Any agency aiming for success needs reliable billing software. However, there’s more to billing software than meets the eye. Of course, it can send out invoices and let you watch the money roll in. But it also helps you juggle numbers, keep clients happy, and makes being an accountant easier.

What is an agency billing software?

Agency accountants have to juggle invoices, time sheets, and payment reminders. Historically, all this had to be done by hand, with books, ledgers, and a keen eye. While billing software doesn't replace the need for careful attention to detail, it does make everything more streamlined and less error-prone.

Every agency project is different, and time is always of the essence. For that reason, billing software that suits an agency must track the hours the team puts into projects, make detailed invoices that don't miss anything, and quickly handle payments.

While billing software is primarily about charging clients and getting paid, it includes many other related features. For example, it can analyze your financial data to give you insights that help you steer the agency to more profitable projects. It shows you where you're making great profits and where you might be lagging behind.

What are the benefits of using a billing system for an agency?

With the basics of billing software out of the way, let's dig into why it can make such a big difference for an agency. With the increase in workflow and ever-evolving digitization, this type of software has become a survival kit for agencies and similar businesses.

- Time-saving wizardry – Do you remember the days of manually creating invoices? With billing software, you don't have to. It automates the heavy work and leaves you with extra free time for more creative and interesting tasks.

- Accuracy – With automation comes precision. These tools are meticulous, perhaps even more than people. They eliminate the chances of natural human error, like sending an invoice with the wrong amount or to the wrong client.

- Cash flow clarity – Keeping track of who has paid and who hasn't can be tricky, especially as your list of clients grows. Billing software gives you a clear picture of your money inflow and clients. As a result, it's easier to plan and breathe easier about your cash flow.

- Professionalism on display – Sending out sleek, professional-looking invoices reflects well on your agency. It shows you mean business, quite literally. Clients will trust you and will want to keep coming back.

- Insightful reports – These tools can produce reports that give you valuable insights into the overall business health. It's a bit like a digital business consultant always on the call to supplement invoicing with data-driven advice.

- Client-friendly features – Some billing software isn't limited to the accountant. Instead, it also lets clients view their own invoices, make payments, and even collaborate online. The software bridges the gap between you and the clients for friendlier billing.

Here are the top 5 billing software that can do all this and more.

