduct premiums paid for insurance policies that cover lost earnings due to sickness or disability (typically these policies are purchase by sole proprietors).

Legal and Professional Services

This Schedule C line item is fairly clear. You can deduct amounts paid to accountants and attorneys if the expense is due to the ordinary and necessary course of your business. This includes tax preparation and tax planning.

Office Expense

For sole proprietors it is important to point out you do not include home office expenses in this line. You only include standard office expenses such as postage and general office supplies.

Supplies

Line 22 of the Schedule C can be tricky depending on what types of products/services you provide. Generally, you can deduct the cost of materials/supplies used in you business. The thing to keep in mind is that on this line you can only deduct supplies used during the tax year. You cannot buy a bunch of supplies at the end of the tax year and treat them as a Supplies deduction if you did not use them during the tax year.

Taxes and Licenses

There are a handful of taxes and licenses you deduct on the Schedule C.

- State and local sales taxes imposed on you as the seller of goods or services. If you collected this tax from the buyer, you also must include the amount collected in gross receipts or sales on line 1.

- Real estate and personal property taxes on business assets.

- Licenses and regulatory fees for your trade or business paid each year to state or local governments. Some licenses do need to be amortized.

- Social security and Medicare taxes paid to match required withholding from your employees’ wages. On the Schedule C you should reduce your deduction by the amount shown on Form 8846, line 4.

- Federal unemployment tax paid.

- Federal highway use tax.

- Contributions to state unemployment insurance fund or disability benefit fund if they are considered taxes under your state's law.

There are also a laundry list of taxes and licenses you cannot deduct so it is worth taking a look at the IRS inclusive/exclusive list.

Travel & Business Meals (Line 24a & 24b)

Line 24a is for all expenses related to lodging and transportation connected to overnight travel for business. Line 24b is for meals so do not include it in line 24a. If you do not want to keep track of incidental travel expenses there is a flat daily incidental amount which may change from one year to another. We recommend you use a travel expense tracker to easily export your records.

For Line 24b you can include expenses for meals while traveling. You can use either a percentage of your actual business meal expenses or the standard IRS meal allowance.

Wages

For Line 26, you will include the total salaries and wages for the tax year minus any applicable credits. The most common credits in 2020 are applied to the following forms:

- Form 5884

- Form 5884-A

- Form 8844

- Form 8845

- Form 8932

- Form 8994

Home Office Deduction

The home office deduction can be incredibly complicated if you plan on itemizing. If you itemize your home office deduction, and you are not familiar with the process, it is probably worth touching base with a tax professional for at least the first year to avoid a home office deduction audit.

Other Expenses

This line is where you include all the items on the "Other Expenses - Grouped" tab.