The IRS has resurrected the 1099-NEC form, making big changes to Form 1099-MISC. The new 1099-NEC form will be used for reporting non-employee compensation (NEC) payments beginning with the 2020 tax year, and payments that previously belonged in Box 7 of Form 1099-MISC, Miscellaneous Income, will now be shown on Line 1 of Form 1099-NEC.

This may appear to be a major change at first sight, but ultimately, the tax implications are the same. This blog post will look into the changes made on IRS Form 1099-MISC, and what you need to know about the new Form 1099-NEC.

Let's get started.

Note: If you need help managing your 1099 taxes (and recording all of your business receipts), try Bonsai Tax. Our app sends filing reminders, estimates taxes, and records all of your write-offs for you at the push of a button. In fact, our automatic expense tracker saves users on average, $5,600 from their tax bill every year. Try a 7-day free trial today.

Form 1099-MISC Box 7: What has changed?

Form 1099-MISC helps in reporting miscellaneous income such as:

- Rent

- Attorney fees

- Prizes and awards

- Healthcare payments

Previously, box 7 on the 1099-MISC was utilized to record non-employee compensation. It helped in reporting all types of compensation that independent contractors received -- from awards, commissions, to fees.

Independent contractors who provided services but were not considered employees of the payer received a Form 1099-MISC rather than a W-2 form. But that has since changed. Such information now belongs on Form 1099-NEC.

So, for freelancers who typically receive 1099-MISC forms with information in box 7, they'll now get the 1099-NEC instead.

Box 7 on 1099-MISC now helps in recording direct sales of $5000 or more. These sales need to be of consumer goods to a client on a buy-sell, deposit-commission, or other commission bases for resale outside of a permanent retail location.

This mostly applies to multi-level marketing companies. Multi-level marketing (MLM) firms generally sell products to their sellers at a wholesale rate and may give incentives, commissions, or rewards to the sellers.

These companies will now have to mark the checkbox on box 7 with an X -- the part written: "payer made direct sales". They'll also need to provide a Form 1099-NEC to their sellers.

Note that the due date for 1099-NEC is Feb. 1 to both the IRS and recipients. For IRS e-filing, the new 1099-MISC due date was pushed back to March 31, because it no longer includes Box 7.

What if you want to correct Box 7 details on an old 1099-MISC?

If you've entered an incorrect Box 7 amount on a Form 1099-MISC that was filed earlier than 2019, you don't have to worry. According to the IRS, changes to 1099-MISC box 7 for tax years 2019 and prior will remain on the old 1099-MISC form.

Why did the IRS bring back Form 1099 NEC?

The IRS has revived Form 1099-NEC, which was retired back in 1982, to address the confusion caused by the PATH act. The PATH (Protecting Americans from Tax Hikes) Act of 2015 was confusing to many small-business owners and tax professionals as it created different due dates for the various types of income reported on the 1099-MISC. As a result, taxpayers often received undeserved penalty charges.

Prior to the 2015 PATH Act, taxpayers had until February 28 of each year to submit one Form 1099-MISC for non-employee compensation and other payments. The due date for submitting a Form 1099-MISC was changed by the PATH Act from February 28 to January 31 for reporting non-employee compensation.

On top of the confusion, this change also resulted in the IRS mistakenly considering forms received after January 31 as late returns.

The change also helped the IRS to combat fraud. Taxpayers were claiming small amounts of non-employee compensation but hefty amounts of withholding. The IRS found it very difficult to verify recipient statements with the payer copies of Form 1099-MISC.

