Freelance artist taxes involve reporting all income from art commissions to the IRS, as this is considered taxable income. As a self-employed individual, you must pay self-employment tax and possibly quarterly estimated taxes.

Key deductions include:

- Home office expenses

- Supplies

- Health insurance

To file, use forms like Schedule C for profit or loss and 1040-ES for estimated taxes. Accurate record-keeping is crucial for maximizing deductions and minimizing tax liabilities. Consider using tax software or consulting a professional to ensure compliance and optimize your tax strategy. Understanding these steps can help freelance artists manage their finances effectively and avoid penalties.

If you sell commissions in exchange for a fee, you need to learn about freelance artist taxes. Even if it is something you enjoy doing in your spare time, you still get paid for it. If you get paid, you must report the income to the IRS.

Income received from a freelancing business is taxable income. As a result, you are considered self-employed. Read our guide to find out what taxes you have to pay and which tax deductions you can claim.

Note: If you want to capture all your graphic designer tax deductions and maximize your savings, try Bonsai Tax. Our app could scan your bank/credit card receipts to discover all your potential tax write-offs. In fact, users save on average, $5,600. Try a 7-day free trial today.

Do you have to pay art commissions taxes?

As long as you receive money from art commissions and earn a profit, you must pay taxes. Only if you do it as a hobby without making any profits can you get your tax money back.

You must report your income regardless of the amount—whether $400, which triggers self-employment tax, or $1. On tax day, you can apply for deductions to recover tax money spent on resources.

If the art is a hobby, income and deductions generally cancel each other out, so you effectively pay nothing. Despite this, you must still report and pay taxes.

Can freelancers avoid art commissions taxes?

You must declare your freelance earnings by the end of the tax year, regardless of the amount earned.

If you ignore your taxes, you might avoid IRS attention temporarily. However, this is risky. If the IRS notices, you could face interest, fines, or even jail time.

You might only pay what you owe if you report yourself. However, if the IRS issues the audit, you could face greater penalties.

