One of the first decisions you will have to make before your startup even earns its first dollar is which bank to use for your business. Unless you are not serious about the success of your business, you need to have a separate business bank account to divide personal and business accounts.

Using a personal bank account for business undermines the legitimacy of the business. Even the Internal Revenue Service (IRS) won’t recognize your business which will lead to unnecessary hassles during tax time.

However, you can’t just pick any bank and hope it works for your startup. You need to look at the services being offered to see if they align with your business goals. The bank you choose needs to have provisions that facilitate the growth of your business.

So, to make things easy for you, we compiled a list of top financial institutions to consider when it comes to startup banking.

- Bonsai's business account

- BlueVine

- Chase

- Nearsire

- Novo

- Silicon Valley Bank

- Wells Fargo

- Lending Bank Club

- Mercury

But before we can get to that here are important factors to consider before choosing the appropriate bank for you.

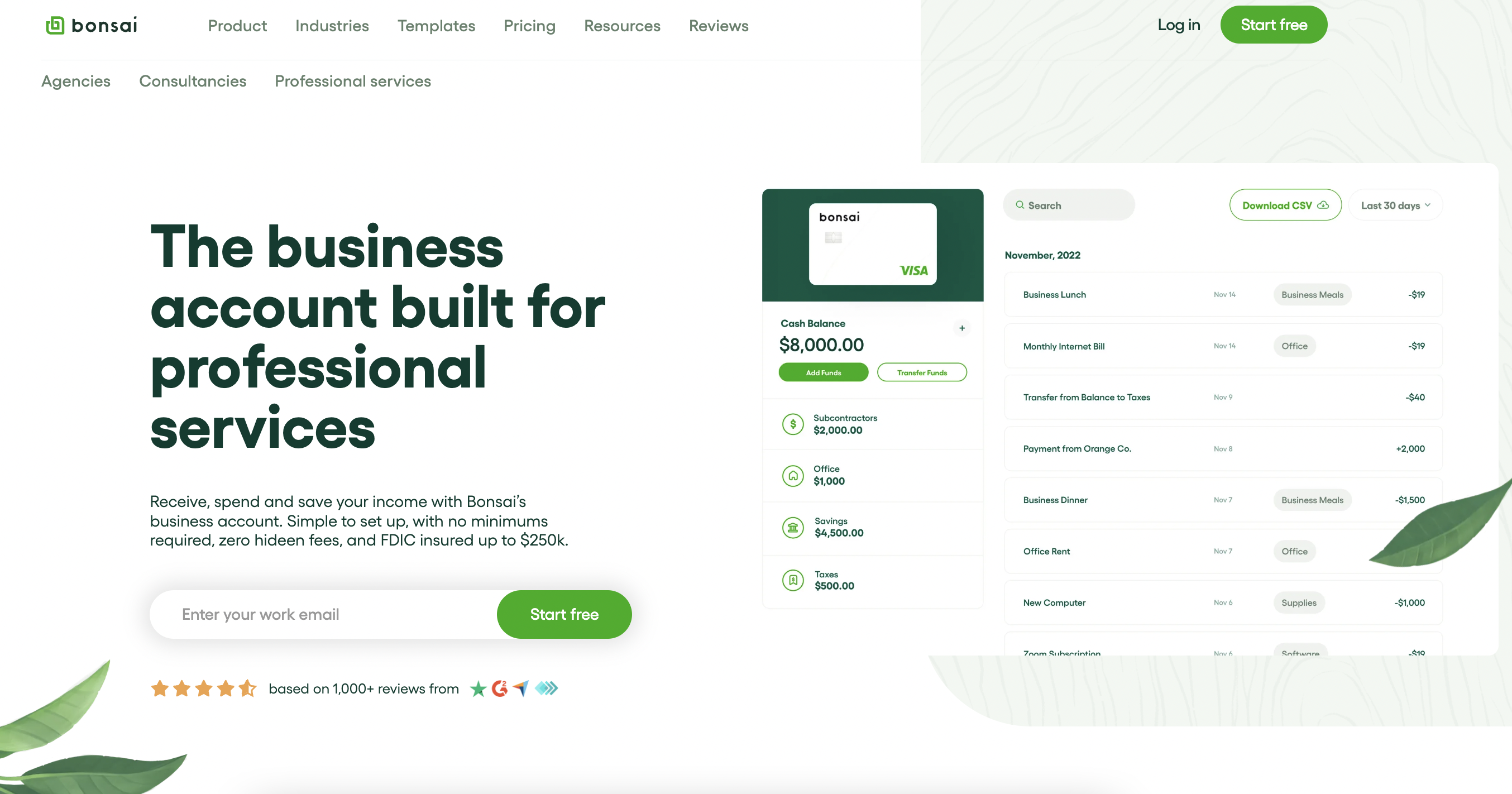

Note: If you want to open the best bank account for start ups, try Bonsai's business account. Our account has no hidden fees or minimums and is simple to set up. There's no application or ChexSystem report so our account is guaranteed. Bonsai's business account also allows you to create sub-accounts to organize your finances quicker. Try Bonsai's business account for consultants, coaches, lawyers and other professional services, open an account today.. If you are looking for the best bank for home services, construction, barbers, or freelancers check out BlueVine as a great option!

Traditional business bank accounts vs Online business bank accounts

The rise of online-only financial institutions is challenging traditional setups and as an entrepreneur, it’s up to you to weigh between these two options and decide which one makes the most business sense.

Traditional banks have been in existence for a long time and, therefore, offer a sense of stability to account holders.

