As a business owner, especially one at the beginning of the career, you might be working through your business finances - which makes you wonder about no minimum business checking accounts. When you don't have the capital to cover a minimum balance requirement, this might be music to your ears.

But are no minimum balance checking accounts that common? And where can you find such an account? Picking a business checking account is something that you should pay really close attention to, which is why we are here to help you make your choice.

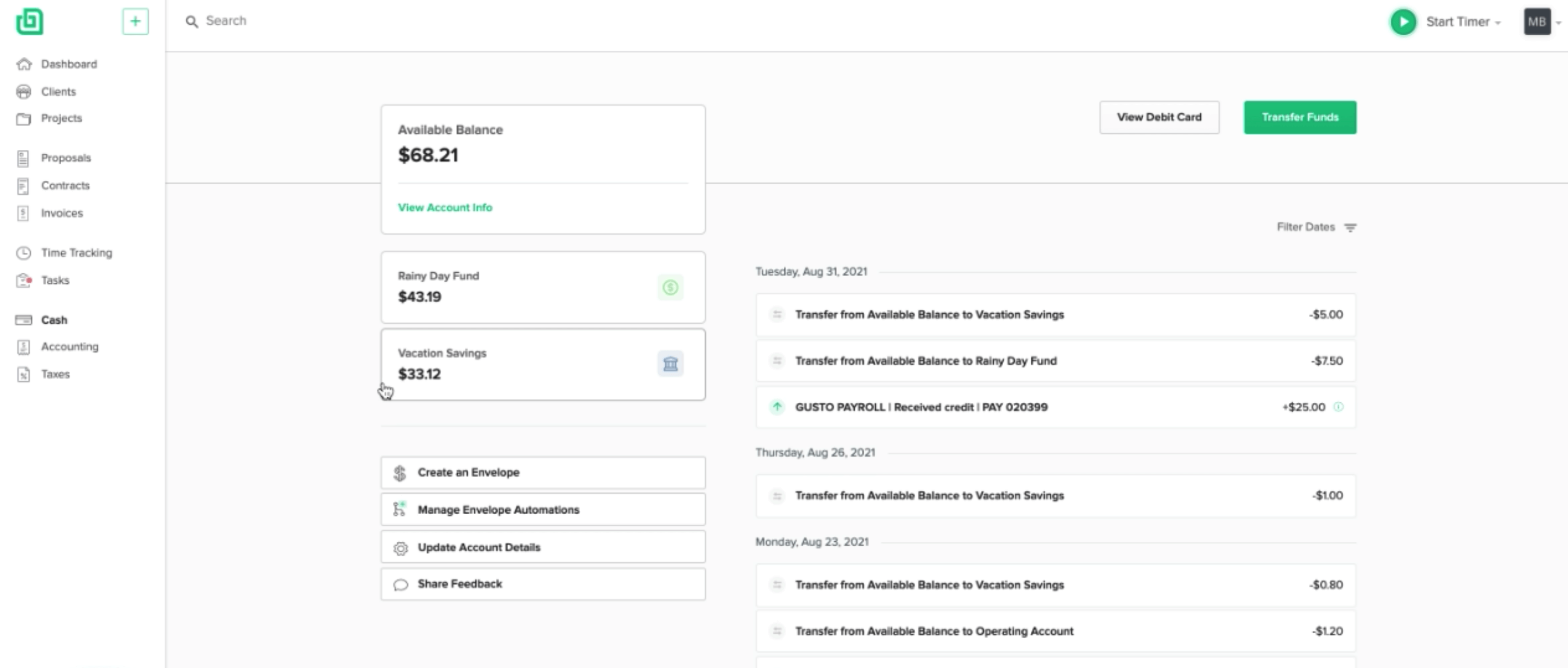

Note: If you want to open the best bank account without any minimum balance requirement, try Bonsai's business account. Our business account is guaranteed, has no hidden fees, and allows you to create sub-accounts instantly with our Envelopes feature. Open an account today.

Why Do Banks Have Minimum Balance Requirements?

Banks have minimum balance requirements for various reasons. First of all, it gives them access to enough deposits, so that they can maintain a certain financial ratio and provide loans.

For the most part, this minimum opening deposit is required when you open a savings account. However, depending on the bank, it may ask for a minimum deposit for the checking account as well.