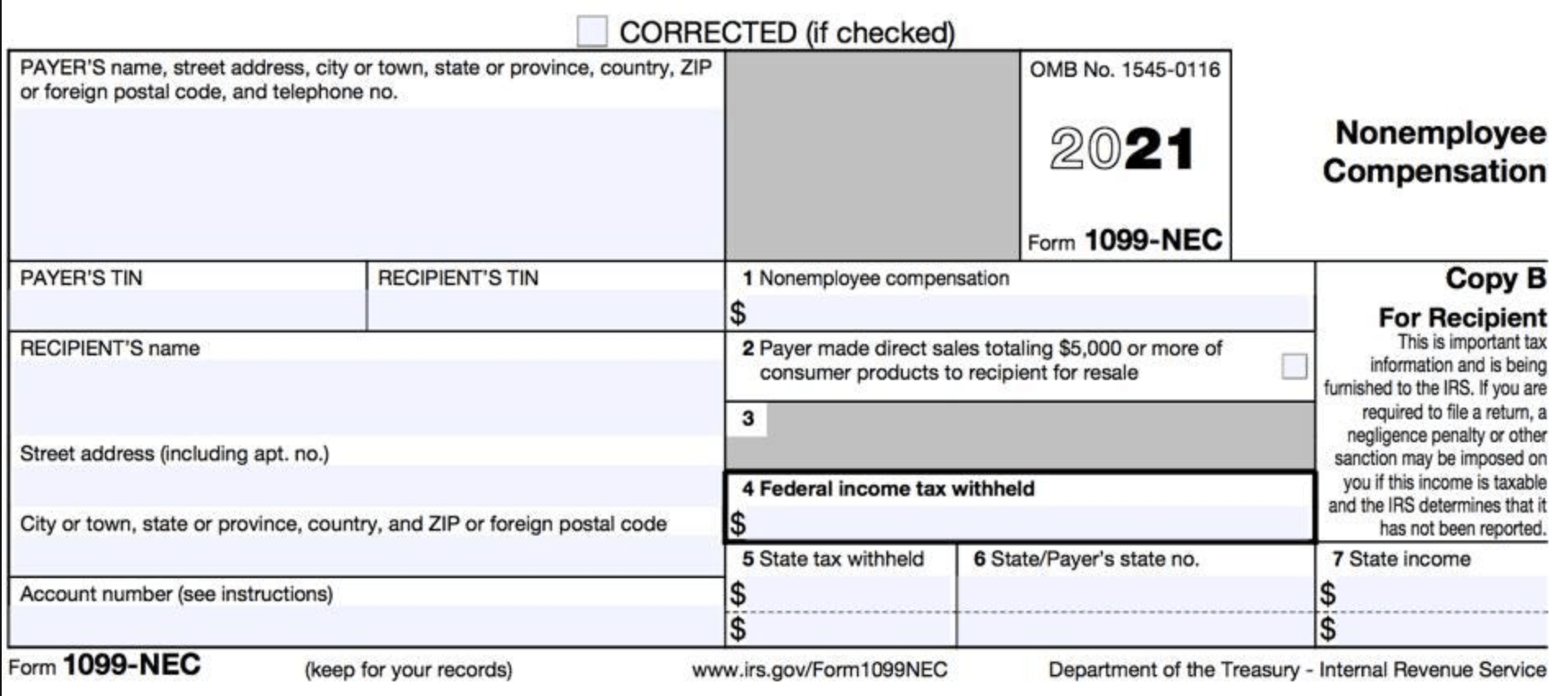

If you make over $600 as a freelance artist, then you will receive a form 1099-NEC or form 1099-MISC from your payer. One of these forms will go to you, and the other will go to the IRS - which means they will certainly know you owe taxes.

If you make under $600, then you won't get either of those forms. However, you still need to report it as self-employment income by tax time.

If you are self-employed with a freelancing business but have never paid taxes, consult your attorney and accountant. To remain in good standing with the IRS, you must pay up to six years back taxes. Otherwise, you risk severe penalties, especially if the IRS catches you first.

What art commissions taxes do freelancers have to pay?

Freelancers or sole business owners must pay income taxes, just like employees. Additionally, you must pay self-employment tax.

Self-employment tax covers Social Security and Medicare taxes that your employer would have paid. Now that you are your own boss, you must pay these taxes yourself.

Income taxes break down into different types: federal, state, city, and local taxes. If you hire people to work for you, whether full-time or project-based, you must pay half their income tax and withhold the other half from their taxable income.

Sales tax is another obligation for sole proprietors of freelancing businesses. All states except Alaska, Montana, Delaware, New Hampshire, and Oregon impose sales taxes on products and goods.

When you file your taxes for the income tax return, you only need to file for physical products. If your freelancing business only provides a service, then you don't have to worry about the sales tax.

Sales tax basics for art commissions

When do art commissions require sales tax?

Art commissions generally require sales tax if you sell tangible personal property or taxable services in states that impose sales tax on such transactions. Most states consider commissioned artwork as taxable goods once the physical piece is delivered to the client. For example, if you create a custom painting and ship it to a customer in California, you must collect California sales tax unless the buyer provides a valid resale certificate.

However, some states have exemptions for original artwork or digital art services. New York, for instance, exempts sales tax on commissioned artwork if it is delivered electronically without a physical medium. It is important to check your state’s specific rules because taxability varies widely. States like Texas tax art commissions as tangible personal property, while others may not.

To stay compliant, register for a sales tax permit in every state where you have a tax nexus. Nexus can be created by physical presence, sales volume, or economic thresholds.

For example, in 2024, many states require you to collect sales tax if your sales exceed $100,000 or 200 transactions annually. Use tools like TaxJar or Avalara to track nexus and automate tax collection.

How to calculate and collect sales tax on art commissions

Calculating sales tax on art commissions starts with determining the correct tax rate based on the buyer’s location. Sales tax rates vary by state, county, and city. For example, the combined sales tax rate in Chicago, Illinois, is 10.25% in 2024, which includes state, county, and local taxes. You must apply the total rate where the artwork is delivered or where the customer takes possession.

To collect sales tax, include the tax amount as a separate line item on your invoice or sales receipt. Many invoicing platforms like HelloBonsai allow you to add sales tax automatically based on the client’s address. This ensures transparency and helps clients understand the charges. Remember to keep detailed records of all sales and taxes collected for reporting purposes.

Using a sales tax automation tool can simplify this process. For instance, TaxJar’s AutoFile feature can calculate the correct rate and file returns on your behalf. This reduces errors and saves time, especially if you sell art commissions to clients in multiple states. Always verify the rates quarterly, as tax laws and rates often change.

Filing and remitting sales tax for art commissions

Filing sales tax returns is required in every state where you collect sales tax on art commissions. The frequency of filing depends on your sales volume and state rules. For example, California requires monthly filings if you collect over $10,000 in sales tax per month, but quarterly filings if under that threshold. Missing deadlines can result in penalties and interest.

