Being your own boss sounds exciting, but it comes with its fair share of new responsibilities. For example, you’ll often have to pitch potential writing clients, chase overdue invoices, and market your services on social media.

And one particularly challenging task you’ll have to carry out is filing your own freelance taxes – it involves you sifting through receipts, crunching numbers, and filling out multiple IRS forms. Unfortunately, you can’t avoid it as it’s a crucial part of running your business.

In this guide, we’ll walk you through how to file freelance writer taxes and give you some examples of the deductions you can claim.

Note: If you want to stay on top of your taxes, manage your business expense and maximize your tax deductions, try Bonsai Tax. Our app would scan your bank/credit card receipts to discover potential tax write-offs (automatically) and save you thousands of dollars from your tax bill. Users typically save $5,600 from their tax bill. Try a 7-day free trial today.

What taxes do freelance writers pay?

In the eyes of the IRS, freelance writers are independent contractors. And as an independent contractor, you have to pay self-employment taxes if you earn more than $400 in a calendar year.

The self-employment tax rate is 15.3%. It represents 12.4% in Social Security tax and 2.9% in Medicare tax. So, if your net income from freelance writing is $1,000, then you’ll need to shell out $153 in self-employment tax.

If you work as a W-2 employee, then self-employment tax is split between you and your employer – you each pay 7.65%. Your paycheck is typically less than the money you really earned. The reason why? Your employer withheld part of your income for Social Security and Medicare taxes and then sent it to the government.

As an independent contractor, the entire burden for handling self-employment tax falls on you. Luckily, though, the IRS allows you to deduct 50% of the amount you pay as an income tax deduction. For instance, if your self-employment tax payment is $,1500, then your taxable income will reduce by $750. If you’re in the 25% tax bracket, then you’ll save $187 in income taxes. This is an above-the-line deduction and you claim it whether or not you itemize deductions.

Note that you have to pay self-employment tax in addition to the standard income tax that most taxpayers owe.

When do freelance writers need to pay taxes?

Freelance writers who expect to owe the IRS more than $1,000 in taxes in a year need to pay their taxes in 4 installments. You’ll need to pay estimated taxes four times a year instead of once a year like most taxpayers.

Estimated quarterly taxes help ease the tax burden of self-employed business owners. Instead of paying everything all at once when you file your taxes annually, you can separate your big tax burden into four parts.

Note that if you make a late payment, the IRS can penalize you. That’s why you need to know the due dates for the entire tax year.

Here’s when the estimated tax payments are due for 2022 tax season:

1st Quarter

- This covers any income you received between January 1st and March 31st

- The deadline is April 18, 2022

2nd Quarter

- This covers any income you received between April 1st and May 31st

- The deadline is June 15, 2022

3rd Quarter

- This covers any income you received between June 1st and August 31st

- The deadline is September 15, 2022

4th Quarter

- This covers any income you received between September 1st and December 31st

- The deadline is January 17, 2023

Typically, the due date for making quarterly payments is on the 15th of April, June, September, and January. But if the 15th falls on a weekend on holiday, the deadline for quarterly tax payments is pushed to the following business day.

What are the different types of tax forms for freelance writers?

Here are the IRS tax forms that freelancers need to deal with:

