Consultant tax deductions are essential for reducing your tax liability as an independent contractor. Key deductions include:

- Meals and entertainment

- Home office expenses

- Professional services

- Business travel costs

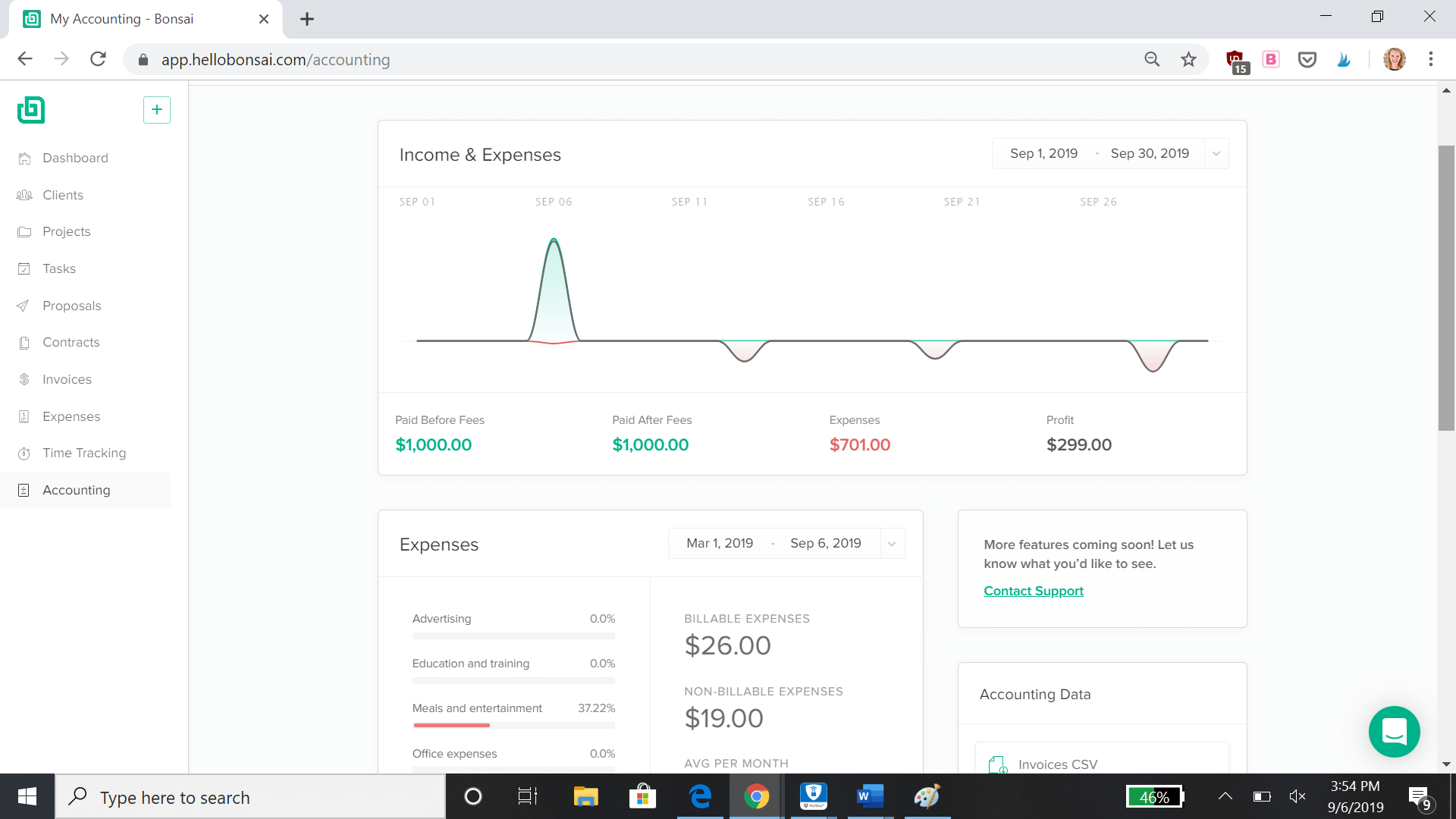

To maximize savings, track expenses meticulously using tools like Bonsai Tax, which can help identify potential write-offs and save an average of $5,600 annually. Keep detailed records and receipts to substantiate claims. By understanding and utilizing these deductions, consultants can significantly lower their tax burden, ensuring more of their hard-earned income stays in their pockets.

Working as a freelance consultant offers a lot of perks. You get to be your own boss, set your own hours, and control your workload. But there are also some downsides—namely, taxes.