However, it’s the online services that are emerging as winners in terms of services provided. To begin with, these online institutions are coming up with innovative ways to manage your business finances in a way that’s impossible with traditional setups.

This is made possible through in-built tools and integration with other software that you were already using in your business.

Another advantage online banks have over traditional banks is borderless banking. They make it extremely simple to conduct international transactions.

Not to mention the fact they are not limited by time or location. You don’t have to worry about waiting for hours to be served. You are in charge of your account.

Borrowing options for startups: Does your bank matter

Something else to think about is how to finance your startup along the way and how your bank of choice helps in the matter. Does the bank have a Line of credit or a business credit card?

What about loans? What are the conditions for qualifying for a loan and are the payment terms favorable to your startup?

Now, some banks already offer these services but if your preferred bank does not offer business financing options it’s not a deal-breaker.

The most important thing is that you have a business bank account and you can provide a detailed report of your business earnings and spending.

If you have these, you won’t have a problem accessing funds from any institution.

The 9 Best Banks for Startups In 2023

Here is our list of the top 9 business account solutions for startups.

Bonsai's business account - Best Online business account for small businesses

Bonsai's business account is a new online business checking account that will be perfect because of how simple it is to use while still packing all the tools you need to efficiently manage your funds.

The account is completely free to open and maintain. This means there is no initial deposit required, no minimum balance to maintain, and no monthly maintenance fees.

You will have to wait a while to get your physical business debit card but Bonsai also provides you with a virtual card that you can use to make online purchases and pay for your subscriptions.

The virtual card can even be scanned using Apple Pay and Google Pay to add it to mobile payments.

Bonsai's business account can be integrated with any payment software to enable you to receive business payments directly to your account.

