Independent contractors will receive a 1099 construction worker form, where the payment made will be recorded. Still, how the form is received and completed will pretty much depend on your status as a worker.

Whether you are a freelancer or someone with a business, as an independent contractor, you may or may not need to file a 1099. Read this article to find out whether you are due a form or not.

Note: if you need help managing your taxes and recording all of your tax deductions for the year, try Bonsai Tax. Our software will send you filing reminders, estimate your taxes, and help you maximize your tax write-offs. Our app will scan your bank/credit card statements to uncover potential tax deductions and save you thousands of dollars. In fact, users typically save $5,600 from their tax bill. Try a 7-day free trial today.

How Much Taxes Do Construction Workers Owe

Any person who takes care of their employment taxes and does not work as an employee for a construction company will have to pay their own taxes. These taxes can be registered beneath the Construction Industry Scheme, especially added for this kind of independent contractor.

As a result, an independent contractor working in the construction field would have to pay around 15.3% of their income to the IRS. This percentage may change, more or less, depending on the workers' compensation that you are eligible to receive. For this reason, you might want to hire an accountant so that they may give you tax advice.

Tax Forms They'll Deal With In The Construction Industry

Depending on the nature of your work as an independent contractor, you may have various forms to deal with. You just have to meet some requirements when it comes to your employment status.