In case the balance is not maintained, banks may obtain their profit from the monthly fees. To put it simply, this minimum opening deposit is a way for them to profit from your account, but also to cover the cost of your account maintenance.

Not every bank will ask for a minimum opening deposit for an online business checking account. However, if the monthly fee is not charged for this particular purpose, there is a good chance there will be other hidden fees - such as overdraft fees in case you use your business debit card too many times that month.

To avoid these fees, do proper research on the bank account that you are planning to use. The best business checking accounts will have options and alternative fees for you to get that fee waived.

Why Look For Free Business Checking Accounts?

When you run a business, you are bound to have a lot of expenses coming your way. From paying the rent for your working space to handling taxes and buying supplies, gathering up money to provide a minimum opening deposit for your checking account might seem the last thing on your mind.

Small businesses at the beginning of their road may not have enough money put aside to fund a minimum balance, due to minimal cash flow. This can cause a lot of stress in the long run, especially if there are months when you do not make any profit.

A business checking account that asks for a minimum deposit will also frequently request a monthly service fee, for the maintenance of the account. There are a lot of things you can do with a business bank account and those fees help cover those costs. As small as those fees may be, they add up in the long run, which can cause losses to your business.

For that reason, you may want to go for a free business checking account. These accounts ask for no monthly fee, no ATM fees, and the best free business checking account will also provide unlimited transactions. This will help you discard your worries and save money so that you may help your business grow.

Is a Free Business Checking Account Really Free?

Free business checking accounts usually offer no monthly fees and ask for no minimum requirements, but that does not mean they are completely free to use. There are certain unavoidable fees that you may want to consider.

No bank is ever the same when it comes to the fees that they ask for, which is why you may want to do some research. Here are some of the other fees that you may come across.

ATM Fees

Usually, if you withdraw money from the bank associated with your debit card, there are no ATM fees involved. That being said, when you withdraw money from a different business account network, you may be charged a withdrawal fee.

Depending on the case, you will either be charged by the machine operator or by your own bank. This may be avoided if you stick to the bank where you opened your business checking account.

Overdraft Fees

Also referred to as a non-sufficient funds fee, this is typically charged when you spend more than what you have available in your business checking account.

You may have written a check, made a purchase with your debit card, or withdrawn from the ATM. Each bank may charge different fees for that.

Since your bank does not have a minimum balance requirement, it might be easy for you to forget just how much money you have in your account.

To avoid these fees, you should make sure you always keep track of your balance.

Inactivity Fees

Depending on the bank that you are going for, you may be charged with an inactivity fee when you stop using your account - usually for around 6 months. Not many business checking accounts ask for this fee, so you may want to do your research.

On average, an inactivity fee can go for as high as $20 as a monthly fee. It may change depending on where you open your business bank account at.

Paper Statement Fees

If you get your statements by mail, you may be charged a paper statement fee. Depending on the bank that you are using, you may be charged a couple of dollars every month. You may avoid this fee by requesting online bill pay and electronic statements.

How to Avoid the Fees

Whether you use a major bank or not, you may be able to reap the most out of your no minimum bank account - actually turning it into a free business checking account.

You just need to learn how to dodge the account fees. Here is what you may do in order to turn the stakes to your advantage.

Set Up Direct Deposits

While some banks may not require a minimum opening deposit, they may need you to make regular cash deposits up to a certain sum every month. For instance, for the monthly service fee to be waived, you may have to put $500 in your account every month (the sum depends on the bank).

If your regular clients deposit cash in your account, you may want to try fixing a certain payment day. Also, if you have multiple business checking accounts that do not meet the cash deposits requirement, then you may want to consider using just one account and closing the other.

Use the Bank Account Regularly

Depending on the bank that you are using, not only may you be charged inactivity fees for your account, but you may also have them waived if you actually use your account.

For instance, certain banks have your fees waived if you use your debit card more than 10 times every month. Just like inactivity can bring your finances to a disadvantage, activity can prove quite beneficial.

Use Your Status

Depending on your status, you may get your fees waived. If you are a past member of the army forces, a student, or a senior citizen, then you may bring the documentation with you. This way, you may have some of the fees waived.

Ask for Options

As a standard, banks often send paper forms and bills, which can charge you extra. To waive those fees, you may want to inquire about paperless options. This way, you may actually enjoy the full perks of a free business checking account.

