What Is Invoice Financing?

Invoice financing is a system that lets businesses manage their cash flow by using their outstanding invoices as leverage.

This system is particularly popular in businesses that frequently have revenue tied up in unpaid invoices — it’s a method to reduce financial pressure while the clients settle their accounts.

As waiting for clients to pay outstanding invoices can take weeks or even months, businesses can receive a portion of the money owing from a lender upfront. This provides the business with instant cash flow based on the money owed from clients.

Invoice financing is based on viewing invoices as assets with a tangible value, instead of just payment requests. Companies can be flexible when deciding which invoices to finance, meaning they can use them to bridge cash flow gaps when needed.

Invoice Financing Example

The way invoice financing works is as follows: A company delivers goods to a client, and issues an invoice worth $5000, with a payment due in 30 days.

However, the company has outstanding operational expenses and needs the money now to pay for them.

Instead of waiting for the client to pay, the company can approach a lender and ask them to advance 90% of the invoice amount so they can meet their operational expenses.

Once the invoice is paid by the client, the company can then repay the lender, including any financing fees or interest charged by the lender.

What Is Invoice Factoring?

Invoice factoring is a different facet of invoice finance. In a nutshell, invoice factoring is when a business sells its unpaid invoices to a third party, known as a factoring company.

The responsibility of collecting the unpaid invoice now falls entirely to the factoring company, and the business gets an upfront payment that amounts to a large percentage of the invoice total. The company receives immediate cash flow and also transfers the credit risk from themselves to the factoring company.

Factoring is particularly popular with small and medium-sized businesses, who may not have a big financial buffer to get them through periods of low cash flow.

Factoring also has the advantage of offloading the collection aspect of the invoice, meaning that staff are free to focus on operations and business growth.

Businesses are also shielded from clients defaulting on their debts, as the responsibility of collecting the debt is now in the hands of the factoring company.

Invoice Factoring Example

As an invoice factoring example, let’s imagine that a small business has a $10,000 invoice owing from a client, but needs cash now to pay for business expenses.

They decide to sell this invoice to a company that offers invoice finance factoring, for an upfront factoring discount of 85% of the value of the invoice ($8,500).

The small business now has cash on hand to use for their expenses, and the factoring company has the job of collecting the invoice total.

Once it is paid, the factoring company repays the remaining 15% to the small business, less their factoring fee (this can be variable, but is usually 1–6% of the total invoice amount).

In factoring, the discount given depends on a variety of factors, including the trustworthiness of the client that owes the money.

