Wenn Sie nach einer Alternative zu QuickBooks Self-Employed suchen, sehen Sie sich unsere Top 8 für 2026 an. Diese Alternativen bieten Funktionen wie Rechnungsstellung, Zeiterfassung und Projektmanagement, die speziell auf Freiberufler und Kleinunternehmer zugeschnitten sind. Ziehen Sie Optionen wie Bonsai Tax in Betracht, mit denen Sie Zeit und Geld sparen können, oder FreshBooks, das für seine benutzerfreundliche Oberfläche und umfassenden Buchhaltungstools bekannt ist. Jede Alternative wird anhand von Preis, Funktionen und Nutzerbewertungen bewertet, damit Sie die für Ihre Bedürfnisse am besten geeignete Lösung finden. Der Übergang zu einer neuen Plattform kann Ihr Finanzmanagement verbessern und Ihre Geschäftsabläufe optimieren.

Viele Freiberufler und andere Selbstständige werden sich zunehmend bewusst, dass sie Unterstützung benötigen, um ihre Geschäfte reibungslos zu führen und ihr finanzielles Potenzial voll auszuschöpfen. Eine hilfreiche Unterstützung, wie beispielsweise Buchhaltungs- und Buchhaltungssoftware für kleine Unternehmen, vereinfacht, organisiert und rationalisiert diese Aufgaben.

Die Desktop-Unternehmenssoftware QuickBooks ist eine der ältesten und bekanntesten Marken und wurde daher für viele Freiberufler zur ersten Online-Buchhaltungssoftware. Einige fanden schließlich Gefallen daran und blieben dabei. Andere hingegen stellten fest, dass die Funktionen von QuickBooks entweder zu unflexibel oder einfach nicht für ihre speziellen Anforderungen geeignet sind, und begannen, nach einer „ähnlichen, aber doch anderen“ Lösung zu suchen.

Wenn Sie nach Alternativen zu Ihrem „QuickBooks Self-Employed”-Abonnement suchen, lesen Sie weiter, um zu erfahren, wie andere Top-Marken im Vergleich zur Konkurrenz abschneiden.

Hinweis: Wenn Sie die bestbewertete Alternative zu QuickBooks Self-Employed ausprobieren möchten, testen Sie Bonsai Tax. Unsere Software spart Nutzern in der Regel 5.600 Dollar an Steuern, indem sie ihre Steuerabzüge automatisch erfasst und nachverfolgt. Probieren Sie eine 7-tägige kostenlose Testversion.

Die besten QuickBooks-Alternativen für Freiberufler & Kleine Unternehmen

Hier sind einige Online-Alternativen zu QuickBooks , die ebenfalls Softwarelösungen für unabhängige Auftragnehmer anbieten, beginnend mit der führenden Produktsuite für Freiberufler.

