Applying for a bank account can reap so many benefits for your business, but it often seems like a daunting task. This is especially true when you're running a newly-incorporated LLC and trying to balance the competing demands that a new business puts on you.

The options for business checking accounts seem endless, and it can be hard to decipher which account is best for your LLC.

Luckily, we’ve compiled a list of the best business bank accounts for LLC owners. We'll compare the different requirements, perks of each, and fees to open a business bank account. Let’s get started.

Best Business Checking Accounts For LLCs

We'll review our top 7 picks for LLC business owners.

- Bonsai's business account

- BlueVine

- Axos

- Wells Fargo

- Bank of America

- Chase

- U.S. Bank Silver

We'll start with the one we know best--our own.

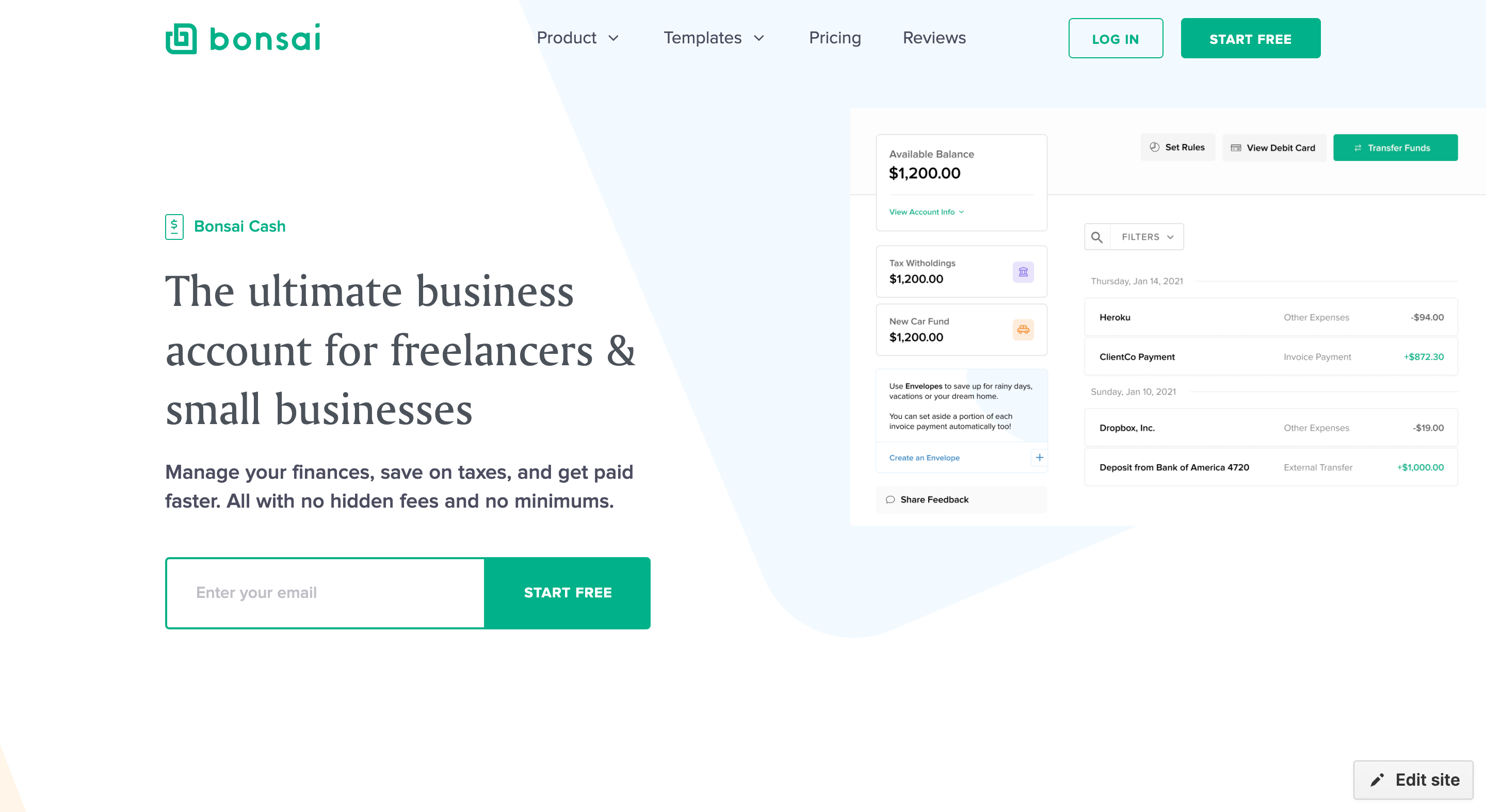

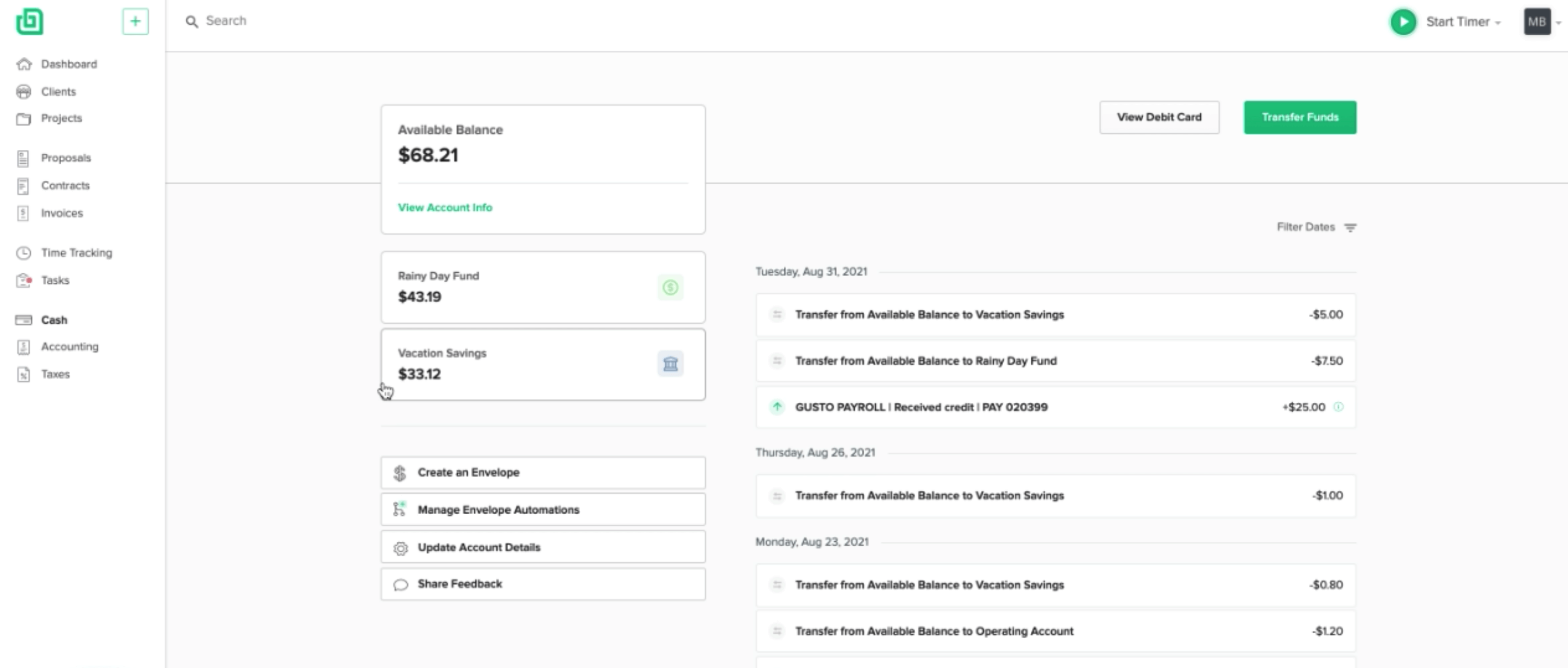

Bonsai's business account offers you a convenient business checking account

Opening an account with legacy, brick-and-mortar banks can often be time-consuming, and there are a lot of complexities involved. Bonsai's business account is a business checking account that is simple to set up. Worse yet, you may have to incur some extra fees, which is not ideal for LLC owners who are getting their business off the ground.

Bonsai's business account is a better alternative: a convenient, easy-to-use, and intuitive business checking account to manage funds, send money, simplify expenses and set up a rainy day fund. With Bonsai's business account, you can manage everything in one simple platform which saves you from the hassle of juggling different accounts.