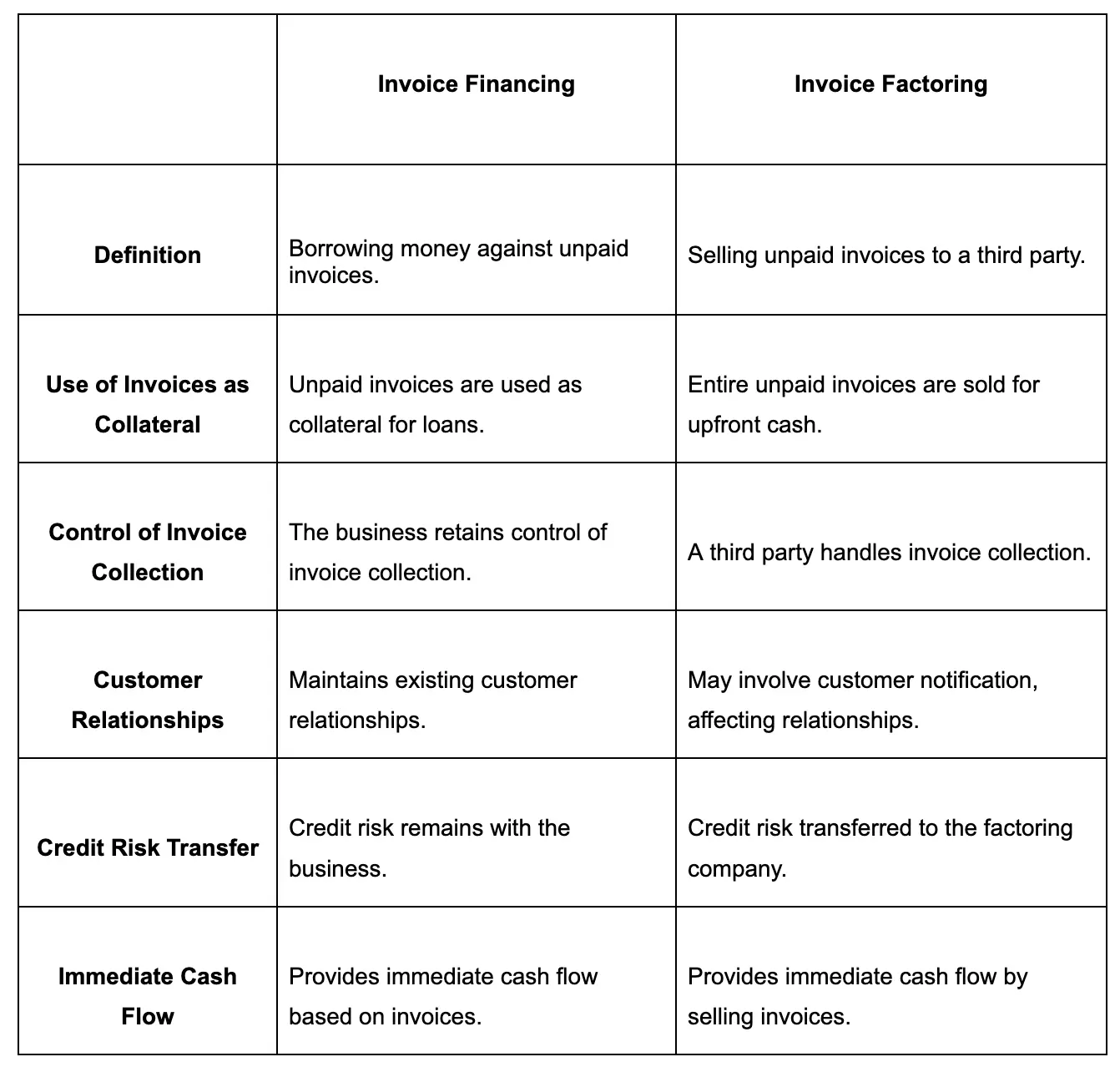

Invoice Financing vs. Invoice Factoring: Summary

While both invoice financing and factoring are options for a business that needs instant access to cash flow, there are differences between the two.

Invoice Financing:

- Borrowing money against unpaid invoices: Businesses use their unpaid invoices as collateral to borrow money. The unpaid invoices are used as a guarantee to lenders that the money will be recouped.

- Retains control of invoice collection: With invoice financing, the business remains in control of invoice collection. This means businesses can use their preferred methods when pursuing payments.

- Maintains customer relationships: Invoice financing maintains the relationship between the client and the business without introducing any third parties into the mix.

Invoice Factoring:

- Selling unpaid invoices to a third party: With invoice factoring, the business sells the entire unpaid invoice to a third party in exchange for a percentage of the invoice balance.

- A third party collects the invoices: The business no longer has the responsibility of collecting the invoices.

- May involve customer notification: One potential downside is that invoice factoring may involve customer notification, which can damage relationships with the client.

While both invoice financing and factoring offer immediate cash flow, businesses making the choice should consider the potential impact on customer relationships and their business’s particular needs.

In general, invoice financing is cheaper and more flexible, but it may be less accessible to certain businesses and comes with a higher risk and more administrative work.

Advantages of Invoice Financing and Invoice Factoring

When deciding whether invoice financing vs. factoring is right for your business, it’s important to compare and contrast the advantages offered by both methods.

You can then weigh the advantages against the specifics of your business to decide which method is preferable for your unique situation.

Invoice Financing Advantages

- Improves cash flow: Through borrowing against your business’s unpaid invoices, invoice financing instantly boosts cash flow and provides access to funds without waiting for clients to pay.

