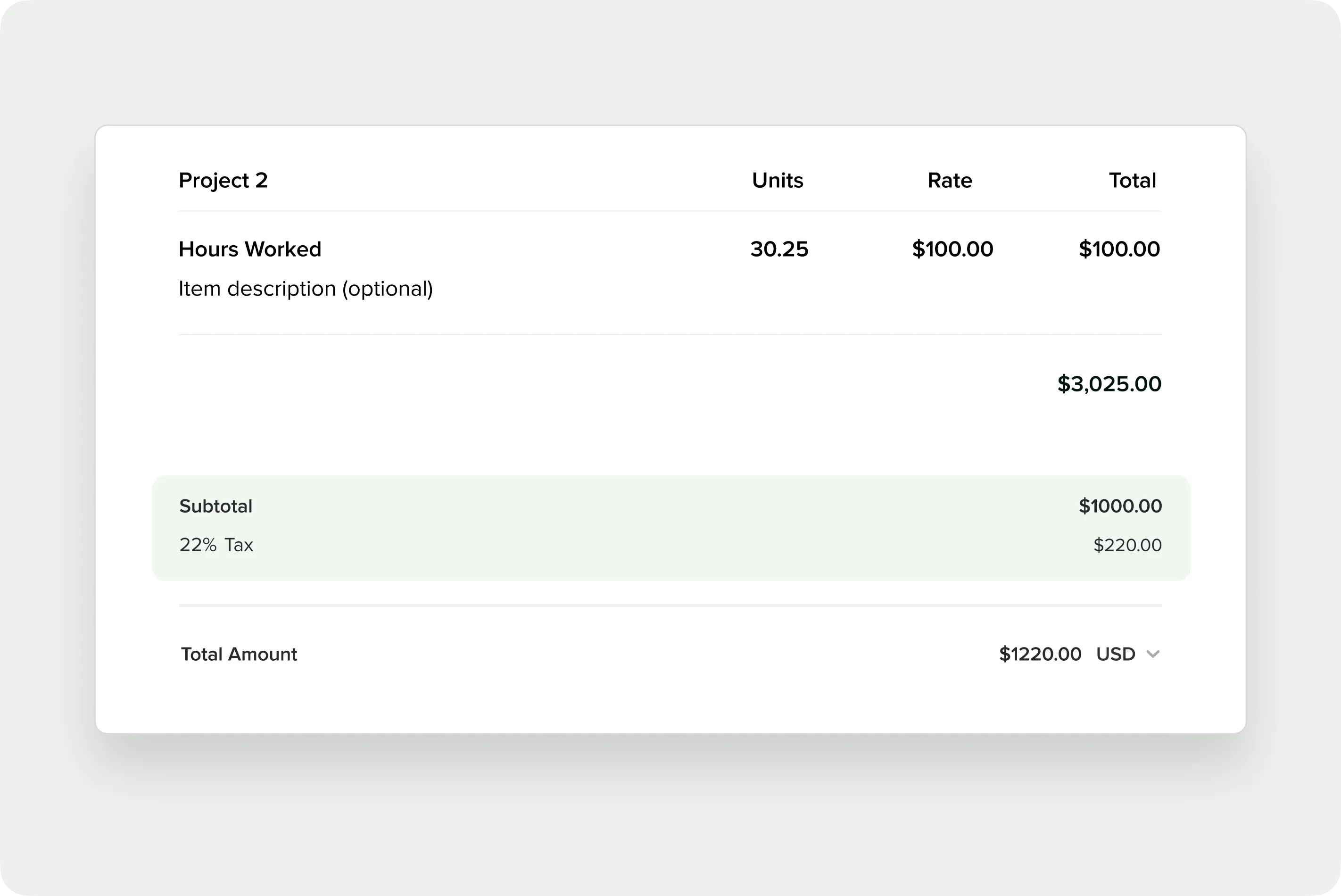

A tax invoice is an invoice that specifically includes a description of the goods or services, their prices, quantities, and the total amount due with any applicable taxes. Although similar, a tax invoice differs from standard invoices except for the emphasis on the tax as a part of the transaction.