And the best part? You don’t have to incur any of these fees:

- No minimum balance charges

- Transaction costs

- Monthly service fees

Bonsai's business account also incorporated a feature called Envelopes, that allows you to create sub-accounts. This allows you to have separate savings accounts for vacations, emergency funds, tax liability, etc. Bonsai's business account is great for LLC owners who want to get set-up quickly, send payments instantly, and manage their business checking account easily.

Sign up for an account today.

BlueVine Business Checking

The BlueVine Business Checking account earns 1.20% APY on all balances up to $100,000, which is higher than what you'll find at most brick-and-mortar banks. And unlike other interest-earning accounts, it does not require you to maintain a daily or monthly minimum balance.

There are no monthly fees, insufficient funds fines, ACH payment costs, or minimum opening deposit with the BlueVine business bank account. This account also includes unlimited transactions and fee-free ATM access.

The account gives you all of the tools you need to manage your money, including mobile check deposits and recurring and one-time payments. You may also link transactions to accounting programs such as QuickBooks Online, Wave, or FreshBooks. In addition, you can connect your accounts to third-party services like PayPal and Expensify.

BlueVine does not offer in-person services through branches. Customers may still use a variety of transaction choices, though, as BlueVine has partnered with several other financial networks. For instance, through the MoneyPass ATM network, BlueVine users can access over 38,000 fee-free ATMs in the U.S.

Although BlueVine doesn't have physical branches, you can still make cash deposits with BlueVine. Green Dot, a bank holding company, has partnered with BlueVine to allow the online bank's customers to make cash deposits. Currently, you can make cash deposits in over 90,000 U.S. retail locations.

Unfortunately, cash deposits carry a fee -- one of the few BlueVine services that you'll have to pay for. Green Dot charges up to $4.95 for each cash deposit, which may be subject to daily limits.

