As of 2023, there are almost 90,000 accounting firms in the United States. It's an attractive option for those looking to start a small business; you can manage a successful accounting practice with a relatively small investment.

However, the sheer number of clients and tasks involved in running an accounting firm can be overwhelming for even the most organized business owners. Most firms find that the only way to keep their operations running smoothly is by using accounting practice management software.

What is Accounting Practice Management Software?

In any accounting firm, there is a front-end and a back-end to the accounting operations.

The front-end is the client-facing side of operations, where accountants interact with clients and manage their accounts. The back-end is the behind-the-scenes work of managing an accounting firm's internal processes, such as payroll, billing, tax filing, bookkeeping and reporting.

Accounting practice management software streamlines these two sides of accounting operations by providing tools to help firms manage both front-end activities like client communication and back-end tasks like invoicing. It also offers a range of features designed to make it easier for firms to stay compliant with state and federal regulations while delivering high levels of service to clients.

The Purpose of Accounting Management Software

For many years, companies and independent accountants alike were stuck with very archaic tools – like Excel, for instance – that simply weren't up to the task of managing a modern accounting firm.

With the advent of cloud-based accounting practice management software, however, businesses now have access to an array of powerful tools designed for use in professional settings.

These solutions are designed with efficiency and accuracy in mind; they help firms automate mundane tasks like invoicing and bookkeeping so that staff can focus on more important issues like client relations and growth strategies. They also provide comprehensive reporting dashboards so users can get a bird's eye view of their performance in real time.

Finally, many solutions offer features specifically tailored toward compliance with state and federal regulations. This can help firms ensure that they remain in good standing with the IRS and other regulatory bodies, avoiding costly fines or even criminal prosecution.

Small Business Benefits of Using Accounting Practice Management Software

Small businesses often have limited resources when it comes to technology, and accounting practice management software can help them make the most of what they have. The automated features offered by these solutions enable firms to do more with fewer staff members, allowing them to take on larger clients and increase their profits.

Moreover, this type of software helps streamline operations so that firms can focus on serving their clients better. They can provide faster response times for queries or requests and giving customers access to real-time updates about their accounts via secure portals. APM tools also allow firms to offer value-added services like financial planning advice or budgeting assistance in order to help clients make better decisions about their finances.

Key Features of Accounting Practice Management Software

Managing your accounts effectively is crucial for any business; with the right operations management software you can streamline the process, allowing you to focus on other important aspects of your business.

Accounting practice management software can come with a range of features designed to help firms stay organized and efficient. Let's look at some of the most common features.

Time and Billing

It's crucial for any business to bill its clients accurately – that much is obvious. Getting your invoices right relies heavily on the accuracy of your time tracking. With APM software, you'll typically gain access to helpful time-tracking and billing tools that automate the entire process, including generating invoices and collecting payments.

Client Management

Did you know that 65 percent of your sales will come from existing clients? It costs far more to onboard new clients than it does to retain existing ones, so having the right client management tools is key.

Accounting practice management software can help here, too; it allows firms to view all their client information in one place, making it easier to identify potential opportunities and act on them quickly.

Document Management

Accountants juggle thousands of documents. Between contracts, invoices, tax returns, and other materials, it's easy for papers to get lost in the shuffle. With APM software, all of these documents can be stored in a secure location so that firms can access them quickly when needed.

Many platforms (like ours, Bonsai) also provide helpful lawyer-reviewed document templates to make the process of creating new contracts and documents even faster.

Workflow Management

Regardless of whether you're a one-person show or a multi-person accounting firm, it's easy to get overwhelmed by the sheer volume of tasks that must be handled. APM solutions typically come with workflow management tools that allow users to create and assign tasks, prioritize them according to importance, and track their progress toward completion.

Reporting and Analytics

It's absolutely crucial to track metrics as an accountant – or any business, for that matter. Why? Because accurate reporting can help you make informed decisions about how to approach your business.

With accounting practice management software, firms can access real-time financial data and key performance indicators so that they have a better understanding of their current state.

