There are plenty of advantages to setting up your business as a Limited Liability Company (LLC). Opting for the LLC structure establishes your business as its own legal identity that’s separate and apart from you or any other stakeholders.

It offers a variety of taxation options, shelters you from personal liability for your business partners’ or employees’ actions, and formalizes the way that profits and losses will be divided, as well as other important issues.

Though all of these are important factors, the most frequently cited reason for choosing to set a business up as an LLC is the liability protection that the popular business structure provides.

As the owner of a sole proprietorship, is your are personally liable for all of your business's legal obligations. By contrast, an LLC is a separate legal entity from you as its owner, and if it is named in a lawsuit or pursued for a debt, it’s your business that’s on the hook rather than you. You can even open a business bank account without an LLC if you have not formed the structure yet.

To ensure that the separation between you and your business is fully recognized, it’s both a smart business move and good common sense to have a separate LLC bank account.

Note: If you want to open a business checking account for an LLC with no hidden fees and minimums, try Bonsai's business account. Our online account will help you manage your finances, save on taxes, and get paid faster. Sign up today.

.jpeg)

Why Should You Open a Separate Business Bank Account?

Opening a business account makes tracking and managing your finances much easier, as your business account records will be restricted to business transactions. It will also give you the professional advantage of receiving and making payments in your business’ name, providing a far greater sense of legitimacy.

The requirements for opening business checking accounts for an LLC are different from those for opening a personal bank account. Here’s what you need to know about how to open a business bank account for an LLC.

Why Separate Personal and Business Finances?

If you’ve been operating as a sole proprietor, you may have used a single bank account linked to your Social Security Number for both your personal and business finances. Since sole proprietorships are pass-through companies that are indistinct from the business owner, this is legal, though it unquestionably adds an unnecessary layer of complexity when it comes to documenting business expenses at tax time.

By comparison, LLCs are separate legal entities from their owners, and overlooking a business expense or accidentally including a personal expense on business books can mean cheating yourself of a write-off. This can make you vulnerable to audit, or give creditors a reason to view you and your business as inseparable.

By separating your business checking accounts and business credit cards from your personal checking and savings accounts, you provide yourself, your accountants and financial advisors, and any overseeing body with distinct records.

The Benefits of a Separate Bank Account for Your Business

There are numerous advantages to having a separate business bank account for your LLC, including:

- If your business is sued, having a single bank account that includes both your personal and business finances makes it impossible to argue that your business is a separate entity and opens all of your personal assets to seizure. By contrast, being able to prove that your finances are entirely separated shows that you and your business are distinct, strengthening and confirming the liability protection afforded by your status as an LLC.

- If you are trying to build a credit history and business credit score in order to improve your chances of borrowing money, having a separate account both provides a clear-cut track record of financial transactions and money management. It confirms that your business if worthy of professional consideration.

- Having separate financial records will provide a significant advantage at tax time. Not only does it ensure that all business expenses have been paid from a single source and are included in your list of deductions, but it also provides an easy-to-follow paper trail of income and expenses in case of an audit and saves money on accounting fees.

- Most business bank accounts will offer merchant services accounts that allow you to accept credit and debit card transactions from your customers. This also provides your customers with an additional layer of protection and security when purchasing from you.

- Opening a business bank account provides your company with an associated business credit card and/or debit card that can be used specifically for making business purchases.

- Keeping your business transactions separated from your personal finances helps ensure that you are able to stick to your personal budget without accidentally charging business expenses to one of your personal credit card accounts. This is particularly easy to do when it comes to paying for vehicle expenses, entertainment or travel expenses, and office supplies and equipment.

Having A Separate Business Bank Account Saves Time and Money

If you’ve previously operated as a sole proprietorship without the benefit of a separate business bank account, you are probably familiar with the extraordinary amount of extra time at tax time trying to remember whether a specific expense was personal or for your business. Opening a bank account for your LLC eliminates that time-consuming task and ensures that every potential business expense deduction is captured.

Having a separate business bank account also will save you significant time and trouble in case your business is audited.

Steps to Opening your LLC’s Business Account

The first step in opening a separate business bank account for your LLC is choosing the right bank for your needs. Though it may be tempting to choose the same bank where you keep your personal funds, and there may be advantages to doing so, it is important to remember that your business has different needs than what you look for in a personal checking or savings account.

Choosing a Financial Institution

When looking for banks offering new business accounts, compare all of the different perks. Where benefits such as no minimum monthly balance requirements may be attractive for your personal finances, there may be other merchant services or account features geared towards small businesses that make another bank a better choice for your LLC account. These might include:

- Availability of a business debit card and/or business credit card account

- Ability to have multiple business accounts/sub-accounts

- Access to business loans

- How much it costs to open a business account i.e. no monthly fees, no minimum monthly balance

- Ability to accept credit card payments on your behalf

- Overdraft protection

- Generous number of transactions per month

- Easy transfers from business checking account and savings account

When considering different options for your LLC’s business bank account, be sure to consider the distinct advantages offered by local banks and credit unions, as well as of opening a business bank account online rather than at a traditional brick-and-mortar bank.