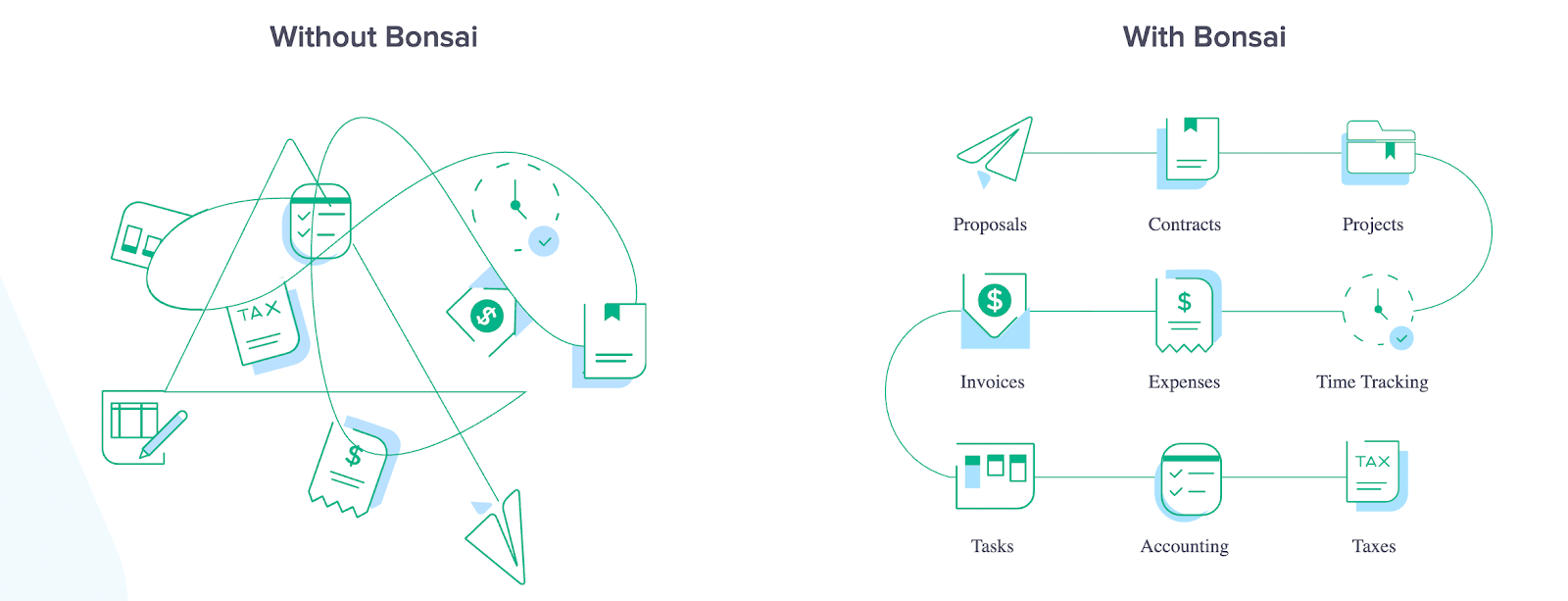

1. Bonsai: Das insgesamt beste digitale Produkt für Freiberufler

Bonsai ist das beliebteste digitale Business-Tool/die beliebteste digitale Business-Lösung unter Freiberuflern und die erste Wahl für die CRM- und Buchhaltungsanforderungen unabhängiger Auftragnehmer. Es ist als One-Stop-Shop-Software/digitaler Raum für alle Geschäftsabläufe unabhängiger Auftragnehmer konzipiert.

Die Software bietet ein sicheres, cloudbasiertes Online-Konto, über das vielbeschäftigte Freiberufler alle Anforderungen in Bezug auf Fach-, Verwaltungs- und Buchhaltungssoftware über eine einzige, äußerst benutzerfreundliche Oberfläche erfüllen können. Darüber hinaus bietet es eine Vielzahl weiterer unverzichtbarer Funktionen für Selbstständige, darunter vielseitige Angebots- und Vertragsvorlagen für unbegrenzte Rechnungen, Zeiterfassung, Projektmanagement und andere CRM-Tools (Customer Relationship Management).

Melden Sie sich jetztan und genießen Sie die 7-tägige kostenlose Testversion von „ “!

Bonsai All-In-One Freelancer Produktplattform Funktionen

- Zeit- und Projektmanagement-Tools: Bonsai hilft Ihnen dabei, den Überblick über abrechnungsfähige Stunden und die zahlreichen Aufgaben zu behalten, die Sie gleichzeitig bewältigen müssen.

- Anpassbare Vorlagen für Angebote, Verträge, Rechnungen usw. Bonsai bietet zahlreiche Vorlagen für alle administrativen Aufgaben, die Kommunikation, individuelle Rechnungen und andere Vertragsunterlagen von Freiberuflern, aus denen Sie auswählen und die Sie anpassen können.

- Die Funktionen sind miteinander integriert: Die persönlichen und geschäftlichen Informationen, die Sie in das System eingeben, sowie die Rechnungen/Verträge/Angebote, die Sie in Ihrem Konto erstellen, können mit anderen Projekten und Aufgaben sowie Zeiterfassungsfunktionen integriert und in Echtzeit mit Ihren Mitarbeitern geteilt werden.

Die Bonsai-App für Steuerbuchhaltung und Buchhaltung – Funktionen für Freiberufler

Für 10 US-Dollar pro Monat können Sie die Anwendung „Bonsai Tax“ zu Ihrer Bonsai-All-in-One-Suite hinzufügen und die folgenden integrierten Funktionen nutzen:

- Einkommen verfolgen (ohne Vorlage für Hauptbuch)

- Verfolgen, organisieren und sortieren Sie Ihre Geschäftsausgaben (dies ist für zukünftige Steuerabzüge erforderlich!).

- Bankkonten-/Kreditkartendaten werden in Echtzeit automatisch importiert.

- Die beste App zum Scannen von Belegen, um Ausgaben zu verfolgen, die nicht über Kreditkarten/Bankkonten abgewickelt werden.

- Finanzberichte auf Abruf („Gewinn und Verlust“) für die laufende Budgetüberwachung

- Die vierteljährlichen Steuerschätzungen werden auf der Grundlage der gemeldeten Einnahmen und Ausgaben erstellt (damit Sie niemals unterschätzen, wie viel Steuern Sie dem Finanzamt schulden!).

- Jährliche Unterstützung beim Ausfüllen und Einreichen von Steuererklärungen (alle zuvor eingegebenen Daten werden automatisch in die Steuerformulare importiert)

Die Bonsai-App Unterstützende Funktionen

Die Bonsai CRM-/Buchhaltungs-/Buchführungssoftware ist sehr benutzerfreundlich und bietet folgende Garantien:

- Hervorragender Kundensupport: Der Kundenservice von Bonsai ist per Telefon und E-Mail erreichbar. Außerdem stehen zahlenden Kunden eine umfangreicheOnline-Hilfeseite und ein Online-Chat-Support zur Verfügung.

- 100 % Genauigkeitsgarantie: Schlafen Sie ruhiger, weil Sie wissen, dass Ihre Steuerberechnungen stimmen. Keine Spekulationen und keine Notwendigkeit, eine manuelle Vorlage zur Erfassung von Ausgaben zu verwenden.

