Learning to understand Profit and Loss Statement PDFs is crucial for assessing a company's financial health. The key elements of this critical report are:

- Gross profit

- Operating profit

- Net profit

Nevertheless, dissecting such statements can sometimes evoke a sense of overwhelming confusion. The good news is the process becomes more straightforward with patience and practice. Please remember, understanding these financial documents is crucial in making informed business decisions or investment choices.

How to read a profit and loss statement pdf: introduction

There is no doubt that a Profit and Loss Statement summarizes the revenues, costs, and expenses incurred by a company during a specific period. The benefit of these documents is they indicate whether a company made a profit or loss over the fiscal period.

This financial report reveals crucial information about a company’s ability to generate profit by doing the following:

- Increasing revenue

- Reduction of costs

- Or both

It’s surprising how it serves as a crucial tool for businesses to monitor their financial health!

What is a profit and loss statement?

Remember a Profit and Loss Statement is also known as an “Income statement.” Undoubtedly this statement is crucial for a company. It’s obvious that it shows a company’s revenues and expenses over a specific period.

The critical components of an income statement include the following:

- Revenues

- Costs

- Expenses

- Net Profit or Loss

- Sales

- Cost of goods sold (COGS)

- Operating expenses

This statement is vital for analyzing the financial health of a company. It allows stakeholders to see:

- Revenue generated

- Expenses incurred

- Profit or loss results

- Where the money is coming from (the revenues)?

- Where is it going (the expenses)?

