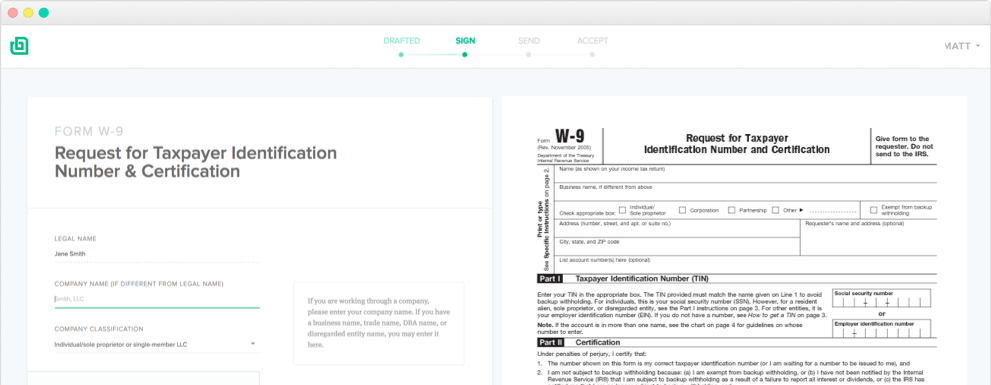

You don’t have to be a freelance for very long before you’ll be asked to fill out a W9 in preparation for your self employment taxes. For those of you who have traditionally earned most of your income as an employee, you may not have much of an idea what it is for or how to fill out a W9 form, or how to prepare for it with every invoice template you create and send for payment.

Fortunately, there are few things simpler than this necessary tool for anyone working as an independent contractor.

1. What’s a W9 tax form?

This form performs much of the same function as a standard W-4 (the form used by employees of businesses each year). While it doesn’t get into all the details of making you calculate a number of dependents for tax withholding, this is because you – not your freelance client – is responsible for figuring out how much tax to pay the IRS each quarter. Clients don’t usually have the responsibility of helping you pay your taxes.

The W9 will ask some basic info, such as your name, mailing address, social security number, and how you plan on classifying your business (independent vs. sole proprietor, for example). There is also the option of providing an EIN (Employer Identification Number) instead of a social security number. Some freelancers like providing this number instead as a way of protecting their social security info, but it’s not mandatory to do this. Read more about the benefits of an employer identification number for a sole proprietor.

Note: If you do want to substitute an EIN for a SSN, it’s free to do so. You simply need to reside in the U.S. and be able to fill out this form online.

You’ll also be asked if you are subject to backup withholding. If you have not been told that you need to do this (usually by the IRS for failure to pay taxes or report properly) than you simply certify that you are exempt from withholding. Most freelancers will be exempt, but if for some reason you aren’t, your client will be responsible for withholding 28% of your paycheck to send to the IRS.