Integration with Other Systems

You won't always be able to run your entire business with one tool. That's why it's important to look for solutions that integrate with other systems and services.

This way, you can use your accounting practice management software as a hub from which to access all the tools you need, instead of having to switch back and forth between different programs. Accounting practice management software will typically integrate with tools like QuickBooks, Xero, or Salesforce.

Types of Accounting Practice Management Software

In the not-so-distant past, all software was stored on-premise – meaning it was physically stored in data centers owned and operated by the organization that used it. Today, however, we've got more options for software and data storage. The option you choose will depend largely on the size of your firm, as well as its technical requirements.

Cloud-Based Software

In the early 2000s, Amazon Web Services (AWS) was one of the very first cloud-based services to hit the market – and since then, cloud computing has become the normal. Cloud-based software is stored in a server located off-site, meaning you don't have to host it yourself or manage your own physical data centers.

The idea is that an external provider is responsible for the storage of your software and data. You simply access it through the internet. This is often a great choice for smaller firms, as it eliminates the need to maintain expensive hardware and IT staff.

On-Premise Software

For larger accounting firms with more complex requirements, on-premise software might be the better option. With this type of solution, you can host your software and data in your own physical facilities – meaning that all aspects of security are up to you (and any other third-party vendors that you hire).

On-premise solutions are typically more expensive than cloud-based ones, but they can provide much greater control over how your data is stored and used.

Hybrid Software

Finally, there's the option of hybrid software – a combination of cloud-based and on-premise solutions. This type of APM often offers the best of both worlds: You can store your data in a secure location while also taking advantage of the flexibility that comes with cloud computing.

Often, this will look like storing your company data in a local cloud or hard drive, but accessing the APM platform itself via the cloud. Hybrid solutions can be especially useful for firms that require a lot of customization and control but don't have the resources to handle hosting or maintenance on their own.

Choosing the Right Accounting Practice Management Software

While managing your accounting practices with this software, it's equally important to consider managing your other IT projects. This can be effectively done with the use of proficient IT project management software. Both these software can streamline your business operations significantly.

As an accountant, you're already pretty savvy when it comes to managing finances – but choosing the right accounting software can be tricky. No single solution is perfect for every firm, and it's important to consider the size of your organization, your technical requirements, and the security measures you need when making a decision.

Fortunately, there are plenty of options out there – from cloud-based solutions to hybrid ones – so you're sure to find something that works. Let's explore some of the key factors to consider when making your choice.

Identify Your Needs

Regardless of size, every company is going to have its own unique set of needs when it comes to accounting practice management software. Before you start shopping around, take the time to identify what those needs are:

- Which features are non-negotiable? For example, do you need a system that integrates with other software programs? Do you require a client portal for self-service?

- Do you need collaboration features like document sharing or task management?

- What type of support do you need from the vendor?

- How tech-savvy are your employees? Do you need a tool with a gentle learning curve and a very basic interface?

It's better to be over-prepared than under-prepared when it comes to finding the right APM solution – and if you prepare a list of your must-haves before consulting with vendors, you'll be in a much better position to select the right tool.

Research and Compare Different Software Options

The research phase of your purchase is critical. Don't be swayed by flashy features or promises – take the time to read user reviews, consult with industry experts, and ask plenty of questions before making your decision.

Unbiased websites like Capterra are a great resource for comparison-shopping, as they provide reviews and ratings from real users to help you make an informed decision.

Look carefully at the pros and cons of each option (not just listed by review sites, but actual customer reviews) to get a better understanding of what users like and dislike about the product.

Make sure you also consider scalability – will the software be able to grow with your business, or do you need to invest in an entirely new solution as soon as your firm grows? It's easy to select a great tool only to find out later that it doesn't have enough features for larger firms.

Consider Your Budget

Software programs are certainly an investment, some more so than others. You're paying for features, support, and security – all of which are important for your firm's success. But you also need to consider the cost of implementation and maintenance over time.

When selecting an accounting practice management software, be sure to compare prices between different vendors and select one that fits into your budget. Don't forget to factor in additional costs like training, integrations with other tools or services, etc., as these can add up quickly.