- Cloud-basierte App: Sie müssen nichts auf Ihr Gerät herunterladen: Solange Sie über eine Internetverbindung verfügen, können Sie auf Ihr Bonsai-Onlinekonto zugreifen.

- Befreien Sie sich von Papierkram: Da Sie alle Ihre Belege für Steuern, wiederkehrende Rechnungen und andere Unterlagen in einem sicheren digitalen Cloud-Konto speichern können, können Sie die altmodische Methode mit Stift und Papier abschaffen und alle diese Papierausdrucke in den Papierkorb werfen.

- Verwenden Sie es auf jedem Gerät: Bonsai ist als Computersoftware für Mac und PC sowie als mobile Buchhaltungs-App für Android- und iOS-Smartphones verfügbar.

- Mit kostenloser Testversion: Wenn Sie sich nicht sicher sind, ob das Bonsai Freelance Toolkit Ihren Anforderungen und Ihrer Benutzererfahrung entspricht, können Sie es zwei Wochen lang (14 Tage) kostenlos testen, um sich selbst davon zu überzeugen.

- Zahlreiche kostenlose Ressourcen: Bonsai gibt es zwar nicht als kostenlose Version, aber es bietet eine Vielzahl kostenloser Vorlagen für Rechnungen, Verträge, Angebote und andere nützliche Materialien sowie eine kostenlose Buchhaltungssoftware mit einem Steuerrechner für Selbstständige, den Freiberufler kostenlos auf der Website des Unternehmens nutzen können.

Die Buchhaltungs-/CRM-Software Bonsai ist ausgezeichnet – ideal für Freiberufler und kleine Unternehmen.

Bonsai ist nicht für jedermann geeignet, sondern speziell für Freiberufler, unabhängige Auftragnehmer und andere Kleinstunternehmen konzipiert, die als „selbstständige 1099-Arbeitnehmer” eingestuft sind. Es ist mit Finanztools integriert, die Ihnen einen umfassenden Überblick über die finanzielle Lage Ihres Unternehmens bieten, darunter Einkommensberichte, Steuererinnerungen und vieles mehr.

Darüber hinaus generiert Bonsai automatisch Rechnungen auf Grundlage der Angebote oder Verträge, die Sie mit dieser Software erstellt haben, sodass Sie Zahlungen von Kunden problemlos einziehen können. Bonsai verfolgt auch Ausgaben, maximiert Abschreibungen, schätzt vierteljährliche Steuern, verwaltet 1099-Formulare und hilft dabei, Geld zu sparen!

Innerhalb der engeren Nische der Buchhaltungssoftware für Freiberufler ist das digitale Toolkit/die digitale Lösung von Bonsai unschlagbar! Angesichts all der oben aufgeführten erweiterten Funktionen ist Bonsai eine großartige Alternative zu QuickBooks Online. Melden Sie sich für die kostenlose Testversion von an und erleben Sie Bonsai hautnah!

2. Expensify

Expensify ist eine gute Alternative zu QuickBooks mit einer benutzerfreundlichen Arbeitsumgebung. Es erleichtert Menschen und Unternehmen die Nachverfolgung ihrer Ausgaben und anderer damit verbundener Daten, wodurch Zeit und Aufwand gespart werden, die sonst allein für die Dokumentation der Ausgaben aufgewendet werden müssten.

Darüber hinaus ist diese Software cloudbasiert und somit über verschiedene Geräte, darunter Android und iOS, zugänglich. Es wird für seine Einfachheit und Benutzerfreundlichkeit gelobt, hat jedoch Probleme mit doppelten Gebühren.

Hier sind einige Alternativen zu Expensify.

Funktionen & Preise

- Intelligentes Scannen von Belegen

- Abrechnung und Rechnungsstellung

- Ausgabenmanagement (Nachverfolgung)

- Anpassbare Arbeitsabläufe

- Zeiterfassung

- Robuste Integration

- Automatischer Bankabgleich

- Individuelle Spesenabrechnungen

Expensify bietet verschiedene Tarife für Privatpersonen und Unternehmen an.

Geschäftsplan:

- Collect Plan (Paket): Ab 10 $ pro Benutzer/Monat

- Kontrollplan (gebündelt): Ab 18 $ pro Benutzer/Monat

- Collect Plan (ungebündelt): Ab 20 $ pro Benutzer/Monat

- Kontrollplan (ungebündelt): Ab 36 $ pro Benutzer/Monat

Privatpersonen und Selbstständige:

- Track: 4,99 $/Monat (25 kostenlose SmartScans pro Monat)

- Einreichen: 4,99 $/Monat (25 kostenlose SmartScans pro Monat)

Warum gefällt es uns?