How to Choose a Small Business Checking Account

When choosing a business bank account with no minimum requirements, there are certain things that you may want to consider. Review the different requirements for a business bank account and their features such as:

Account Limitations

Very often, business checking accounts with no monthly fees and minimum requirements will have certain limits. For example, you may be able to transfer to and from electronic wallets, but there may be a limit as to how much you can transfer.

You may also have to deal with ATM withdrawal limits, as well as a limit for your credit card purchases. Not every bank puts up the same limits, so you may want to do some thorough research.

Many banks set up a limit for their business account, and once you go past that limit, you will have to pay an overdraft fee.

If your bank of choice does have a limit, make sure that it covers at least the amount that you are planning to spend every month.

Good business accounts will offer unlimited transactions. So, if you are not completely sure how much you will make, you should go for this type of account.

If you go for online business account accounts, the chances are high that you may have the incoming wire fees waived as well.

Alternative Bank Accounts

Your plan may be to open an online business checking account, but you should also make sure that the financial institution of your choice has other account options.

Perhaps you may need a savings account alongside the checking account - or perhaps a money market account. It is much easier to use the same financial institution for your business transactions, so you may want to put that option on the table.

Cash Deposit Options

Depending on the business checking account that you go for, minimum or no minimum, you may or may not be able to deposit cash on your account.

For example, if you use online and mobile business account, you may simply transfer between accounts or put up a mobile check deposit. You may not have the option for a classic cash deposit.

For instance, some banks will require you to go to a certain location in order to make a deposit. Depending on how widespread the bank is, you may have to go over quite some distance in order to reach that location.

When choosing business bank accounts, make sure that you have a cash deposit location near you.

Business Tools Provided

Depending on the bank account, you may get extra tools as well. For example, you may get access to envelopes, which allow you to organize your money for different savings purposes.

This can be very useful if you want to put money aside for taxes or for business purposes (i.e., new equipment).

Some accounts offer tax help as well. For example, you may select a percentage of your earnings to go to a tax folder, ensuring that you stay organized. Look for features that might prove convenient for you.

Rewards

Some banks, such as the United States Bank, waive fees and offer specific rewards to certain categories of people. This can include senior citizens, students, and military veterans.

Fidelity Advantages

Frequently, banks offer certain perks to small business owners who keep a high balance of open multiple checking accounts at their bank.

This can improve your relationship with the bank, which may earn you better rates if you go for an interest-bearing account (such as savings accounts).

New Client Bonuses

Some banks offer bonuses for clients who open a basic business checking account for the first time. You may need to meet specific requirements, such as making a certain number of direct deposits.

However, these promotional bonuses depend on the bank that you are going for. When you are looking for the best free business checking account, you may want to be thorough with your research.

Platforms

A lot of free business checking accounts inquire for extra fees simply because you need to go to a physical branch. Whether you need a bank statement when you deposit cash or need to sign on some extra functions, this will always cost you extra.

This is why you should check whether it supports online transactions or not. The best free business checking account should allow you to make a wire transfer for free, withdraw at an ATM for free, and conduct mobile business account operations, without the need of going to a physical bank.

Fees and Interest

No two best free business checking accounts are the same. One business account may earn interest for the money that you do have in your account, whereas others may not. Some may provide you with a physical business debit card, whereas others may offer a virtual card.

You need to check for any potential extras that can prove helpful to you. Consider the potential monthly maintenance fees, and see if the bank account that you chose has a good explanation for those fees.

If you are going to pay for those fees in lieu of the minimum balance, you may as well ensure that it is worth it.

Documents Needed to Open Free Business Checking Accounts

Each bank requires different documents, which means you will have to consult with their terms. That being said, most banks will need the following in order to open a checking account:

- Employer Identification Number (EIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN)

- Formation documents

- Business license

- Owners agreement

Aside from these documents, you may also have to provide identification documents, contact information, a business address, or a P.O. box.

Best No Minimum Checking Accounts

When it comes to business checking accounts that require no minimum opening deposit, there are several options that you may go for. Here are some of the most popular options:

Bonsai's Business Account

Bonsai is quite a popular option among freelancers, due to the fact that it does not have minimum deposit requirements. It is a cash management account that offers automation without any tricky monthly fees or further complications.