1. Bonsai - Best billing software for agencies

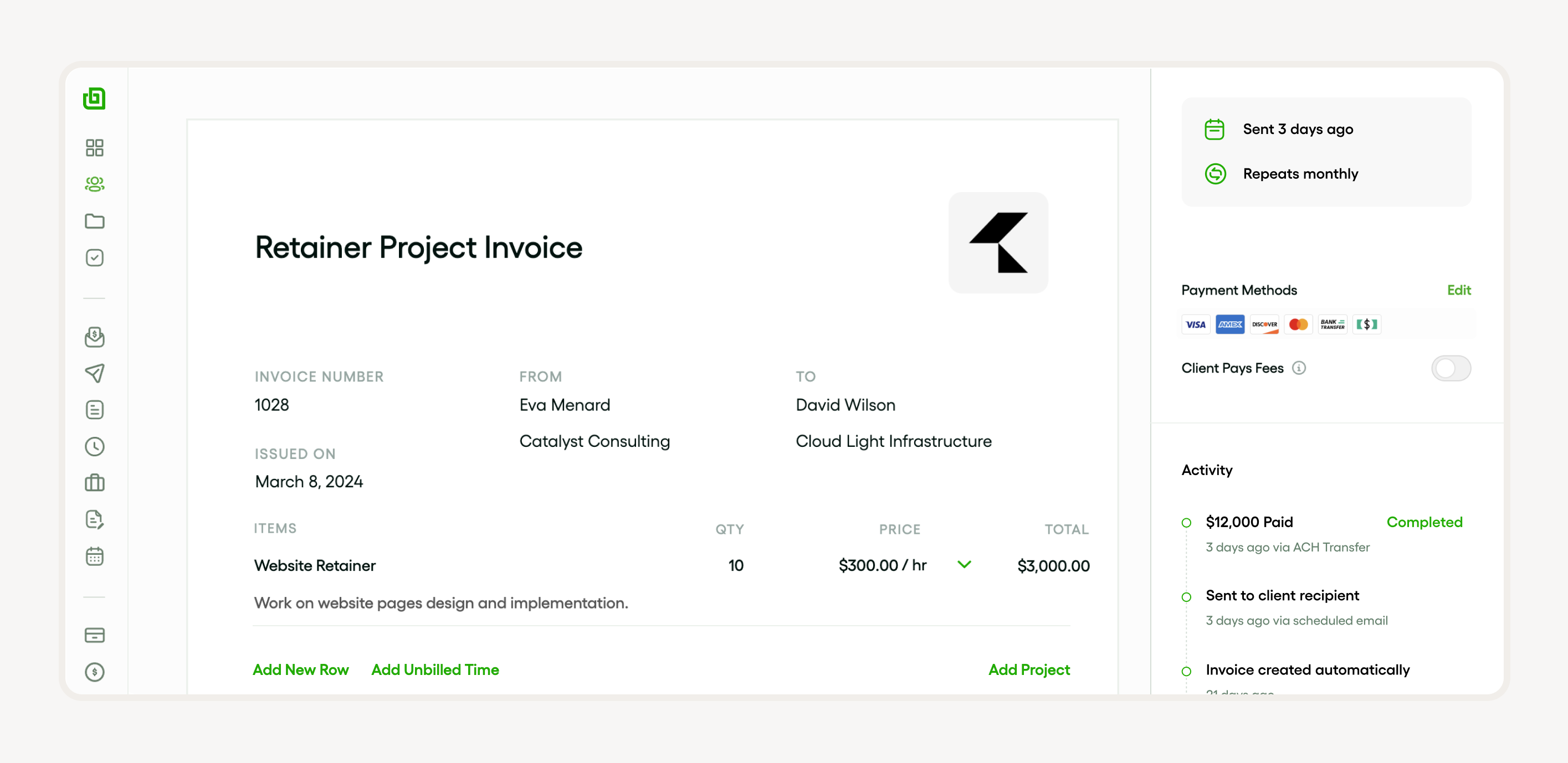

Bonsai is an all-in-one software for managing projects, tracking time, managing resources and bill clients.

What are Bonsai's key features?

- Track time on tasks: track billable and non-billable time on tasks using the integrated timer.

- Create invoices in seconds: use Bonsai's professional invoice templates to create invoices and set workflows to automatically send your next invoice. Add you unbilled time to your invoice in a click and make sure you bill every minute spent on a project.

- Manage recurring billing: put your retainers and ongoing client work on auto-pilot with recurring billing. Choose your cadence and get peace of mind you'll get paid on time.

- Automatic reminders and notifications: create automatic reminders for client payments and get receipts when clients view your invoice.

- Project insights: get instant reports on time spent on task vs estimate, and profitability.

Why is Bonsai the best billing software for agencies?

Bonsai is one of the best billing software because it does so much with so little effort. It has a user-friendly interface and features that benefit most agencies. In some ways, it replaces a personal financial assistant.

It also comes with a private client portal where you can securely share files with the clients and collaborate. This makes it an excellent pick for fostering client trust and continuous support.

The software can create and maintain thorough task lists collaboratively and track billing times accurately. Therefore, it's a robust and powerful tool for agencies that demand precision and efficiency, which is to say – all of them.

What is Bonsai pricing?

Bonsai is fairly flexible regarding payment options. There are three billing plans, each billable either per month or annually. The first is the starter plan that costs $21 per month when billed annually. It's perfect for freelancers who are just starting out. It includes basic features like invoicing, time tracking, client CRM, and expense tracking.

