If you have a business that generates cash inflows/outflows (income and expenses) you should definitely consider a decent way to manage your accounts. There are many accounting software options that are available on the web. However, most of these are often expensive and quite complex, especially for small businesses that don't require extensive features and customization.

This article will inform you about excel templates and how to leverage them to meet your accounting needs. We'll discuss a variety of topics on the matter so you can gain a better understanding of your business. We'll answer the following questions.

- What exactly is an Excel bookkeeping template?

- Can Excel be optimized for bookkeeping?

- How to create an accounting system in Excel?

- What are some reasons to use Excel for bookkeeping?

- How would a sample bookkeeping template look in Excel?

- What are some pros and cons of Excel bookkeeping templates?

- What is a great place to find Excel bookkeeping templates for my needs?

What is an Excel bookkeeping template?

Microsoft Excel is an incredibly versatile tool used to solve various business problems. From providing a convenient way to store information to help manage employee information. MS Excel also has the ability to create accounting templates for bookkeeping.

An Excel accounting template is a pre-designed Excel spreadsheet created to help individuals and businesses organize their financial information. It contains various built-in formulas, charts, and tables. These automate financial calculations and streamline the accounting process.

Accounting templates can be customized to suit the user's specific needs. These include tracking income and expenses, managing invoices and payments, or preparing financial statements. This versatility means that a company can save time. Also, it enables firms to quicken the processes by choosing a template that suits their business needs.

Small businesses, freelancers, or individuals can use Excel accounting templates to manage their financial records. The templates are easy to use and can be modified to reflect the unique requirements of each user.

Some templates come with pre-defined categories, while others allow the user to create their own categories. Categories should obviously differ between small businesses and large businesses. Furthermore, service-providing firms have different bookkeeping considerations than product firms.

An accounting template typically contains several sheets, including a balance sheet, income statement, and cash flow statement. The balance sheet summarizes a business's assets, liabilities, and equity at a given time.

The income statement shows the revenue and expenses of the business over a specified period. The cash flow statement tracks the inflow and outflow of cash over a period, providing insight into a company's liquidity.

Other features of an accounting template may include a general ledger, accounts receivable and payable, and inventory management. These features help users to keep track of transactions, manage customer and vendor accounts, and monitor inventory levels.

Is Excel good for bookkeeping?

Excel can be a useful tool for bookkeeping. This is especially so for small businesses or individuals with basic accounting needs. Excel is readily available and easy to use. It can also be customized to suit the unique requirements of each user.

It also provides flexibility in terms of data entry and analysis, allowing users to organize and analyze financial data in a way that works best for them. Excel also allows users to create charts and graphs to visualize financial data. This makes it easier to interpret and analyze data.

Moreover, Excel can help users to track income and expenses, manage invoices and payments, and create financial statements. It has built-in formulas and functions to automate calculations, saving time and reducing errors. However, one of the key things excel lacks is the ability to automate expense tracking. keep this thought in mind as you continue to read on.

Should I switch from Excel to bookkeeping software?

HAs the size and complexity of a business's financial data increase, Excel may become less effective as a bookkeeping tool. Manual data entry can be time-consuming. Moreover, as data grows, it becomes harder to maintain data integrity.

Additionally, Excel does not have the advanced features of specialized accounting software. For example, it lacks automated bank feeds and integrations with other financial systems. For larger firms, such requirements are necessary as they must engage several clients and perform many transactions simultaneously.

Accounting software, on the other hand, is designed specifically for bookkeeping and provides more advanced features than Excel. It automates much of the data entry and processing, reducing the risk of errors and ensuring accuracy.

Accounting software also has more robust reporting capabilities and can generate financial statements quickly and easily. That's because Excel, by design, is extremely versatile. In addition, accounting software is optimized for bookkeeping processes only.

Ultimately, while Excel can be a useful tool for bookkeeping, it has its limitations. Accounting software is a better option for businesses with more complex financial data. In addition, accounting software provides more advanced features and automation, reducing the risk of errors and improving the accuracy and efficiency of financial management.

Creating an accounting system in Excel step-by-step

Creating an accounting system in Excel is quite a straightforward process. All you have to do is follow the steps below, and you're good to go.

1. Set up a chart of accounts

A list of all the accounts that are used to record financial transactions is called a chart of accounts. Create a new worksheet in Excel and list all the accounts you will use to track your financial transactions. These can include cash, accounts receivable, accounts payable, and expenses. Be sure to include the factors that are relevant to your needs.