Expensify bietet ein einfach zu bedienendes System zur Erfassung und Verwaltung von Ausgaben. Es verfügt außerdem über eine benutzerfreundliche Oberfläche, über die Benutzer Kategorien für jede Abteilung und den Genehmigungsworkflow für jeden Mitarbeiter einrichten und hinzufügen können. Mit der SmartScan-Funktion können Mitarbeiter ihre erstattungsfähigen Arbeitsausgaben und Belege einreichen, um sie innerhalb von Sekunden prüfen und genehmigen zu lassen.

3. FreshBooks

FreshBooks ist einer der größten Namen im Bereich der Buchhaltungssoftware. Es wurde 2003 gegründet und wird von der in Toronto ansässigen Firma 2ndSite Inc. betrieben.

Ähnlich wie Bonsai ist FreshBooks eine Full-Service-Produktsuite für kleine Unternehmen, Freiberufler und Solopreneure und eine gute Alternative zu Quickbooks. Sie bietet CRM-Vorlagen (Kostenvoranschläge, Angebote, Rechnungen usw.), Zeiterfassung, Erfassung/Organisation von Einnahmen und Ausgaben, Steuererklärungen usw. Es bietet außerdem ein umfassendes Dashboard, das einfach zu bedienen ist und alles, was Sie brauchen, an einem Ort vereint.

Entdecken Sie die besten Alternativen zu Freshbooks.

Funktionen & Preise

- Einfach zu bedienende Benutzeroberfläche

- Einfacher Abgleich von Bankkonten

- Zeit- und Projektverfolgung

- Nahtlose Integrationen

- Rechnungssoftware

- Geschäftstransaktionen automatisch kategorisieren

- Kostenlose Vorlagen

Freshbooks bietet eine kostenlose 30-Tage-Testversion und die folgenden Tarife mit 80 % Rabatt für die ersten 4 Monate.

- Lite-Tarif: 17 $/Monat

- Plus-Tarif: 30 $/Monat

- Premium-Tarif: 55 $/Monat

- Plan auswählen: Passen Sie Ihren Plan an Ihre Bedürfnisse an.

Warum gefällt es uns?

Freshbooks bietet eine leistungsstarke Buchhaltungssoftware und eine hervorragende Rechnungsstellungslösung, die das Finanzmanagement für dienstleistungsorientierte Unternehmen, darunter Einzelunternehmer und Freiberufler, vereinfacht. Die Software erleichtert es neuen und wachsenden Unternehmen, organisiert zu bleiben, Ausgaben zu verfolgen, Rechnungen zu versenden und Zahlungen anzunehmen.

4. Xero

Xero ist eine maßgeschneiderte Buchhaltungssoftware für kleine und mittlere Unternehmen, die ursprünglich in Neuseeland gegründet wurde. Es ist bekannt, dass es sich um eine umfassende und zuverlässige Wahl für Buchhaltungssoftware handelt, was es zu einer beliebten QuickBooks-Alternative unter Freiberuflern und kleinen Unternehmen macht.

Um jedoch die Funktionalität vollständig zu verstehen und die Software effektiv zu nutzen, müssen Benutzer möglicherweise eine steile Lernkurve durchlaufen. Es bietet einen attraktiven Arbeitsbereich mit einem übersichtlichen Design in einer Sprache ohne Finanzjargon, der auch viele Plug-ins unterstützt.

Funktionen & Preise

- Projektmanagement

- Datenanalyse

- Genaue Finanzberichterstattung

- Verfolgt Ihre Ausgaben

- Rechnungszahlung

- Bietet Integrationen

- Unterstützt mehrere Währungen

- Bestandsverfolgung

Xero bietet eine kostenlose 30-Tage-Testversion und die folgenden Abonnementmodelle mit 50 % Rabatt für die ersten 3 Monate an:

- Frühbucher: 15 $/Monat

- Wachstum: 42 $/Monat

- Festgelegt: 78 $/Monat

Warum gefällt es uns?

Xero ist eine zuverlässige Software, die auf einer globalen Cloud-Infrastruktur basiert und Benutzern jederzeit und überall Zugriff ermöglicht. Es unterstützt über 160 Währungen mit Mehrwährungsbuchhaltung, erstellt Rechnungen und integriert die Banken der Benutzer mit Xero, sodass sie jede Transaktion direkt auf einer einzigen Plattform abgleichen können.

5. Zoho Bücher

Zoho Books wurde 2011 von der Zoho Corporation mit Hauptsitz in Indien veröffentlicht und gehört zu den führenden Online-Alternativen zu QuickBooks. Es bietet Buchhaltung, CRM, HR und andere skalierbare Verwaltungstools, die kleinen Unternehmen beim Wachstum helfen.

Die Software bietet einen guten Kundensupport, den Benutzer direkt anrufen können, nützliche Analysen, anpassbare Berichte und einen flexiblen Arbeitsbereich. Zoho erleichtert es Benutzern außerdem, Rechnungen zu erstellen und zu versenden, Ausgaben zu erfassen und schnelle Einblicke in das Geschäft zu erhalten.