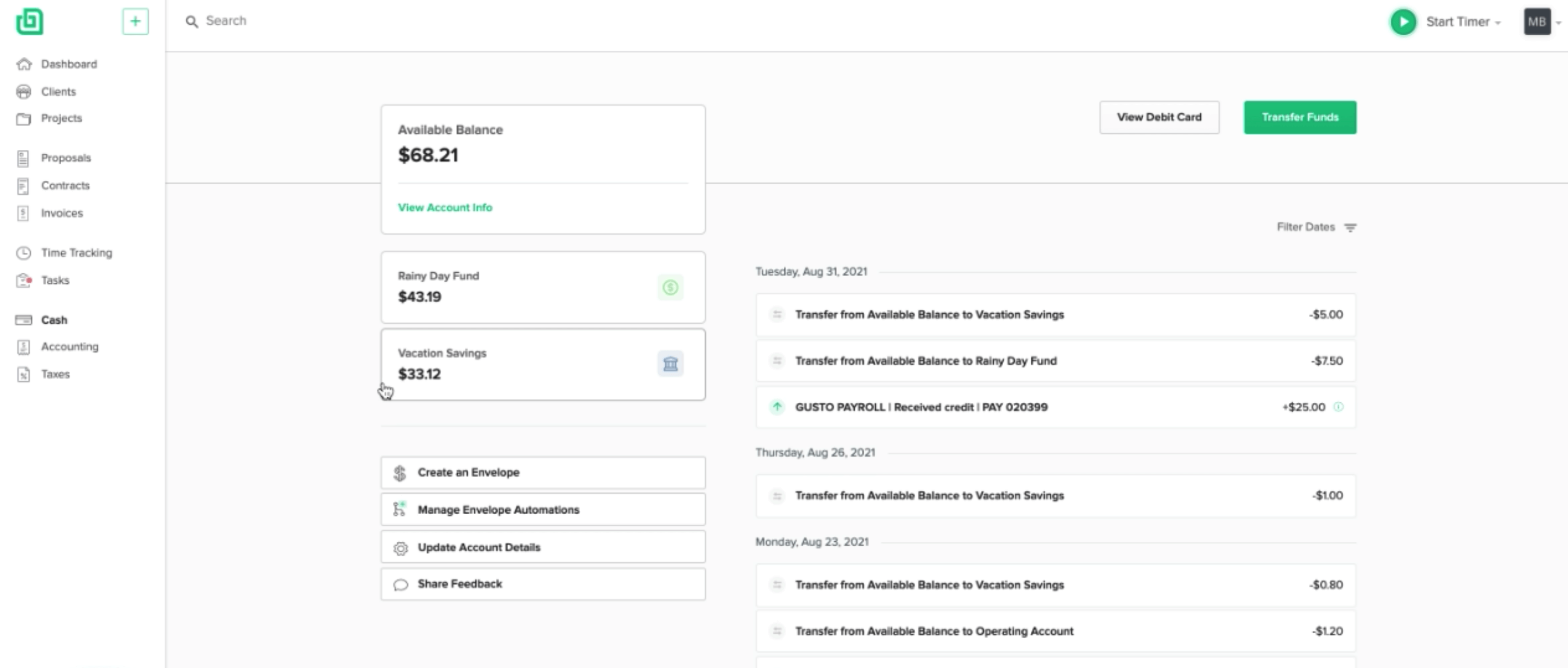

But, it is the Bonsai Envelope feature that really makes this account stand out. The envelopes work as a business bank account with sub-accounts where you can save money for different purposes.

There is no limit to the number of envelopes you can create. Even better, you can set rules that allow money to be automatically sent to a specific envelope.

For instance, you can have an envelope for tax money and another one for salaries, and every time you receive money in your account, a certain percentage of the money is sent to a specific envelope.

You never have to worry about business expenses catching you unprepared.

The daily transaction limit for Bonsai's business account members is $5300. That is $300 for ATM withdrawals, $2,000 for card transactions, and $3,000 for transfers to external banks. Bonsai's business account does not use the ChexSystems reports, so a business account is guaranteed.