2. Create a journal entry template

A journal entry is the first step in recording financial transactions. Create a journal entry template that includes fields for the date, account name, transaction type (debit or credit), and amount. You can also include additional fields to provide more detail about the transaction. Finally, add the details to the columns. You can also add drop-down lists to make it more efficient.

3. Record transactions

Use the journal entry template to record all financial transactions. Enter the date, account name, transaction type, and amount for each transaction. Then, use formulas to calculate the totals for each account automatically. The formulas should be in place before you start recording data to help you save time for data analysis. This list can be useful for any bookkeeper.

4. Create a trial balance

A trial balance is a list of all the accounts and their balances. First, create a trial balance by listing all the accounts and their balances. Then, use Excel formulas to calculate the total debits and credits automatically. A trial balance is essential to developing financial statements for your business.

5. Prepare financial statements

Financial statements summarize the financial activity of a business over a specific period. First, use the trial balance to create financial statements, including income and balance sheets. Then, use Excel formulas to calculate the totals for each statement automatically. This will bring you the information you would need to conduct an analysis.

6. Analyze financial data

Once you have recorded and summarized your financial data, you can use Excel to analyze the data. Use Excel charts and graphs to visualize the financial data and identify trends or areas that require attention.

7. Keep practicing

By following the above steps, you can create an accounting system that tracks your financial transactions and summarizes your financial data. It may also provide insight into the financial situation of your business. Keep practicing and making templates for different departments and goals. You'll master it in no time.

Why use an Excel template for bookkeeping?

There are several reasons why using an Excel template for accounting can be a great initial decision for your businesses:

1. Excel offers a great deal of customization to suit a variety of needs

Excel template for accounting is that it can be customized to suit the specific needs of your business. This is a major reason why so many businesses and individuals continue using it. For example, you can create a template that includes all the accounts and categories that are relevant to your business, as well as any other fields or formulas that you require.

2. Excel is comparatively much more cost-effective than most alternatives

Excel templates for accounting are typically more cost-effective than using dedicated accounting software. Moreover, Excel is widely available, and most businesses already have access to it, so there are no additional costs for software licenses or upgrades.

3. Excel is quite easy to use

Excel is a user-friendly tool that is easy to use and navigate. Even if you're not trained in accounting, you can learn how to use it and prepare your own financial statements. In addition, excel templates provide a clear and organized framework for entering financial data, which can help to reduce errors and ensure accuracy.

4. Excel provides a lot of flexibility

You can easily modify and update Excel templates to reflect changes in your business. For example, if you add a new account or category, you can simply update the template to include this information. This flexibility allows businesses to adapt to changing financial circumstances and maintain accurate records.

5. Excel is compatible with a variety of devices and systems

Excel is a widely used tool. This means that it is compatible with many other software applications. This makes it easy to import and export financial data from other systems, such as banking or tax preparation software.

6. Excel is advantageous in analysis and reporting

Excel templates can help generate reports and perform financial analyses with great efficiency. In addition, Excel's powerful charting and graphing tools allow you to visualize financial data and identify areas that require attention.

However, it's important to note that Excel templates have their limitations and are not a substitute for dedicated accounting software in more complex or larger businesses that require more robust features such as audit trails, user permissions, and automated financial statements.

Some examples of Excel bookkeeping templates

Excel is used all over the world in various industries. As such, there are different templates for different requirements. For example, excel has virtually any bookkeeping template you would want. These include a general ledger, an income statement, a balance sheet, a cash flow statement, and so much more.

A general ledger template on Excel

You can use Excel to develop a general ledger. It is a simple and cost-effective way to manage their financial records. A general ledger is a record-keeping system that tracks all financial transactions for a business. These include revenue, expenses, assets, liabilities, and equity.

Using Excel as a general ledger, you can create a worksheet with columns for each account and corresponding debit and credit columns. Each financial transaction is recorded in the worksheet, and the amount is entered in the appropriate debit or credit column.

Excel's formula capabilities can automatically calculate account balances, total debits and credits, and other financial metrics. In addition, conditional formatting and data validation options can help ensure that the data entered into the worksheet is accurate and consistent.

An income statement template in Excel

Small businesses and individuals can use Excel to prepare income statements. It provides a simple way to track their revenue and expenses. An income statement is a financial statement that depicts a company's revenues and expenses over a particular time period.