Bonsai's business account allows you to manage your business finances, receive cash deposits and save on taxes. It lets you automatically set aside money for your business so that you do not spend more money than you can actually afford.

Bonsai's business account has different payment options, depending on your preferences. You can go for a virtual card, a physical card, and even Apple Pay if you want. It allows you to pay from your business account, no matter where you may be. Not to mention it is a guaranteed bank account (no need to apply).

It can be integrated with various other tools as well, such as Bonsai Payment. You can also create envelopes or sub-accounts in your business checking account.

This allows you to save for different expenses (i.e., taxes, new equipment for your business, and so on). Whenever you get a payment, you can set it so that a certain percentage goes straight to that envelope.

Bonsai Cash enables you to make free ATM withdrawals from whichever bank you choose, although you are limited to $300 per day. If you try to withdraw more than that, then you will be charged an extra fee.

Bonsai does not charge anything for any online transactions you make, nor does it ask for any monthly maintenance fee. For all intents and purposes, it is a free business checking account that allows you to organize your business more efficiently. You'll also be hooked up with a virtual and physical business debit card.

Bank of America

If you have larger cash deposit needs, then the Bank of America may be useful. Technically speaking, this business checking account does not require a minimum balance - but it still requires a monthly fee to maintain your account.

These monthly fees may be waived if you respect a transaction minimum, or perhaps even a $100 balance minimum. So, while the minimum is not mandatory, it is recommended if you want to save money in the long run.

the Bank of America business account offers you the option of a mobile app as well. This allows you to view your accounts, deposit checks, conduct online bill pay, and transfer money. You also get 200 monthly transactions and up to $750 in cash deposits.

Citizens Bank

With its Clearly Better business checking accounts, Citizens Bank is a decent option for those in need of a business checking account. The bank itself has branches in 11 states, meaning that your chances of finding an ATM are high.

With Citizens Bank, you get access to free business checking accounts and the ability to deposit cash up to $5,000. There is also an online option for the bank, but you will have to visit the branch itself to apply.

Withdrawing from Citizen Bank ATMs is free, although limited. If you opt for an out-of-network ATM, then you will have to pay $3 each time you make a withdrawal. The bank charges no monthly fee, as long as you stay within the transactional limits.

Novo Bank

Those looking for a free online business checking account might want to check Novo Bank's offers. This checking account asks for no minimum balance, requires no monthly fee, and charges no ATM fees as well.

Novo allows you to send physical checks if you need one. You just have to submit the order and then have Novo send it on your behalf.

With Novo, you can send money, make payments and transfer the funds directly from your smartphone. It comes with a MasterCard debit card, which may be used with Apple Pay and Google Pay.

Novo Bank does not allow you to deposit cash, as there are no ATMs specifically designed for it. With that in mind, you can add money to your checking account by transferring it from a different account.

U.S. Bank

The U.S. Bank is also an option that you may go for if you want to open a business checking account with no monthly fee. You have a limited number of transactions per month, which is 125, but this is enough for a small business that is just starting out.

The bank itself is a brick-and-mortar one, but you also have the option of mobile business account. You may get up to five business credit cards, and can also be integrated with overdraft protection.

If you need a basic account, the Silver business checking account might be convenient for your small cash deposits. The bank itself does not charge if you try to withdraw from a different ATM, but operator fees may still apply.

Bluevine

Those looking to reap the benefits of mobile business account may be interested in the Bluevine business checking account. This small business checking account allows for unlimited transactions, no monthly fees, and requires no minimum balance.

The app allows you to schedule recurring payments, making it a great option if you have to pay business bills or your suppliers. You also get to make withdrawals with no ATM fees from more than 37,000 MoneyPass ATMs in the United States.

Bluevine allows you to make cash deposits at the Green Dot locations, using your debit card. That being said, you will have to pay a $4.95 fee each time you make a deposit.

The Bottom Line

A no minimum deposit bank account can be very useful for a small business that is just starting out and does not have the money to cover monthly minimum requirements. Not every bank offers this kind of account, but if this is what you are looking for, you might want to consider doing your research.

A no minimum deposit is a great starting point and helps you build a strong business relationship with your bank. Once you start earning a bigger cash flow and get capital, you can move on to an interest-bearing account with a minimum deposit.