A step above basic is the professional plan, costing $32 per month if billed annually. Growing businesses will get the most out of this option. It includes everything already in the starter plan, plus extra features like workflow automation, a branded client portal, and integrating with QuickBooks, Calendly, and Zapier.

Finally, there's the business plan, which is for $66 per month if billed annually. This plan is great for small businesses and agencies that have already found their footing. It includes all the professional features, as well as subcontractor management, hiring agreement templates, and unlimited subcontractors.

Try Bonsai for free now or book a demo to know more.

2. QuickBooks

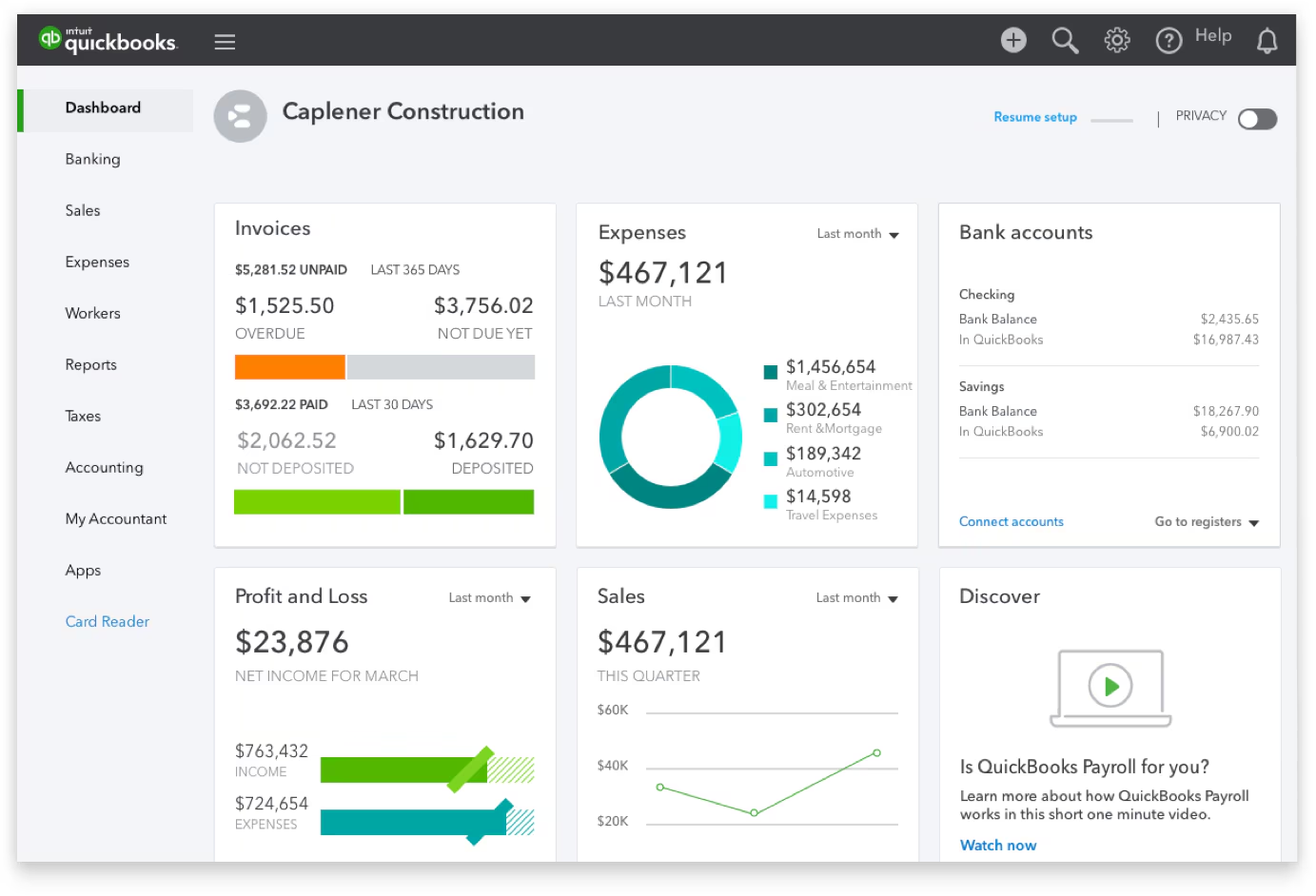

QuickBooks is another billing software with quite a reputation. There are several features that make it appealing, but also a few drawbacks.