Cloud-based solutions are typically more cost-effective than on-premise solutions, but they also come with their own set of considerations. Price isn't the only factor to keep in mind.

Evaluate the Security Features

Accountants are responsible for significant amounts of sensitive data. You've got payment details, tax returns, company financials, client information, and more. It's all too easy for this valuable data to fall into the wrong hands if you're not careful.

When selecting accounting practice management software, pay attention to the security features it offers. Look for tools that come with bank-level encryption, two-factor authentication, and other measures to keep your data safe from hackers.

People often assume that on-premise software is safer than cloud-based solutions, but that's not always the case. Both types of software can be secure as long as you select a reputable vendor with strong protections in place.

Look for Vendor Support

Customer service is absolutely essential when it comes to choosing accounting practice management software. The last thing you want is to be stuck with a program that you can't figure out how to use or have questions about. In the case of a full shutdown or data breach, you need to know that the vendor will be there to help.

Look for vendors that offer round-the-clock customer service and technical support. Ask about their response times and how they handle data recovery in emergencies. If a vendor is unwilling or unable to provide satisfactory answers, it's probably best to look elsewhere for software solutions.

Again, customer reviews are very telling here. Check out what other users have to say about the software and its customer service before investing in it. If the customer service is bad, it's one of the first things people will complain about.

Best Accounting Practice Management Software

Before you head out and begin your search for the best accounting practice management software, we've got a few recommendations for you. Here's a breakdown of our top picks.

Bonsai – Best All-Rounder

Source: Bonsai

At Bonsai, we don't do things halfway. Our platform is designed to be an all-in-one business solution, not just for accountants, but for everyone. It comes with features like invoicing, payment processing, and time tracking that help you manage your practice more effectively, as well as client management and project management tools for keeping everything organized.

Accountants work with piles of documents in their day-to-day work – and we cater for this by providing a library of lawyer-reviewed templates and contracts. Plus, we've got a customer support team ready to answer your questions 24/7.

In terms of client-facing features, Bonsai allows you to create a branded client portal that makes it easy for clients to access their information, track progress and make payments. Manage all of your accounts from a simple dashboard and get access to detailed reports that show you exactly how your business is performing.

User Interface

Bonsai has been designed with a simple yet powerful user interface that makes it easy for accountants to get up and running. Plus, our mobile app lets you manage your practice from anywhere in the world – perfect for busy professionals who want access to their data 24/7.

Security

Bonsai has three main payment providers – Stripe, PayPal, and Plaid – all of which employ high-level encryption to protect your data. Stripe is actually a certified PCI Level 1 Service Provider.

Pricing

You can start with Bonsai for free in order to test out the features. After the trial, the price tiers are as follows:

- Starter: $17/month

- Professional: $32/month

- Business: $52/month

As a cloud-based service, Bonsai is considerably more affortable than other solutions – but not at the expense of features!

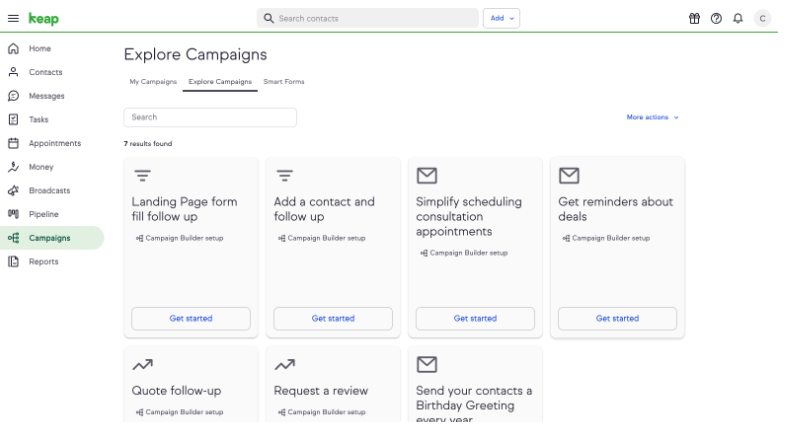

Keap – Best For Client Relationship Management

Keap CRM is a platform designed to help small businesses manage their high-value relationships. It offers a suite of tools that help you to better understand and serve your clients, including sales pipelines, automated follow-ups, and customer segmentation.