You can use a standard format to create an income statement in Excel. It should include separate columns for revenue, cost of goods sold, gross profit, operating expenses, and net profit. Each revenue and expense item is listed under the appropriate column, with the corresponding amount entered in the adjacent cell.

Excel can automatically calculate subtotals and totals for each column. From there, you can calculate gross, operating, and net profits. In addition, conditional formatting can help highlight negative numbers or other key information in the income statement.

A balance sheet template in Excel

Excel is a powerful tool that can create balance sheets for businesses requiring speed and efficiency. A balance sheet is a financial statement that displays a company's financial position at a particular point in time. It lists a company's assets, liabilities, and equity.

To create a balance sheet in Excel, the first step is to organize the data. Assets should be listed on the left side of the sheet. In contrast, liabilities and equity should be listed on the right side. The total assets should always equal the total liabilities and equity.

Calculate the totals for each section of the balance sheet with Excel formulas. Furthermore, they can also calculate ratios such as the debt-to-equity ratio or the current ratio.

It is important to ensure that the balance sheet is accurate and up-to-date, as it is a crucial tool for evaluating a company's financial health. Regularly updating and reviewing the balance sheet can help identify potential financial issues and allow for informed decision-making.

Excel also provides the ability to create graphs and charts from the balance sheet data, making it easier to visualize and analyze financial information. Using Excel as a balance sheet can provide a simple and effective way to track a company's financial position.

A cash flow statement template in Excel

Excel can be a valuable tool for creating and analyzing cash flow statements. These financial statements show the inflows and outflows of cash for a company over a specific period. A cash flow statement is divided into three sections: operating activities, investing activities, and financing activities.

The operating activities section includes cash inflows and outflows. These are generally related to the company's core business operations, such as revenue and expenses.

The investing activities section includes cash inflows and outflows. They are related to the company's investments, such as buying or selling property, plant, and equipment.

The financing activities section includes cash inflows and outflows. These are related to the company's financing, such as issuing or repaying debt or paying dividends to shareholders.

Excel formulas can calculate the net cash flow for each section and the overall net cash flow for the period. In addition, these formulas can also calculate important metrics such as free cash flow and cash conversion cycle.

Creating a cash flow statement in Excel can provide a clear and concise understanding of a company's cash flow over time. This information can identify potential financial issues and make informed decisions about future investments and financing activities.

Pros and cons of using Excel bookkeeping templates

Excel, while a convenient and versatile tool, is not perfect. While it opens many doors for small businesses to manage their books, the limitations might hold others down. Here are some pros and cons of using Excel accounting templates so you can make up your own mind.

The pros of excel bookkeeping templates

Using Excel accounting templates can provide many advantages for businesses of all sizes. Here are some of the pros of using Excel accounting templates:

1. Efficiency

By automating many routine accounting tasks, Excel accounting templates can save time and increase efficiency. For example, with pre-built templates, businesses can easily track expenses, generate invoices, and manage financial records without having to input data each time manually.

2. Cost-effectiveness

Excel accounting templates are often more cost-effective than accounting software or hiring an accountant. In addition, templates are typically available for free or at a low cost, making them a great option for small businesses with limited budgets.

3. Customizability

Excel accounting templates are customized to meet the specific needs of a business. For example, templates are modified to track specific expenses or create reports tailored to a business's unique financial situation.

4. Accessibility

Excel is a widely-used program that is accessible to many people. Templates can be easily shared among team members or with clients, making collaborating and sharing financial information easier.

5. Accuracy

Excel accounting templates can help reduce errors and improve accuracy in financial record-keeping. Templates can be set up to automatically calculate totals and generate reports, reducing the risk of human error.

6. Scalability

Excel accounting templates can grow with a business, providing flexibility as the business expands. In addition, templates are easily modified or replaced as the needs of the business change over time.

7. Versatility

Excel accounting templates are used for a variety of accounting tasks, including budgeting, forecasting, and financial analysis. This versatility makes them a valuable tool for businesses of all sizes and industries.

The cons of Excel bookkeeping templates

While there are many benefits to using Excel accounting templates, there are also some potential drawbacks to consider. Here are some of the cons of using Excel accounting templates:

1. Limited features

While Excel accounting templates can be customized to some extent, they have limited features compared to dedicated accounting software. This may make it difficult to perform complex accounting tasks or generate detailed financial reports.