If your business charges taxes on the services and goods, tax amounts will be added to the invoice. But that's not all; the tax invoice also serves as a supporting purpose for solopreneurs and small businesses as evidence of the transaction and accounting.

In this article, you will learn about tax invoices in detail. Our article covers the following:

Here's what you should include in your tax invoice, followed by a format of how you should.

Both the tax invoice and receipt are issued by the seller to its customers or clients.

However, a tax invoice is an invoice that comprises a description of the goods or services, their prices, quantities, and the total amount due with any applicable taxes. It is issued by the seller or a vendor to its customer before the payment to evoke the payment for goods or services provided.

Meanwhile, a receipt is documentation of payments being made to finalize the purchase by the customer. It serves as proof of the customer's ownership over the purchased goods or services. The receipt outlines a description of goods or services, their prices, discount, taxes, the total amount paid, and the mode of payment.

Tax invoice is issued before requesting payment, and receipts are issued to the customers as proof of payment or purchase. Learn about the differences between an invoice and a receipt in detail.

Tax invoice serves as evidence of the transaction and accounting. It can serve other purposes. Following are some of the main reasons for which a tax invoice is necessary:

Although small businesses are limited in their ways of functioning, bookkeeping is a vital part of running the business. Bookkeeping includes organizing, storing, and analyzing the financial data.

Tax invoice is critical in bookkeeping as it comprises major financial data such as the amount charged for the goods or services, the applicable taxes, and any applied discounts. This data concludes the business's financial status.

Taxation is a means by which the government charges tax from a company or an individual on their income. And if your business is registered for taxation, then a tax invoice is necessary.

This is because the tax invoice provides accurate records of your income with the applied taxes, which can be used to calculate and report the tax owed or due by the buyer and seller.

If your small business is registered for tax collection, you must use a tax invoice to adhere to government tax laws. And though auditing is often viewed as a stressful process, it can actually help your business, and tax invoices can help with the auditing process.

The data in the tax invoice can help you maintain accurate records. These records help tax authorities to verify compliance with tax laws and detect potential frauds or errors. What's more, it can effectively help your small business recognize areas for improvement.

As mentioned in the above points, when your small business is registered for tax collection, the law requires your businesses to issue tax invoices. Having tax invoices provides evidence of your adherence to the government.

What's more, tax invoices also provide data to support the buyer's claim of the input tax credit. It means tax invoices help determine the time in which the claim for the charged tax was made and when it was accounted for.

Tax invoice is not much different from standard invoices, except for the "tax" inclusion. So, this makes a tax invoice an invoice with a solid financial history of your business.

Tax invoice contains financial data of your business, which can help you in more than one beneficial way. It can help you track sales, gauge the profit and cash flow, develop marketing strategies based on invoice data, and help protect your small business from false accusations or lawsuits.

You can create a tax invoice from scratch on platforms like MS Excel or using easy-to-use templates. Provided, it can be time-consuming and a lot of work.

So, how else can you draft your tax invoice? Considering today's fast-paced life, automating tax invoice creation can help small businesses scale higher on different levels.