Keap helps you create personalized correspondence for each client based on their unique needs. Whether it's a reminder to submit tax information or a marketing email to promote a product, you can create tailored messages that are sure to make an impact.

Since Keap is primarily a CRM, you'll probably need to integrate with other platforms using the API. There are other all-inclusive solutions to consider (like Bonsai) if you don't want to stitch multiple apps together.

User Interface

Some reviews for this platform mention that, if you aren't already familiar with the platform, the user interface can take a bit of getting used to. Thankfully, there's a bustling online community of users who are more than happy to help out newcomers.

Security

Keap is a fully encrypted platform with various security certifications in place. It uses the Transport Layer Security (TLS) protocol version 1.2; all personal data is encrypted with AES-256 (at minimum).

Pricing

After a free trial, there are two pricing options for Keap:

- Pro: $149/month

- Max: $199/month

There's also the option to negotiate a Max Classic subscription, which will be priced depending on your needs. Small businesses will be more than happy with the Pro or Max plans.

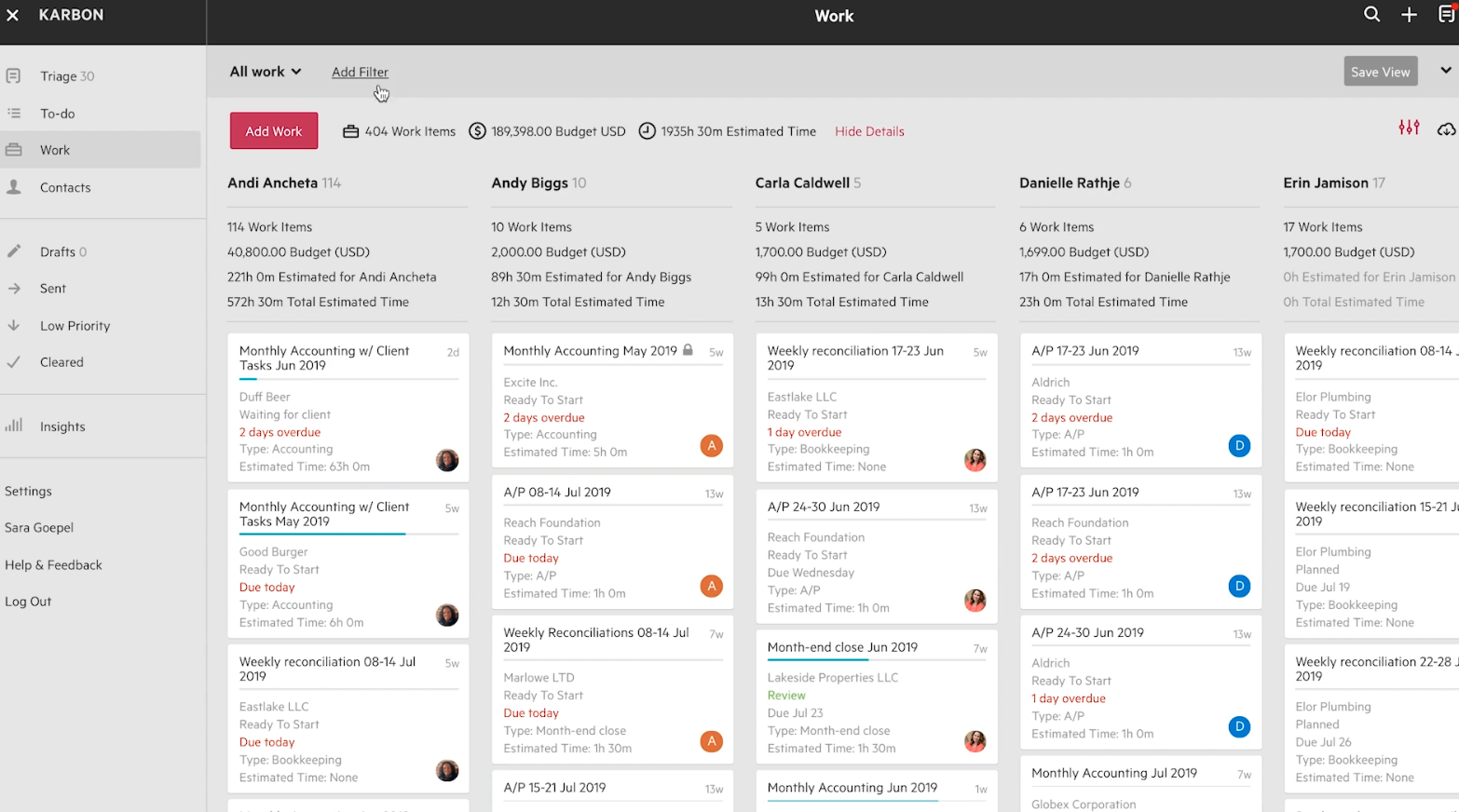

KarbonHQ – Best For Analysis and Business Intelligence

Source: KarbonHQ

The KarbonHQ platform is most known for its modern, flashy aesthetic, but it also offers a suite of features that are useful to accountants. It's a cloud-based solution with tools for data analysis and business intelligence, budgeting and forecasting, client communication, and more.

Karbon is set up to be an all-in-one solution, but it's probably more accurate to call it a front-end solution. It covers things like client relationship management, emailing, client portal, and document sharing, but it's not as comprehensive as a solution like Bonsai.