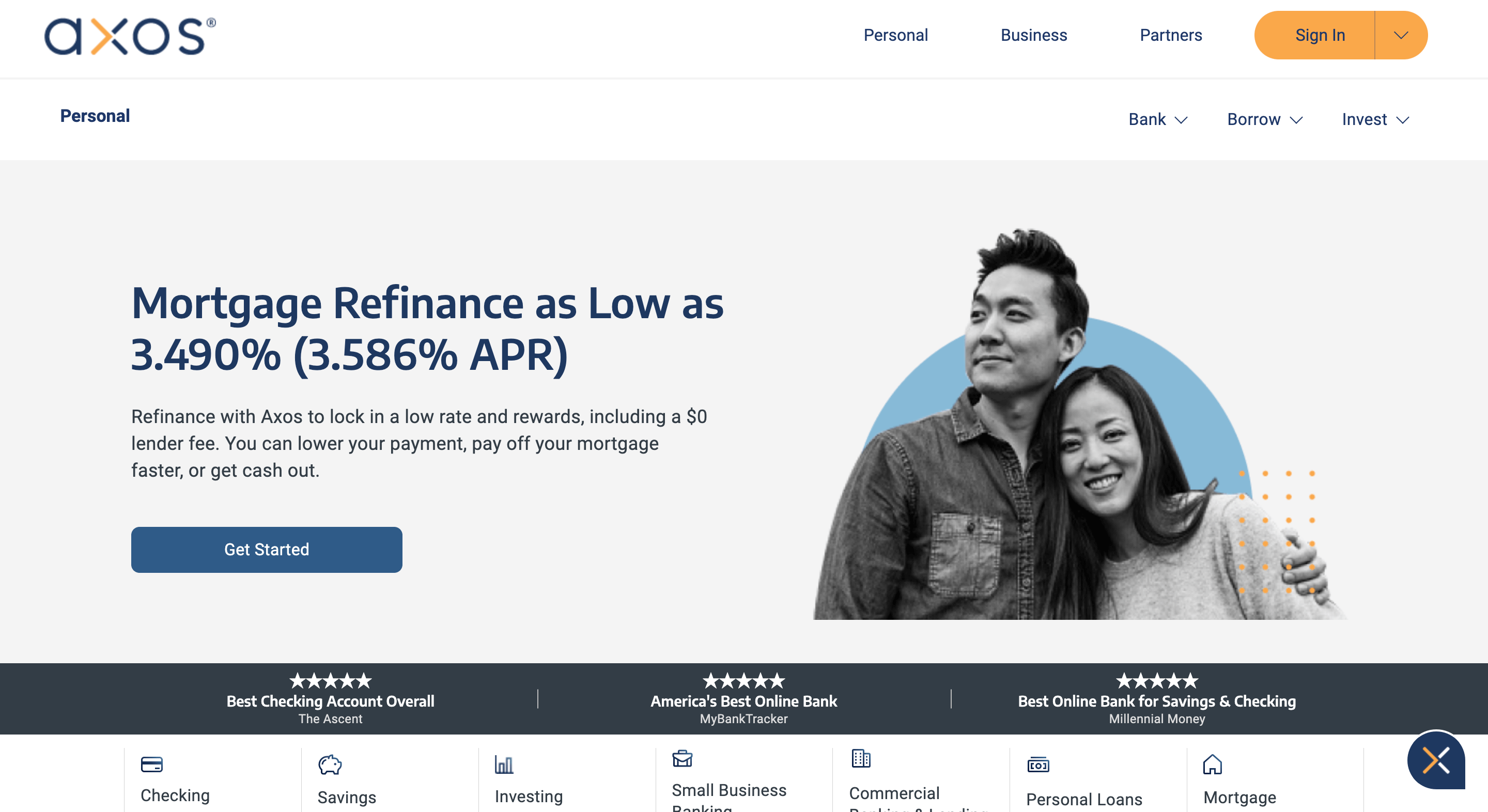

Axos Business Checking

Axos offers two primary business accounts:

- Basic Business Checking

- Business Interest Checking

The Axos Basic Business Checking account is ideal for LLC owners who don't want to deal with monthly charges or maintain a minimum balance.

With this account, you won't pay any monthly maintenance fees -- so you don't have to worry about waiving the monthly fee that most legacy banks charge.

And although the account has a minimum deposit requirement, you're not required to maintain the balance in order to avoid additional fees or account closure. Most brick-and-mortar stores, on the other hand, require you to maintain a minimum amount, which can be difficult for newly-incorporated LLCs and first-time business owners.

The Business Interest Checking account can be a better fit for you want to earn interest on your money, have a balance of at least $5,000, and make a few transactions every month.

With this account, customers can get interest rates of up to 0.81%, depending on the amount in their accounts. To open a Business Interest Checking account, you must first deposit at least $100. Also, you have to maintain a $5,000 minimum daily balance to waive the $10 maintenance fee.

Similar to the Basic Business Checking account, the Business Interest Checking account offers unlimited domestic ATM fee reimbursements Your first 50 transactions each month are free, and each additional transaction costs $0.50. Note that you're limited to 60 deposit attempts via Remote Deposit Anywhere, which enables you to deposit checks remotely using Axos Bank's mobile app.

Another benefit? If you're the owner of a newly-incorporated LLC, you can earn a $200 bonus for opening an account. You can use the promo code NEWBIZ100 to claim the bonus. Note that you'll need to keep a minimum daily balance of at least $2,500 in the first two months to claim the $200 bonus.

To summarize, Axos business checking may be perfect for your LLC if:

- You're looking for a free online bank account

- You want fee-free ATM access throughout the U.S

- You're running a newly-incorporated LLC and you can qualify for the bonus

Wells Fargo Business Choice Checking

Wells Fargo is the fourth-largest bank by assets and has nearly 5000 branches across 37 states, making it a good option for businesses with multiple locations or those that prefer in-person banking. The Business Choice Checking account comes with a debit card, online and mobile banking, and access to 16,000 ATMs nationwide.

Business owners can take advantage of services like merchant services, payroll services, and business credit cards through Wells Fargo. The Business Choice Checking account has a $15 monthly service fee that can be waived if you maintain a $7,500 average balance.

Also, you have a $7,500 monthly limit on the amount of cash deposits you can make without paying a fee, which is better than many other banks. You'll be charged 30 cents every time you deposit more than $100 in cash after your monthly allowance has been used up.

That said, this account is ideal for LLC owners who:

- Prefer in-person banking in physical branches

- Qualify to waive Wells Fargo's monthly service fee

- Expect to make between 100 and 250 monthly transactions

Bank of America Business Fundamentals Checking

Bank of America is the second-largest bank in the U.S. by assets and offers a wide range of business banking products and services, from loans and lines of credit to merchant services and international business solutions.

