As a realtor, you must carefully pick the best tax software for real estate agents. Yes, even if you work in real estate, you still need to make your payments to the state.

After all, like every job, real estate might require some business expenses - for which you may be able to get a return on your taxes.

You just need to make the calculations using the right accounting software, and the information in this article will help you in this regard.

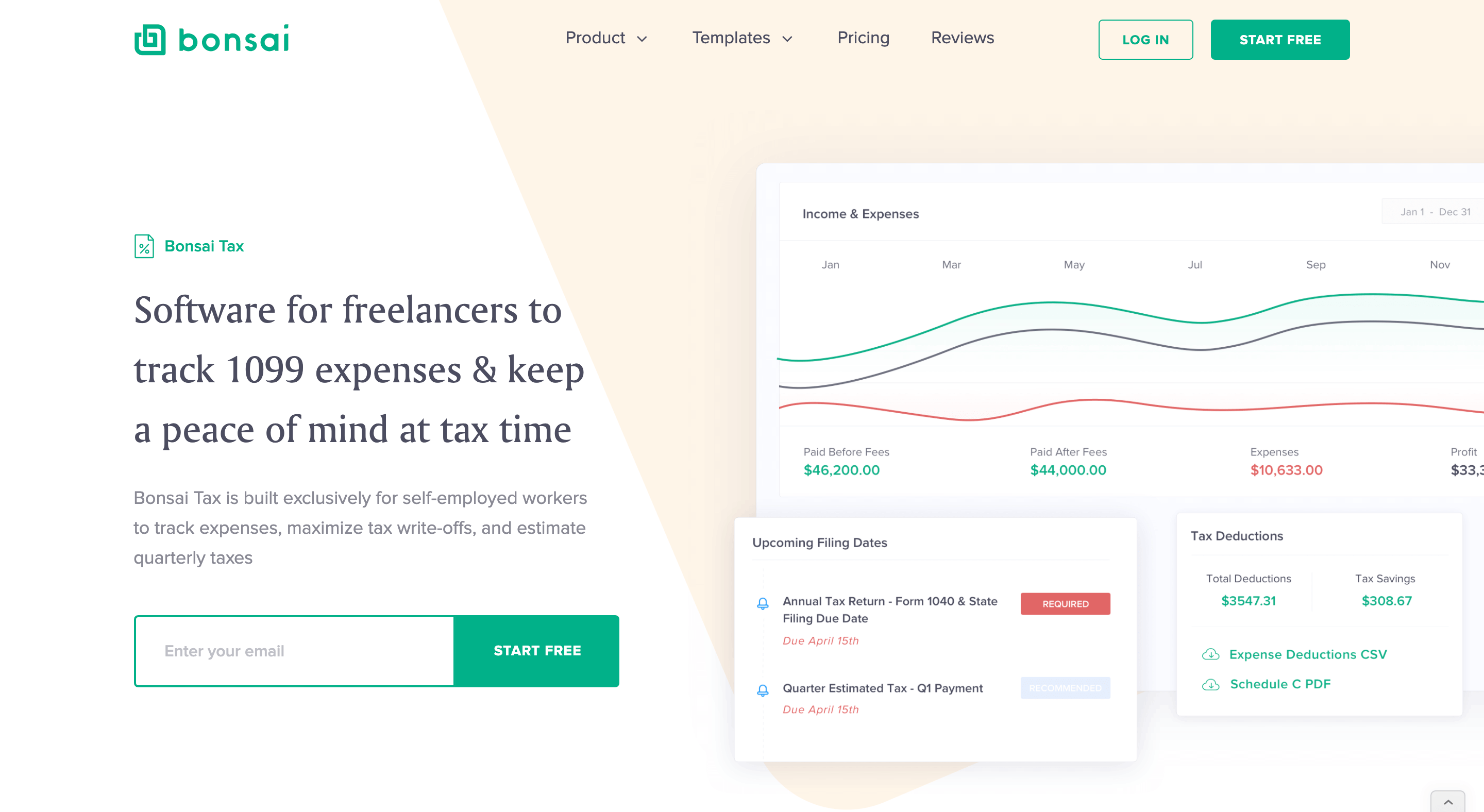

Note: if you want to save money on your taxes, try Bonsai Tax. Our tax software will scan your bank/credit card statements to discover potential deductions you can take advantage of and save you thousands of dollars. Real estate agents who use our software save, on average, $5,600. Claim your 7-day free trial here.

Broker Accounting Software vs. CRM

Real estate agents have two types of accounting software when it comes to keeping track of their small business expenses.

In many cases, the income and expenses can be tracked on both mobile apps and desktop platforms. The best software will have both, but you might still want to do a thorough check on its features.

Brokerage Accounting Software

Brokerage software is often available on both desktop platforms and mobile versions. In most cases, it is free of charge and requires a subscription-only when you want to get access to high-end features.

Generally, brokerage software includes accounting, compliance tracking, financial planning tools and commission management.

It is a good option for a small business that does not have a payroll, but it's also great for those who are looking to save money.

Here are some apps that a real estate small business often uses for its accounting and track record:

Bonsai

Bonsai is the best option for realtors to track their tax deductions. From advertising to mileage, phone, and desk fees, the app is popular as it removes the need for entries.

It simply needs to be connected to the credit card, and the data transfer is automated. Also, there are multiple free features that you can use (like their tax calculator for freelancers as well as their mileage template)

Note: If you want to track all your tax deductions and save thousands of dollars during tax time, try Bonsai Tax. Our app can automatically discover potential tax write-offs by scanning your credit card/bank receipts and record your deductions. Users typically save $5,600 by using our software. Try a 7-day free trial now.