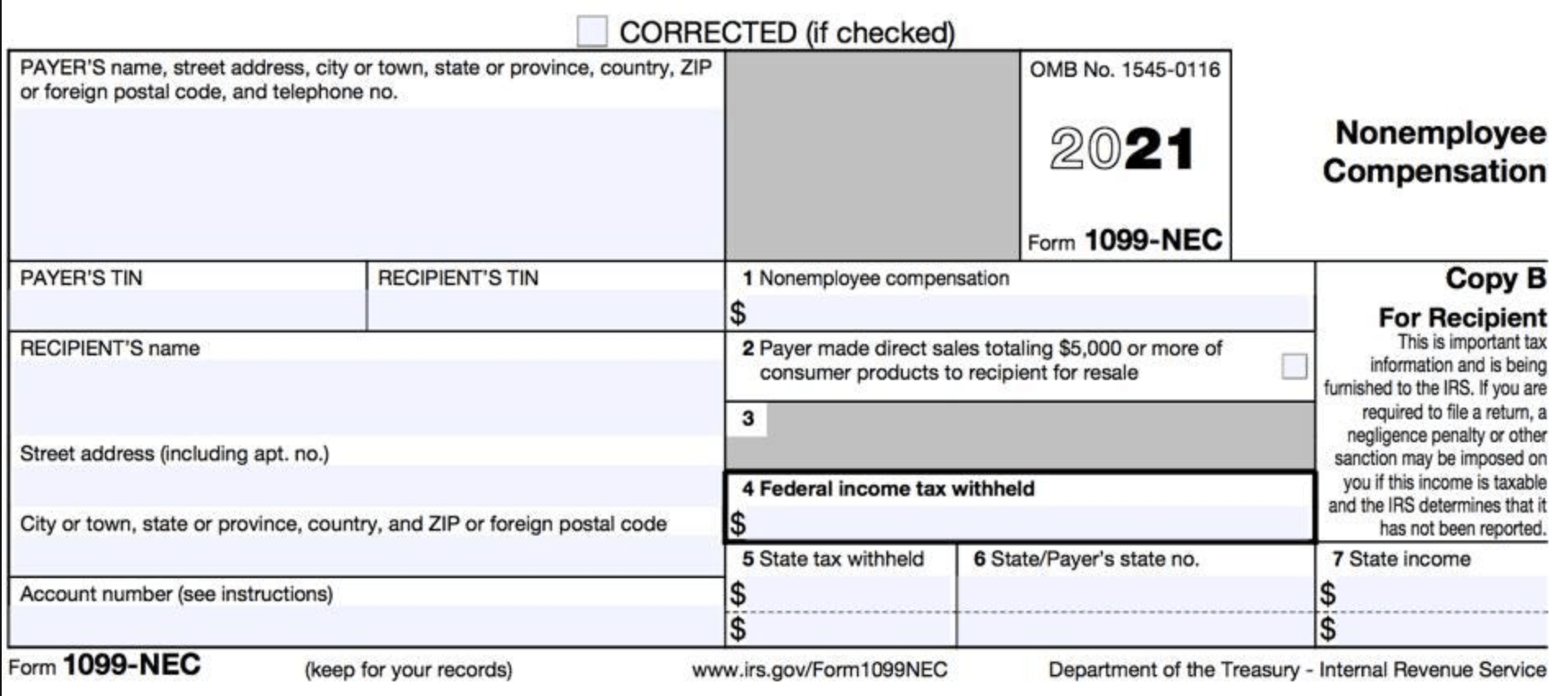

What is reported on IRS Form 1099-NEC?

The form is used to report the non-employee compensation (NEC) paid by a business. This includes things like fees, commissions, or reimbursements for expenses that you don't need to pay tax on because of your profession.

For example, if you're an attorney and your law firm pays you $1,000 as reimbursement for an expense you incurred as part of your job, that amount is reported on Form 1099-NEC. Earned income such as wages and tips are not reported on this form; those go on Form W-2.

Who needs to use IRS Form 1099-NEC?

You need to file the 1099-NEC form if you're a business that paid someone over $600 via non-employee compensation during the year. This includes independent contractors, lawyers, accountants, etc.; basically, anyone who provides services for your company but is not an employee.

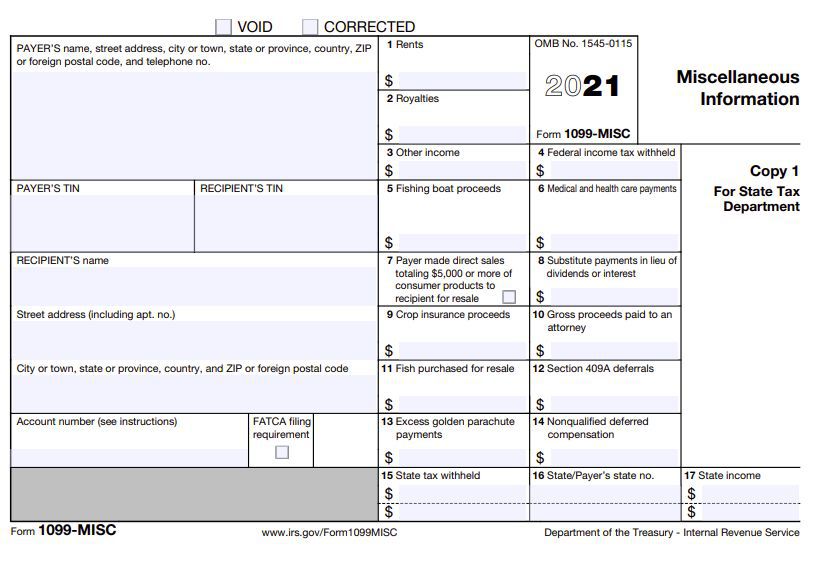

What are the other changes on 1099-MISC?

Because of the introduction of Form 1099-NEC, Form 1099-MISC has been revised, with box numbers rearranged as follows:

- Crop insurance payments are recorded in box 9

- Attorney's gross earnings are shown in box 10.

- Box 12 records deferrals under Section 409A,

- Non-qualified deferred compensation income is recorded in box 14

- State tax amounts withheld, state identification numbers, and amount of money earned in the state go into boxes 15, 16, and 17, respectively.

Do You Have to file Form 1099-NEC directly with your state?

The IRS has integrated Form 1099-NEC into its Combined Federal State Filing (CF/SF) program, which was announced with the release of Publication 1220 for the tax year 2021.

This program is designed to alleviate the stress of filing 1099s directly with states since the IRS transmits federal 1099s to participating state agencies. At present, 36 states and the District of Columbia are still working under their own direct reporting requirements for the 1099-NEC that are not met by the combined federal/state filing.

That said, It's important to double-check your state's rules if you're submitting Form 1099-NEC. If the state filing requirements are not followed, most states may impose punitive fines and interest.