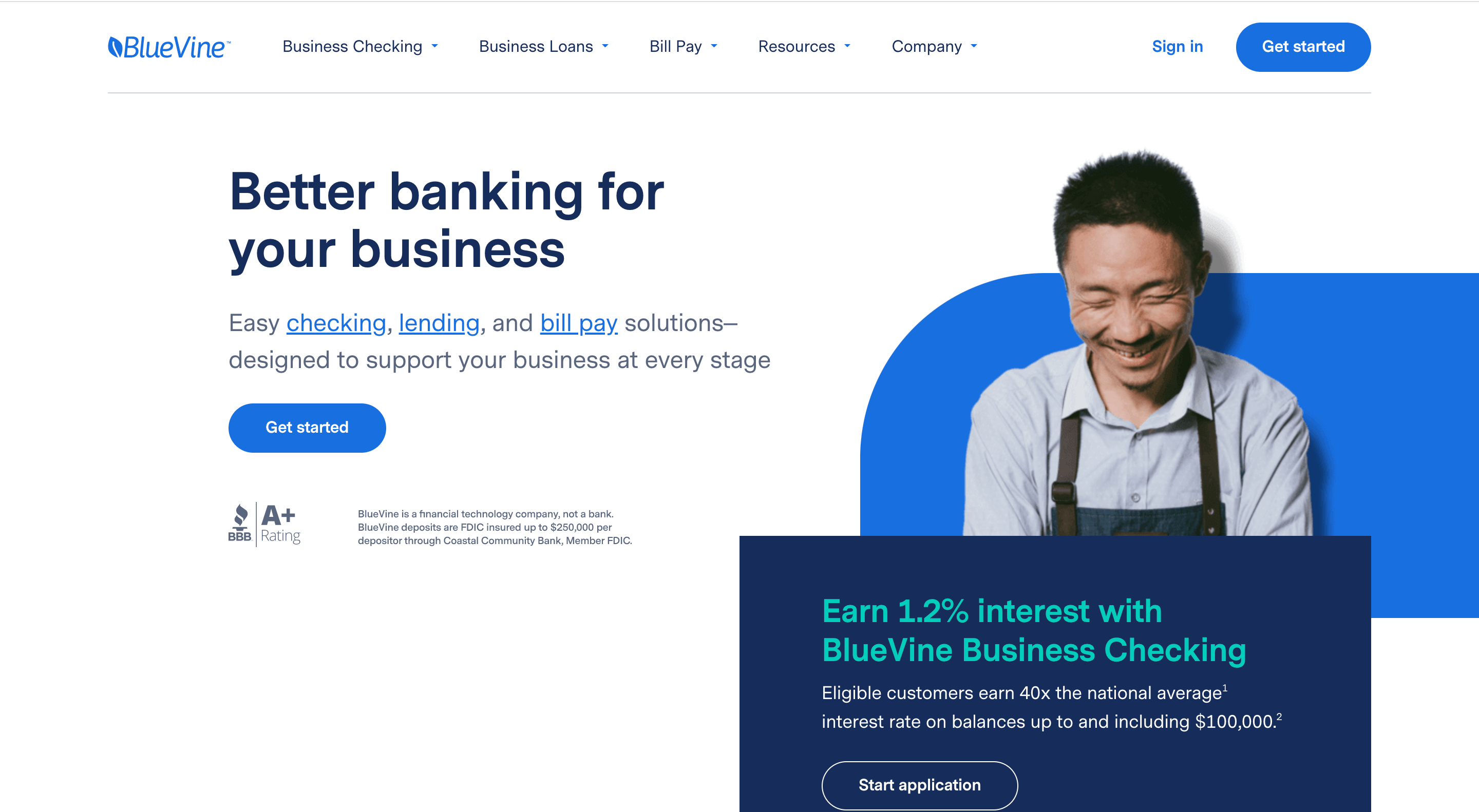

BlueVine

BlueVine is another online business checking account that will be great for freelancers, barbers, construction businesses, home service startups and cleaning services. The account is completely free to use. It does not require that you maintain a minimum balance and there are no monthly fees. BlueVine has a network of 37,000 ATMs country-wide that allow you to make fee-free withdrawals.

Another good thing about this account is that it offers unlimited transactions. However, they do have a maximum amount that you can transact daily. For ATM or over-the-counter withdrawals, it’s $2,000. For card purchases, it’s

BlueVine. For outgoing transfers, the limit is $100,000 per month.

BlueVine also supports mobile check deposits and limits you to $20,000 per 30-day period.

This account can also earn you interest for deposits of up to $100,000 but certain conditions need to be met. You need to have either spent $500 with your BlueVine debit card or received $2,500 payments into your account.