Here's a review of the best business bank accounts for LLC.

Advantages of A Local Community Bank

If your company operates locally, it may work to your benefit to open your business bank account at a local bank. Though local banks offer the same products and services that national banks do, they often have greater freedom when it comes to establishing their own interest rates and fees, as well as when it comes to making lending decisions.

Local banks frequently take an active role in business development within their communities, and work to encourage the economic health of their region. Their employees generally live in the area and provide a welcoming, personalized banking experience, while still offering online services to provide 24/7 access to account information.

Advantages of a Credit Union

A credit union is a nonprofit organization that focuses on providing high levels of customer service. Credit union fees are generally lower than those found with other types of bank accounts, and they frequently offer high savings rates and lower interest rates, along with full-service business account services that include checking, lending, investments, and business credit card.

.jpeg)

Advantages of an Online Business Account

The advantages of online banking are not news to anybody living in the 21st century, but they are particularly beneficial for businesses. Having a business account online provides the ability to receive payments, pay bills, make deposits and transfer funds between accounts from your phone, tablet, or laptop 24/7 provides invaluable convenience, and so too does the ability to review account statements and all transactions with the click of a button.

Online business accounts are location independent, as you can access the from anywhere on the globe as long as you have an internet connection, and online banks typically offer low fees or no-fee business account services. They also frequently offer built-in integration with other bank accounts as well as with popular accounting software packages and other payment apps to accommodate the needs of both your accountant and diverse clients.

Note: If you want to open a hassle-free business account, then try Bonsai's business account. There are no hidden fees and you can organize your business funds for taxes easily. On top of that, you'll get access to freelancer tools like proposal, contract, and invoice templates to make running your business easier. Sign up today.

Documentation Required for Your LLC’s Business Account

Once you have selected a financial institution for your LLC bank account, you’ll want to collect all of the documentation that’s needed to get set up. Every bank has different requirements so it’s a good idea to call beforehand, though most will require the following:

- Business identification. This may include your LLC’s articles of organization or certificate of formation

- A copy of your resignation resolution if your article of organization was filed by an organizer rather than by one of your LLC members.

- Your Employer Identification Number or Social Security Number (if operating as a single-member LLC and disregarded entity.)

- A copy of your LLC Operating Agreement, which both proves your authorization to open a financial account on behalf of the business and pertinent information regarding who has authority to withdraw funds.

- A physical address or mailing address to which documents can be sent.

- Proof of personal identification such as a driver’s license or passport

- If your business is using a DBA (Doing Business as), a trade name, assumed name, or fictitious name, you’ll need additional documentation displaying the business name and proving that it is in good standing.

Why Bonsai's business account Is the Right Choice for Your Business Bank Accounts

Realizing that you need (and can benefit from) business bank accounts that are separate from your personal accounts is just half the battle. You also need to find the time to gather all the necessary documents and get new accounts set up. That’s where Bonsai's business account can help.

Bonsai's business account is the newest resource from Bonsai, the platform dedicated to smoothing the way to growth and success for freelancers and independent companies. Bonsai's business account provides the perfect solution for setting up separate business accounts for your business, and an easy, cost-free way to manage your finances, boost your cash flow, and even lower your tax liability without incurring monthly fees, transactions fees, or minimum balance penalties. It's a business bank account guaranteed for approval.

Bonsai's business account Lets You Link Your Payments Directly to Your Business Checking Account

Bonsai already helps manage and streamline your business process, allowing you to prepare proposals and contracts, track client contacts, tasks, and time, and even to generate invoices. Combining these features with Bonsai's business account completes the all-in-one aspects of the platform, making it easy to direct client payments directly into your account and then use funds to pay for business expenses via a dedicated virtual card.