What are QuickBooks' key features?

Firstly, QuickBooks lets you make custom invoices and manage payments. It's easy and efficient, requiring no more than a few clicks once you get started.

You can also easily track and categorize business expenses and automate other bookkeeping tasks. Track business mileage, inventory, and project profitability to report on expenses or identify and manage tax deductions. QuickBooks lets you do all that and more. Plus, it works with multiple currencies.

Why are QuickBooks limitations?

QuickBooks is feature-rich, but that can be a double-edged sword in some cases. The wealth of features might overwhelm some beginners or those whose expectations and needs are simpler. Furthermore, the service is cloud-based, so it needs a stable internet connection to keep everything in order.

What is QuickBooks pricing?

There are four primary pricing plans for QuickBooks: Simple Start, Essentials, Plus, and Advanced. Simple Start costs $15 per month (50% off for three months) and includes basic features like invoicing, expense tracking, and receipt capture. Essentials costs $30 per month (also with a 50% discount for the first three months) and adds billing management, time tracking, and multi-user support to the basic features. Plus, the plan costs $45 per month and includes everything in Essentials, plus inventory tracking and project profitability. Finally, advanced costs $100 per month but includes powerful reporting, custom access control, and automation for up to 25 users.

3. Stripe

Stripe has changed the way agencies handle online transactions. Here’s a breakdown of some of its features.

What are Stripe's key features?

Stripe's main feature is the embeddable checkout form that you can add to a website with just JavaScript. You can create and send invoices with built-in payment and charge your clients in over 135 currencies using various local payment methods. It's fast and secure, and lets you keep track of everything.

What are Stripe's limitations?

While Stripe has many advantages, it's not without its flaws. For one, it has policies in place regarding types of businesses, products, and industries that can or can't use it. This could be restrictive for some. Furthermore, its rate limits on the number of API requests may be somewhat limiting. For most APIs, Stripe allows for up to 100 reads per second and 100 writes per second. Finally, its structure might not be the most straightforward or cost-effective for B2B transactions.

What is Stripe's pricing?

Stripe's payment methods are fairly straightforward. There's the standard plan for 2.9% + 30¢ per successful charge for domestic cards. Then, there's the custom pricing plan for companies with large payments or unusual business models.

4. PayPal

PayPal is a well-known name in invoicing and billing. Let's see why.

What are PayPal’s key features?

PayPal offers cash back from many brands, which makes them attractive for buyers and, by extension, sellers. This program also includes a MasterCard virtual card without an annual fee. It's a safe and fast platform that operates in most of the world and can handle many currencies. It also includes payment options like "Buy Now, Pay Later."

What are PayPal’s limitations?

PayPal charges fees for some transactions and these fees can sometimes be higher than with other similar services. The service can also impose limitations on the account depending on certain activities which aren't always transparent. Unfortunately, disputes are said to be time-consuming and not always fruitful. Another possible limitation is the existence of additional fees for some international transactions.

What is PayPal’s pricing?

PayPal doesn't have monthly fees and, therefore, no payment plans. Instead, it charges transaction fees, which depend on the type of transaction. It's convenient for agencies that like pay-per-transaction pricing.