The annual percentage yield is 1.20%.

BlueVine also facilitates better management of your business funds by allowing you to open two sub-accounts complete with different account numbers. The account also supports integration with Quickbooks for a more rounded approach to your business finances.

Finally, this account comes with some business financing options you can consider. The first is invoice factoring which lets you take a loan based on your outstanding invoices.

They also offer a line of credit of up to $250,000

Chase - Best big bank for startups

Chase is our best choice for big banks for startups because it has all the banking services you need. They have a checking account, a merchant services account to enable you to accept debit and credit card payments, business credit cards, and business financing through lines of credit, and business loans.

The account also comes with access to online Bill Pay, wire transfers, and QuickDeposit if you are looking for more ways to send and receive payments.

Although Chase bank falls under the category of traditional banks, they have done a great job with its online services. Chase allows you to access and manage the funds in your account through an online portal and a mobile app.

With the app, you can manage alerts, schedule automatic payments, make international money transfers, and generate paperless reports to give you an overview of your business income and spending.

Chase requires that members pay a monthly fee of $15. However, they are conditions that if met, the fee will be waived. These include maintaining a daily balance of $2,000 in the account, making purchases of up to $2000 using a Chase business card, receiving a deposit of $2,000 through specif merchant services, and linking a Chase private client checking account to your business account.

Another downside with Chase is that they only offer 20 free transactions. After that, you will be charged 40 cents for any extra transaction. You also get free deposits for up to $5,000. After that, you will be charged $2.50 for every $1,000 deposit you make.

Nearside

Nearside is a free online-online business checking account that comes with great rewards for its members

New members get rewarded with a welcome bonus of up to $40 on their first deposit while existing members are rewarded with a 2.2% unlimited cash back on every business purchase they make.

As a Nearside member, you won’t be required to maintain a minimum balance in your account and there are no monthly service fees. And thanks to the company’s network of 55,000 ATMs, you get to make fee-free withdrawals.

Nearside can be integrated with the payment software you are using in your business to enable you to receive the funds in your account.

Also, if you make your money through various apps such as Uber, Airbnb, Lyft, Shopify, or Amazon, you can integrate them with Nearside allowing you to receive the money in your account.

The account can also be integrated with accounting software for a clear overview and management of your business income.

The daily transaction limit for the Nearside business checking account is $1,000 for online payments and $1,000 for ATM withdrawals

As you continue, business account with Nearside, you build your credit report and you may qualify for a business loan of up to $10,000. Unlike in traditional banking, there are no origination fees for your loan and no prepayment penalties.

Novo

Novo is a free-to-use account that only requires an initial deposit of $50 to get the account activated. After that, you won’t be required to maintain a minimum balance and there is no monthly maintenance fee.

Once you have set up your account, Novo gives you a virtual card that you can be using for online payments as you wait for the physical card.

Novo also comes with a free tool that lets you create and send invoices to your client. It then integrates with popular online payment platforms such as PayPal and Stripe to enable you to receive money directly to your account.

In fact, you won’t find another account that integrates as seamlessly with Stripe as Novo. You can even check your Stripe balance directly from Novo and you get $20,000 worth of free transactions when you sign up for stripe after opening a Novo account.

Novo has a feature called Reserves that works the same as Bonsai's business account envelopes. The reserves allow you to set aside funds for specif uses in your business.

The other great thing about this account is that you can make mobile check deposits and it’s free of charge.

Silicon Valley Bank

You have most certainly heard about Silicon Valley Bank abbreviated as SVB. It’s a highly popular bank that specializes in startups in tech and life sciences. 50% of all venture-backed startups in these industries bank with SVB.

When you open a checking account with SVB, it’s completely free to use for the first 3 years. After that, you will be required to pay a $50 monthly service fee.

SVB also allows you to open a merchant services account so that you can receive credit card and debit card payments.

Silicon Valley Bank members are presented with an SVB innovators card which affords them numerous perks including cash rewards and venture-friendly credit approvals.