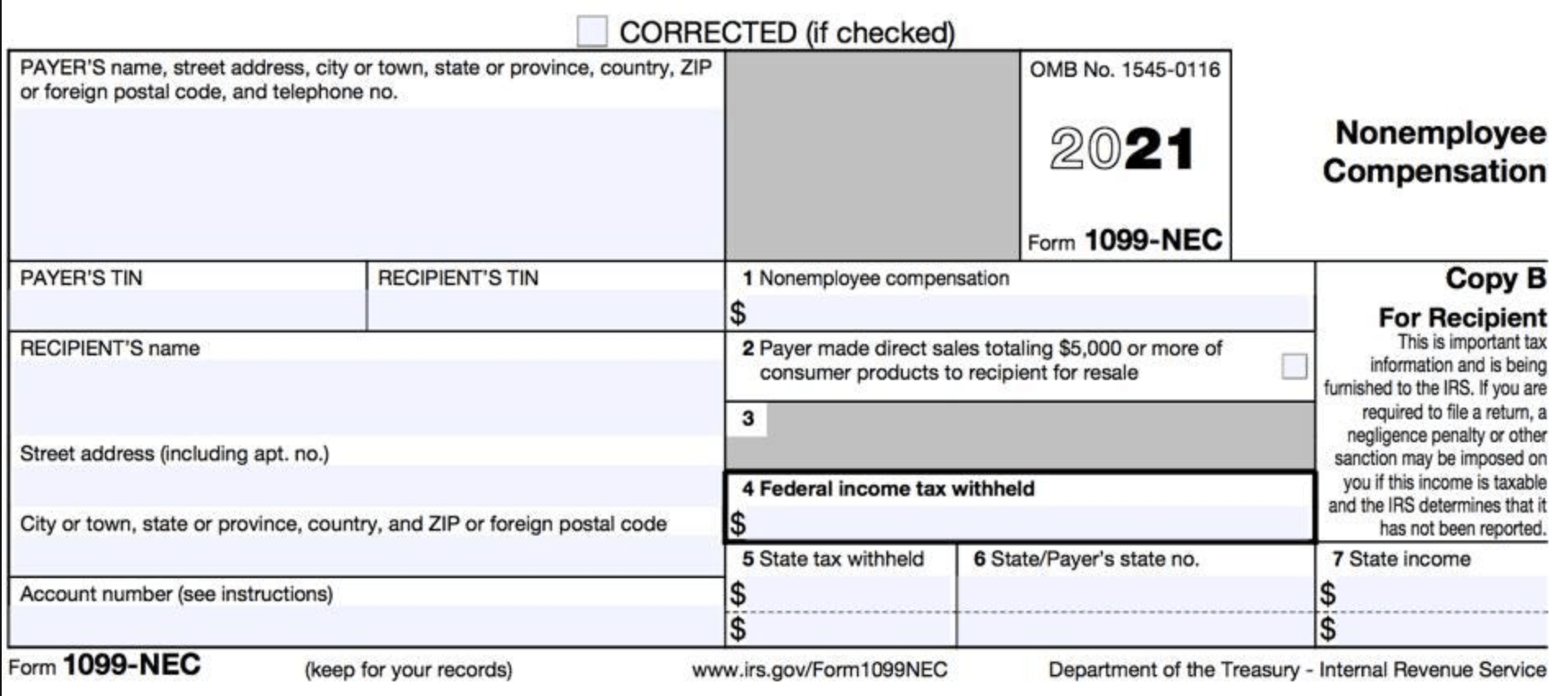

Form 1099-NEC

Form 1099-NEC is used for reporting non-employee compensation. The IRS defines non-employee compensation as any payment made to an individual – who’s not on payroll – to undertake a specific project.

Non-employee compensation includes any of the following:

- Commissions

- Fees

- Benefits

- Rewards for services performed by individuals who aren’t employees

- Any other form of compensation for a service performed by a nonemployee for your business

That said, here are a few things you should know about the IRS Form 1099-NEC:

- If you offer your writing services to a business and receive compensation of at least $600, then you can expect to receive Form 1099-NEC from that business

- If you receive more than $600 in freelance income from multiple businesses, then you can expect to receive the 1099-NEC from each business you offered your services

- The IRS requires businesses to send Form 1099-NEC to independent contractors by January 31st each year

Here are detailed instructions to file a 1099-NEC.

Schedule C

Schedule C is used to report a business’ profit or loss. Freelance writers should fill out the form and attach it with Form 1040.

You should use this to report any revenue your business generated as well as the expenses you incurred when running your business. After reporting these two figures, you can easily determine your net profit.

Your net profit is the figure you obtain after subtracting your total business expenses from your total business income. After figuring out your net profit, you can then report it as income on Form 1040.

Here are instructions to file a Schedule C.

Schedule SE

Schedule SE is an IRS form that allows you to determine how much self-employment tax you owe the IRS. It is one of the several schedules of IRS Form 1040 – a form that allows you to file your individual tax returns.

After calculating your self-employment tax using Schedule SE, you’ll report this figure on another Form 1040 schedule – Schedule 4 (line 57).

If you earn at least $400 in self-employment income in a year, then you need to use Schedule SE to report this income and pay quarterly taxes – even if you’re already getting Social Security or Medicare benefits.

That said, you can’t include income from any of the following sources as self-employment income:

- Stock dividends

- Interest from loans

- A limited partnership

- Capital gains from selling assets

- Real estate rentals

What are the deductions that freelance writers can claim?

Freelance writers often overlook some of the tax deductions they can claim because of the demanding nature of their work. Some of these deductions include the home office deductions, subscriptions, travel expenses, unpaid invoices, online presence fees, depreciation of equipment, and depreciation of equipment. Check out our full list of freelance writer tax deductions here.

Home office deduction

In your line of work, you mostly spend your time at home working. So the home-office deduction is probably the biggest write-off you can claim as a freelance writer.

You can deduct a portion of your rent that is equal to your home office’s percentage of space compared to the total size of your home.

For instance, if your home office accounts for 20% of the size of your home, then you can write off 20% of your home.

The IRS, however, has specific rules for claiming this deduction:

- You must use your home office regularly and exclusively for your business

- Your home office needs to be the principal place of your business

What most freelancers often overlook, though, are the expenses they incur when maintaining their home office. Note that anything you purchase to maintain or improve your home office is tax deductible.

Subscriptions

To produce your best work, you’ll need some helping tools. Grammarly and Hemingway, for instance, can help simplify your work when writing. The money you pay to subscribe to such tools is tax deductible, as long as the tool is necessary for your line of work.

Travel expenses

Sometimes, you may need to travel to meet a client, conduct an interview, or attend an industry event. Any costs you incur – which include expenses for flights, car rentals, or hotel rooms – are deductible when you file your tax return. That said, if you decide to also go on vacation during your business trip, you can only write off the portions of the trip that were related to your business.

Unpaid invoices

This deduction often goes under the radar, as most freelancers don’t know they can deduct the losses incurred due to unpaid invoices. If you provide your writing services to a business and they fail to pay you, you can write off the unpaid invoice as bad debt. Typically, this goes on Line 6 of Schedule C Form 1040.

There’s a catch, however. For you to write off unpaid invoices, you need to have claimed this as income.

Online presence

As a freelance writer, almost half of your work involves you promoting yourself on various channels. Potential clients need to easily find you so that you can never run out of paying work.

That said, the costs of advertising yourself on social media and setting up your freelancer website are deductible when paying taxes. This means that if you pay for LinkedIn Premium or subscribe to MailChimp, you can deduct the cost you’ve incurred at the end of the year.

Website expenses such as the following are also deductible:

- Hosting fees

- Website plugins

- Website themes

- Stock photos

Depreciation on equipment

According to the Internal Revenue Service, depreciation refers to the decline of an asset’s value. What most freelancers don’t know, though, is that depreciation is a deductible expense.

In the past, self-employed business owners could deduct a little bit of an asset's value over time. But Section 179 now allows you to write off the entire purchase price of equipment instead of depreciating it with time. This allows you to significantly reduce your tax bill.