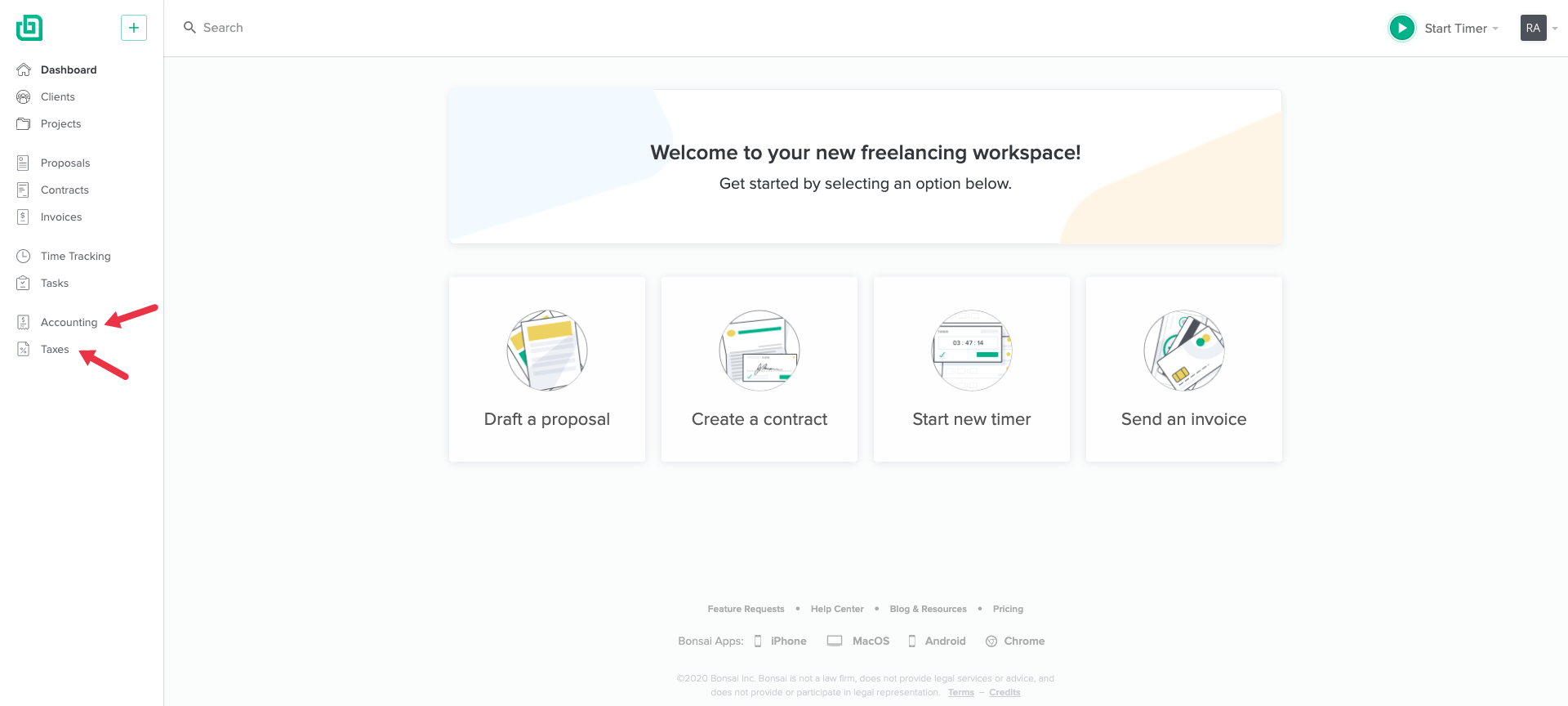

Did you know that you can use Bonsai for bookkeeping? Or that Bonsai can help you be prepared for self-employment tax by providing tax estimates, filling date reminders, and identifying your tax write-offs?

Let's see how that works. First, head to your main Bonsai dashboard and have a close look on the left side - we'll be working with the accounting and taxes sections. First click on "Accounting".