But if there is one thing that distinguishes SVB from other banks and makes it a top choice for startups is its startup guidance.

The bank gives members access to professionals who will advise them on the best financial steps to grow their business. Silicon Valley Bank also hosts occasional events and pitches.

sessions which give a chance for members to network and learn from each other.

The Silicon Valley Bank mobile app is an important part of their account offering as it enables account holders to easily access and manage their funds as well as deposit mobile checks.

SVB may be in the traditional bank category but they have done a great job of leveraging technology to provide the best services to their customer.

You can even integrate the account with other business software such as Quickbooks and Xero for more complete management of business finances.

The only problem with this bank is the intricate process involved when opening an account with them. You will first have to talk with a representative from the bank.

Also, the bank only has branches in 16 states.

Wells Fargo

Wells Fargo is another well-known institution that offers business checking accounts for startups and also business financing options. You will need to make an initial deposit of $25 to activate the account.

There are three levels within their Checking account and you get upgraded as you grow with them. As a beginner, you start with Clear Access business account. With this account, you get a virtual card for online purchases but you can’t make check payments. The account comes with a $5 monthly service fee.

The second tier Checking account is Everyday checking and it comes with a few benefits over Clear Access. For instance, it supports overdrafts although there will be overdraft fees. This account comes with a $10 monthly service fee.

Once you have created a solid reputation with the institution, you will be upgraded to the Portfolio account which is the last tier account. This will come with several premium benefits including interest on your deposits.

I should mention that Wells Fargo also gives you the chance of skipping the account’s monthly service fees if certain conditions are met.

Apart from business checking, Wells Fargo also offers business credit cards and loans which is perfect if you are looking to expand your startup.

This institution only supports 250 free transactions and $20,000 in fee-free cash deposits. Anything beyond that will come at a cost.

I would say the best thing about Wells Fargo is its reputable name and nationwide availability.

LendingClub Bank

This is another business bank account that will be attractive to startups especially because they also offer business loans. Lending Club allows you to take a personal loan of up to $40,000 and a business loan of up to $500,000.

Their tailored checking account is the best option for startups not just because it’s free to use if you can maintain a balance of $5,000 but also because it earns interest on your balance at the rate of 0.1% per year.

Members of the bank are entitled to 1% unlimited cashback on payments made using the LendingClub debit card. Moreover, you don’t incur any charges when you make ATM withdrawals even with out-of-network ATMs. LendingClub reimburses you.

If your balance is below $5,000 you will be required to pay a monthly service fee and you won’t earn interest on your balance.

LendingClub bank does not require that you maintain a minimum balance with them but they will require a $100 initial deposit to activate your account.

This account can be integrated with other business software including Quickbooks for more efficient accounting in your business.

