Invoicing may seem like a small task for your business, but if you get it wrong, you could run into cash flow issues. Imagine the stress of sending out invoices and waiting for weeks or even months for clients to pay.

Regarding billing clients, here are some of the invoicing best practices you should follow to simplify the process and get paid on time. First, we always recommend you use a software for the invoicing process.

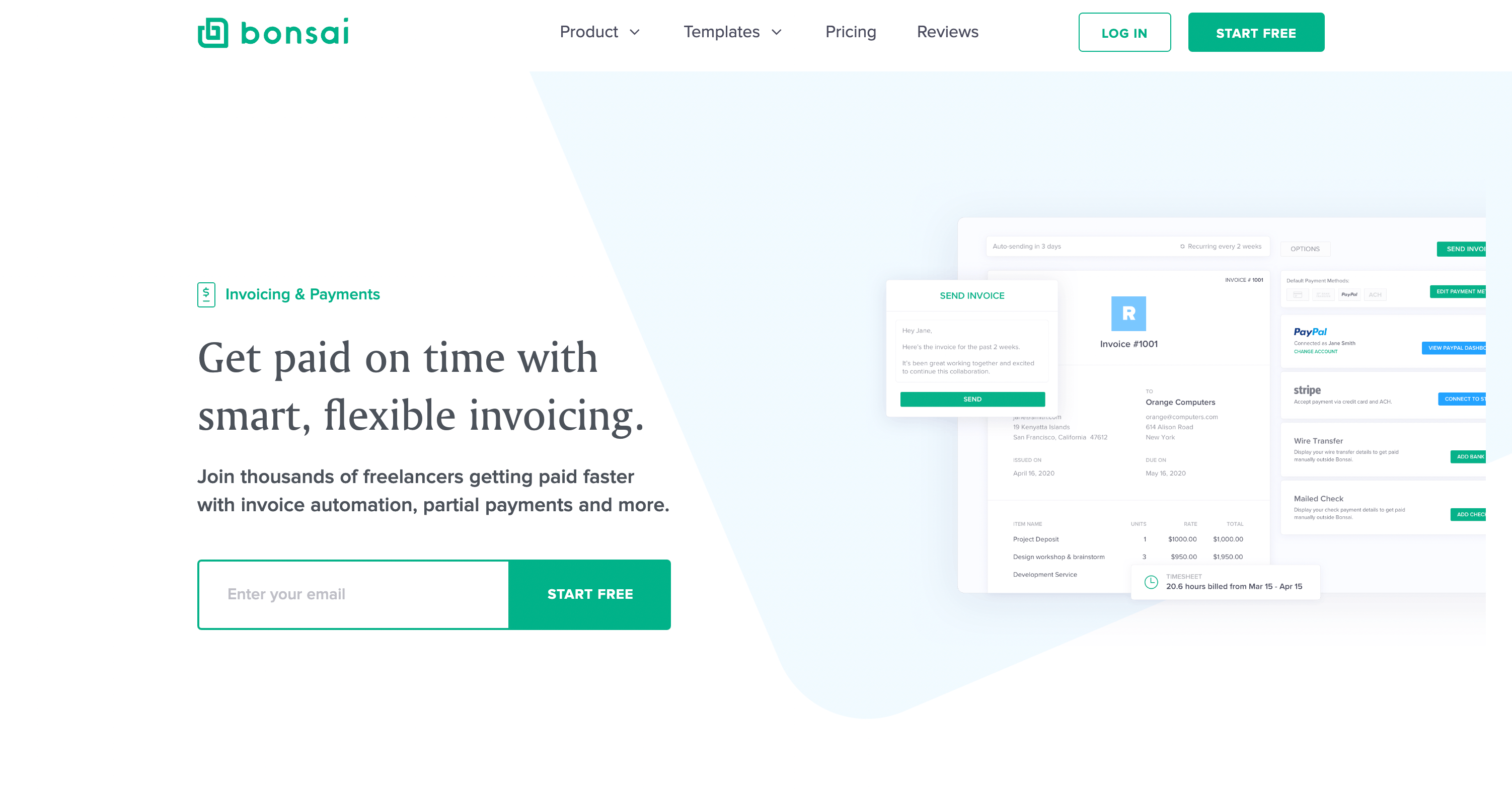

Note: If you want to keep up with all the best practices for invoicing, a software like Bonsai can help you automatically do it. Bill your customer easily with our templates and our program can help you automate everything. Try a 7-day free trial here.