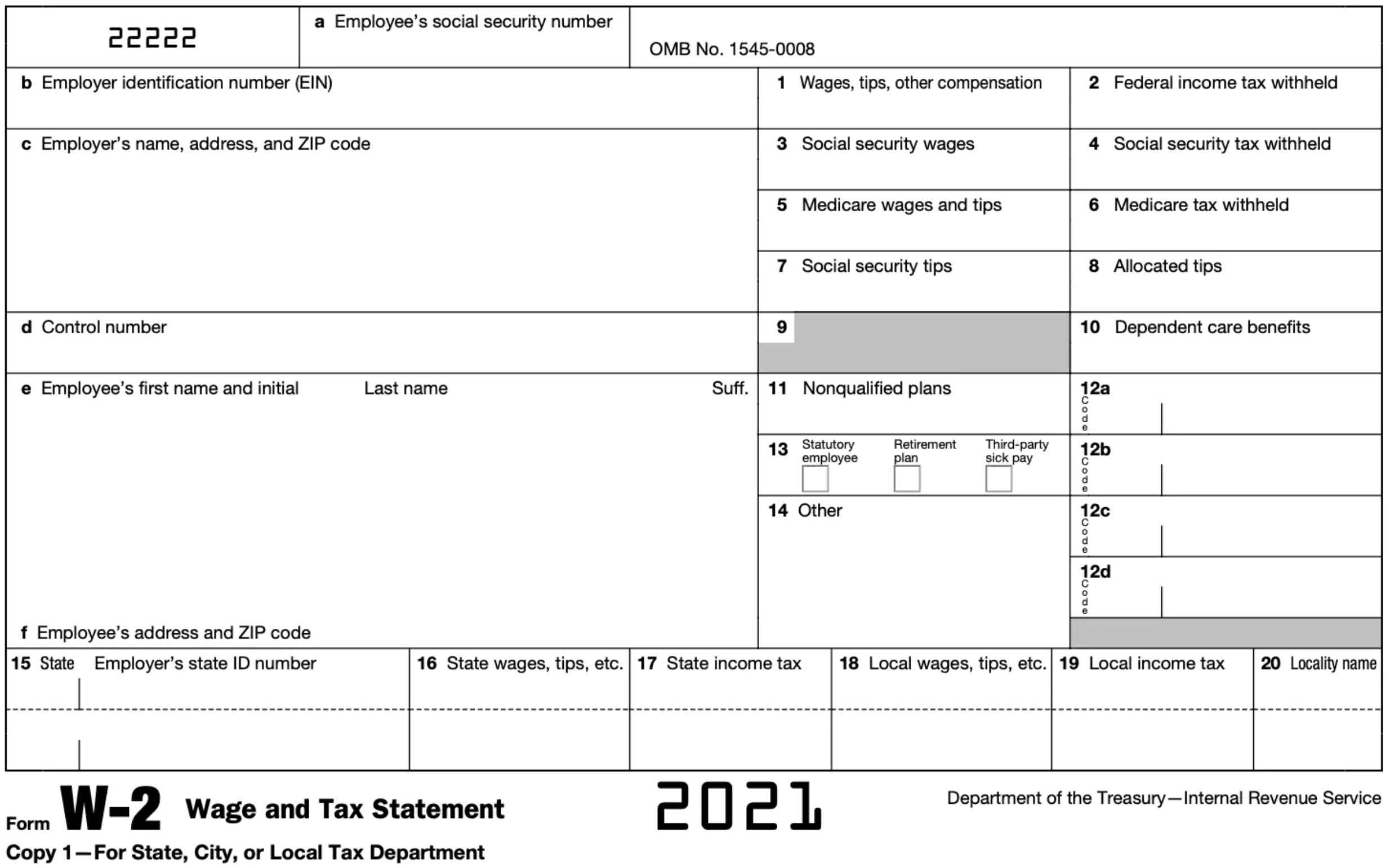

For instance, if you are working for a construction company under a written contract with an employer, then you'll be getting a W-2. Both parties involved, employer and employee, will be responsible for contributing to the taxes, but it will be your boss that will automatically deduct them from your income.

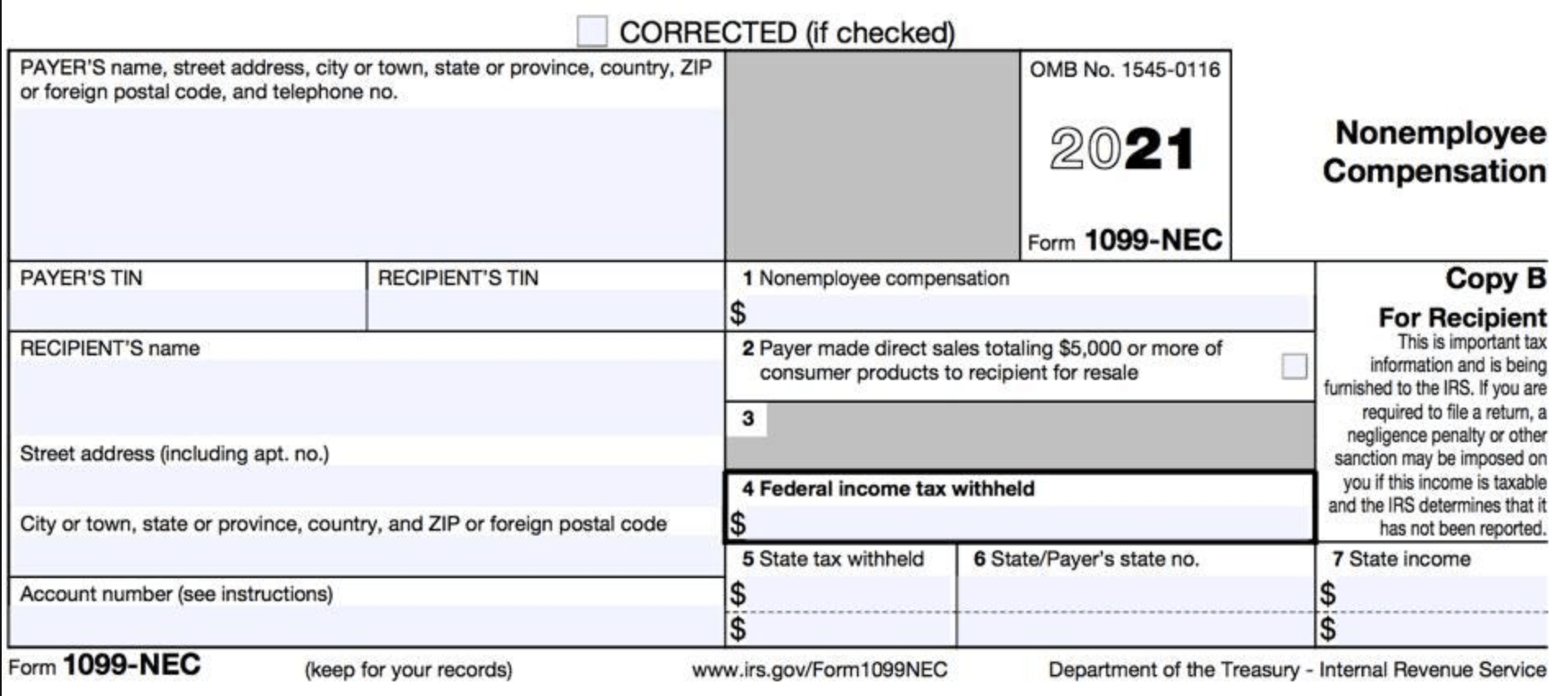

On the other hand, if you are an independent contractor bound by no employers under long-term written contracts, then you will likely receive a form 1099-NEC.