The Business Fundamentals Checking account is best suited for LLC owners who have enough money in their account to avoid the monthly fee, prefer visiting banks and ATMs over online business account, and don't make loads of transactions every month.

You can avoid their $16 monthly maintenance fee by maintaining a $3000 minimum daily balance, making at least one qualifying deposit of $250 or more per statement cycle, or linking your Business Fundamentals Checking account to a Bank of America Merchant Services account. If you do any of those things, you'll get unlimited monthly transactions.

A benefit of opening this account is that Bank of America won't charge you fees for your first 200 transactions, including checks that have been paid or deposited. Following this, the bank will charge you $0.45 per item. Cash deposits don't incur any charges for the first $7,500. After you've exceeded your $7,500 limit, the bank will charge you a $0.30 fee for every $100 you deposit.

Another reason why we've included Bank of America in this list is that the bank loves to give sign-up bonuses to new customers. It is currently offering a Business Fundamental Checking account signup bonus of $750 -- but you'll need to deposit at least $50,000 to claim this bonus.

If you deposit at least $5,000 within 15 days of opening your account, you will receive a bonus of $200. This number rises to $500 if you deposit at least $20,000.

Chase Bank Business Complete Banking

The Chase Business Complete Business Account account is designed for small businesses and comes with several features to help you manage your finances, including online and mobile banking, access to 16,000 ATMs, and a dedicated business banker.

There are no transaction fees for the first 20 transactions conducted using a teller or paper checks drawn on the account. Users are charged 40 cents each time they make a purchase after that point.

The Chase Business Complete Business Account account does not require a deposit and allows for unlimited electronic payments. Customers can also use Chase QuickDeposit, wire transfers, and Chase Online Bill Pay to send and receive money, which saves them from the hassle of having to visit a physical bank branch.

To avoid the $15 monthly service fee, you'll need to meet any of the following conditions during your monthly statement period:

- Spend at least $2,000 in purchases using your Chase Ink Business Card

- Maintain a minimum daily balance of $2,000

- Deposit a minimum of $2,000 from Chase QuickAccept transactions or other eligible Chase Merchant services transactions

- Have a linked Chase Private Client Checking account

The Chase Business Complete Checking account offers a sign-up bonus of $300 if you deposit $2,000 in the first 20 days. Maintain that balance for 60 days and complete five of the qualifying activities -- including debit card purchases or mobile check deposits -- and you'll earn $300.

U.S. Bank Silver Business Checking

U.S. Bank is the fifth-largest bank in the U.S., with branches in 26 states. It is a good option for LLC owners who want the convenience of mobile and online banking without sacrificing in-person customer service.

The Silver Business Checking account from U.S. Bank comes with a free debit card, online and mobile business account, and access to 4,700 ATMs nationwide through the Allpoint ATM network.

You can also open a Silver Business Savings account to help you manage expenses and set aside funds for taxes or other business purposes.

There are no monthly fees with the Silver Business Checking Account, and you get 125 free transactions and 25 free cash deposits each month. You won't receive a signup bonus for this account, but the lack of fees and minimums make it a fantastic choice for LLCs that don't need a lot of sophisticated features.

How to choose a business checking account for your LLC

Choosing the right business checking account can be the difference between a thriving business and one that struggles to make ends meet. The wrong account can cost you time, money, and peace of mind.

The good news is that there are a few key factors you can look at to help you choose the right account for your business. They include:

Account Features and Services

When you’re looking for the best business checking account, the account features and services offered are important to consider. Do you need an account that offers online bill pay? Does your business require a merchant account so you can accept credit card payments?

Some businesses may also need specialized accounts such as payroll accounts or accounts for managing inventory. Make sure the account you choose has the features and services that are right for your business.

For example, if you’re running a one-person LLC, you may not need an account with a lot of bells and whistles. But if you run a small business with employees, you’ll want to make sure the account you choose offers features like direct deposit and online payroll.

Take some time to review the features and services offered by each account and compare them to your business needs.

Service fees

Next, take a close look at the service fees charged on business checking accounts. Many banks will waive monthly maintenance fees if you meet certain requirements, such as maintaining a minimum account balance or making a certain number of transactions per month.

Other common service fees to watch out for include:

- Minimum balance fees

- Transaction fees (for each check you write, for example)

- ATM fees (if you use an out-of-network ATM)

- Overdraft fees

- Returned deposit fee

- Wire transfer fee

- Deposit slip fee

There may also be other miscellaneous fees charged on business checking accounts, so it’s important to read the fine print.

