One integral part of any online business is its payment system. Regardless of the industry a company falls under, the services being rendered, and the number of customers being served, no business will succeed without a secure and reliable payment gateway for customers to carry out online payments.

As you know, cash payment methods are fast fading in the 21st century. This causes a heightened need for most brands or businesses to adopt digital payment channels. However, many of these channels are out there, so choosing the best one can be challenging.

If you own a business, the only way to know the most suitable payment platform for the kind of goods or services you provide is to understand payment gateway architecture and how it works.

That way, you can decipher how payment systems work and ultimately select the best payment platform for you or your business. Keep reading to find out more!

Note: If you want to try the best payment platforms for architects, try Bonsai Payments. Our software supports a variety of online and offline payment methods to help you get paid quickly. Our processor provides the lowest fees among integrated payment processors. Claim your 7-day free trial here.

What Is A Payment Gateway?

A payment gateway is a platform that allows users to make online payments for goods and services. With these platforms, it's easier for your customers to send payments through electronic channels so you can then receive the money in your bank account.

What Is The Architecture Of A Payment Gateway?

Before we dive deeper into the working processes of a payment gateway, certain things come together to make online payments possible that you should know. They include:

- Acquiring Bank: This is the bank or financial institution a merchant uses that allows him to process debit/credit card transactions from customers.

- Issuing Bank: This refers to any bank that gives debit or credit cards to its customer so that they can make online transactions.

- Card Schemes: These are the payment networks associated with the credit and debit cards of different banks

- Encryption: This is the series of steps involved in converting data or information into secret codes before sending them via secure channels.

- Secure Server: A secured server is one that follows the SSL (Secure Sockets Layer) protocol to enhance the security of online payments.

These five things are an integral part of any payment gateway. Now, to how it all works with our software.

How Does Bonsai's Payment Platform Architecture Work?

Now you know the various things that make the internal workings of any payment gateway, here's how they all work together:

Step 1:

A customer places an order on the merchant website (or any website at all that accepts online payments) for certain goods/services

Step 2:

The customer's payment request is sent to the payment gateway for processing

Step 3:

The payment gateway collects every information required to process the payment from the customer. Such information includes credit or debit card details, transaction details, customer names, etc. All this data is then stored in secured servers

Step 4:

The payment system encrypts all the data, converting it to secret code, and then sends it to the acquiring bank (merchant's bank).

Step 5:

The acquiring bank receives the data as codes, decodes it, and now sends the payment details and an authorization request to the card schemes. In this step, one of two things can happen: either the request is approved or not.

If the request is approved, it is processed through the issuing bank again.

If the request is not approved, the card schemes send back a message to the acquiring bank showing that the payment wasn't approved. For example, you may see a "card declined" or "transaction failed" error message. The card schemes also explain the reason why the payment failed.

Step 6:

If everything works out fine, the issuing bank sends a message to the payment gateway that the transaction is successful.

Step 7:

The payment gateway notifies the customer that the payment was successful or declined, as the case may be.

Payment gateway architecture is quite complex, but still, all these things are done in a matter of a few seconds to give you the optimum payment experience.

Note: Try the easiest payment platform for architects here at no cost. Send and receive payments quickly with Bonsai Payments. See for yourself and claim your 7-day free trial here.

Why Do Online Businesses Need Payment Service Providers?

Instant Payment Processing

Online payment platforms make the magic of instant payment processing possible for merchants and customers. Neither party has to do any work (like going to banks to fill deposit slips), but everything is handled by the financial institution and the payment service provider.

Secure Transactions

An online payment gateway allows customers to make secure payment transactions. The various protocols set up in payment gateways make it difficult for any malicious activity to be done.

Even if complications arise during payments and the money doesn't get to the merchant, these issues can be easily traced and rectified.