How to Sign Your LLC Up for a Bonsai's business account Business Account

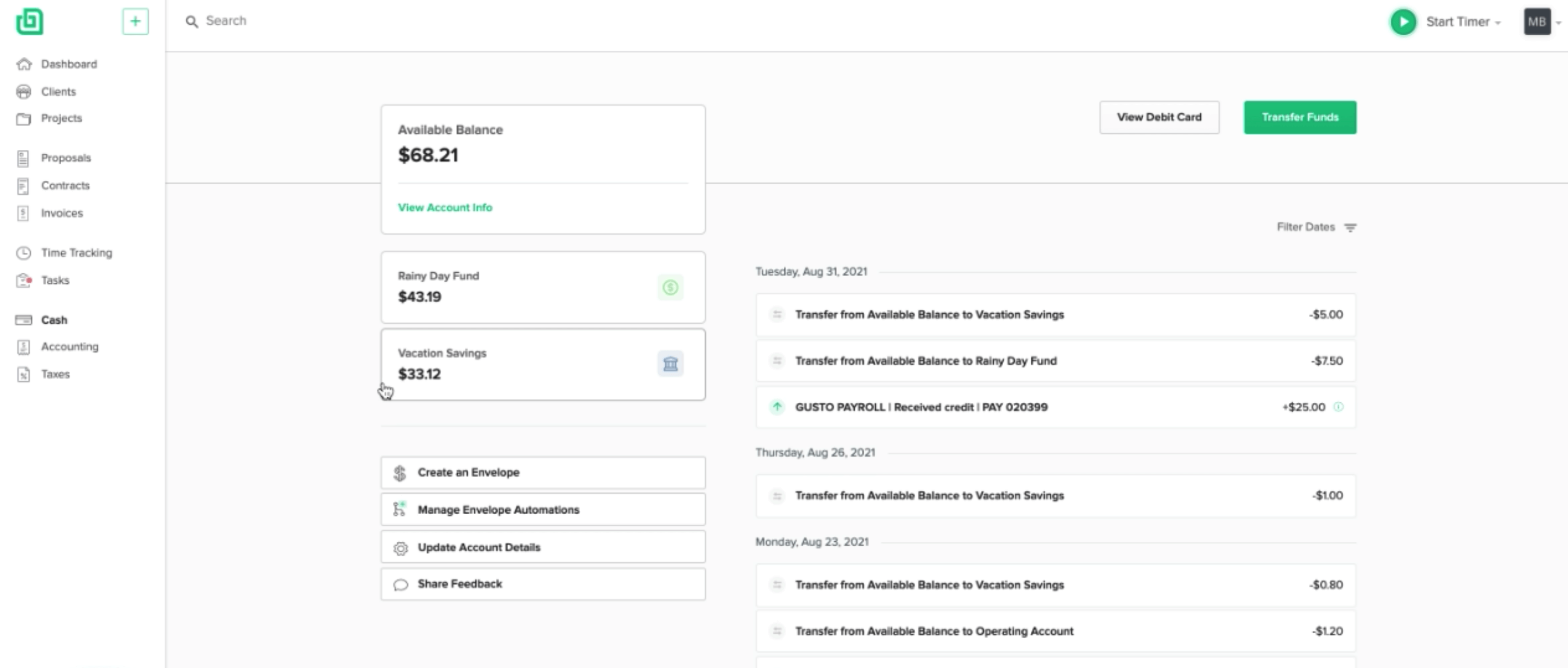

Bonsai's business account is an online business account checking account that is available whenever you are. Once you log on to the website, you’ll be presented with a series of straightforward onboarding questions designed to help you set up your account. Once you’re set up, you’ll have access to an account overview, self-directed “envelopes” you can create to fund specific expenses or goals, and the ability to create “if/then” rules to automate repetitive tasks.

Perhaps more importantly, you’ll be able to use a single platform through which you can receive and send payments and transfer funds, have access to a digital spending card, and get the benefits of merchant processing services including accepting payments via credit card.

Bonsai's business account Envelopes Are Built-In Business Saving Accounts

Bonsai's business account provides the ability to move your business funds into internal mini accounts known as “envelopes.” Envelopes are entirely customizable and are intended to be used for individual projects, tax accounts, and savings goals for which you can establish automations to ensure that every payment received in your account is processed using the rules you’ve established for disbursement. Without instructions the deposit will remain within your main checking account, but you can also create as many envelopes as you wish and have specific percentages of the deposit transferred from the main account into each.

Facilitate ACH Bank Transfers

In addition to receiving payments directly from clients, your LLC can transfer funds to and from your business checking account to external bank accounts via ACH bank transfer. You can use the same feature to send payments via other payment processing platforms, freelancing platforms, and applications.

Digital Debit Card

Bonsai's business account provides your LLC with access to a digital cash debit card that is securely activated online via two-factor authentication. Once stored in your digital wallet you will be able to use it for online purchases for all of your business expenses, as well as for ATM withdrawals. This is helpful for ensuring that recurring purchases exclusive to your operations - such as subscriptions – are paid from your business checking account rather than from your personal account. Though not yet available, physical cards will be distributed in the future.

Read here to discover how to get set up with Bonsai's business account.

Disadvantages of Opening a Business Bank Account for an LLC

While opening a separate business bank account for your LLC will provide you with legal documentation showing that your business is a separate entity from you as its owner, there are some potential pitfalls that are worth considering and guarding against.

Increased Vulnerability with Multiple Accounts

Though single member LLCs will not have this problem, the new bank account will be accessible to every stakeholder in businesses that are established as a limited partnership. This significantly eliminates control over spending and management and makes your business vulnerable to malfeasance. Fortunately, tools like Bonsai's business account help keep all transactions transparent so that you can remain informed and your financial status is highly visible.

Additional Fees Created by Having a Separate Account

Creating a legal wall between your own finances and your business finances is essential, but it can also be expensive and time consuming. Business bank accounts frequently have maintenance fees that can quickly add up. Some require that a monthly minimum balance be maintained, some charge monthly fees, and some charge based upon the number of transactions processed. Though bank service charges and credit card fees exclusive to your business can be written off, it is still good practice to be careful in your selection of the right bank in order to minimize this expense.