2. Susceptible to errors

While Excel accounting templates can reduce the risk of human error, they are still susceptible to problems. For example, suppose data is entered incorrectly, or formulas are not set up correctly. In that case, the result will likely be wrong as well. This can lead to inaccurate financial records and potential legal or financial issues.

3. Security risks

Excel accounting templates can pose security risks. For example, a business can face significant damage if sensitive financial data is stored on an unsecured computer or shared with unauthorized individuals. This can lead to data breaches or theft of financial information.

4. Potential obsolescence

Companies can become so complex that Excel's functions simply aren't viable for them anymore. Eventually, Excel may not be relevant for larger businesses. As the business grows, it may need to switch to more sophisticated accounting software.

5. Dependency on Excel

Businesses can become overly reliant on Excel if they have been using it for a very long time. In addition, it may limit the business's ability to switch to other accounting software. Furthermore, it can pressure the accounting department more as they rely on older tools and systems to analyze recent data.

6. Lack of support

Unlike dedicated accounting software, Excel accounting templates may not come with technical support or customer service. This can make troubleshooting issues difficult or getting help if something goes wrong.

7. Limited collaboration

Excel accounting templates can be shared among team members easily. However, they may not facilitate collaboration as much. Dedicated accounting software can have potential for teamwork, however. This can make it difficult to work on accounting tasks as a team on Excel.

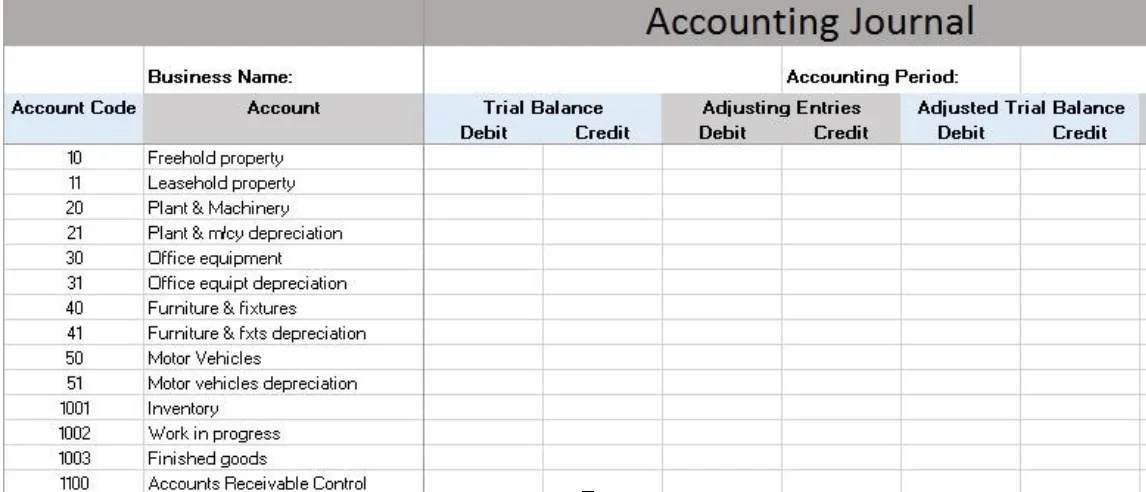

Consider this sample below to give you a brief idea of what you'll see. Accounting templates in Excel will generally follow a similar look and approach.

Conclusion

In conclusion, using Excel accounting templates can provide several benefits for businesses looking to streamline their financial record-keeping. These templates can help save time, increase efficiency, reduce errors, and provide customizable financial reporting.

However, businesses should also be aware of some potential limitations and drawbacks. For example, limited features, susceptibility to errors, and security risks. These can make the company suffer in the long run, hindering growth.

Despite these potential drawbacks, Excel accounting templates can be a cost-effective and accessible option for small businesses with limited budgets. In addition, you can share these templates among team members or with clients. This will make collaborating and sharing financial information easier.

Whether using Excel accounting templates or dedicated accounting software, businesses need to maintain accurate and up-to-date financial records. Doing so can help businesses make informed decisions about their finances, plan for the future, and avoid potential legal or financial issues.

If you want the best leap forward for your business, then Bonsai can help. They provide tailor-made accounting and bookkeeping templates to start you off on the right path. Signup for a free 7-day trial and gain access to all of Bonsai's accounting practice management software.