Funktionen & Preise

- CRM-Management

- Rechnungserstellung

- Projektverfolgung

- Inventarisierungswerkzeuge

- Anbieter- und Kundenportal

- Ausgabenverfolgung

- Workflow-Automatisierung

Zoho Books bietet sechs Abonnementmodelle an, darunter eine dauerhaft kostenlose Version mit begrenzter Benutzeranzahl und eingeschränkten Funktionen.

- Standard-Tarif: 20 $/Monat

- Profi-Tarif: 50 $/Monat

- Premium-Tarif: 70 $/Monat

- Elite-Tarif: 150 $/Monat

- Ultimativer Tarif: 275 $/Monat

Warum gefällt es uns?

Zoho ist eine der besten kostenlosen Alternativen zu Quickbooks und umfasst fast alles, was für die Führung eines kleinen Unternehmens erforderlich ist. Die Möglichkeit, mühsame und fehleranfällige Buchhaltungsaufgaben zu automatisieren, die umfassende und benutzerfreundliche Oberfläche sowie die Integration mit anderen Zoho-Apps und anderen Tools für die Buchhaltung sind ebenfalls wichtige Verkaufsargumente.

6. Salbei

Sage ist eine All-in-One-Business-Suite, die als geeignete Alternative zu QuickBooks in Betracht gezogen werden sollte. Die Software wurde in Großbritannien gegründet und war früher unter dem Namen Sage 50 bekannt, wurde jedoch 2021 in Sage 50Cloud umbenannt.

Sage 50Cloud ist eine umfassende Buchhaltungssoftware für kleine und mittlere Unternehmen. Es bietet viele weitere nützliche Funktionen, wie beispielsweise eine gut durchdachte App für die Bestandsverwaltung, die Lohnabrechnung und Personalverwaltung. Die Cloud-Buchhaltungssoftware von Sage Business umfasst auch weitere erweiterte Funktionen, die sich besser für technisch versierte Nutzer eignen.

Funktionen & Preise

- Rechnungs- und Cashflow-Manager

- Erweiterte Bestandsverwaltung

- Bankabstimmung

- Projektverfolgung

- Microsoft 365-Integration

- Berichterstellung und branchenspezifische Funktionen (Bauwesen, Fertigung, Vertrieb und mehr)

Die Preise für Sage50 sind wie folgt:

- Pro Accounting: 58,92 $ pro Benutzer/Monat

- Premium-Buchhaltung: 96,58 $ pro Benutzer/Monat

- Quantum Accounting: 160 $ pro Benutzer/Monat

Warum gefällt es uns?

Sage Accounting bietet hervorragende Buchhaltungsfunktionen, darunter tägliche Buchhaltung, Kreditorenbuchhaltung und Debitorenbuchhaltung, mit denen Sie alle Buchhaltungsprozesse stets im Blick behalten. Die Software bietet außerdem genügend Flexibilität, um zu wachsen, ohne eine bestimmte Anzahl von Benutzern, Mitarbeitern oder Artikeln upgraden zu müssen.

7. Welle

Wave ist eine kostenlose QuickBooks-Alternative mit Sitz in Toronto, die für kleine Unternehmen entwickelt wurde. Die Software wurde 2009 gegründet und wird von H&R Block betreut.

Es handelt sich um eine Finanzierungssoftware, die mit allen grundlegenden Tools ausgestattet ist, die für das Finanzmanagement von dienstleistungsorientierten Unternehmen erforderlich sind. Wave bietet außerdem eine benutzerfreundliche Oberfläche mit hervorragender Workflow-Automatisierung, die Ihre Transaktionen automatisch herunterlädt und kategorisiert, sodass sich die Benutzer nicht um die manuelle Eingabe kümmern müssen.

Kunden loben die folgenden Funktionen von Wave:

- Es ist für immer kostenlos (Wave bietet zwar kostenlose Buchhaltungssoftware und digitale Rechnungsstellungsdienste an, aber wenn Sie Zahlungs- oder Gehaltsabrechnungsvorgänge hinzufügen möchten, gibt es Preispläne für diese Funktionen).

- Eine gute Auswahl an Buchhaltungssoftwareprodukten

Funktionen & Preise

- Benutzerfreundliche Oberfläche

- Anpassbare Vorlagen

- Rechnungsstellung

- Zahlungen und Gehaltsabrechnungen

- Grundlegende Buchhaltungstools

Im Gegensatz zu anderen Finanz- oder Unternehmensmanagement-Tools sind die Preispläne von Wave produktbezogen und nicht paketbezogen.

- Rechnungsstellung: 0 $

- Buchhaltung: 0 $

- Zahlung: 2,9 % + 0,60 $ pro Transaktion

- Mobile Quittungen: 8 $/Monat

- Lohnabrechnung: 40 $/Monat + 6 $ pro Mitarbeiter/Auftragnehmer

- Berater: 149 $/Monat

Warum gefällt es uns?

Wave ist ein Finanzmanagement-Tool, das einfach einzurichten ist und sich daher ideal für Freiberufler und kleine Unternehmen eignet. Die Software erleichtert das Erstellen und Versenden von Rechnungen, Angeboten und Zahlungen.