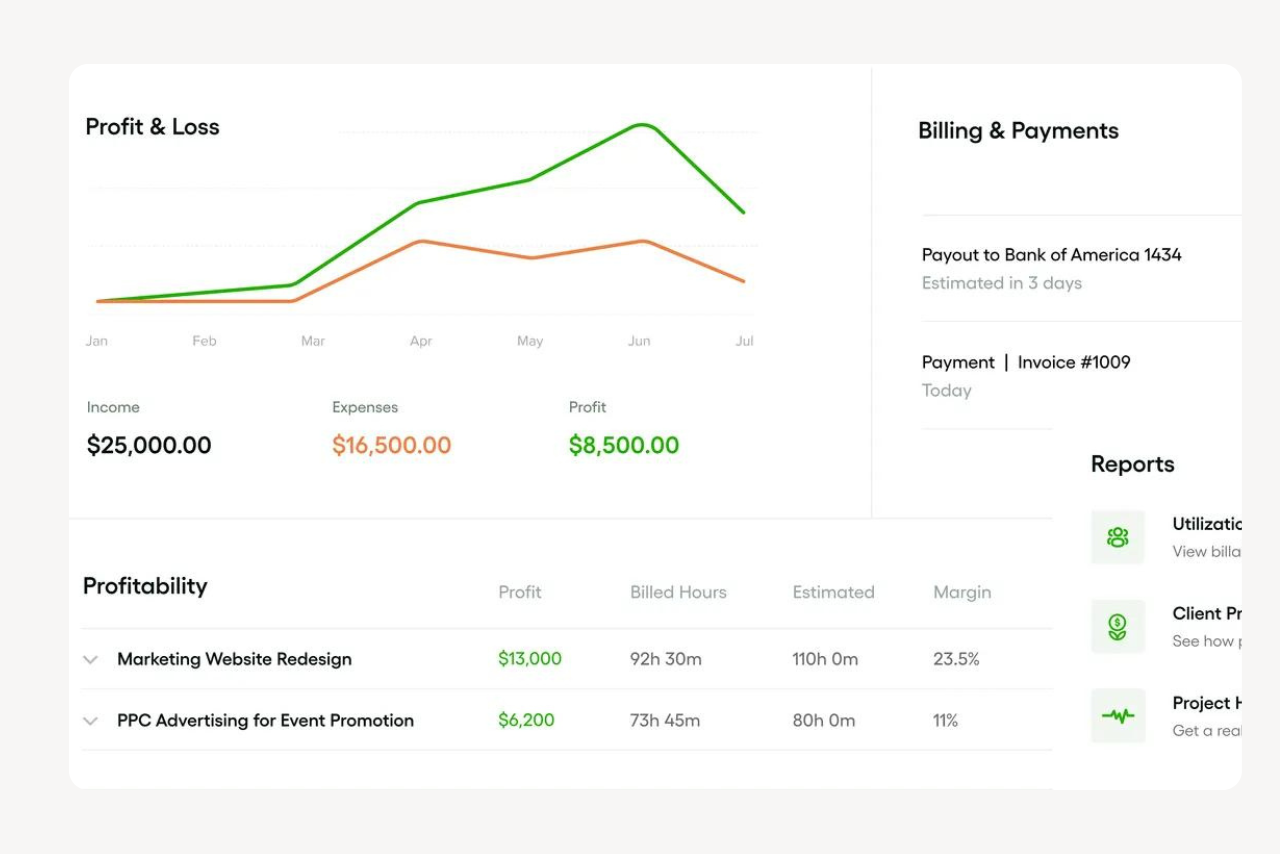

Why profit and loss statements matter for agencies

One thing is for sure: Income statements are indispensable for agencies.

The cool thing about these statements is they enable agencies to measure their financial performance. It’s staggering to find out how strategic planning and financial management are facilitated by these statements!

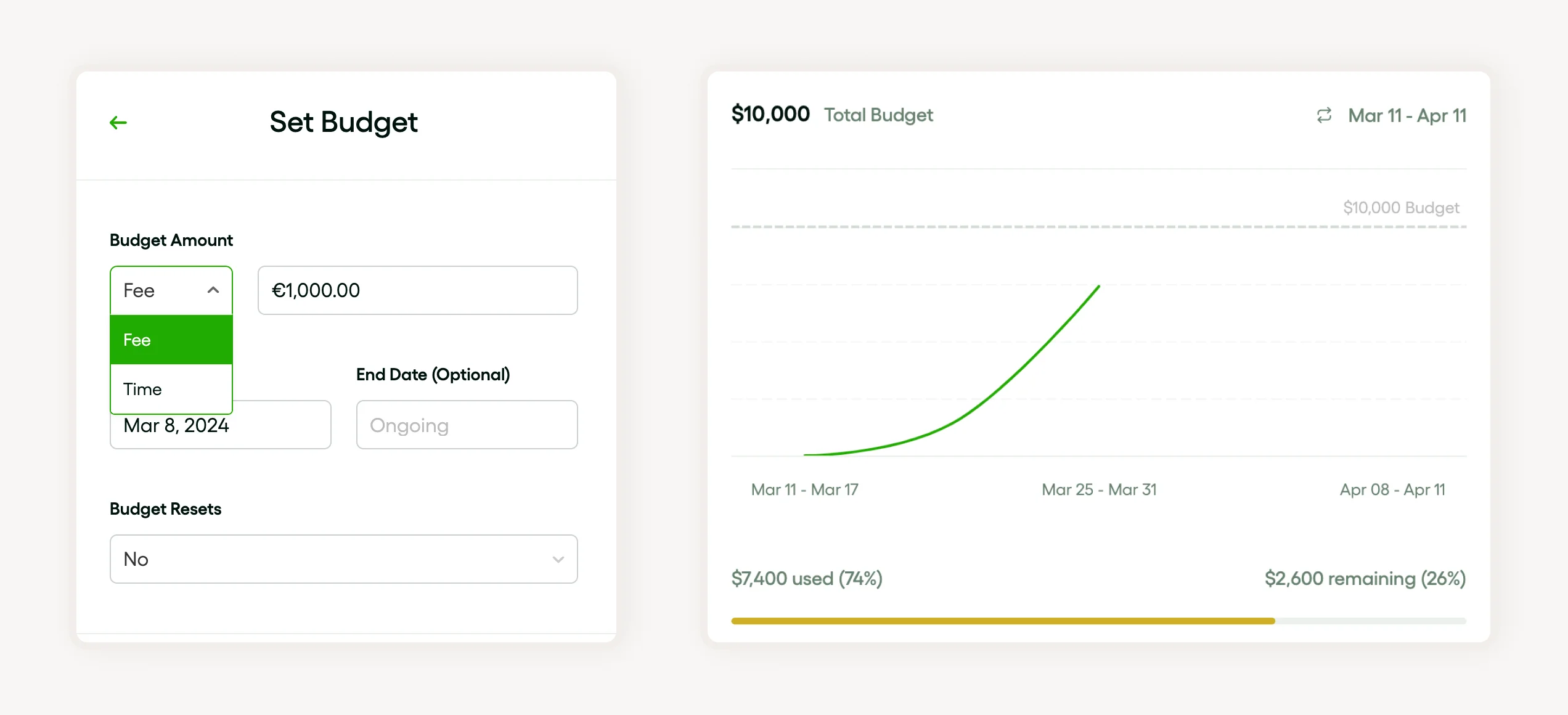

Why to track budgets carefully

The Bonsai management tool streamlines the budget-setting process for your project, making it straightforward and efficient. It allows easy updates or deletions to align budgets quickly with project changes.