All independent contractors that take on a short-term construction job will likely be classified as 1099 contractors. This means that they will be personally responsible for filing their own taxes for the construction trades they undergo.

Things change if the independent contractor is hired by a business. For instance, if you were not hired by a business entity, you may receive the 1099 form. Clients typically have no right to control and direct the work that you perform.

On the other hand, if you are doing labor for a company, then they are in direct control over what you are doing there. It may not be exercised, but the right is still there. Even if it is in the short term, you are still their employee and will likely get a W-2.

How to Get a 1099 Form

The source of a 1099 will depend on what your position is. If you are someone who wishes to send someone a 1099, then you may get the form for free from the main IRS website. Once you get your hands on the form, you will need to familiarize yourself with all the boxes that are in that form.

However, if you are an independent contractor in the construction work, you may receive a copy of the 1099 from the payer - the other one being filed with the IRS. This form will document the payments that were made to you from a particular payer.

If the payment is below $600, then you will not need to file a 1099-NEC. However, should the payer choose so, they may still do it. All they have to do is go to the IRS main page, download the form, fill in the boxes and then file it. Anything from income to workers' compensation needs to be added there as well.

Quarterly Taxes for Construction Workers

Independent contractors, regardless of the nature of their work, will have to pay quarterly taxes. As a business owner in the constructions industry, the payment will not be withheld from the paycheck, but you will have to file it personally.

The payments are made in increments by the following deadlines:

- April 15 - Covering January 1 to March 31

- June 15 - Covering April 1 to May 31

- September 15 - Covering June 1 to August 31

- January 15 (of the year that follows) - Covering September 1 to December 31

If the deadline falls on a legal holiday, then you may issue the payment on the next business day. For example, for the 2021 tax year, the payment deadline is pushed to January 18, as January 15 is on a Saturday and Martin Luther King Day is on January 17.

To calculate quarterly taxes, independent contractors will have to add their total tax liability for the year that they are filing. This includes income tax, self-employment tax, income tax, and any other tax that they may owe. In the end, they should divide that sum by 4.

The percentage that you will have to pay will depend on the income that you get that year, and not your business revenue. Try to determine how much you will have to pay every quarter, and make an average of your taxable income. Based on that sum, you will have to pay an average of 25% every quarter.

To file or send quarterly payments, you will have to sign up for the Electronic Federal Tax Payment System. You can also pay on the IRS page for payments, using a credit or debit card. Money orders may also be issued for this purpose.

Deductions A Construction Worker Independent Contractor Can Claim

As a construction worker that is not under anyone's payroll, you will likely have multiple expenses to handle on your own. Luckily for you, there are a couple of tax deductions for construction workers that you may claim as well. This includes:

Note: The best way to record and manage your tax deductions is with Bonsai Tax. Our app will scan your bank/credit card receipts to discover potential tax write-offs and help you maximize your savings. Our users typically save $5,600 from their tax bill. Claim your 7-day free trial today.

Expenses for Motor Vehicles

As a construction worker, you'll have to drive to various locations, be it to reach your client or to drive up your construction tools. To do that, you'll probably spend quite a bit in terms of vehicle expenses.

First, you may track and deduct the mileage between business-related drives/ multiple job sites. To do that, you may either use the actual expenses method or the standard mileage method of the Internal Revenue Service (IRS). A tax advisor should be able to give you legal advice in this matter.

Your morning commute cannot be deducted, but if you use your personal car for multiple purposes, then you may be able to get some workers' compensation coverage. This applies to meetings that may take place in an unusual place or going from one client to another one in-between jobs.

Track business mileage with our free template for tax miles.

Work Clothing

People in the construction industry will have to pay quite a bit for their work gear, but the silver lining is that you can at least deduct these costs. You may write off clothing like boots, tool belts, hard hats, overalls - even blue jeans. All of these are standard deductions, as long as you can prove that you only wear them for work.

Gloves and goggles may also be deducted, as they are necessary for protection. You may also write off sunscreen and sun protection, since they are a necessary part of working in constructions in hot weather.

Training

Construction work requires self-education as well. You need to have your necessary licenses, and very often, these requirements can change from year to year. This is why independent contractors or owners of small construction companies may claim training and education deductions, as long as they cover business aspects that are relevant to them.

In these circumstances, you may write off seminars, training courses, and conferences. One example here would be a first aid course, or training to obtain a particular license that is relevant to the job.

