If you’re a freelancer or small business owner, you know plenty of ways to increase your revenue. But did you know you can boost your bottom line (and hold onto more of your hard-earned money) by minimizing your tax liability through tax deductions?

It’s all based on how you calculate your personal taxes. In the same way that you can deduct business expenses to offset your self-employment tax bill, you can also trim what you owe on your taxable income by making the right choice between the standard deduction and itemized deductions. You just need to know which works best for you, and that starts with understanding the difference between the two. Let’s take a look.

Note: For most self-employed folks, itemizing deductions would lead to a greater tax write-off. If you need help recording all your business expenses, and maximizing your tax bill, try Bonsai Tax. Our app would scan your bank/credit card receipts to find potential tax write-offs and save you thousands of dollars. Users typically save $5,600 from their tax bill. Try a 7-day free trial today.

Standard tax deductions versus itemized deductions?

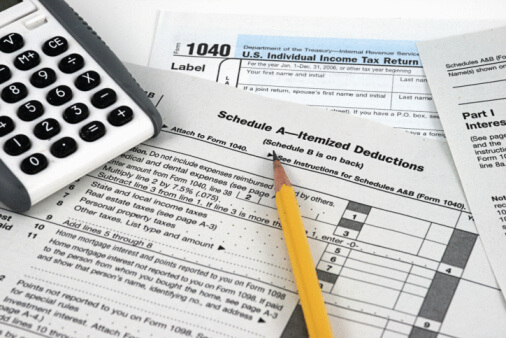

When you are preparing your Form 1040 tax return, you have the option of taking either the standard deduction — a preset amount based on your filing status — or itemized deductions. Each type of deduction reduces the amount of your income you’re required to pay taxes on. The rules and thresholds for both standard deductions and for itemization change frequently based on inflation and shifts imposed by Congress.

If you have incurred a lot of qualifying out-of pocket expenses, it may be to your advantage to add up the total itemized deductions you qualify for and compare your total to the standard tax deduction allowed for your particular filing status. If you don't want to worry about missing out on tax deductions or recording expenses, just claim the Standard Deduction.

You can then choose the one that provides the larger deduction and lowers your liability the most.

Note: Tax deductions are not the same as tax credits. Any tax credits that you’re entitled to get subtracted from the tax amount that you owe rather than from your taxable income.

Itemized deductions

Though itemized deductions change from time to time in terms of what is allowed, the income limitations that apply, and how each deduction is calculated, the basic theory behind them remains the same. They were designed to counterbalance or reward individual circumstances ranging from the catastrophic to the philanthropic. A look at the history of itemized deductions reveals four separate goals:

- To offset the impact of expenses caused by catastrophes

- To encourage social behaviors such as home ownership or charitable giving

- To offset the impact of paying state and local taxes

- To balance the significant out-of-pocket costs of operating a business

Under the Tax Cuts and Jobs Act of 2018 (TCJA), these are the approved categories for itemized deductions:

Home mortgage and home-equity loan interest

The government has long encouraged home ownership, and to that end they have offered a mortgage interest deduction, as well as including the points paid on your mortgage among available deductible expenses. For 2021, home mortgage interest on the first $750,000 in loans can be deducted from personal income whether you purchased or refinanced, though if your mortgage originated before December 16, 2017 you can deduct the interest you’ve paid on a higher amount — the first one million dollars of your mortgage loan, and starting in tax year 2026 everybody will be able to deduct interest on up to one million dollars in loans.

If you took out a home equity loan rather than purchasing a new property, you are able to deduct the interest paid on that loan as long as you used the funds to purchase, construct or make substantial improvements on the home for which the loan was secured.

There is no need to track the amount of interest that you pay on your home mortgage loan. Each year your borrower should send you Form 1098, which provides the exact amount of both deductible interest and points that you’ve paid.

Unreimbursed medical expenses and dental expenses

Catastrophic medical expenses have a well-earned reputation for being one of the leading causes of bankruptcy, and they can also significantly impact your ability to pay income taxes. To balance this effect, the government provides a deduction for those whose out-of-pocket medical and dental expenses (not covered by health insurance) add up to more than 10% of their taxable income.

Tracking the amount that you’ve spent out of pocket can be time-consuming and complicated after the fact, so it’s a good idea to keep a separate file for these receipts throughout the year if you’ve suffered a serious illness, accident, or similar high-number expense.

Long-term care premiums

Not everybody spends money on long-term care insurance, but those who do know how quickly the expense can add up. The rules are specific to your age and whether your insurance policy qualifies, but generally if your annual expenditures on premiums adds up to more than 10% of your AGI, you can deduct the expense.

State taxes, local taxes, and personal property taxes

The federal government recognizes the burden of paying state income taxes and local income taxes and allows itemized deductions for local taxes paid for each tax year in question (but not for taxes paid ahead for the next tax year). Taxpayers who itemize on their tax returns can take the local tax deduction as well as a tax deduction for personal property taxes such as real estate taxes.

Note: Until the end of 2026, a deduction can be taken on a maximum of $10,000 of these combined taxes, and if you’ve received a refund from the previous year on any of these taxes then you must report it as income.

Losses from casualty and theft

If you have lost or suffered significant property damage or theft as a result of a federally declared disaster and those losses add up to more than 10% of your adjusted gross income (AGI), you can deduct the amount over that threshold (less $100) from your federal taxes.

Note: If you receive reimbursement in a future tax year from a loss that you reported as an itemized deduction, you are required to report it as income.