BackAgent

Featuring brokerage intranet and transaction management, this accounting software can track all the expenses you make from your business credit card and more. The setup is free, but you'll have to pay different fees depending on the tools that you need.

BrokerMint

If you want some simple accounting software that won't take too much of your budget, you may use BrokerMint. It tracks your expenses in an easy manner, and it also features a user-friendly online platform.

BrokerWOLF

Also known as Lone Wolf Back Office, this accounting software is a good option to track your credit card transactions, license, trust accounts, payroll tools, and many more. Upon tax time, you will have all the data necessary to get your deductions.

Other options

Other good accounting software options are Brokersumo, Moxiworks, or Paperless Pipeline. The choice depends on your preferences, more often than not.

Platforms and CRMs

Platforms and CRMs are also good options to keep track of your transactions and commissions. CRMs also have accounting and management tools, so some of these pieces of software can actually help users in their deduction calculations.

Best Real Estate Accounting Software Features

When looking for real estate accounting software types, you might want to consider comparing multiple options first. Get the top three and compare their expense tracking feature with one another.

For instance, some pieces of software will allow you to handle your P&L (Profit and Loss Statement). Sometimes you may want to work with an accountant vs a tax software to help you.

This expense tracker enables you to save your receipts and justify your expenses in case the IRS gets curious about your work. Keeping track of these will avoid trouble.

If you have a larger operation - for example, one that involves teamwork, then you'll want to go for a slightly more sophisticated accounting program. The more features you can snatch, the better.

Features You Should Look For

Depending on what kind of realtor you are, you might not need all the features that the accounting software might put on your plate. Still, here are some of the features that you must look for:

- W2 Payroll

- Tax Preparation

- Invoicing

- Cloud-Based vs. Offline

- Easy-Exported Data

Other than that, search for features that you believe would help your real estate business the most. Some may even be given for free. Nevertheless, make sure the above-mentioned ones are part of the package.

How Much Should a Real Estate Agent Save for Taxes?

Realtors should pay the current self-employment tax rate alongside their taxes for income and expenses.

At the moment, the self-employment IRS rate is a total of 15.3%. From that amount, 12.4% goes to social security, whereas the rest of 2.9% goes into Medicare.

The above only applies to income that goes as high as $128,400. If the income goes above that amount, then you'll still have to pay that amount for Medicare, then you won't need to input that extra amount for social security.

Adding the self-employment payment together with your income taxes, it's safe to assume that you should put aside around 30% of your income for taxes (although the amount may vary from state to state). Make sure you familiarize yourself with your region's law.

How Do Real Estate Agents Do Taxes?

Realtors are usually independent contractors, which means that their payment is not withheld automatically by the broker they are collaborating with.

When tax season turns a corner, they will have to handle their payments just like a self-employed person would.

What Form Should They Use?

All real estate agents that make more than $600 per year need to handle their expenses just like any other person would have to. Use the accounting software to keep track of your receipts, and when the year comes to an end, you have to file for returns to the IRS.

This can be done by using form 1099-MISC. You can send the file to the IRS, along with a copy of the form to the agent you are working with.

You may also allow the IRS to calculate the taxes for you, but the accounting software of your choice should help you in this regard.

What Expenses Can Real Estate Agents Claim?

When you work in real estate, there are several tax deductions that you may claim. These are:

Paid Commissions

It might seem like a surprise for you, but if you pay commissions to another business that is working with or for you, then you may get a deduction for those commissions. Keep track of each commission cost in your QuickBooks and get your returns on tax time.

Desk Fees

You may be working as an independent broker, or you may be collaborating with a franchise. No matter the case, you are eligible for deducting your desk fees. Just bear in mind that you won't be able to deduct fees for home offices.

Home Office

As a self-employed person, you will likely have to conduct a part of your business at home - and to be able to deduct those business expenses, you'll need to have an actual office in your house. And unless you are deducting desk fees, you are more than likely eligible to claim home office deduction.

Track your write-offs using Bonsai's free home office excel sheet.

Bear in mind that for these deductions to apply during tax time, the office must be used exclusively for work purposes. This means you won't be able to deduct a bed or a kitchen table as a business expense.

Education and Training

The industry changes at a very rapid rate, which is why self-improvement is often necessary.

If you are taking training or education to remain competitive, you may be able to deduct the payment. The condition is that the courses must be used only for that business or trade.

Advertising and Marketing

Marketing and advertising are far from free, but you may deduct them as well. As long as you take advantage of a tracking app, you may get your tax money back.

Equipment and Office Supplies

You may be working with your clients on the field, but that does not mean you won't have to pay for office supplies. Every real estate agent will handle paperwork.

To make things easier, make the purchases using a business credit card. After that, connect the card to the accounting software. You can either use one of the above, or you may find other free options on your app store.

Other Expenses

Besides the expenses above, you can also claim tax deductions on:

Meals

As long as the meals are for business purposes, you may deduct them as a business-related expense. You may not be able to eat for free, but you should at least be able to get 50% off.

Business Tools and Software

Ironically, if the business tool or software you use is not free, then you may be able to claim deductions from it. You should try to claim these costs, as software is essential in tracking the expenses. But you can claim a deduction for software that is paid.

Insurance

Many real estate agents invest a lot of money every year in insurance. Luckily for them, this can be deducted as well. Unlike meals, insurance is fully deductible.

Can Real Estate Agents Write Off Car Payments?

As a broker, you may be able to write off some of your car payments. While you may not be able to write off the full costs of buying a car, you may write off other expenses that benefit the business. This may include mileage, car washes, repairs, and so on.

The Bottom Line

Accounting software can offer you a lot of support if you work in real estate. And the best part is that even if the program is not completely free, you may deduct it as well. Just make sure to track your expenses accordingly and file for your returns by the end of the tax year.