User Interface

KarbonHQ has a modern, user-friendly interface that makes navigating the platform easy. It does take longer than other platforms to get up to speed, so you should plan on taking some time to explore and get used to the layout.

Security

Karbon is SOC 2 Type 2 certified and uses Transport Layer Security (TLS v1.2, v1.1, and v1.0) encryption for client-to-server requests.

Pricing

With KarbonHQ, businesses pay depending on the number of users.

- Team: $59/month/user

- Business: $79/month/user

- Enterprise: custom pricing

Unfortunately, these plans can only be paid on an annual basis – so it's not the most flexible pricing scheme. It's great if you won't be adding or removing users frequently, however.

Ignition – Best for Administration

Source: LinkHQ

Where Keap and KarbonHQ are largely front-end solutions, Ignition is an accounting platform through and through. It takes care of things like proposals, contracts, payments, and business intelligence.

Ignition is a cloud-based solution aimed at reducing the manual workload for accountants. Powerful automation features, such as automatic reconciliation and invoice generation, allow accountants to focus on their core competencies.

User Interface

Ignition has a clean interface that is easy to navigate. It also offers helpful visualisations for complex data sets, which makes it easy to interpret information quickly.

Security

Ignition employs the latest security protocols including 256-bit SSL encryption for all data exchanges with clients. Data is backed up daily and stored in secure data centres.

Pricing

You can make the most of a brief free trial before choosing one of three options:

- Starter: $89/month

- Professional: $199/month

- Scale: $499/month

All are paid on an annual basis; the Starter should be sufficient for most small businesses, but carefully consider what features you need before committing to a plan.