8. ZipBooks

ZipBooks ist eine in Utah ansässige Software, die 2017 auf den Markt kam und Auftragnehmern und kleinen Unternehmen Software für Rechnungsstellung, Zeiterfassung und Buchhaltung bietet. Die neue Funktion der Lohnabrechnung-Integration macht die Software für kleine Unternehmen mit Mitarbeitern nützlich.

Die ZipBooks-Software eignet sich jedoch aufgrund fehlender Funktionen zur Bestandsverwaltung nur für dienstleistungsorientierte Unternehmen. Darüber hinaus bietet ZipBooks im Rahmen seines kostenlosen Tarifs eine gute Auswahl an Funktionen und ist damit eine weitere kostenlose QuickBooks-Alternative für kleine Unternehmen.

Funktionen & Preise

- Bankabstimmung

- Kundenportal / Lieferantenmanagement

- Buchhaltung und Transaktionsverfolgung

- Kosten- und Umsatzmanagement

- Workflow-Automatisierung

- Zahlungserinnerungen

- Rechnungsstellung

- Zeiterfassung

- Übersichtsberichte

ZipBooks bietet die folgenden Preise für seine 4 Abonnementmodelle an.

- Starter: 0 $

- Smarter: 15 $/Monat

- Anspruchsvoll: 35 $/Monat

- Buchhalter: Individuelle Preisgestaltung

Warum gefällt es uns?

ZipBooks ist nicht nur eine der besten kostenlosen Alternativen zu QuickBooks, sondern auch eine hervorragende Finanz- und Buchhaltungssoftware. Die Software erleichtert die Verwaltung aller Finanzen, Rechnungen, Lohnabrechnungen und Ausgaben kleiner Unternehmen auf einer einzigen Plattform.

So wählen Sie eine Buchhaltungssoftware aus

Die Verwaltung Ihrer Unternehmensbuchhaltung und Steuern hat einen entscheidenden Einfluss auf die Leistungsfähigkeit Ihres Unternehmens. Die Suche nach intelligenter Software, die einen Großteil der Arbeit für Sie automatisiert, spart Ihnen Energie und Zeit.

Es gibt eine Vielzahl von Alternativen zu QuickBooks, und die Auswahl der richtigen kann überwältigend sein. Wenn Sie jedoch wissen, welche Funktionen für Ihr Unternehmen unverzichtbar und welche optional sind, und sich über die neuesten Buchhaltungssoftwareprogramme/mobilen Apps informieren, können Sie Ihren Auswahlprozess eingrenzen.

Die gute Nachricht ist, dass Freiberufler und Kleinunternehmer mit moderner Technologie mit keiner der oben genannten QuickBooks-Alternativen etwas falsch machen können, da es sich dabei um erstklassige, angesehene Buchhaltungssoftware handelt. Sie sind es jedoch sich selbst und Ihrem Unternehmen schuldig, in die am besten geeignete Lösung für die Betriebsführung/Buchhaltung zu investieren, die die folgenden Funktionen/Anforderungen erfüllt:

- Es muss benutzerfreundlich und einfach einzurichten und zu bedienen sein.

- Sollte Funktionen bieten, die für Ihre geschäftlichen Anforderungen wichtig sind.

- Die Software muss Add-ons und Integrationen von Drittanbietern zulassen, die Ihren Anforderungen an die Unternehmensbuchhaltung entsprechen oder bereits in Ihren Geschäftsprozessen vorhanden sind.

- Es sollte so flexibel/anpassbar sein, wie Sie es benötigen.

- Es sollte für Ihr erwartetes zukünftiges Wachstum skalierbar sein.

- Es muss mehr als nur eine Buchhaltungssoftware bieten – sondern zusätzliche Funktionen wie nützliche Kundenansprache, Projektmanagement, Zeiterfassungsfunktionen usw.

- Es muss in der Preisklasse liegen, die für Sie akzeptabel ist bzw. die Sie sich leisten können.

Der Online-Dienst QuickBooks ist gut – aber seine Konkurrenten sind es auch.

Es lässt sich nicht leugnen: QuickBooks ist mit vier Millionen Konten weltweit einer der „Urväter” der Buchhaltungs-/Buchführungssoftware in der Branche. Seine Beliebtheit ist verständlich, da die Software in irgendeiner Form bereits seit 1983 existiert (entwickelt von der Finanzsoftwarefirma Intuit in Kalifornien).

In der modernen Welt ist die Auswahl an Buchhaltungssoftware jedoch so groß, dass ein einziges Buchhaltungstool, so solide es auch sein mag, nicht den Bedürfnissen und Interessen jedes einzelnen Kunden gerecht werden kann. Verschiedene Online-Tools richten sich an unterschiedliche Unternehmensdemografien und priorisieren daher je nach Größe, Art und Branche der von den einzelnen Diensten angesprochenen Unternehmen unterschiedliche Funktionen, Schnittstellen, Skalierbarkeit, Integrationen und Preisklassen.

Brauche ich als Freiberufler QuickBooks Self-Employed?