Bear in mind that this is the rule: it needs to be for your current job. It can't be claimed if you needed it for a promotion or to get into a different role. It needs to benefit your current status.

Home Office

Typically, independent contractors do not have an office in a construction company, particularly if they are just starting out. This is why the Internal Revenue Service allows them to deduct a study or an office in their own homes.

Various methods can be used in order to claim deductions for the home office. For instance, the Taxation Federal Department Office offers a $0.52/hour rate in terms of workers' compensation coverage. This covers heating, lighting, cooling, and even depreciation of necessary furniture (i.e., chairs, desks).

Expenses like Internet services, computers, or stationaries can also be claimed (use our home office excel sheet to track expenses). This is either done separately or based on the floor area. Expenses such as rent or mortgage interest can also be claimed for that particular side of the house that is being used as a home office.

Tools and Equipment

As an independent contractor with your own construction company, there is a good chance you will not have anyone supplying you with tools. You will have to get them yourself - otherwise, you won't make it as a construction worker.

As long as you can offer eligible claims for them, you may deduct the following independent contractor expenses:

- Construction equipment and tools

- Repairs and maintenance done on equipment and tools

- Interest on loans taken out to buy work tools

- Equipment insurance

- Tablets, computers, smartphones

Bear in mind that in order to claim these deductions, you'll have to keep the receipts as well. By claiming these deductions, you would be able to maintain financial control of your income.

Advertising and Marketing

As a construction worker on a 1099 Form, you will have to do your own business advertisement. You will no longer be attached to any employer, so you will have to find a way to get your brand known. Whether it's on social media or traditional panels, you should be able to deduct these costs.

Travel Costs

This is something normal when you are a construction worker. If you are going out of town for a construction project, there is a good chance that you will have to stay there overnight as well. So, you will be happy to know that you should be able to deduct all the travel expenses that are related to your work.

If you are also using some manner of transportation, that may be deducted as well (tickets or mileage). Parking fees and meals can be deducted, as they are necessary for your business. However, be careful what you decide to itemize - the IRS may raise their eyebrow if they catch you trying to deduct a Disneyland ticket.

Phone Bill

As a construction worker, you may spend a lot of time on the phone. You may be calling a client, a supplier - or they may be calling you. That being said, if a good chunk of your time is spent on the phone, then you may deduct the phone bill.

A good piece of advice here would be to get a separate phone line for work - i.e., a work cellphone. This way, you may deduct the exact amount that you spend on the phone. However, you could also use the same line, provided you check the phone log to set up a percentage.

Other Expenses

Other expenses may also be deducted, as long as they are necessary for the job. For instance, lawyer fees or costs from professionals and union fees may also be deducted. Health insurance tax may also be deducted as part of workers' compensation, considering that the job of a construction worker is rather dangerous.

FAQ

If you still have some queries, here are the answers to some of the most common questions asked by construction workers.

Do Construction Workers Get a W2 or a 1099?

This mostly depends on your status. If you are an independent contractor, with your own construction business, then you will receive the 1099 form.

On the other hand, if you are a construction worker under employment, then you'll get the W-2. Unlike independent contractors, W-2 employees have their taxes automatically deducted, and the payments get sent to the government through the employers. Read our resource if you didn't get a Form 1099.

Do Construction Companies Get a 1099?

This also depends on each situation. For instance, if the construction company is a corporation, then they won't get a 1099 form. However, if you are an incorporated construction company, then you may get a 1099-B or a 1099-C. These forms are given as barters or cancellation of an owed debt.

Does a 1099 Contractor Count As an Employee?

A 1099 contractor is pretty much are self-employed independent contractors. They will receive their payment according to the terms set in their contract. After the work is done, they will receive a 1099 form where they will report their own tax return. The employee will receive the W-2, as they will be the ones to get the employee benefits and regular wage. If you work for a company and do construction work on the side, you may file a W-2 and 1099 in the same year.

Can 1099 Independent Contractors Collect Workers' Compensation?

Yes, independent contractors in the construction field can collect workers' compensation. The condition is that they have to be working for a business, under a temporary contract where they are recognized as an employee. If not, workers' compensation may not apply.

The Bottom Line

As a construction worker, you may or may not have to deal with form 1099. It all depends on how the state law categorizes you. If you are employed, the employer will handle it. If you are an independent contractor with a small business, then you'll have to file the form and deal with the taxes. However, if you are a contractor, you'll want to maximize self-employed tax hacks in order to save money at the end of the year.