Whether or not you love what you do, the most important part of working is getting paid – and as a freelancer, it’s up to you to ensure you get paid fairly and on time.

A self-employed invoice template is the best way to start creating a professional and successful payment system with your clients. Whether you focus on a single gig per month or if you’ve developed a full-time freelancing business, calculating your time and work for proper billing is vital.

In this article, we’ll outline what your invoice template should include and why. We also include the ultimate freelance invoice template so you can begin setting up your payment system ASAP.

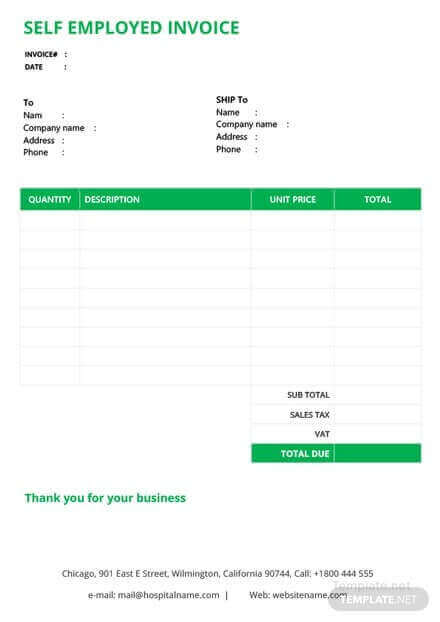

11 must-have sections for your self employed invoice template

Invoices don’t need to be fancy – they just need to provide all the information required so your clients know how much to pay you, when to pay you and what system to pay you through.

Let’s look at some must-have self-employed invoice template sections.

1. Your self employed invoice should have a professional header

As obvious as it sounds, your full name or logo should be the first thing your client sees on the invoice. Make sure the logo of your front and/or logo is bigger than the rest so that it stands out (as you do!)

2. Don't forget to include invoice date

Include a date that shows when the invoice was submitted to your client. This is an important section as you may need to refer back to it if a client is late on a payment.

(We’ll get deeper into late payments in the payment terms section below.)

3. Include contact information on your self employed invoice

Again, another basic section to have – but it’s all about including everything for that professional approach, right?

Make sure you include your phone number, mailing address, email address and website (or LinkedIn if you don’t have a site yet) directly underneath your business name.

You can include your contact info on either top corner of the invoice, however, our template below will sort this out for you.

4. Mention client contact information on the self employed invoice

The recipient’s contact information is important for your own records. Include the same information you did for your own contact section to help “future you” if you ever need to track down payments for tax purposes.

5. Include invoice number

Underneath the contact information on your self-employed invoice template, you should include the invoice number. This helps you keep track of invoices, so make sure you number them in sequential order to stay on top.

For instance, if you’re making your first invoice, you may start with #0001. Then, the next invoice will be $0002 and so on. This can help you track which clients have paid and which ones haven’t.

6. Add the invoice due date

This is a big one. Make sure you specify when the payment is due – exactly. The length of time is totally up to you, however, most freelancers request payment within 30 days or “due upon receipt” so that the client pays the invoice as soon as the invoice has been received.

Make sure you talk about payment due dates well before your client receives your invoice – hopefully through a signed contract. While verbal agreements may be convenient, they can lead to issues down the line, especially when it comes to payment.

If your client doesn’t pay you on time, you can use the invoice to refer back to the due date.

7. Mention payment systems and options on your self employed invoice

Invoices should make payment easy for clients to complete. One way to support this is by specifying your payment options.

Do you prefer getting paid via cash or cheque? If you use a direct payment system such as Paypal or Transferwise, make sure you include your deposit information such as PayPal email address or bank details – whatever your preferred system requires for deposits.

8. Include terms of payment on your self employed invoice

Include a section that outlines what will happen if the payment is late. Will you charge a late fee for invoices paid pas the due date you’ve set? If you’ve had issues chasing clients down for payment in the past, this may help enforce on-time payments for the future.

Typically, freelancers will include a 20% late fee. If you do choose this route, it’s recommended you remind the client of the payment a couple of times before enforcing the fee. This will help strengthen your relationship.

9. Make a breakdown of services on the self employed invoice

Make sure your client knows exactly what you’ve done and what they’re paying for. You can include different services on separate lines if the month’s work included more than one project. Then, beside each service, you can include the price.

10. Include amount due on the self employed invoice

Ah, now we’re onto the good stuff. If your breakdown of services includes a list of items from the month, display how much you charge for each item. This can be either the cost of a service or an hourly rate.

Add these items up and display a full amount at the bottom including taxes or PayPal fees if applicable.

11. Sign off the self employed invoice with gratitude!

Studies have shown that gratitude helps you connect with others better while earning their trust. Being thankful for the work a client has provided will help improve your working relationship while supplying confidence in your daily life.

Below the total amount owed on your self-employed invoice template, consider adding a personal note to the client – this will benefit you in more ways than one.