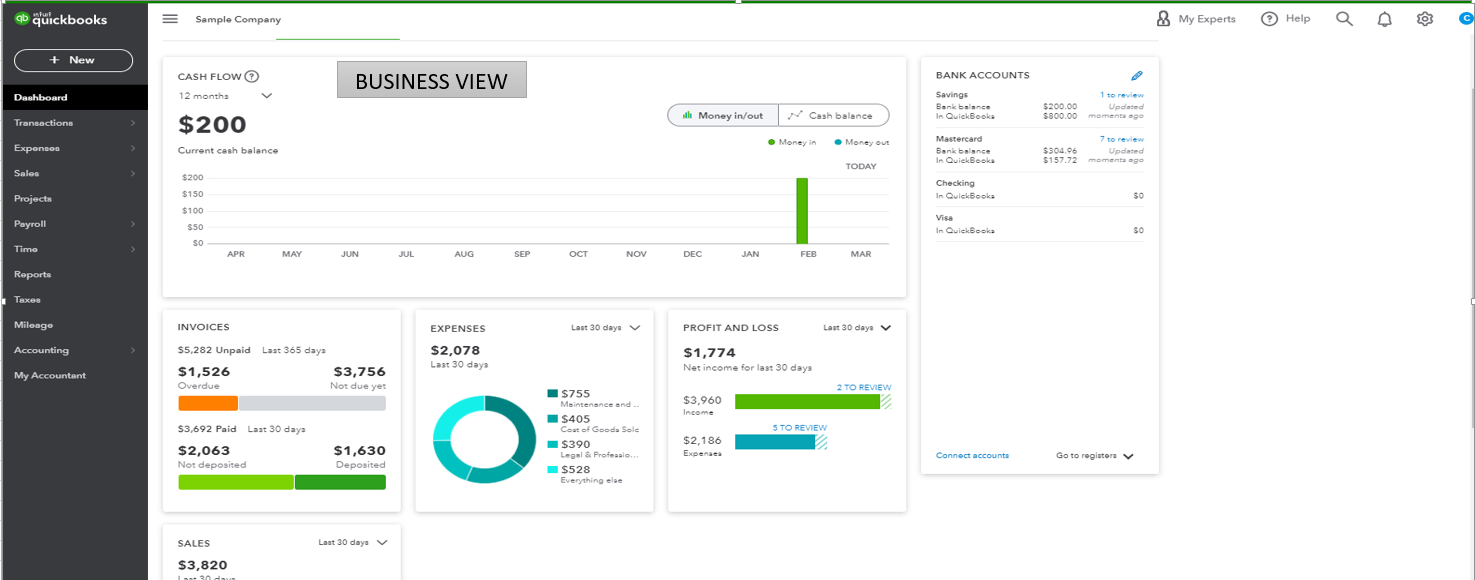

Intuit (QuickBooks) – Best For Financials

Source: QuickBooks

QuickBooks is known for its affordable, comprehensive cloud-based tools. One of these tools is Intuit – a popular accounting solution for small businesses.

Intuit is designed to make it easy for accountants and business owners to track financials, create invoices, and manage payroll. It also provides helpful features such as automatic bank reconciliation, expense tracking, and cash flow forecasting.

User Interface

The QuickBooks interface is straightforward and intuitive. It's one of the most popular platforms around, so at this point, plenty of integrations have been added and features have been well-refined.

Security

Intuit actually has a Security Center with multiple layers and facets of security. It uses two-factor authentication, anti-fraud measures, scam detection, alerts, and high-level encryption.

Pricing

Intuit is probably the most flexible in terms of pricing options:

- Self-employed: $15/month

- Simple start: $30/month

- Essentials: $55/month

- Plus: $85/month

- Advanced: $200/month

It's also worth noting that Intuit offers free guided setups to help you get started.

Our Top Pick

Bonsai is far and away the most comprehensive accounting practice management system on the market. We're biased, but we're also honest – and we know our platform like the back of our hands.

The Bonsai platform is designed to make your life easier by combining project management, client interaction, and accounting features into one streamlined and user-friendly solution. It's cloud-based, so you can access your data from anywhere.

Our other options on this list are excellent too, but they're not as comprehensive as Bonsai. If you're looking for an all-in-one solution, Bonsai is the way to go.

Conclusion

Accounting practice management software is your ticket to efficient and streamlined accounting. It simplifies processes, reduces manual workloads, keeps your data secure, and makes it easy to forecast cash flow.

With the right software in place, you can focus on the tasks that will bring value to your business. Our list of the top accounting practice management systems should help you find a solution that works for you.

Keep in mind that all platforms come with a learning curve. Your best bet is to provide training to your team, so that everyone can take full advantage of the features and benefits – and leave room in your budget for the initial time investment. Try us out free for 7 days and discover the value Bonsai can bring to your business.