- Maintains control over collections: Financing invoices lets companies retain control of invoice collection, meaning they can still use their preferred collection methods and practices.

- Preserves customer relationships: Avoiding introducing a third party helps preserve customer relationships, as clients interact directly with the business.

- Suitable for businesses with good credit: For companies with a good credit history, invoice financing may be particularly beneficial as lenders will be more likely to offer lower interest rates and more favourable terms.

Invoice Factoring Advantages

- Immediate cash infusion: Invoice factoring gives an instant influx of cash. It lets businesses receive the majority of the amount owing on the invoice upfront, giving them an immediate cash infusion.

- Outsources invoice collection: Another benefit of using this method is that it saves time — the business is no longer responsible for invoice collection, so it can focus on other operational issues.

- Suitable for businesses with credit issues: Invoice factoring largely considers the credit history of the clients that owe money, not the business itself, so it’s a good option for businesses with a patchy credit history.

- Provides liquidity for growth: Thanks to the instant cash infusion from invoice factoring, businesses can funnel this liquidity into growth initiatives such as expanding operations.

Disadvantages of Invoice Financing and Invoice Factoring

While both methods have their own unique advantages, they are not without their disadvantages. When considering which method is best for your business, ensure you look at them from all angles to choose the perfect system for your company.

Invoice Financing Disadvantages

- Interest costs may accrue: This is true with all forms of borrowing, but invoice financing does come with interest. If the borrowed amount stays unpaid, interest can accumulate, which leads to higher overall costs.

- May require credit checks: Financial institutions may require credit checks before lending against unpaid invoices. If your company is new or has a checkered credit history, this could mean you receive unfavorable terms or are unable to access invoice financing entirely.

- Limited to businesses with invoices: If your business uses other methods of payment, invoice financing won’t be available to you. Those who operate on a cash basis or a prepayment system will need to investigate other funding avenues.

- Potential debt burden if unpaid: With invoice financing, the onus stays on the business to collect the client’s debts. If the client fails to pay, the business is still responsible for paying back the borrowed amount to the invoice factoring company — this can cause financial strain.

Invoice Factoring Disadvantages

- Factoring fees reduce profits: Factoring companies charge factoring fees, which naturally reduce overall profits. The fee amount can vary based on things like perceived risk and the size of the invoice.

- Loss of control over collections: When a business uses a factoring service, it gives up all control of how the debt is collected. The factoring service might use a more aggressive approach than you’d prefer, which can be off-putting for customers and might not align with your preferred practices.

- Customer relationship risks: Aggressive collection practices can damage customer relationships, leading to the loss of repeat customers and a bad reputation in your industry.

- Not suitable for all industries: Invoice factoring isn’t suitable for all industries. For example, businesses with only a small number of big clients are not suitable, as factoring companies like to spread their risk widely.

Conclusion: What’s Right for My Business?

Understanding invoice financing vs. factoring can be confusing, but getting a good understanding of the pros and cons of both systems will help you make your decision. Both systems are methods to get instant access to cash that is tied up in unpaid invoices, but they work differently and have different considerations.

If your business is particularly focused on customer relationships and prefers to have control over all interactions with your clients, then invoice financing may be a better fit. This is also a great choice if your business has a good credit score.

Invoice factoring is a good option if your business needs an instant cash infusion and you’re looking to focus on operational issues instead of debt collection.

Factoring outsources debt collection, which can free up your staff to look at growing your business or chasing up leads. It’s also a good choice if your business has a not-so-great credit record, or if you’re a new business looking to grow quickly.

Overall, you need to consider the specific needs of your business, the industry you’re operating in, and the dynamics your business has with customers. The right choice is one that works for your business and can help your company grow and thrive.

Sources

https://www.adobe.com/sign/hub/document-types/invoice-factoring-vs-financing.html

https://www.linkedin.com/advice/0/how-do-you-measure-optimize-roi-invoice-financing-factoring

https://www.fundthrough.com/blog/invoice-factoring/invoice-factoring-rates-what-can-i-expect/

https://gocardless.com/guides/posts/what-is-invoice-factoring/