Being a freelancer is an exhilarating ride. You're the boss, you set your hours, and you pursue projects that spark your passion.

But let's face it; freelancing isn't always a breezy beach walk. It's often more like a roller coaster ride with unexpected dips and turns, particularly when it comes to managing your finances.

Perhaps you've had those sleepless nights, wondering if you've priced your services right or if you're saving enough for taxes. Or those unsettling moments when a client is late on a payment, and your bills are due.

Don’t worry; we’ve got your back! By the end of this blog, you’ll be able to learn what you’re doing wrong that’s keeping you from scaling your business.

Money mistakes to avoid as a freelancer (& what to do instead)

Sip your go-to beverage (mine's a piping hot cafe latte), and learn about the most common financial mistakes made by freelancers & how you can avoid them to strengthen your financial footing.

- Not keeping an emergency fund

We've all had those months with fewer gigs, sudden huge expenses, or even unexpected health hiccups. Without a regular paycheck, these can feel like nightmares.

An emergency fund is your financial parachute during these times. Aim for at least three to six months of living expenses saved up. It'll help you sail through tough periods without plunging into a sea of debt.

- Undercharging for your skills

Early in your freelance journey, you might feel compelled to set your prices low (or even work for free) to lure more clients. Remember, now you've got much more experience & providing premium services, and so your pricing should mirror that.

Study the market rates, and make sure you're considering all your costs, experience, and goals while pricing your services.

- Overlooking tax savings

As a freelancer, tax season can give you the blues because you don't have an employer handling your taxes. To bypass the tax day trauma, it's vital to squirrel away money for taxes with every paycheck.

So, track your taxes efficiently and automate getting paid with invoice templates. Moreover, don't skip out on exploring your eligible tax deductions, like your home office, business trips, and even specific meals and entertainment expenses.

- Operating without a budget

It might seem fundamental, but this is one of the most common financial mistakes made by freelancers – they operate without a defined budget. A thoughtfully-crafted budget helps you track your cash flow, rein in your expenses, and plan for your financial future.