What does a profit and loss statement show about your business

Understanding your business’s profitability

A profit and loss statement (P&L) reveals your business’s profitability over a specific period, usually monthly, quarterly, or annually. It shows how much revenue your business earned and subtracts all expenses to determine net profit or loss. This snapshot helps you see whether your business is making money or operating at a loss.

For example, if your freelance graphic design business earned $10,000 in revenue but spent $7,000 on software subscriptions, marketing, and other costs, your P&L would show a net profit of $3,000. This clear figure helps you understand if your pricing and expenses are balanced effectively.

Regularly reviewing your P&L statement allows you to spot trends in profitability. If profits are shrinking, you can take action by adjusting prices or cutting unnecessary expenses. Using tools like QuickBooks or FreshBooks in 2024 makes generating and analyzing P&L statements straightforward and timely.

Tracking revenue sources and expense categories

A P&L statement breaks down where your income comes from and how your money is spent. This detailed view helps you identify which products or services generate the most revenue and which expenses consume the largest share of your budget. Understanding these details is crucial for making informed business decisions.

For instance, a small bakery might see that 60% of its revenue comes from custom cakes while 40% comes from daily bread sales. On the expense side, rent and ingredient costs might be the biggest expenses. Seeing these numbers in a P&L PDF helps the owner decide whether to focus more on custom cakes or negotiate better ingredient prices.

Using accounting software like Xero or Wave in 2024, you can categorize income and expenses automatically. This makes it easier to generate clear P&L reports and spot opportunities to boost revenue or reduce costs by focusing on specific categories.

Assessing cash flow health and business sustainability

While a P&L statement doesn’t show cash flow directly, it provides clues about your cash health by highlighting profitability trends. Consistent profits suggest your business can sustain operations, pay bills, and invest in growth. Conversely, repeated losses signal potential cash flow problems that need urgent attention.

For example, a freelance consultant who sees declining profits over several months on their P&L PDF should review outstanding invoices or rising expenses. They might need to improve client payment terms or reduce discretionary spending to maintain positive cash flow.

Pairing your P&L statement with a cash flow statement in tools like QuickBooks Online gives a full picture of financial health. Regularly reviewing these reports in 2024 helps freelancers and small businesses stay financially stable and plan for future investments confidently.

Why is it important to understand your profit and loss statement

Make informed business decisions

Understanding your profit and loss statement allows you to make informed business decisions based on actual financial data. This statement shows your revenue, expenses, and net profit over a specific period, helping you identify which areas of your business are profitable and which are costing you money.

For example, if your profit and loss statement reveals that marketing expenses are high but sales have not increased, adjust your marketing strategy or budget. Freelancers and small business owners can use tools like QuickBooks, Wave, or Xero in 2024 to generate clear profit and loss reports in PDF format, making it easier to analyze trends over time.

Regularly reviewing your profit and loss statement empowers you to allocate resources wisely and avoid costly mistakes. Make it a habit to examine this report monthly or quarterly to stay on top of your financial health and take timely action.

Prepare for taxes and financial compliance

Knowing how to read your profit and loss statement is crucial for accurate tax preparation and compliance. This document summarizes your income and deductible expenses, which directly impact your taxable income for the 2024 tax year.

For example, freelancers in the U.S. can use their profit and loss statement to complete Schedule C for IRS Form 1040. Understanding the statement helps you identify deductible expenses like office supplies or software subscriptions, ensuring you don’t miss valuable tax deductions.

Using accounting software like FreshBooks or Xero can help you generate detailed profit and loss PDFs that are easy to share with your accountant. This reduces errors and saves time during tax season, helping you avoid penalties and maximize your tax benefits.

Track business growth and set realistic goals

Your profit and loss statement is a key tool for tracking business growth and setting achievable goals. By comparing statements from different periods, you can see if your revenue is increasing and if expenses are being managed effectively.