Provides Multiple Payment Options

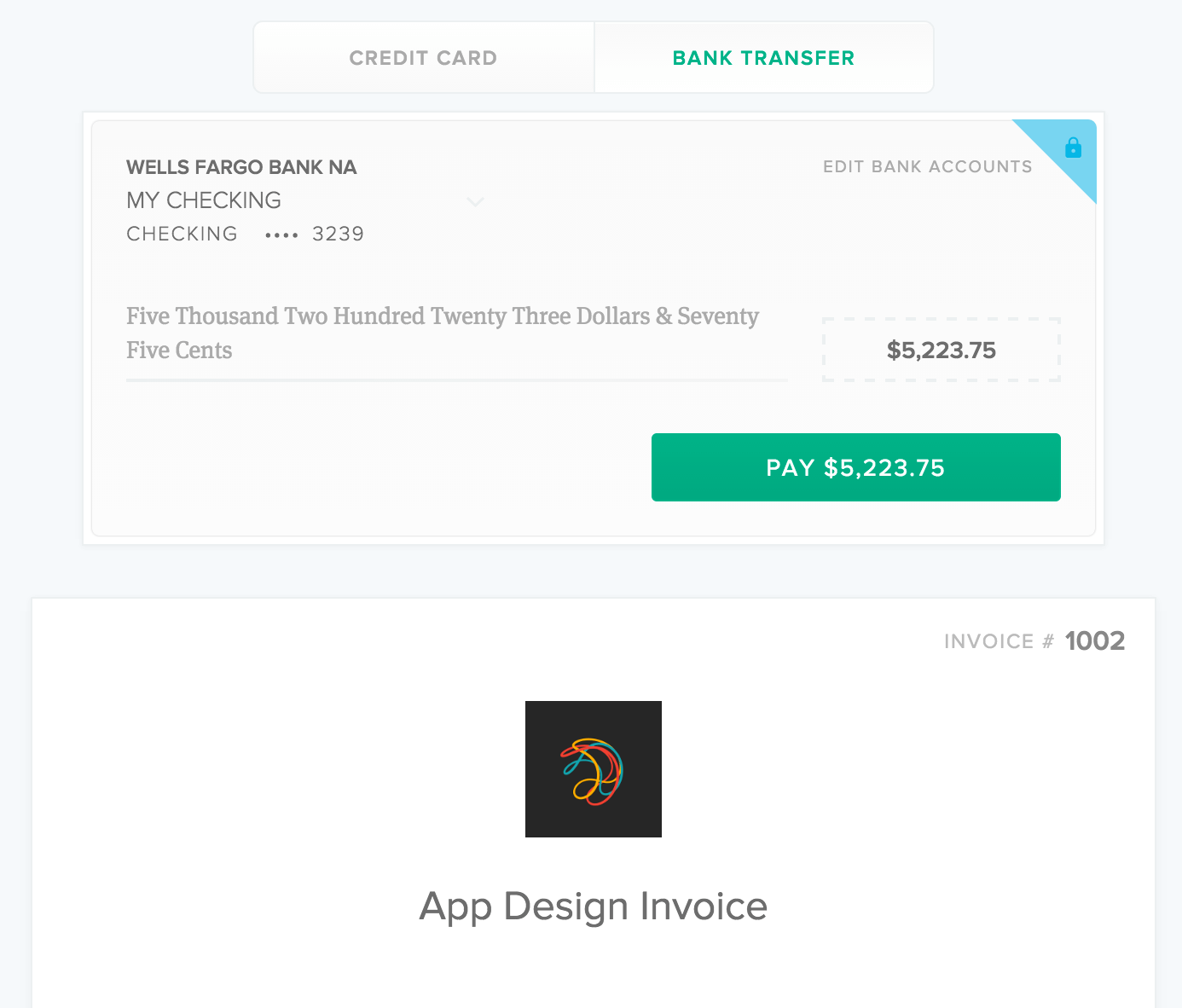

A perfect payment gateway doesn't just provide a platform for secure payments and gives customers multiple payment options for the merchant's services. This helps improve convenience.

Promotes Sales

When payments can be done in a matter of seconds, customers won't have time to second-guess their choices. Payment gateways make payment safe, easy, and convenient, so people won't mind paying or buying multiple times, as they know their money is secure.

However, if customers encounter prolonged speeds during online transactions due to the payment system, they'll be very reluctant to buy stuff next time. This is another reason why companies must select a gateway with the perfect payment platform architecture so customers get the best experience when paying for goods and services.

How To Select The Best Payment Gateway

Having learned the importance of payment gateways and payment platform architecture, let's see some things you should look out for when trying to select the right one for your business.

Platforms With Distributed System Architecture

Distributed systems can process thousands of digital payments daily, offering unparalleled performance and flexibility. These systems utilize the actor model (where code components are treated as actors that can send messages and react with each other) and distributed databases that allow for data storage in multiple nodes. With this, nothing can go wrong in the internal services of the system.

Platforms With Adequate Security Protocols

It goes without saying that any good payment gateway should provide high data security. Whether its a new system or an old system for payments, the following boxes should be checked as regards security:

- GDPR

- Multi-layer security measures

- Firewall &Server side security

- SSL certificate

- DSS compliance

Platforms That Allow For Recurring Payments

The best payment platforms are those that allow people to pay again and again, as much as is necessary. Platforms like these usually feature horizontal scaling, so there'll be high availability (24/7 payments) and low latency regardless of the workload.

Platforms With Reactive and SOA Architecture

A payment gateway with reactive architecture uses reactive principles to handle sudden activity spikes on the platform efficiently. Top payment gateways use this sort of setup. It provides the needed support for the system in case of sudden overload.

Top platforms like Bonsai also feature a Service Oriented Architecture (SOA Model), which massively reduces customer charges and improves response times.

What Payment Gateway Is Best For You?

If you're looking for a payments system that checks all the boxes and has a perfect payment platform architecture, then we recommend Bonsai Payments. From security to flexibility and speed, Bonsai makes processing payment transactions a seamless experience for both merchant and customer.