Ideally, you’ll want to find a business checking account that doesn’t charge any service fees at all. But if that’s not possible, look for an account with fee waivers or a low monthly maintenance fee.

You should also consider whether the fees charged are worth the features and benefits you’ll get in return. For example, the best business checking accounts for LLCs come with valuable extras, such as free checks or a free debit card.

Other business checking accounts may offer interest on your deposited funds, which can offset any fees you’re charged.

Interest rates for deposit accounts

The next thing to look at when comparing business checking accounts is the interest rate you’ll earn on your deposited funds.

This may not be a top priority if you don’t keep much money in your account, but if you do, it can add up to real earnings over time. Many banks offer tiered interest rates, which means the interest rate you earn will increase as your account balance grows.

Some banks also offer business checking accounts that come with an annual percentage yield, or APY. This is the actual interest rate you’ll earn on your deposited funds over a 12-month period.

When looking at interest rates offered on business checking accounts, compare the APYs to see which bank is really offering the best deal.

You may also want to consider whether you’ll have easy access to your deposited funds. If you need to make regular withdrawals, for example, you may want to steer clear of business checking accounts that come with steep early withdrawal penalties.

Bank branches and access to ATMs

If you prefer to do your business account in person, it’s important to choose a bank with branches near you. It’s also important to consider ATM access, since you may need to withdraw cash from time to time.

Some banks will charge you a fee for using out-of-network ATMs, so it’s important to find a bank with ATM locations that are convenient for you. You may also want to consider whether the bank offers a mobile deposit, which can be a handy feature if you’re always on the go.

Transaction limits

When comparing business checking accounts, be sure to look at the transaction limits that are in place. These limits can vary from bank to bank, and they may also change depending on the type of account you have.

For example, some banks may limit the number of checks you can write per day or per week. Others may limit the amount of money you can withdraw from an ATM.

If you regularly exceed the transaction limits on your account, you may be charged fees or your account may even be closed. So it’s important to find a business checking account that meets your needs in this regard.

Welcome bonus offers

Many banks offer introductory bonus offers to new business checking account holders. These offers can vary, but they may include things like a percentage of interest on your deposited funds or even cashback on certain transactions.

If you’re considering opening a business checking account, be sure to ask about any introductory bonus offers that may be available. You may be able to take advantage of a great offer and earn some extra cash for your business.

What do you need to open a business bank account for an LLC?

Applying for a business is almost similar to opening a personal checking account. The difference, however is that opening a business account requires you to provide more documents. Here's what you'll need to open one for your LLC:

- A valid government-issued ID such as a driver's license or passport

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- The Articles of Organization for your LLC

- An Employer Identification Number (EIN)

- A business license or permit (if required in your state)

You will also need to have the following ready when you apply for your LLC:

- A completed application form

- The minimum deposit required to open the account

Once you have all of the above documents and information ready, you can apply for your LLC at your chosen bank. Make sure to bring all of the required documents with you to avoid any delays in the process. Once your LLC is approved, you will be able to start using your new business bank account and reaping its benefits.

LLC Business Bank Accounts FAQs

Now that you know more about choosing a business checking account for your LLC, you may still have some questions. Here are answers to some frequently asked questions about LLC business bank accounts.

Do I need to have a business checking account if I have an LLC?

While it’s not required, it is generally recommended. Having a business checking account can help you keep your personal and business finances separate, which can make things simpler come tax time.

How much does it cost to open a business checking account?

The cost of opening a business checking account can vary depending on the bank you choose. Some banks may charge a monthly fee, while others may charge per-transaction fees. Be sure to ask about any fees that may be associated with opening and maintaining a business checking account before you choose a bank.

Do all banks offer business checking accounts?

No, not all banks offer business checking accounts. However, many major banks do offer business checking accounts, and there are also a number of smaller banks and credit unions that offer business checking accounts.

Do I need a minimum balance to open a business checking account?

Some banks may require you to maintain a minimum balance in your account, while others may not. Be sure to ask about any minimum balance requirements before you choose a bank.

Final thoughts

Choosing a business checking account is a big decision. There are a lot of factors to consider in order to find the best account for your specific needs. But by taking the time to compare your options, you can find an account that will help you run your business more effectively.