For instance, if your profit margin improves steadily over several months, it indicates healthy growth. Conversely, if expenses rise faster than income, you may need to revisit your pricing or cost control strategies. Freelancers can use PDF reports from tools like Zoho Books to visualize these trends clearly.

Setting goals based on your profit and loss data makes your business planning more realistic and data-driven. Schedule regular reviews of your profit and loss statement to adjust your strategies and keep your business on a growth path.

Formulas and terminology in profit and loss statements

Understanding key profit and loss terms

Knowing the main terms in a profit and loss statement helps you interpret your business’s financial health. Key terms include:

- Revenue

- Cost of Goods Sold (COGS)

- Gross Profit

- Operating Expenses

- Net Profit

Revenue is the total income from sales, while COGS represents the direct costs to produce those goods or services.

Gross Profit is calculated by subtracting COGS from Revenue, showing how much money is left before other expenses. Operating Expenses cover costs like rent, utilities, and salaries. Finally, Net Profit is what remains after all expenses, including taxes and interest, are deducted from total revenue.

These terms provide a snapshot of profitability at different stages.

When you open a profit and loss statement PDF, look for these terms usually listed in order. Recognizing them allows you to quickly assess where your business is making money and where costs might be too high. This foundational knowledge is essential for informed financial decisions.

How to calculate gross profit and net profit

Gross profit is calculated by subtracting the Cost of Goods Sold (COGS) from total revenue. For example, if your revenue is $50,000 and COGS is $20,000, your gross profit is $30,000. This figure shows how efficiently your business produces goods or services before other expenses.

Net profit is found by subtracting all operating expenses, taxes, and interest from your gross profit. Suppose your operating expenses total $15,000 and taxes plus interest add up to $3,000. You would subtract $18,000 from the $30,000 gross profit, leaving a net profit of $12,000. This is the actual profit your business earned during the period.

Using these formulas in your profit and loss statement PDF helps you verify the numbers and understand your profitability. Regularly calculating gross and net profit enables you to spot trends and make adjustments to improve margins in 2024 and beyond.

Interpreting common financial ratios from the statement

Financial ratios derived from your profit and loss statement provide deeper insights into your business performance. The gross profit margin, for example, is calculated by dividing gross profit by revenue and multiplying by 100 to get a percentage. A gross margin of 60% means you keep 60 cents from every dollar of sales after covering direct costs.

Another important ratio is the net profit margin, which divides net profit by revenue. If your net profit margin is 24%, it indicates strong overall profitability after all expenses. These ratios help you benchmark your business against industry standards or competitors.

To calculate these ratios using your profit and loss statement PDF, extract the relevant figures and apply the formulas. Tracking these ratios quarterly or annually can guide strategic decisions like pricing adjustments or cost control measures to boost profitability in 2024.

How to read a profit and loss statement pdf: components

This statement encompasses several key components. The report typically includes revenue, which is the sales a company made during a specified period.

COGS is listed in the income statement. It generally details operating expenses too. This statement also shows net profit or income. Each element is vital in assessing a company’s financial health.

Cost of Goods Sold (COGS)

The Cost of Goods Sold (COGS) is a critical figure in the financial management of a business. It represents the direct costs associated with producing goods or services sold by a company, including raw materials and direct labor costs.

These expenses are directly tied to the production of the goods or services a company offers. Businesses use the COGS to calculate gross margin and manage inventories effectively. It’s also used in calculating efficiency ratios. The calculation of COGS may vary depending on accounting practices within different industries.

Gross profit

Gross profit is total revenue minus the cost of goods sold (COGS). To calculate gross profit, understand the direct costs associated with producing the goods or services sold.

Gross profit is not the total profit. It does not account for other operational costs and taxes.

Operating expenses

It’s no secret that maintaining a steady profit margin is integral to managing operating expenses. In this context, the interesting thing is all costs associated with the normal operations of a business are considered. Tracking these expenses regularly is key but it’s equally important not to become overly restrictive.

Sadly, there’s no ‘one-size-fits-all’ strategy when it comes to managing operating expenses. Factors such as sector, as well as company size all determine what constitutes necessary spending.

Net income

What's fascinating is net income, which refers to a company’s total earnings or profit, is a crucial tool that helps businesses as well as potential investors determine profitability.

How net income is calculated?

By subtracting all operating expenses, including taxes and cost of goods sold, from the total revenue. However, the notable thing is due to potential factors such as irregular income sources, net income doesn’t always provide a comprehensive view of a business’s financial health.