Limited unreimbursed job-related expenses

Teachers are able to deduct up to $250 in unreimbursed expenses, and taxpayers who are qualified performing artists, state or local government officials working on a fee basis, armed forces reservists or who have impairment-related work expenses are able to deduct job-related expenses that exceed 2% of their taxable income.

Charitable contributions

The government encourages public participation in philanthropic activities, and to that end they offer the opportunity to take a significant deduction for contributions to qualified recipients up to 60% of your AGI. In light of the ongoing hardships caused by the pandemic, Congress created an additional deduction of up to $300 that incentivizes donations of either cash or food.

Miscellaneous expenses

In addition to all of the categories for itemized deductions listed above, there are certain other miscellaneous itemized deductions for which you may qualify. These include:

- Gambling losses (balanced by winnings)

- Estate taxes paid by the taxpayer on behalf of a person who died

- Losses from partnerships or sub-chapter S corporations

Read our tax deduction cheat sheet resource to discover more tax write-offs.

The Standard Deduction

Each year, taxpayers choosing between standard deductions vs itemized deductions either calculate the value of the deductions that qualify for itemization or they can do as the vast majority of the country does and opt for plugging in that year’s standard deduction for their individual filing status. This involves simply subtracting the standard deduction amount from their taxable income on their tax returns.

If it sounds like standard deductions are the equivalent of the government allowing you to avoid paying taxes on a big chunk of your income, you’re exactly right. The point of the deduction is twofold:

- It makes filling out your tax forms easier (and makes processing them easier for the government)

- It prevents low-income taxpayers from having to pay taxes at all, and significantly diminishes the amount that middle-class taxpayers have to pay.

To understand why the tax law offers standard deductions, just look back at the history of the American tax system. At one point taxes were only levied against the wealthy, but when the government needed help funding the war effort during World War II, many more people were asked to pay. To simplify the process and lessen the burden, the government offered a standard deduction of 10 percent of income.

Years later, they realized that the percentage-based system was requiring low-income taxpayers to pay more than they could afford to, so they shifted to a specific dollar deduction amount that would effectively eliminate the need for lower income individuals to pay federal tax at all and limit taxes to households with incomes above a specific threshold. The amount shifted from year to year to reflect both policy priorities and inflation.

While the Tax Cuts and Jobs Act eliminated many of the itemized and personal deductions that had previously been available, it doubled the standard deduction to $12,550 for single filers in 2021 and to $25,100 for joint filers. Head of household filers can take a standard deduction of $18,800, and if you are over 65 or blind the deduction is $1,350 higher. If you’re 65 or older and blind as well as unmarried and are not a surviving spouse, you can deduct an additional $1,700.

Note: Itemizing tax deductions is not available for taxpayers who are married filing separately on their tax return.

Now you know the difference between the itemized and standard deduction. What’s next??

When evaluating the standard deduction vs itemized deductions, there’s no doubt that it’s far easier to plug in the standard deduction and walk away, thanking the government for granting you the ability to reduce your adjusted gross income by a significant amount. But is that the right thing for you to do?

The vast majority of Americans — well over 80% — opt for standard deductions. Since you can’t take both, that option is unquestionably easier. Checking the box for the standard deduction makes completing the Form 1040 take a lot less time. But those taxpayers may be leaving money on the table.

The deciding factors on whether to itemize deductions or take the standard deduction

For some taxpayers, there is no question as to the advantages of the standard deduction. Not only is it faster and easier, but they know intuitively that they have not incurred enough out-of-pocket expenses from the qualifying categories to come close to exceeding the amount provided by the standard deduction. For others, the answer is not as clear.

If there’s a possibility that you’ve spent enough on mortgage interest, medical expenses, and other qualifying tax deductions that itemizing may add up to more than the standard deduction, then it’s probably a good idea to sit down and do the math.

Factors to consider and keep in mind as you decide

- If you pay mortgage interest and local, state, and property taxes, you are already well on your way to exceeding the standard deduction, especially if you also had medical bills that exceeded 10% of your AGI.

- If you donate a significant amount of money to qualified charitable organizations then your itemized deductions may exceed the amount of the standard deduction

- If you are thinking about itemizing deductions, make sure that you have records and receipts for all of the expenses that you plan to include as out-of-pocket expenses.

- If you are planning on itemizing – or even to do the calculation to determine which way to go — use IRS Form 1040 Schedule A to list all of your qualifying expenses.

Special considerations for business owners

Finally, as a business owner or freelancer, keep in mind that whether you choose to itemize deductions or to take the standard deduction, you are still able to deduct all of your business expenses (which are recorded using Schedule C.)

Your business expense tax receipts should be tracked throughout the year, as they quickly add up and can serve as a substantial balance to the taxes required of all self-employed individuals who earn more than $600. Typical deductible business expenses include:

- Car expenses related to any work-related driving you do (either the standard mileage rate or actual vehicle expenses)

- Travel expenses including hotel fees, plane tickets, Wi-Fi charges, meals, entertaining clients

- Home office expenses

- Subscriptions

- Commercial rent

- Technology (computers, printers, scanners, software, cloud storage systems, design tools)

- Inventory

- Payroll

- Marketing

- Tax-related expenses and licenses

- Continuing education

Final thoughts

Combining your business expenses with either the standard deduction or itemized deductions can make a world of difference in the amount of money you owe the IRS. And the lower your tax liability is, the more you have to invest in yourself and your future.