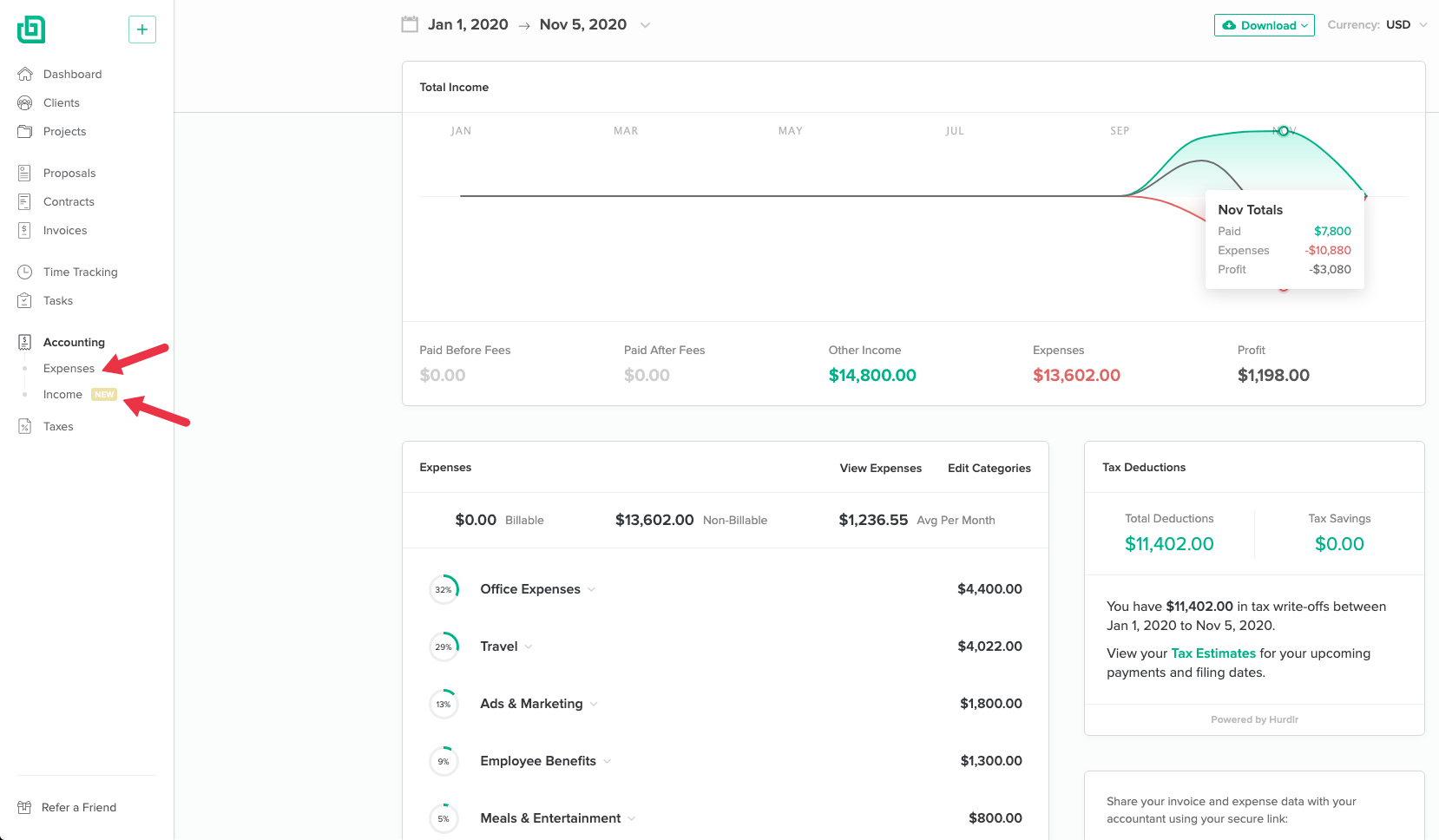

Inside the accounting section, you'll see a breakdown of your income and expenses. Both can either be automatically imported from your bank account, or manually added (you can track using a 1099 excel template). Work you got paid for via Bonsai will also be registered here.

Make sure this section is properly filled in and click on "Taxes" next.

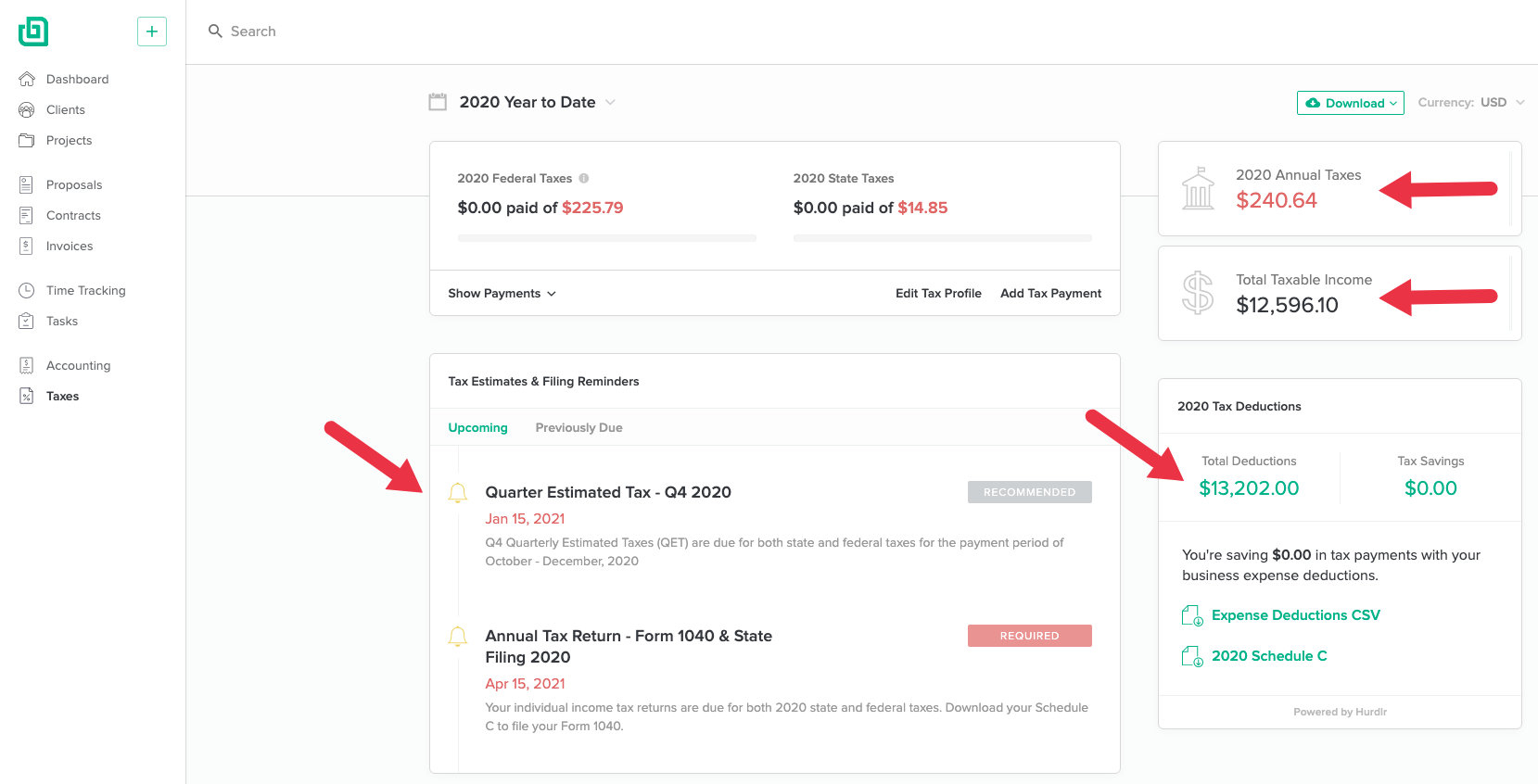

This is where the magic happens: Bonsai will do all the calculations for you, and we'll provide you with an overview of your tax estimates, a list of tax deductions you can use for the upcoming tax season, and reminders for all the upcoming filling dates.