It's significant to note that it’s essential to consider net income alongside other financial metrics.

How to read and interpret a profit and loss statement pdf

It’s no secret that an income statement summarizes the revenues, costs, and expenses incurred during a specific period.

Typically reading an income statement starts with understanding these terms:

- Gross profit

- Operating profit

- Net Income

How to understand the top line: revenue

It’s a matter of fact that in the realm of finance and business, the “top line” refers to a company’s revenue or sales. It’s staggering to find out how it indicates the total profits from the firm’s primary business operations without deducting any costs or expenses!

Notably, top-line growth can suggest effective marketing strategies along with strong customer demand. The sad thing is an increasing top line does not always translate into bottom-line growth.

How to decipher operating expenses and gross profit

Operating expenses are a crucial part of a business’s daily operations. These expenses can include:

- Employee salaries

- Rent

- Other essential costs to run a business

It’s significant to point out that managing these expenses can significantly impact a company’s bottom line. Additionally, gross profit highlights how well a company uses its resources.

The best thing is by comparing operating expenses and gross profit, companies determine profitability and efficiency.

How to interpret the bottom line: net income

It’s surprising how essential Net income is in assessing a company's profitability!

It’s crucial to realize that a high net income denotes a company is profitable, but a negative net income can signal financial distress.

The sad thing is one-off revenue or cost items can distort the net income.

Interestingly understanding net income also offers insights into efficiency, making it pertinent for investors and decision-makers. It’s prudent to review net income trends over time as well as in comparison to industry peers for a comprehensive view.

How to create a profit and loss statement

It’s well known that an income statement outlines the revenues, costs, and expenses incurred over a specific period. It's just astonishing how owners and investors utilize this crucial financial report to gauge the financial well-being of the company!

The core elements of the income statement comprise:

- Revenue

- Expenses

- Net Income

How to use Microsoft Excel for profit and loss statements

Excel is an excellent tool for creating profit and loss statements to track your business’s financial performance. Microsoft Excel supports the meticulous recording and analysis of all revenue streams and expenses. Additionally, this tool’s strong calculation capabilities minimize the risk of human error.

Excel has limitations for income statements. One main limitation is that it is not designed to handle large amounts of data. It can be difficult to create complex models that accurately reflect real-world scenarios.

Using Excel for profit and loss simulations can be time-consuming to set up. This is especially true if you need to make frequent updates to the model.

How to use QuickBooks for profit and loss statements

QuickBooks is a versatile accounting software essential for generating Profit and Loss Statements. QuickBooks’ standout feature enables businesses to track expenses effortlessly, offering a transparent view of the company’s financial status.

Generating a Profit and Loss Statement is a swift process within QuickBooks. The more consistently you record business transactions, the more reliable your income statement will be.

Common mistakes in profit and loss statements

Several common pitfalls exist when preparing profit and loss statements. Frequent mistakes include the misclassification of expenses, which skews the bottom-line results.

Another common blunder is the misreporting of revenue.

The miscalculation and erroneous recording of the cost of goods sold can significantly alter gross profit metrics. Being aware of these errors can prevent inaccuracies and provide a truer representation of your business’s financial state.

Why overlooking small expenses is a mistake

Individuals often neglect minor expenses in their financial management. Even these seemingly negligible expenses can accumulate and substantially affect one’s budget over time. Vigilance in tracking every expense is vital for effective financial management.

It is important to monitor routine expenditures, such as daily coffee purchases. Recognizing the importance of every cent is fundamental to achieving financial well-being.

Why incorrectly categorizing expenses causes errors

Exercise caution in expense categorization. Frequent misclassification can lead to future complications.

Here are three main points to consider:

- Apologies are often required when expenses are incorrectly reported, leading to complications in financial transactions and audits.

- But, correct management and categorization can prevent such mishaps.

- There's no better alternative to organized records for streamlined financial management.

Don’t forget to provide a structured hierarchy of your expense payments for efficient management.

The role of profit and loss statements in agency success

Profit and loss statements are pivotal to an agency’s success. They provide a comprehensive account of its financial performance.

By transforming obstacles into opportunities, agencies can safeguard themselves against potential financial downturns.

Financial transparency builds stakeholder confidence, as shown by profit and loss statements.

Address unforeseen risks and unexpected expenses efficiently to turn negative outcomes into positive financial results. Maintaining precise and timely profit and loss statements is vital.