When sending invoices to clients, the best thing you can do is to take all of the work off your plate and automate the entire process. Invoice software will allow you to set up recurring invoices or partial payments, get you paid promptly to improve your cash flow, send automatic reminders, and manage multiple invoices. Bonsai is an invoicing software that does all of this and more.

With the help of Bonsai's smart invoice processing, your next billing request could be generated automatically. The software will also email read receipts and remind your client to pay. With a Bonsai account, you can access our extensive library of templates and invoicing tools to send billing requests quickly.

When it comes to the best invoicing practices, business owners should also always integrate accounting software to track and record invoice receipts. Bonsai's all in one software comes with an accounting tool along with our software for invoices. Track your invoices, manage your busienss expenses for deductions and much more with Bonsai Tax.

Skip out on using a checklist to make sure you have everything and use an invoice template instead. You could select one from Bonsai's library of invoice templates and simply customize the relevant information. Let's quickly review all of the

Bonsai's templates allow you to insert your business name, bank details, billing address and logo on the invoice. Adding your business's branding on the invoice template makes your business appear professional.

On top of your business info on the invoice, our templates allow you to easily add your client's details. It is best practice to address the invoice to the client or person and not the company. Double-check with your client for who to bill to invoice the right person.

You'll want to include when you should get paid in your payment terms. Most small businesses ask for bills to be paid within 7 days.

Our template allows you to edit the invoice due date. After you set the due date, Bonsai's software will automatically send payment reminder notifications to your client. The State you reside in must permit you to enforce late payment fees if it is agreed upon.

Typical late fees for not paying an invoice on time are 1.5%-5% every month the bill is not paid. Some freelancers even give incentives to customers or clients who pay on time. May offer a 2% discount on an invoice paid within 10 days.

When billing a client, you want to include various payment choices for your client to choose from. Bonsai's software gives you many alternate options. Give your clients an option to pay via cash, check, credit card, wire transfer, etc.

You'll want to identify transactions for every invoice with a distinct number. A unique number makes it easier for both you and your client. It allows you to keep a record of accurate invoices. Structure invoice numbers any way you want. You may use only numbers 001, 002, 003 etc. or include letters to organize your invoices for each client. For example, you can write an invoice number like B001, CN002, or BL001.

Writing out the scope of work and list of services will let the client in on what they are being charged for. Include your billable hours, hourly rate, and a description of the goods/services.

If you send payment requests late, your client may not even remember the transaction. A customer disputing an invoice would cost you time and money. That's why it is important to send requests within a reasonable time frame from when it is due.

Bonsai's online invoicing software allows you to always send invoices on time. No more forgetting to bill clients or sending requests late. Again, double-check with your new client or customer got where to send the invoice if it's not clear from the purchase order.

Invoicing software will send invoices quickly and routinely, so you won't miss a date.

Bonsai includes a direct link with payment options so clients can collect your quicker. If your client doesn't send the payment promptly, Bonsai's invoice software will follow up with your client.

Note: Simplify your billing process with a software for invoicing. Bonsai can help you speed up the invoicing process and help ou get your money faster and on time. Claim your 7-day free trial here and see for yourself.

After you send the invoice, it is always good practice to add a thank you note once you've received a payment. It leaves a lasting, positive impression to improve your customer satisfaction. Adding a thank you note is an invoicing best practice because it is a nice gesture that produces goodwill with your client.

All invoices sent by small businesses to clients include the invoice payment terms that specify how quickly they anticipate receiving payment for their services and the various payment options that clients may use. Clearly state the itemized list of deliverables and the total amount your client would be paying.

Before you generate the invoice, make sure you consider the client's expectations and budget.

Here is where you would include the late payment terms. If a client disputes the added fees, make sure you have it written in the signed contract how much they would pay.

A signed agreement or contract is the best way to avoid small claims court over invoices.

You don't want to clutter your invoice with a bunch of information and make it hard for your client to pay you. Instead, keep it preferably a short one. Only include the correct information in an easy-to-understand invoice. Make sure your client can clearly see how much they owe you or the costs, when it is due, how to pay and the terms.

There you have it. The invoicing best practices to follow to get paid on time and avoid the overall stress of not receiving payments. Keep a good invoicing workflow to keep your cash flow good and payment issues to a minimum.

Small business invoicing doesn't have to be hard. Try Bonsai's invoicing tool to seamlessly send payment requests for your business. Sign up today and you won't regret it. Claim your 7-day free trial here.