Nun, als vielbeschäftigter Freiberufler brauchen Sie sicherlich die Hilfe einer Buchhaltungssoftware!

Ob Sie sich nun für QuickBooks, Bonsai oder einen anderen Anbieter entscheiden, der ähnliche digitale Online-Tools für die Buchhaltung von Freiberuflern anbietet, hängt ganz von Ihren individuellen unternehmerischen Anforderungen ab.

QuickBooks Self Employed hat seine Grenzen

QuickBooks ist eine solide, bewährte Wahl unter den Buchhaltungsprogrammen, aber es ist nicht für die geschäftlichen Anforderungen jedes einzelnen Auftragnehmers gleichermaßen gut geeignet.

Darüber hinaus ist QuickBooks Self Employed in erster Linie eine Buchhaltungs-/Rechnungswesen-Software: Es bietet nicht die gleiche Auswahl an freiberuflerorientierten „Customer Relationship Management“ (CRM)-Tools und -Vorlagen, Projektmanagement-Funktionen oder Zeiterfassungshilfen wie andere auf dem Markt erhältliche Softwareprodukte, die speziell dafür entwickelt wurden, Freiberuflern die Möglichkeit zu geben, alle ihre Buchhaltungs- und Verwaltungsaufgaben an einem einzigen Ort zu erledigen.

QuickBooks Self Employed bietet eine einfache Buchhaltungssoftware für Selbstständige (1099) mit grundlegenden Tools zur Erfassung von Einnahmen und Ausgaben (z. B. Organisation von Steuerbelegen, Erfassung von Geschäftsfahrten, Berechnung von Schedule C-Abzügen, Erstellung von Ausgaben- und Finanzberichten, Berechnung von vierteljährlichen Steuerschätzungen usw.). Das Programm beschränkt sich jedoch weitgehend auf den Finanzbereich und bietet kaum Unterstützung bei der Arbeitsbelastung und den Arbeitsabläufen eines Kleinunternehmens.

Buchhaltungsfunktionen, auf die Sie bei einer Online-Buchhaltungs-App für selbstständige Auftragnehmer achten sollten

Wenn Sie von QuickBooks Self Employed zu einer ähnlichen Software wechseln möchten, die besser zu Ihren Geschäftsabläufen und Herausforderungen passt, sollten Sie sowohl die Mängel Ihrer aktuellen Software als auch die allgemeinen Aspekte beim Kauf von Buchhaltungs-/Buchführungslösungen berücksichtigen.

QuickBooks-Alternative Funktionen

Zu den Schwächen der Software QuickBooks Self Employed gehören:

- zu einfache/begrenzte Rechnungsvorlagen/-optionen

- Online-Kundensupport mangelt es an Lösungen/Nützlichkeit

- Projektmanagement- und Teamzusammenarbeitsfunktionen werden nicht angeboten.

- Schwierigkeiten beim Upgrade des bestehenden QuickBooks Self Employed auf das nächsthöhere Paket (in diesem Fall QuickBooks Online)

- kein Hauptbuch/kein System für doppelte Buchführung (zum Ausgleich des Soll-/Haben-Zustands des Budgets)

- Keine Möglichkeit, Kreditkarten-/Bankkontodaten abzugleichen

- Während QuickBooks Online eine Desktop-Version anbietet, ist QuickBooks Self Employed nur als Mobil-/Smartphone-Version verfügbar.

Wenn Ihnen diese Funktionen in QuickBooks gefehlt haben, suchen Sie nach ihnen in anderen Buchhaltungs-/Kaufmännischen Apps – achten Sie dabei jedoch darauf, dass Sie beim Wechsel keine Abstriche bei den Funktionen machen, die Sie an QuickBooks schätzen.

Wenn Sie sich nach einer Buchhaltungs-/Buchführungssoftware für Ihr freiberufliches Unternehmen umsehen, ist es sinnvoll, die folgenden Fragen zu stellen:

Werden Plug-Ins unterstützt?

Die meisten Buchhaltungs-Apps bieten dieselben oder ähnliche, sich überschneidende Buchhaltungsfunktionen, die als Standard und für jedes Unternehmen als notwendig gelten. Bei Plug-ins sieht das jedoch anders aus. Plug-ins für das Konto-Management ermöglichen es Unternehmen, Beziehungen zu bestehenden und zukünftigen Kunden aufzubauen und zu pflegen: Sie sammeln und analysieren Verbraucherinformationen, verfolgen Konten, benachrichtigen Kunden und bitten sie um Feedback usw.

Einige Apps (wie Xero) unterstützen viele Plug-ins, andere hingegen nicht: Wenn Sie Ihre Buchhaltung mit Zusatzfunktionen optimieren möchten, wählen Sie eine App, die dies ermöglicht.

Ist es anpassbar?