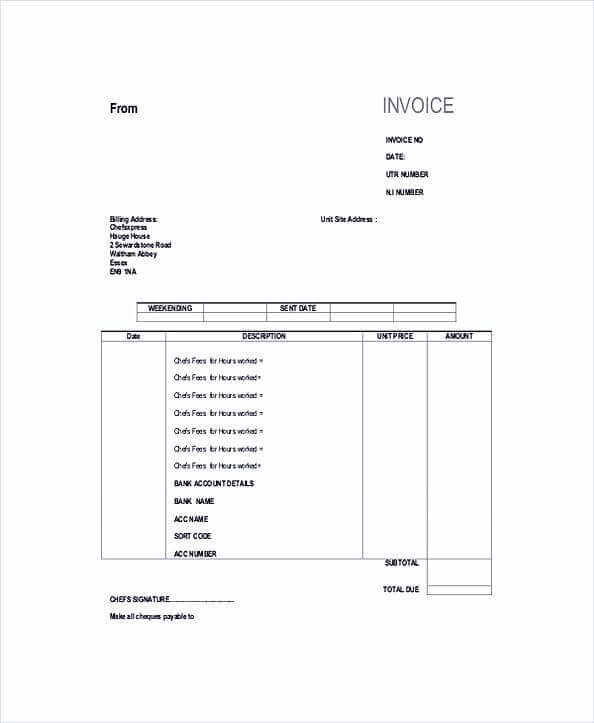

How to make a self employed invoice template for hours worked

The self-employed industry, otherwise known as freelancing, is gaining more prominence by the day. The number of freelancers keeps growing in Europe and predominantly in the US. Freelancing had a direct impact close to $1 trillion on the US economy in 2019, according to a report published by Upwork, a global freelance company. The number of freelancers in the country has continued to grow, with about 35% of the workforce now in the business. So, the niche is up-and-coming but has its challenges.

One of the headaches of freelancing is fixing prices and getting payment from clients. Some reports have it that businesses often take at least 28 days to clear their invoices. If you provide services to clients on an hourly basis, you should be ready to create a self employed invoice template hours worked to request payment officially from your clients. Hourly rate billing is a flexible policy many freelance writers, web designers, graphics designers, and support specialists adopt for charging clients.

You should take note of your billing policy when creating your self employed invoice template hours worked. Being self-employed means, you find your clients and bid for contracts. It means you must be competitive and professional, and this involves your invoicing method as well. Since your goal is to provide quality services to clients and get paid on time for your work, you should consider the following invoicing best practices when drafting your self employed invoice template hours worked.

1. Sign a contract and include your payment terms in the self employed invoice

Don’t seal a contract with a handshake; it works, but you don't want to subject your agreement to chance. Sign a contract before working on a project and then include only the payment terms of your agreement in your self employed invoice template hours worked.

2. Clarify payment terms & date with the self employed invoice

When billing your client, you want to be sure they know when you expect your fees. Include your payment due date like “Due in 30 days”, “45 Days Net” or “payment due upon receipt.” Let your client know about your hourly rate policy and let them see in the invoice that you only billed for the active house you put in the job.

3. Include correct contact information on the self employed invoice

Ensure you provide correct and updated contact information of your business in the self employed invoice template hours worked. You make it easy for a client to contact you if there is a need. Also, include the contact details of your client so they can easily claim responsibility for the bill.

4. Mention service details on the self employed invoice

Let clients know what you are billing them for, and they rate you are providing the service. Be detailed as much as possible to avoid calls and emails requiring you to do some explanation.

5. Create and send the self employed invoice promptly

You should create and send your self employed invoice template hours worked when you complete the job. The longer you delay in sending the invoice to clients, the longer it takes for them to settle your bill.

6. Include invoicing number & date on the self employed invoice

Add an invoice number to the self employed invoice template hours worked for easy tracking of bills. It helps you stay organized with a proper record of which customer has paid and ones that are yet to respond.

7. Charge interest & include incentive with the self employed invoice

The use of interest and incentives are discreet ways of encouraging customers to pay your invoice. Charging interests create a sense of urgency because your customer doesn't want to pay more than necessary. Also, an incentive like a discount for timely payment enhances faster payment.

8. Make room for a note of thanks on the self employed invoice

Include a section to say "thank you" to your customer for the business. That alone may inform a repeating task or seal a recurring service.

Your self-employed invoice template: summarized

As quoted in Forbes: “The next generation of freelancers will simply know freelancing as an attractive, legitimate, career path.”

One of the reasons why this career path has become increasingly legitimate and reliable is because of the way freelancers take professionalism and success into their own hands. As simple as it seems, a professional self-employed invoice template is one of the many steps to get you there.

By using a professional self-employed invoice template, ensuring all your professional information is set up and developing a routine to get you paid on time while keeping your clients happy, you’ll be well on your way to carving a thriving freelance career.