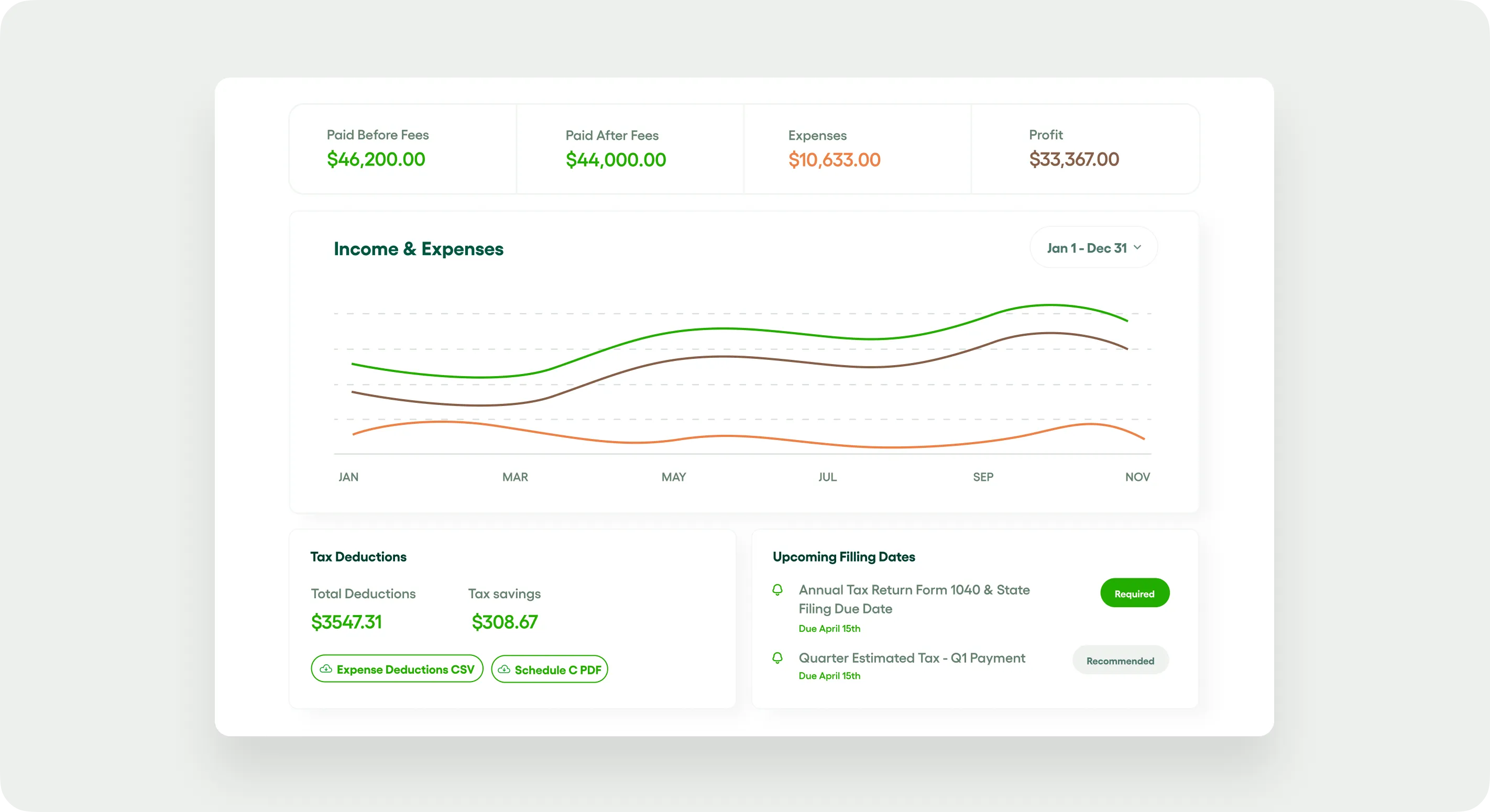

Re-visit and adjust your budget periodically to keep it relevant to your goals and actual expenses. And if you find it difficult to do it manually, use an income & expenses calculator.

- Combining personal & professional finances

When you start freelancing, it might seem effortless to manage income and costs from your personal bank accounts. But this method can lead to financial chaos and make tax season a nightmare.

A separate business account can help you monitor your income, expenses, and business performance more efficiently. Plus, it'll make you feel like a legit business owner – because you are! So, don’t make this terrible financial mistake, and open your new business bank account NOW!

- Not having late-payment terms

Freelancing can mean dealing with erratic payment schedules and, sometimes, even no payment at all.