To file, gather your total taxable sales and the amount of sales tax collected for the filing period. Most states offer online portals for submitting returns and payments. If you use software like Avalara or TaxJar, these platforms can generate and submit returns automatically, reducing the risk of mistakes.

Keep copies of all filed returns and payment confirmations for at least four years, as states may audit your records. Staying organized with bookkeeping software like QuickBooks or FreshBooks helps track sales and taxes accurately. Regularly review your sales tax obligations to adjust for any changes in your business or state laws.

How artists’ marketplaces handle sales tax

Marketplace responsibilities for collecting sales tax

Most major artists’ marketplaces handle sales tax collection on behalf of sellers. Platforms like Etsy, Redbubble, and Society6 automatically calculate, collect, and remit sales tax based on the buyer’s location. This means artists who sell through these sites often do not need to manage sales tax collection themselves.

For example, Etsy collects sales tax on all orders shipped to states where marketplace facilitator laws are in effect, which now includes all U.S. states with a sales tax as of 2024. This shifts the tax collection burden from individual artists to the platform, simplifying compliance.

Freelancers should verify each marketplace’s tax policies before listing art commissions. Understanding whether the marketplace acts as a facilitator can save time and reduce audit risks. Always check the platform’s help center or tax section for the latest updates.

How sales tax varies by state and marketplace

Sales tax rates and rules vary widely across states, and marketplaces adjust accordingly. For instance, Redbubble applies different tax rates depending on whether the buyer is in California, New York, or Texas. This ensures compliance with local tax laws without requiring artists to track each state’s rates.

Marketplace facilitator laws require platforms to collect tax in states where they meet economic nexus thresholds, often $100,000 in sales or 200 transactions annually. This means if an artist sells through multiple marketplaces, some platforms may collect tax while others do not, depending on their nexus and policies.

Artists should keep records of sales through each platform to reconcile income and understand tax obligations. Using tools like TaxJar or Avalara can help freelancers track marketplace-collected taxes and prepare accurate tax filings for 2024 and beyond.

What artists need to do despite marketplace tax collection

Even when marketplaces collect sales tax, artists remain responsible for reporting income accurately on their tax returns. The platforms typically issue 1099-K forms if sales exceed $600 in a calendar year starting in 2024, reflecting gross sales including tax collected.

Artists should also verify whether they need a sales tax permit in their home state or other states where they have nexus. Some states require registration regardless of marketplace facilitation. For example, California artists may need a seller’s permit even if Etsy collects tax on their behalf.

To stay compliant, freelancers should maintain detailed records of all transactions, including commissions sold on marketplaces. Using accounting software like QuickBooks Self-Employed or Bonsai’s invoicing tools can streamline this process and ensure accurate tax reporting.

Art commissions tax forms freelancers need to deal with

As a freelancer, you will have several tax forms to work with. Some are used to report your income, while others help you claim tax deductions. Here are the tax forms you may encounter.

- Form 1040 - This one is used to fill in all your information for your individual tax return. This is used to opt for either itemized or standard deductions, report income, list dependents, and any other information you may need for your tax return.

- Form 1099-MISC - This is a form that you will receive from your payer when you earn more than $600 per project. You may also get a form if you earn less money, but in this case, the payer is not required by the law to send this form.

- Schedule SE - This form is used when figuring out how much self-employment taxes you owe. It can also be used in order to account for half the owed deduction.

- Schedule 1 - Schedule 1 is used to report any additional income you may have. It's also where the last of your business income goes, along with several deductions.

- Schedule 2 - When paying for extra self-employment taxes, you'll be using Schedule 2. This can include the alternative minimum tax or the self-employment tax.

- Schedule A - If you go for itemizing, Schedule A will list out the deductions that you can make here. You will get all the boxes to calculate your taxes and get a minimum.

- Schedule C - This is one of the most important forms for freelancers, as this is where you report any profits and losses that you have. A schedule C with 1099 is where you put in your gross receipts, your business expenses, and all the other key items that have to do with your business.

You likely won’t have to deal with all of these forms. The forms you fill out depend on your income and deductions. Hire an accountant if you are unsure which forms to use.

How much art commissions taxes do freelancers pay?

As a freelancer, you must pay two types of taxes: self-employment tax and income tax. Income tax rates range from 10% to 37%, depending on the federal tax bracket you fall into. The higher your income, the more you owe in income taxes.