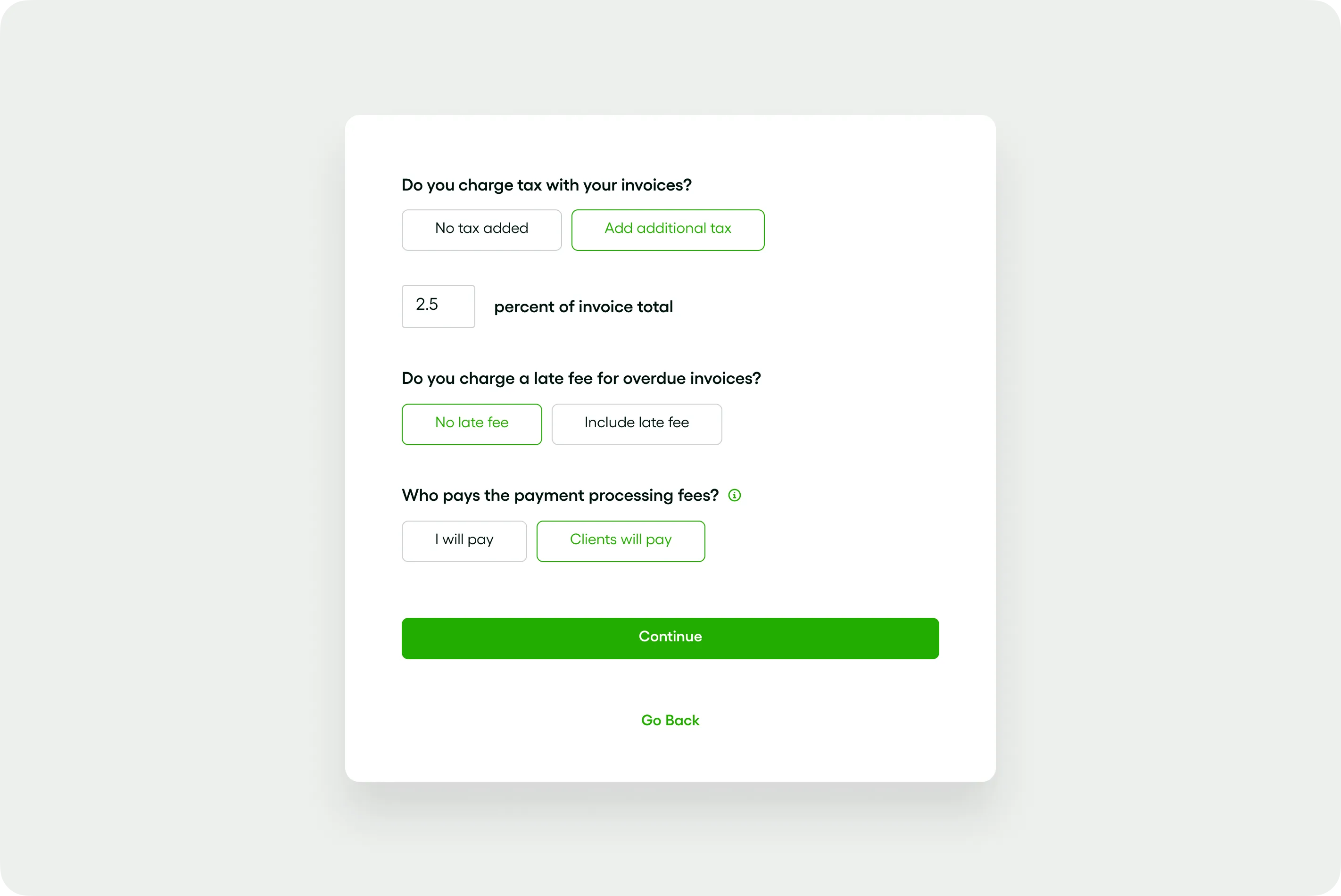

Bonsai is an invoicing tool that provides a competitive advantage, saves time, reduces costs, and improves accuracy and compliance by collecting tax on a sale upfront with no friction. All it requires you to do is add your tax number, and voila! Bonsai will then add the tax to all your new invoices automatically.

You can even calculate your self-employment tax using Bonsai's free tax calculating tool. The platform also has flexible invoice templates, which you can customize to your liking.

A tax invoice is an important document that keeps a record of the transaction. It is a vital part of bookkeeping, legal compliance, taxation, auditing, and business operations.

However, creating a tax invoice from scratch can be a hassle. So why not automate your tax invoice creation process?

Bonsai is a remarkable invoicing tool to use is you want to save time and money. It is easy to use, with a clean and simple interface, which allows you to access hundreds of customizable invoice templates.

You can create your tax invoice with just a few clicks and streamline your invoicing process while staying compliant. So, sign up for Bonsai NOW!