As a consultant, you are an independent contractor responsible for paying your own taxes. There are deductions you can take to help offset the cost.

Note: Try Bonsai Tax today to track your business expenses automatically. Our expense tracker will scan your bank/credit card statements to discover potential tax write-offs. The majority of our users save on average $5,600 from their tax bills. Claim your 7-day free trial here.

Consulting business tax deductions: the most common consultant tax write-offs

Here are a few of the top consultant tax deductions that you can take advantage of:

Consulting business tax deductions for meals and entertainment

Maintaining positive client relationships is one of the most important aspects of the consulting business. To grow your consulting business, you'll often need to take clients out to lunch or dinner or entertain them in other ways.

The cost of these meals and entertainment expenses is tax deductible.

However, there are a few rules you need to follow:

- You can only deduct 50% of the cost of meals and entertainment. So, if you take a client out to dinner and the bill comes to $100, you can deduct $50 from your taxes.

- You can only deduct the cost of meals and entertainment if they are directly related to your business. For example, if you take a potential client out to lunch to discuss the possibility of working together, you can deduct the cost of the meal. But, if you take a client out to lunch just to catch up and chat, you can't deduct the cost of the meal.

Even the expenses you incur when traveling to meet clients are deductible. In such cases, lodging expenses, car expenses, gas, airfare, and car rentals are deductible business expenses.

Consulting business tax deductions for education and certifications

As a consultant, it's crucial to remain competitive in your niche. That means investing in your education, research, and certifications regularly. Fortunately, the IRS offers several tax breaks for consultants who do just that.

You can deduct the cost of tuition, books, conferences, and seminars that are related to your business.

You can also deduct research costs, like the cost of hiring a research firm or subscribing to industry-specific publications.

And if you're required to get certified to operate in your state or city, you can deduct the cost of the certification as well.

The only catch is that the expenses must be related to maintaining or improving your current skill set – so you can't deduct the cost of a new degree or certification that isn't directly related to your business. The IRS considers such expenses as personal expenses and you can't deduct them.

The Lifetime Learning Credit is another great way to offset the cost of education expenses.

The credit is worth up to $2000 per year and can be used for tuition, fees, and other eligible expenses – like books, supplies, and equipment – at eligible educational institutions. Discover how to maximize the education expense deduction here.

Consulting business tax deductions for marketing costs

Having a strong personal brand is essential for any consultant who wants to be successful. After all, if potential clients don't know who you are or what you do, they're not going to hire you. You need to market yourself effectively to land more and better client opportunities.

Fortunately, the cost of marketing your consulting business is tax deductible. This includes expenses like:

- Website design and hosting

- Online advertising such as Google AdWords

- Social media marketing

- Promotional materials

- Email marketing services

- Advertising expenses

- PR

- Website design and development

- Branding expenses

For example, let's say you spend $500 on a new website and $1000 on Google AdWords. You can deduct the full cost of these expenses from your taxes, saving you a significant amount of money and reducing your tax bill. Any business start up costs are deductible as well.

Consulting business tax deductions for home office deduction

If you have a dedicated home office space, you can deduct a portion of your mortgage interest or rent, as well as utilities and maintenance costs like painting or repairs.

The IRS allows you to deduct home office expenses using two different methods:

- the simplified method

- the actual expense method

The simplified method calculates your deduction by taking the square footage of your home office space and multiplying it by $0.50. So, if your home office is 200 square feet, you can deduct $100 from your taxes.

The actual expense method is a bit more complex and requires you to track actual expenses like insurance, repairs, and utilities.

You'll then calculate your deduction by taking the percentage of your home that is used for business and applying it to your total expenses.

For example, if your home office is 200 square feet and your home is 2000 square feet, your home office makes up 10% of your total home. If you spend $20,000 to renovate your home, you can deduct $2,000 from your taxes.

Which method you choose is up to you, but the simplified method is generally easier to calculate and takes less time to complete.

Consulting business tax deductions for professional services

As a consultant, you probably rely on several different professional services – from accounting and legal services to marketing and web design. These services can help you run your consulting business more efficiently and effectively, allowing you to focus on your clients and grow your business.

You can deduct the cost of these services as business expenses. This includes the cost of hiring an accountant or bookkeeper to help you estimate income tax, as well as the cost of legal services related to your business.

And if you use any professional service to help you find new clients – like a headhunter or placement service – you can also deduct those costs.

Note: Organize your finances with Bonsai's consultant accounting software. Manage your consulting business tax deductions, keep track of payments, and organize your finances—all in one place. Try a 7-day free trial here.