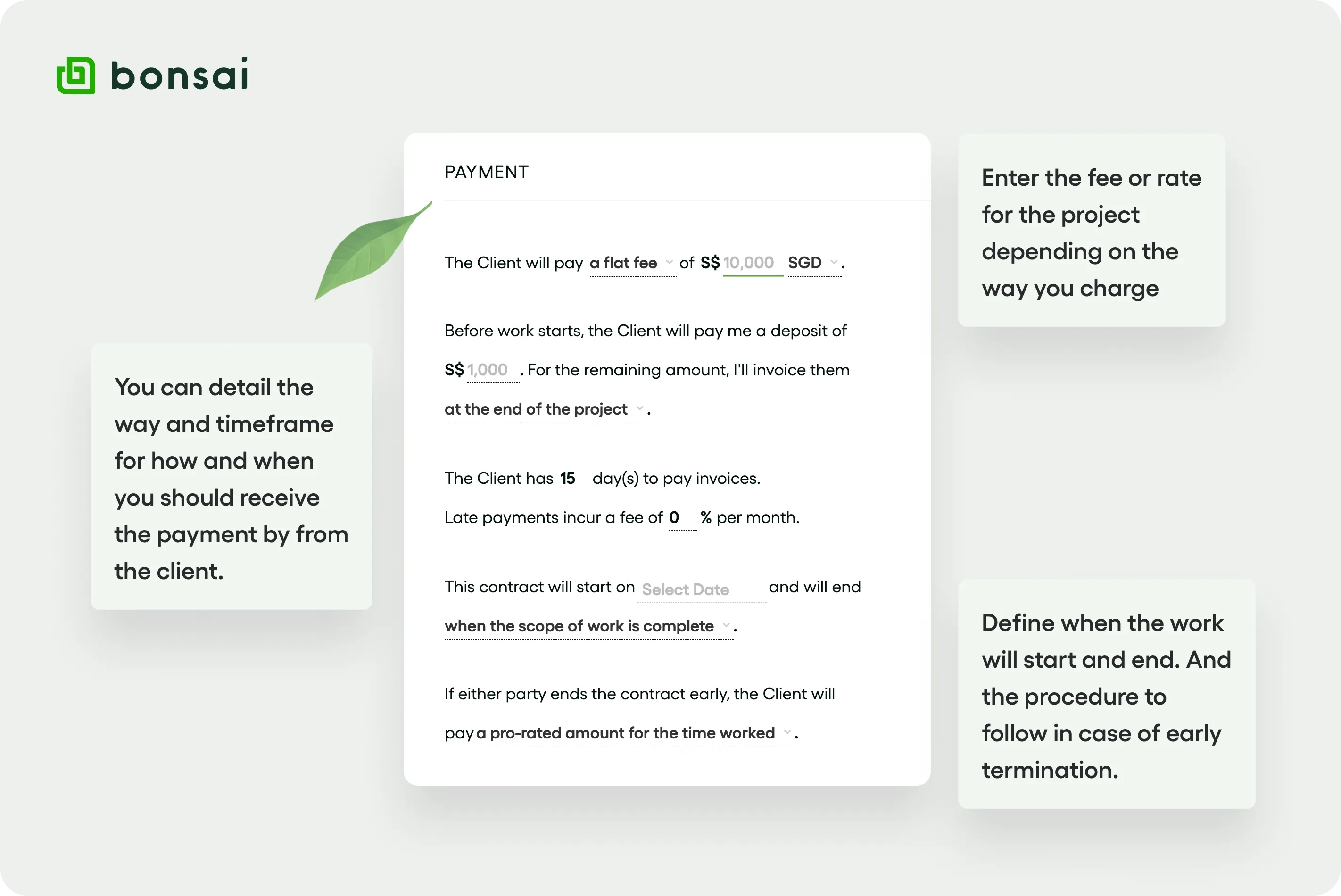

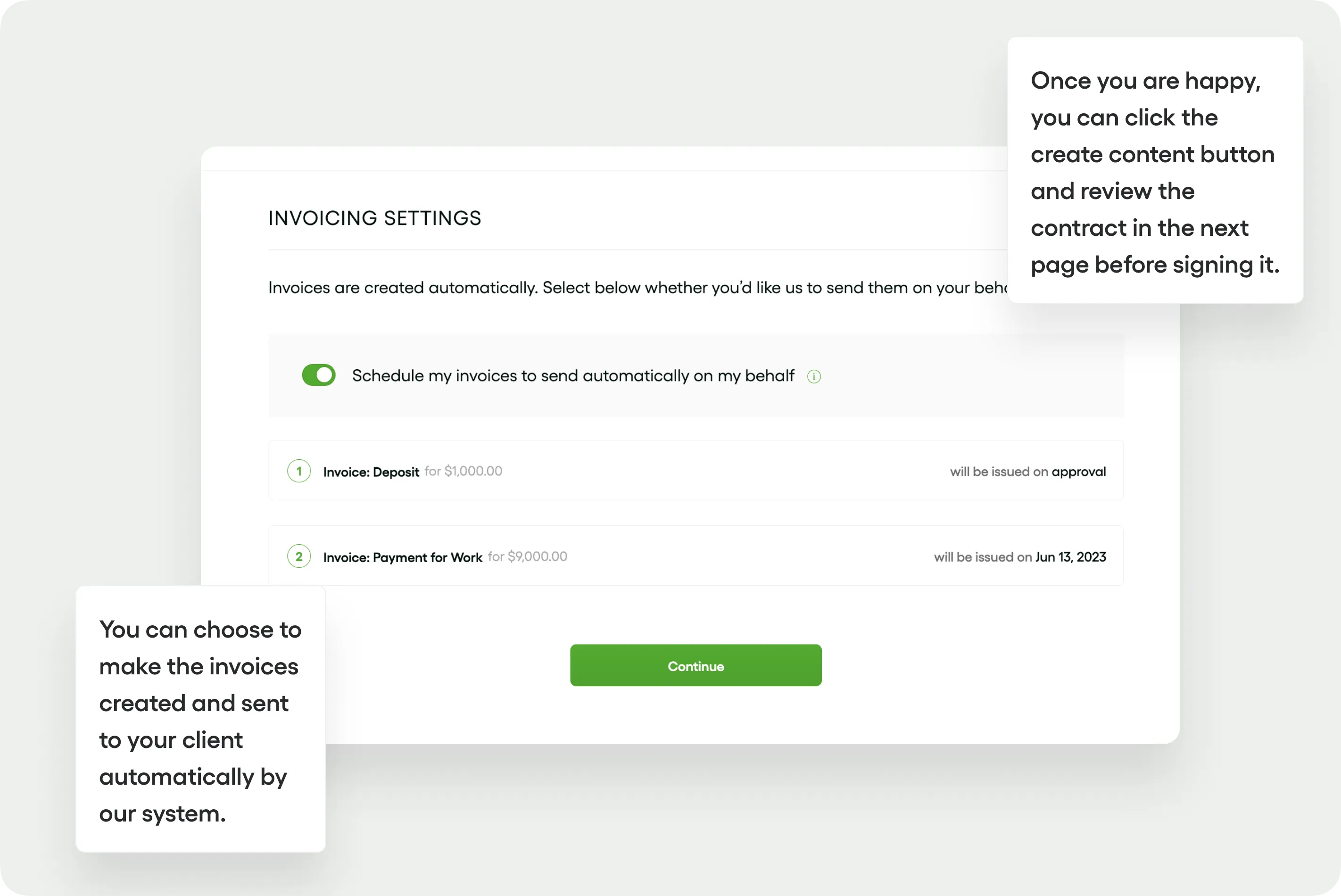

To dodge a financial blow, consider crafting a late payment policy with fees and clearly mention it in a legally-vetted contract. Be proactive in chasing unpaid invoices by sending automated reminders for payment – after all, it's your hard-earned money!

- Ignoring retirement planning

Retirement might feel like a distant future when you're immersed in managing your business. But the truth is, starting your savings early will ensure a comfy retirement.

As freelancers, we don't have the luxury of employer-sponsored retirement plans. It's up to us to establish a Solo 401(k) or an IRA. These retirement savings accounts can fetch significant tax benefits, so don’t make this money mistake & consult a financial advisor to pick the one that suits you best. Bonsai's business account can get you started with budgeting for retirement.

- Neglecting detailed financial records

Maintaining precise financial records is a must for tax purposes and understanding the fiscal pulse of your business.

If you don’t want to spend a ton of your money on hiring a professional and instead manage your finances yourself, use a tool like Bonsai to make sure all transactions, invoices, and expenses are recorded accurately.

Also Read: Invoice Vs. Receipt: What’s the difference?

- Non-systematic invoicing practices

Ensuring timely payment starts with efficient invoicing. A common money mistake many freelancers make is unclear payment terms or tardy invoice sending.

Craft professional, detailed, and transparent invoices. Include your contact info, a breakdown of services, the total due, the payment deadline, and acceptable payment methods. Avoid any ambiguity that can delay payment.

How about making your invoicing process a breeze? Check out invoicing tools like Bonsai, which offers automated reminders, payment status tracking, and tax tracking. This way, you don't miss out on any payment, and you can keep an eye on your income at all times. Use an invoice generator to ensure you don't miss any critical client information.

Conclusion

Remember, effective financial management involves saving, budgeting, and ensuring that money flows in consistently. And nothing ensures this better than efficient invoicing with tools like Bonsai! So, sign up for a FREE 7-Day trial to Bonsai.

Also, keep an eye out for more freelance finance tips and advice. Remember, your financial health is a cornerstone of your business success.

You can also read our related blog posts to stay ahead of the game:

- Key Elements of a Contract and How to Navigate Them

- 6 Tips That Every New Freelancer Should Know