Simple, right? If you're ready to check out Bonsai and explore all the features, go ahead and sign up for the free trial!

2. Handling your W9 with care

One big mistake that many freelancers make is in keeping their information secure. It is recommended that you never email your completed W9 to a client as an attachment to an email, unless you have some form of encryption on your messaging system. Otherwise, you can use a secure document electronic document delivery service, or send your form to your client in the mail.

It is also advised that you never provide a completed W9 form to anyone you don’t have a legitimate working relationship with. In other words, it’s wise to wait until you have a completed contract on file, explaining the independent contractor partnership, before you fill out a W9 form with your sensitive information.

3. Additional details on the W9

How often should you update your form? It depends. Generally, you can keep the same one on file with your client for as long as the information included on it is current. If your address, name, withholding, or tax numbers change, however, you’ll need to send them a new form with the correct info. Some clients also ask for a new form each year or when they update their systems. While it’s not common to ask for this, filling out a new form takes just minutes and is a good way to keep your clients happy with their accounting departments.

A W9 form is required to be on file at each client you do business for. The information provided helps them to fill out and issue a 1099-Misc later in the year. The 1099-Misc is the contractor’s equivalent of an employee’s W-2, and you’ll be using the numbers included to help you file and pay your taxes.

4. Late or missing W9’s

While most clients will be proactive and ask for you to fill out a W9 form when you start doing business with them, you may run into a client who isn’t aware that this needs to be done. It may only occur to them that there is a need when it comes time for them to do their own taxes, and they go to fill out the 1099-Misc for reporting your income. A good freelancer will anticipate this need ahead of time and provide a W9 to new clients even before they ask. By making it part of the onboarding process, along with the contract and invoicing terms, you’ll have it out of the way in plenty of time for tax season. Remember, you can use Bonsai tax to calculate your tax deductions and estimate quarterly taxes.

(Note: There are many things that can hold up your taxes each year, and among them are the various forms you’ll receive. If you can think ahead and help your client streamline some of this, it will help you to avoid delays in getting your forms each year. No one wants to wait on a tardy 1099-Misc, and having the W9 on file can prevent this situation. You don’t want to be one of a dozen or more freelancers waiting in line to get tax form issues resolved!)

5. Common W9 problems

Despite the straight-forward nature of this form, there are still freelancers who report clients or other entities who aren’t sure what they are for. In particular, they might get a request to fill one out from someone other than a client

While you can get a request for W9 from anyone paying you non-employee compensation, you will probably know about it ahead of time.

Interest and dividend payments are often made with the information contained on a W9, so don’t be surprised to get a request from a bank or other financial institution you do business with. Your landlord or other company, however, would never need this info. If the company or person isn’t paying you for services or the value of assets, there is no need to ask you for this sensitive info, and you should ask for further information before complying.

6. Are you truly a freelancer?

W9’s also have the benefit of establishing how you’re being treated in relation to the business you’re working for. If you receive a W9, the assumption is that you are an independent contractor and the working relationship would be treated as such. You wouldn’t receive employee benefits, for example, and you would have the freedom to come and go as a freelancer would. You would enjoy the perks and responsibilities of a consultant and not an employee.

There have been instances of regular employees being asked to fill out a W9 tax form. If you’ve been hired for full or part-time employment, this should be a red flag. Employees should be paid as employees, through the information gathered from a W-4 and reported as income on a W-2. If a business appears to be skirting the law by reclassifying your compensation, you should seek counsel to resolve the matter as soon as possible. The IRS is not lenient when it comes to taxes being paid appropriate, and it’s up to you to know how you are classified and fill out the corresponding paperwork.

7. W9 is not a big deal

While a necessary tool for doing your freelance work, the W9 shouldn’t scare you or cause you concern. Think of it as a quick and legal way for your new client to pay you and stay above-board with the IRS. Filling out W9’s should be as painless as signing a contract or sending an invoice. It’s a sign that you are growing your business. Rather than worry about it being a cumbersome form, celebrate that you’ll soon be earning more income and that you’re truly a successful freelancer now!

For additional info on the W9 form, including an updated copy of it, you can visit the IRS site directly. For help with taxes, or to experiment with Bonsai's suite of freelance products sign up for a free trial!