Consulting business tax deductions for business equipment and supplies

You can write off the cost of most business-related equipment and office supplies on your taxes. This includes big-ticket items like:

- Computers

- Office furniture

- Printer ink

- Paper

Let's say, for example, you needed to improve your home office setup and spent $2000 on a new computer, printer, and office furniture. You can deduct the full cost of these purchases from your taxes.

Just keep receipts and other documentation so you can prove the expenses if necessary.

Consulting business tax deductions for vehicle expenses

If you use your vehicle for business purposes, you can deduct a portion of the operating costs from your taxes. This includes:

- Gas

- Oil changes

- Repairs

- Insurance

You can either deduct your actual vehicle expenses or take the standard mileage deduction, which is 65.5 cents per mile driven for business purposes in 2024.

To deduct your actual vehicle expenses, you'll need to keep track of all your receipts throughout the year. This can be a bit of a hassle, but it may be worth it if your vehicle expenses are high.

If you decide to take the standard mileage deduction, you don't need to keep receipts or track actual expenses. You'll just need to keep a mileage log to document your business miles.

Either way, make sure you're only deducting the percentage of your vehicle that is used for business purposes. For example, if you use your car 25% for business and 75% for personal use, you can only deduct 25% of your vehicle expenses.

Business travel expenses

What qualifies as a business travel expense

Business travel expenses include costs incurred when traveling away from your tax home for work-related purposes. This means trips that require you to be away overnight or long enough to need sleep or rest. Typical deductible expenses are:

- Transportation

- Lodging

- Meals

- Incidental costs directly tied to your consulting work

For example, if you fly to another city to meet a client or attend a conference relevant to your consulting services, your airfare, hotel charges, and meals during the trip can qualify. However, personal side trips or expenses unrelated to your business activities during the trip are not deductible.

To maximize deductions, keep detailed records such as receipts, itineraries, and notes on the business purpose. Using apps like Expensify or QuickBooks Self-Employed can help track and categorize these expenses efficiently for your 2024 tax filings.

How to deduct transportation and lodging costs

Transportation costs for business travel are fully deductible when the trip is primarily for work. This includes:

- Airfare

- Train tickets

- Car rentals

- Taxis

- Rideshares like Uber

- Mileage if you use your personal car

For 2024, the IRS standard mileage rate is 65.5 cents per mile, which you can use instead of tracking actual vehicle expenses.

Lodging expenses are deductible if the stay is necessary for your consulting work and not lavish or extravagant. For instance, staying at a hotel near a client’s office for a two-day project qualifies. Keep in mind that lodging costs for personal vacations combined with business travel are only partially deductible based on the number of business days.

To claim these deductions, maintain clear documentation. Save your boarding passes, hotel bills, and mileage logs. Tools like MileIQ automatically track mileage, making it easier to report accurate transportation expenses on your Schedule C.

Deducting meals and incidental expenses during travel

Meals during business travel are deductible at 50% of the actual cost or 50% of the standard meal allowance set by the IRS. For 2024, the per diem rates vary by location; for example, the continental U.S. allowance averages around $66 per day for meals and incidental expenses. Using per diem rates can simplify record-keeping if you prefer not to save every receipt.

Incidental expenses include tips to porters, baggage carriers, and hotel staff, as well as fees for phone calls related to business. These smaller costs are deductible but should be reasonable and directly connected to your consulting activities.

To ensure you qualify for these deductions, document the business purpose of each meal or incidental expense. Apps like Concur or Rydoo help organize meal receipts and track per diem allowances, which is especially useful for consultants who travel frequently.

Consulting business tax deductions for health insurance

If you're self-employed, you're not eligible for employer-sponsored health insurance. This means you need to buy your own health insurance policy.

Fortunately, health insurance premiums for independent contractors are deductible. This includes the cost of both individual and family health insurance policies.

Consulting business tax deductions for business insurance

As a consultant, you're probably not working for a single company. Instead, you're working with many different clients on a variety of projects – like most independent contractors. This means you don't have the same level of job security that employees have.

You're likely to face several risks that other businesses don't have to deal with. For example, if you give your client bad advice and they lose money as a result, they could sue you for damages.

To protect yourself financially, you need to have business insurance. This includes:

- General liability insurance

- Professional liability insurance (errors and omissions)

- Property insurance

- Workers' compensation insurance (if you have employees)

- Professional liability insurance

- Business interruption insurance

- Product liability insurance

- Insurance for business property

The cost of business insurance premiums can be deducted from your taxable income. This is a valuable deduction for consultants, as it can help to reduce the amount you owe Uncle Sam, and ultimately bring down your business expenses.