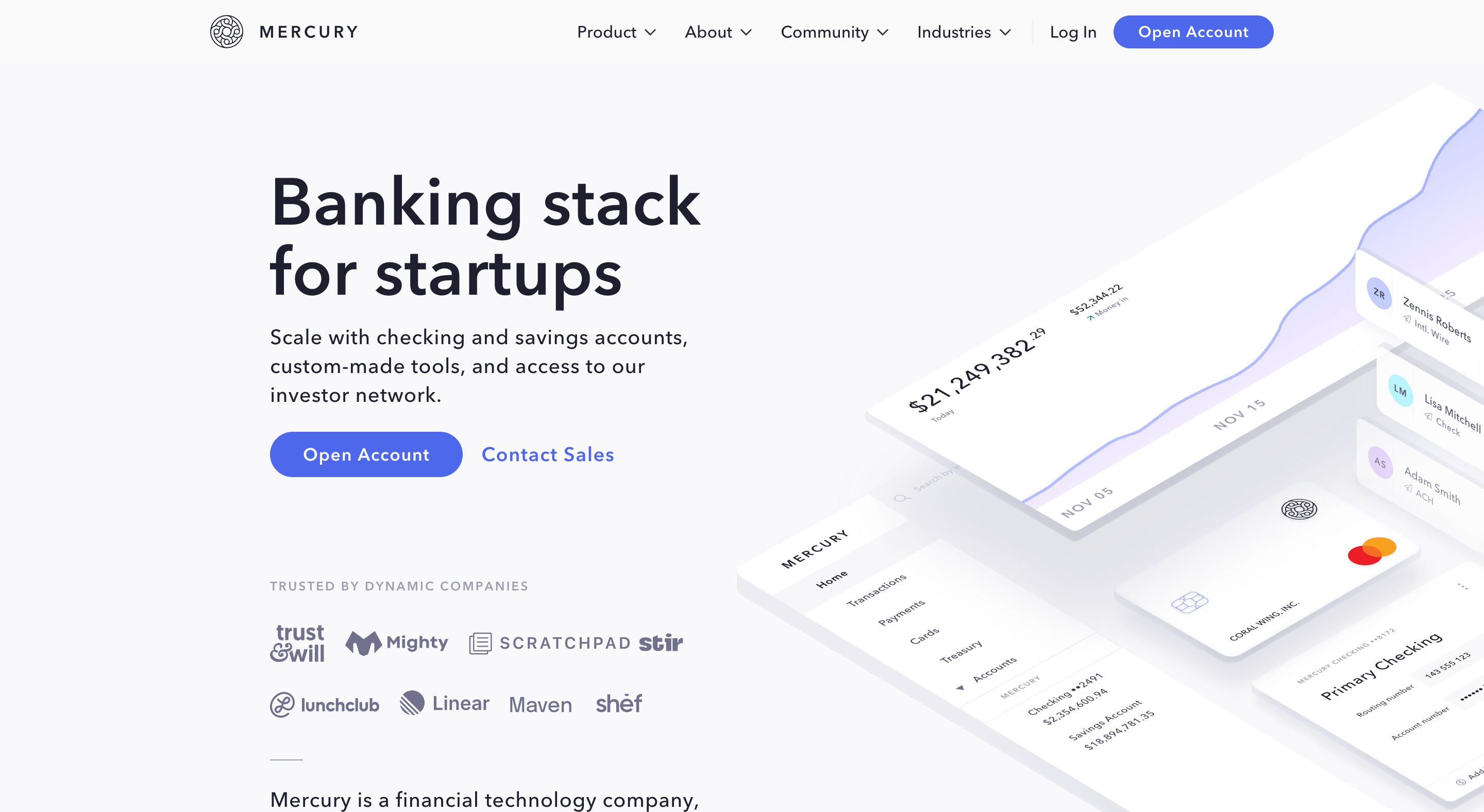

Mercury

Our last recommended startup business account is Mercury. And to quote them, Mercury is not just a bank. It’s a financial technology company. So while they do offer different business account accounts like checking and savings accounts, their services transcend those of a standard bank.

For instance, they give you access to a pool of investors to whom you can pitch your startup and secure funds to expand the business. They have over 500 investors in 26 countries.

In terms of business account, there are two accounts to choose from. The standard and the Tea room account. The standard account is free to open but the Tea room requires an opening deposit of $250,000.

That said, Tea room members will be eligible for extra perks such as access to the Mercury treasury and events created to help grow your business. Also, as a Tea room member, your extra money will be invested into US government securities and money market funds for more returns and security.

Both mercury accounts are free to use. No overdraft fees, no charges for ACH payments, no transaction fees, and no charges for check processing.

However, one feature that makes Mercury stand out is the ability to nominate unlimited administrators for your account.

This is perfect if you have many people in your startup conducting business on your behalf. You can add them as administrators instead of having them pass through you every time they want to transact.

Conclusion

All businesses are not the same. As such, there is no right or wrong bank. It all depends on your unique business needs. Are you looking for a simple solution that allows you to receive and make payments? Perhaps you are looking for a complete bank that will handle all your business finance needs including giving you business loans? In this post, we have explored all the popular solutions and their merits. Hopefully, you have found one that’s specific to your business needs.