Every business expects payment after supplying goods or rendering a valuable service to a customer. Compensation is an essential aspect of a business that keeps it running, and it should be done promptly. You delivered a product or rendered a service; as usual, your client was thrilled with the work. But what do you get next after sending your invoice? Several weeks have passed, and you are yet to get a reply. First, you must understand a business reality that customers don't always pay their bills on time.

In fact, a study from the National Federation of Independent Business revealed that about 64% of small businesses surveyed had clients who don’t pay invoices for at least 60 days. But not to worry, you can always track your unpaid bills if you have a past due invoice template. With that, you don’t spend hours each month following up customers to collect payment.

Why is a past due invoice template used?

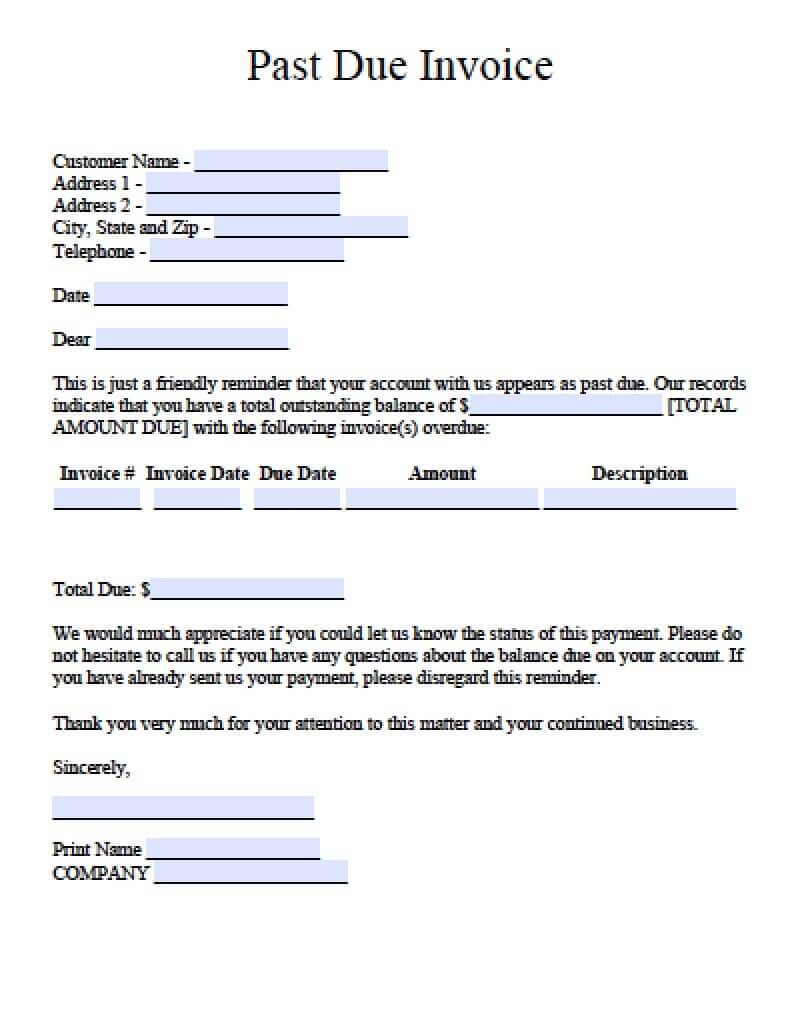

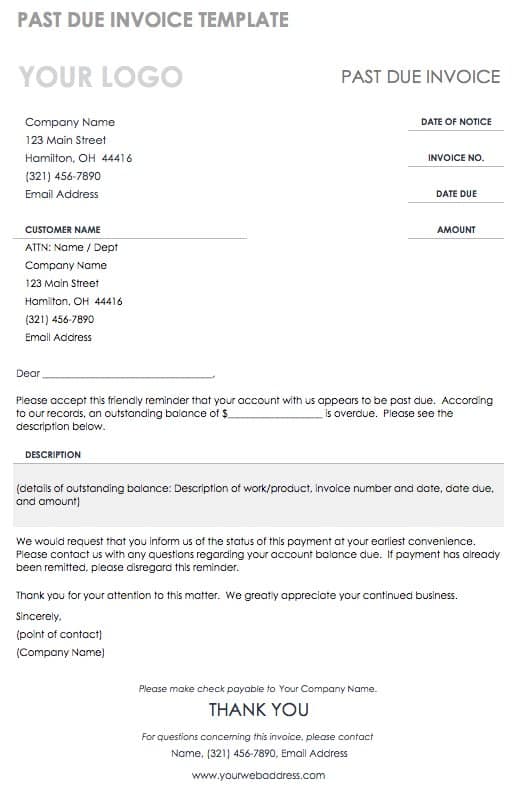

You will always get client accounts lingering unpaid, no matter how you try. Several unpaid invoices stacking up can leave you with hours of work and follow up on clients. You need a better method to track your outstanding invoices and notify clients of their due payment. That is where a past due invoice template comes into the picture.

It gives you the flexibility to organize client's data, track unpaid invoices and get clients informed about their outstanding bills. With a steady template, you don’t have to reinvent the wheel every time you need to send an invoice. You can always fill the template and send overdue invoice bills to a client as fast as possible while maintaining professionalism.

Tips for your past due invoice template to get faster payment

It makes sense to give your client the benefits of the doubt when you have lingering payments. But you must understand that persistent late payment can harm your cash flow and consequently, the health of your business. So, you should think of strategies on how to get faster responses from the client.

See a few tips to employ when creating your past due invoice template to get faster payment.

1. Choose the right payment terms in the past due invoice sample

A study from the Xero group shows that customers pay their bills two weeks late. Adding two weeks to the estimated time of payments you've chosen may be helpful to avoid constant disappointment. For instance, if you want to get compensation in 45 days, you may add 30 days as your payment term when creating your past due invoice template.

2. Choose your words in the past due invoice sample

Mind the phases you use to describe your payment terms. “Payment due in 30 days” is easier for clients to identify payment timeframe than “Net 30.”

3. Offer a small discount in the past due invoice sample

A little reinforcement might be the key to trigger your prompt payment. You may consider a 1 to 2.5% discount for payment made within a certain number of days before the invoice due date.

4. Include a fee for late payment in the past due invoice sample

Unfortunately, not all clients will be motivated with your discount policy and a prospect to save some money no matter how small. For such, fees as small as 1.5% for late payment might grab their attention. So, whether it is a discount or penalty you've included in your past due invoice template, they are both tactful strategies to get prompt payment from clients.

5. Send a gentle reminder in your past due invoice sample

It is not unusual for invoices to miss or never reach their destination. You may save a late payment with a simple follow up message to confirm the receipt of your overdue invoice.

6. Accept a wide range of payment methods in your past due invoice template

Give room for electronic payment and methods that support instant payment through credit cards when clients are short of funds.