5. Xero

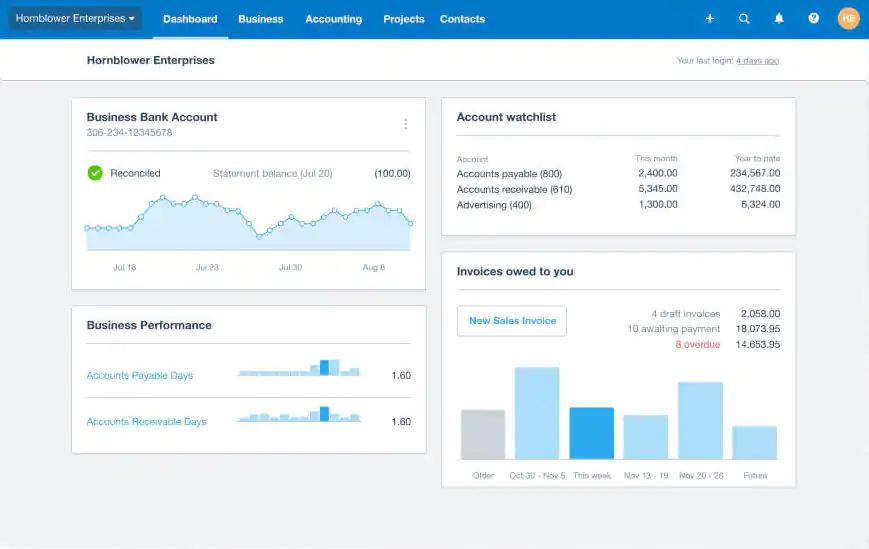

Xero is another cloud-based accounting tool that is gaining traction with agencies. Let's see what it has to offer.

What are Xero's key features?

Its best feature is the all-in-one paperless record keeping. It's safe and secure, centralizing finances on the cloud. It automates reconciling bank transactions and sending invoice reminders.

Not just for record-keeping, Xero can also give you trend analysis and customizable reporting. It can even pull bills and receipts automatically with Hubdoc.

What are Xero's limitations?

Some users who use Xero with large data files or high transaction volumes may encounter some slowdowns or lagginess at times. Furthermore, lower-tier plans may not cover everything a smaller agency or a freelancer is looking for. Lower plans also might not have bulk bank reconciliation.

What is Xero's pricing?

There are three main pricing plans for Xero. The Starter plan costs $29 per month for basic features. The standard plan costs $46 per month, while the Premium plan costs $62.

How to choose the best billing software for your agency?

Now you know what billing software does and what it does for you, the natural question to ask is, "How do you pick one?" To select the right software, you want it to fit your expectations and deliver quality results.

Here’s what you should look for:

- Understand what you're after – First, map out what you need before committing. It depends on what your business does. Are you a small indie agency or a larger, more complex one? Should the software integrate with existing project management tools, or is it right to start from scratch?

- Ease of use – The software should be intuitive and no more complex than a typical phone app. If it feels like you should've gone to school just to use the software, it's likely not the right fit. Look for a user-friendly interface that you and your team can figure out quickly.

- Customization – No agency is exactly the same, neither in structure, culture, or the types of projects it undertakes. Therefore, the billing software may not be one-size-fits-all solution either. Look for software that lets you customize invoices and reports to fit the work your agency does.

- Integration – The billing software should play nicely with other tools you use. While it doesn't have to integrate with everything at all times, integration with project management, CRM, and accounting software is a major plus.

- Scalability – Think about the future. Your agency likely won't remain stuck at the same size and structure permanently. Therefore, you want software that grows with the agency. The software should be able to handle the extra load without a hiccup when the company grows.

- Support system – While the billing software might work perfectly, most of the time, issues will arise. And when they do, you'll want access to top-notch customer support. Look for providers with solid support, whether through tutorials, a helpdesk, or a friendly chat service. Also, check their reviews and see what other customers have to say about their customer support.

- Price point – Budget matters. A piece of billing software may have the best features, the most versatility, and astounding customer support, but it matters little if you can't afford it. Weigh the cost against what it offers and your long-term plans. But remember: spending a bit more can often save you a lot in the long run in terms of efficiency and capabilities.