Für einfache, sich wiederholende Aufgaben und die Buchhaltung mögen einfache voreingestellte Vorlagen ausreichen, aber Freiberufler, die eine Vielzahl von Projekten jonglieren, die speziell auf die Wünsche ihrer Kunden zugeschnitten sind, müssen möglicherweise ihre Angebote, Verträge, Rechnungen und andere Dokumente zum Kundenbeziehungsmanagement für jeden Auftrag individuell anpassen. Achten Sie darauf, sich für eine Software anzumelden, die Ihnen die Flexibilität (oder Starrheit) bietet, die Sie für eine optimale Buchhaltung benötigen (FreshBooks ist beispielsweise dafür bekannt, dass seine Berichte und Rechnungen individuell angepasst werden können).

Ist die Benutzererfahrung das Richtige für Sie?

Es geht nicht immer um Logik, sondern darum, dass verschiedene Software-Schnittstellen für verschiedene Kunden unterschiedlich funktionieren. Bestimmte vertraute Arten, Dinge zu organisieren, oder erkennbare Vorlagenstile oder andere visuelle Muster, die uns ansprechen: Diese Faktoren können uns beruhigen und uns bei den anstehenden Aufgaben entspannen lassen.

Außerdem bieten einige Apps zwar hochmoderne Buchhaltungsfunktionen und -vorgänge, aber die Lernkurve kann zu steil und daher für Anfänger zu abschreckend sein. Ausgefeilte Funktionen sind für Nutzer, die nicht über den Einrichtungsbildschirm hinauskommen, wertlos (Bonsai hingegen bietet eine Vielzahl flexibler Funktionen und ist dennoch unglaublich einfach zu bedienen).

Aus diesem Grund ist es sinnvoll, eine kostenlose Testversion zu nutzen, sofern eine angeboten wird: So können Sie sich mit den verschiedenen Funktionen der Software vertraut machen und herausfinden, ob Ihnen die Bedienung intuitiv genug erscheint, um sich dafür zu entscheiden.

Buchhaltung, Budgetierung und Steuern sind für viele Freiberufler, die mit ihrer beruflichen Arbeit überlastet sind, ohnehin schon ein Thema, das ihnen Sorgen bereitet – und niemand möchte, dass Buchhaltungssoftware die Verwirrung und den Stress noch verstärkt!

Ist der Preis angemessen?

Viele Freiberufler arbeiten mit begrenzten Budgets, daher hat die Preisgestaltung von Software-Abonnements für die meisten von ihnen höchste Priorität (seien wir ehrlich, die Preisgestaltung hat für fast alle von uns höchste Priorität!).

Unternehmertum ist immer ein schwieriger Balanceakt zwischen Sparsamkeit und der Aufrechterhaltung der Funktionen, die Sie für den ordnungsgemäßen Betrieb Ihres Unternehmens benötigen. Je nach den Anforderungen Ihres Unternehmens sind Sie vielleicht mit den kostenlosen Alternativen (wie Wave) vollkommen zufrieden – oder entscheiden sich für das teurere Deluxe-Paket, das alle unterschiedlichen Vorgänge, die Sie ausführen müssen, vollständig abdeckt und integriert, mit mehreren Einnahmequellen von verschiedenen Kunden und Verkäufen, zahlreichen Mitarbeitern und einer ganzen Reihe von Steuerformularen, die zur Steuerzeit bearbeitet werden müssen.

Für die einfachsten geschäftlichen Anforderungen reicht also eine kostenlose QuickBooks-Alternative aus. Wenn Ihre Geschäftsabläufe jedoch komplexes Multitasking mit mehreren Akteuren erfordern, ist es ratsam, sich für einen Tarif zu entscheiden, der Ihren Anforderungen entspricht, auch wenn dieser nicht kostenlos oder besonders günstig ist. Denn wenn es um das Verhältnis von Qualität und Preis geht, bekommt man das, wofür man bezahlt. Betrachten Sie es als eine Investition in die Langlebigkeit und Exzellenz Ihres Unternehmens!

Häufig gestellte Fragen (FAQs)

Welche Buchhaltungssoftware ähnelt QuickBooks am meisten?

HelloBonsai ist die beste Alternative zu QuickBooks und bietet eine bessere Lösung für Ihre geschäftlichen Anforderungen. Es bietet umfangreiche Funktionen, darunter Zeiterfassung, internationale Rechnungsstellung, Workflow-Automatisierung, anpassbare Kundenverträge und Angebote und vieles mehr. Warten Sie nicht länger und melden Sie sich jetzt bei Bonsai an!

Bietet QuickBooks einen kostenlosen Tarif an?

Leider bietet QuickBooks keinen kostenlosen Tarif an. Es gibt jedoch eine kostenlose Testversion für 30 Tage oder einen Rabatt von 50 % für die ersten drei Monate der Nutzung.

Was ist die günstigste Möglichkeit, QuickBooks zu kaufen?

Die günstigste Möglichkeit, QuickBooks-Dienste zu erwerben, ist die Wahl der günstigsten Alternative, beispielsweise Bonsai. Die Preise für QuickBooks liegen zwischen 24 und 140 US-Dollar pro Monat, während Bonsai monatliche Preise zwischen 25 und 79 US-Dollar anbietet.