You owe self-employment tax if you earn more than $400 in net profit from your art. This tax is 15.3% on 92.35% of your net earnings. The amount funds Social Security and Medicare taxes.

How much to set aside for art commissions taxes as a freelancer

Freelancers pay different tax amounts. However, it is wise to set aside around 30% of your income for taxes.

This 30% rule usually applies to those with average freelancing income. If you earn high amounts, you may owe more than 30% in taxes.

If you earn very little, you may pay less than 30%. The tax amount depends mostly on your tax bracket.

Depending on your state, you might also owe a city tax. In most cases, saving for federal tax (Social Security and Medicare), state tax, local tax, and other usual taxes is sufficient.

If you live in a bigger city like New York, your business might face a city tax. This can increase your tax rate, requiring you to set aside as much as 40% for tax season.

What art commissions tax deductions do freelancers qualify for?

Freelancers have their share of tax deductions that they can qualify for. When filing your tax return, here is a list of freelance artist tax deductions you may get:

- Home office deduction

- Business supplies like pens and paper

- Hardware such as computers or tablets

- Software subscriptions or purchases

- Health insurance premiums

- Travel expenses related to your art commissions

- Mileage for business driving

Note: the best way to record all the tax deductions you qualify for and maximize your savings is with an app like Bonsai Tax. Our software will scan your bank/credit card receipts to find all the potential write-offs to claim and categorize the expenses at the push of a button. Users typically save $5,600 from their tax bill. Claim your 7-day free trial today.

Self-Employment Tax

When you work for a boss, they would pay half of your 15.3% self-employment tax. However, now that you have your own business, you will have to pay that tax yourself in full.

Luckily, you can deduct half of the 15.3% self-employment tax, which is the amount your boss would have paid. Eligibility depends on your income. Contact a tax professional to confirm if you qualify for this deduction.

Home Office & Supplies

The home office deduction is a key tax benefit if you do your art business from home. Whether you own or rent, you can deduct the room or part of the room used exclusively for business.

According to the IRS, you may claim a total of $5 per square foot, for a maximum of 300 square feet. Bear in mind that line 16, 25 and 27 should not be included here. All you should deal with is line 30.

If you use items such as pens, paper, or other office tools for your art, you may deduct these expenses through line 18. Keep all receipts to support these deductions.

- Pens

- Paper

- Other office supplies

The Internal Revenue Service now moved on digital means of showing proof. As a result, if you do not have the actual receipt, you can use your credit card statement or bank record, as long as it is clear the purchase was for supplies. If you do not want to stash paper receipts all over your home, you may also snap pictures of each receipt and save them on your computer.

Hardware and Software

As a freelance artist, you likely have hardware and software needs. For example, you can deduct the cost of a tablet, computer, or other hardware required for your art.

Software deductions also apply. For instance, you can deduct costs for programs like Photoshop or any other art-related software. Deductions apply whether you purchase software outright or subscribe.

Health Insurance Premiums

As a self-employed individual, the chances are that you are paying for your health insurance. In this case, you may deduct the health insurance premiums. Bear in mind that this deduction cannot go past your annual earned income, were you to be eligible for it.

Travel Expenses & Mileage

Let's say that you are the sole proprietor of a small business, where you offer commissioned portraits to your clients. In certain circumstances, you may have to travel in order to meet the client - be it to discuss the project or to deliver the finished project.

You may deduct travel expenses related to your art commissions. This includes lodging, plane tickets, car rental, and necessary expenses such as dry cleaning. You can only deduct the portion of a trip spent on business.

- Lodging

- Plane tickets

- Car rental

- Dry cleaning, if necessary

Bear in mind that you may only claim business deductions that are deemed "ordinary and necessary." Let's say you went to the Wizarding World of Harry Potter. If you are an artist looking to interview craftsmen there and are there for an extremely good reason, then you might get some business deductions. Otherwise, it might fall under personal expenses.

Furthermore, just like you can claim tax deductions when you are out of town, you may also deduct the mileage when you are still around. This is very useful when you are driving around a lot, meeting clients.

For 2024, the mileage rate is 65.5 cents per mile. Make sure to do your research, as the mileage rate changes every year.

Try our mileage tracker worksheet template to record your business miles.

Education

On occasion, your line of business may require that you obtain a specific certification or earn certain skills. If this is your case, then you may get deductions for it.

Bear in mind that the education expense deduction only applies if you need the certification in your current line of business. You will not be able to get it if you are trying to change your career or gain different skills unrelated to your business.

Internet and Phone

If you get your business income from freelancing, then you have to pay quite a bit in business expenses for phone and Internet. With that in mind, when you file for an income tax return, you may deduct the phone bill and Internet as well.

To make your tax preparation easier, you might need a different phone line and Internet connection. This way, you will get a full deduction for the income and expenses.

That being said, freelance business owners may also calculate estimated tax on a personal line. You will just need to deduct the percentage that you use for business and then file taxes like you normally would.

Transaction Fees

Does your business get paid through PayPal or any kind of third-party payment platform that requires a transaction fee? If that's the case, then you can deduct the estimated tax as well. This should make it much easier on your income and expenses.

When you file taxes, put them together on line 27A. If your line of business has you selling products on pages such as Etsy, you may write off the tax here as well.

Loan Interest

Business owners need to pay for various expenses such as Social Security tax and other business-related costs. Handling these costs often leaves limited funds to help expand your business.

As a freelancing artist, you might need a loan to buy a higher-end graphic tablet with more features. This will give you more control over your work and help you finish projects faster. The faster you complete projects, the more work you can take on, allowing your business to grow.

These items come at a hefty price, so it is beneficial when you can write off at least the interest. Credit and debit cards used for these purchases can also be deducted on Line 16.

Contributions to Retirement Accounts

When you are the sole proprietor of your own small business, the chances are that you are also responsible for contributing into your retirement account. Social Security and Medicare taxes may cover some of this, but very often, you will find out that it is not enough.

Luckily for you, retirement contributions may also be written off when you file freelance taxes. Make sure that you keep track of all the contributions you make to IRA or SERP accounts, so that you may get your due tax deductions.

Small businesses can contribute up to $66,000 annually to retirement accounts. Each dollar contributed is fully deductible.

Marketing and Advertising

The problem with being a freelancing artist is that unless people know you, you don't get many commissions. When you are just starting the business, you'd be lucky to get one commission every couple of weeks, until people start knowing what you can do.

This is why you need to get your business out there by means of advertising. As the sole proprietor of your somehow small business, you will have to pay these business expenses from your own taxable income.

This is why you will be happy to know that you can get a tax return when you file your taxes. All marketing and advertising expenses used to attract clients to your business are fully deductible.

Startup Costs

Let's say that up until now you were only a hobbyist, but now you decided to level up your art. Now, you want to be your own business owner, so that you can get actual business income from your passion.

The problem is that startup costs for businesses can be rather high, and we are not only talking about registration. We are talking about costs to buy the business gear as well. For instance, this may include tablets, pencils, or whatever tools you may need.

As long as it is related to the startup, these costs are fully deductible. Deduct up to $5,000 of these costs. Discuss with your accountant if you have doubts about what is deductible.

How to do art commissions taxes as a freelance artist

To pay your taxes as a freelance artist, you need to fill in Schedule C from your form 1040 for tax return. You also have to make sure that you pay your self-employment tax.

When doing your taxes, ensure that you report all income you make, even if you do not receive a 1099-MISC. Keep all the records so that you can make the proper calculations.

You may file freelancer taxes yourself using tax preparation software, an IRS tax calculator, or by hiring a tax accountant. The latter is generally recommended when you do not know the tax law.

They will have a better notion of what forms must be filed and how much you will have to pay. This way, you won't have the unpleasant surprise of finding out you paid too little in taxes or even overpaid.

Deadlines for Quarterly Taxes

If you are self-employed, you have two options to pay your taxes. You can pay all at once by April 15, 2026, for the 2024 tax year. You must file the forms first to avoid penalties.

The other option is to make payments quarterly. Freelancers typically pay 25% of their taxes every quarter.

The last quarter payment for the 2023 tax year was on January 16, 2024, covering September 1 through December 31, 2023. The quarterly estimated tax payments for 2024 are as follows:

- Quarter 1 - April 18, 2022: Covering January 1st - March 31st

- Quarter 2 - June 15, 2022: Covering April 1st - May 31st

- Quarter 3 - September 15, 2022: Covering June 1st, August 31st

- Quarter 4 - January 15, 2023 - Covering September 1st, December 21st

Keep them in mind so that you don't miss any payment day. If the due date falls on a holiday or the weekend, then the deadline gets extended until the next weekday when the banks and offices are open.

The Bottom Line

Running your own freelancing business might feel rather scary, especially considering how you will have to do your own tax work. Still, as long as you keep track of what is tax-deductible, things shouldn't be that complicated. Work closely with your accountant so that your freelancing business does not bring you any tax surprises.